Filed Pursuant to Rule 424(b)(1)

Registration No. 333-250092

1,500,000 Shares

Independence Contract Drilling, Inc.

Common Stock

This prospectus relates to the sale of up to 1,500,000 shares of our common stock by Tumim Stone Capital LLC (“Tumim”). Tumim is also referred to in this prospectus as the selling stockholder. We will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive proceeds of up to $5.0 million from the sale of our common stock to the selling stockholder, pursuant to a purchase agreement entered into with the selling stockholder on November 11, 2020, once the registration statement of which this prospectus is a part is declared effective.

The selling stockholder is an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). Tumim may sell the shares of common stock described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” for more information about how the selling stockholder may sell the shares of common stock being registered pursuant to this prospectus.

We will pay the expenses of registering these shares, but all selling and other expenses incurred by the selling stockholder will be paid by the selling stockholder. See “Plan of Distribution”.

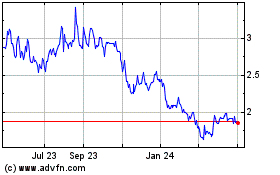

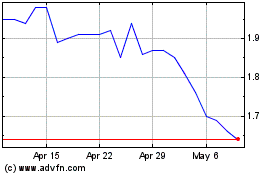

Our common stock is currently traded on The New York Stock Exchange (the “NYSE”) under the symbol “ICD.” The last reported sales price of our common stock on the NYSE on November 30, 2020 was $3.17 per share.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information”, carefully before you invest in any of our securities.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 6 of this prospectus.

Neither the U. S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 1, 2020.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page

|

|

INDUSTRY AND MARKET DATA

|

|

|

PROSPECTUS SUMMARY

|

|

|

RISK FACTORS

|

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND MARKET DATA

|

|

|

USE OF PROCEEDS

|

|

|

THE TUMIM TRANSACTION

|

|

|

SELLING STOCKHOLDER

|

|

|

PLAN OF DISTRIBUTION

|

|

|

DESCRIPTION OF CAPITAL STOCK

|

|

|

LEGAL MATTERS

|

|

|

EXPERTS

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

|

Unless the context otherwise requires, the terms “ICD,” “we,” “us” and “our” in this prospectus refer to Independence Contract Drilling, Inc., and “this offering” refers to the offering contemplated in this prospectus.

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under the section of this prospectus entitled “Where You Can Find More Information”. You should carefully read this prospectus as well as additional information described in the section of this prospectus entitled “Incorporation of Certain Information by Reference,” before deciding to invest in shares of our common stock.

Neither we nor the selling stockholder authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under the circumstances and in the jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the selling stockholder is not, making an offer of these securities in any jurisdiction where such offer is not permitted.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus and does not contain all the information that you need to consider in making your investment decision. You should carefully read this entire prospectus, as well as the information to which we refer you and the information incorporated by reference herein, before deciding whether to invest in our common stock.

Independence Contract Drilling, Inc.

We provide land-based contract drilling services for oil and natural gas producers targeting unconventional resource plays in the United States. We own and operate a premium fleet comprised of modern, technologically advanced drilling rigs. Our first rig began drilling in May 2012. On October 1, 2018, we completed a merger with Sidewinder Drilling LLC. As a result of this merger, we more than doubled our operating fleet and personnel.

As of September 30, 2020, our rig fleet includes 29 marketed AC powered (“AC”) rigs and a number of additional rigs requiring conversions or upgrades in order to meet our AC pad-optimal specifications. We do not intend to complete these conversions or upgrades until market conditions improve.

We currently focus our operations on unconventional resource plays located in geographic regions that we can efficiently support from our Houston, Texas and Midland, Texas facilities in order to maximize economies of scale. Currently, our rigs are operating in the Permian Basin, the Haynesville Shale and the Eagle Ford Shale; however, our rigs have previously operated in the Mid-Continent and Eaglebine regions as well.

Our business depends on the level of exploration and production activity by oil and natural gas companies operating in the United States, and in particular, the regions where we actively market our contract drilling services. The oil and natural gas exploration and production industry is historically cyclical and characterized by significant changes in the levels of exploration and development activities. Oil and natural gas prices and market expectations of potential changes in those prices significantly affect the levels of those activities. Worldwide political, regulatory, economic, and military events, as well as natural disasters have contributed to oil and natural gas price volatility historically, and are likely to continue to do so in the future. Any prolonged reduction in the overall level of exploration and development activities in the United States and the regions where we market our contract drilling services, whether resulting from changes in oil and natural gas prices or otherwise, could materially and adversely affect our business.

Our principal executive offices are located at 20475 State Highway 249, Suite 300, Houston, Texas 77070. Our common stock is currently traded on the NYSE under the symbol “ICD.” To find more information about us, please see the sections entitled “Where You Can Find More Information” and “Documents We Incorporate by Reference.”

The Offering

|

|

|

|

|

|

|

|

Common stock offered by the selling stockholder

|

1,500,000 shares.

|

|

|

|

|

Common stock outstanding prior to this offering

|

6,175,818 shares (as of November 11, 2020).

|

|

|

|

|

Common stock to be outstanding after this offering

|

7,675,818 shares (as of November 11, 2020).

|

|

|

|

|

Use of proceeds

|

The selling stockholder will receive all of the proceeds from the sale of the shares offered for sale by it under this prospectus. We will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive proceeds of up to $5.0 million from the sale of our common stock to the selling stockholder under the purchase agreement described below. Any proceeds from the selling stockholder that we receive under the purchase agreement are expected to be used for general corporate purposes, which may include, without limitation, prepayment of interest-bearing contingent consideration payments due to an affiliate of $3.1 million (including interest) as of September 30, 2020, working capital and general administrative expenses. See “Use of Proceeds.”

|

|

|

|

|

NYSE symbol

|

Our common stock is listed on the NYSE under the symbol “ICD.”

|

|

|

|

|

Risk Factors

|

An investment in our common stock is subject to substantial risks. Please refer to the information contained in the section entitled “Risk Factors” beginning on page 6 for a discussion of factors you should carefully consider before investing in our common stock.

|

The Tumim Transaction

On November 11, 2020, we entered into a purchase agreement (the “Purchase Agreement”) and a registration agreement (the “Registration Rights Agreement”) with Tumim. Pursuant to the Purchase Agreement, we have the right to sell Tumim up to $5.0 million in shares of common stock, subject to certain limitations and conditions set forth in the Purchase Agreement. We have filed the registration statement that includes this prospectus in accordance with our obligations under the Registration Rights Agreement.

Upon the satisfaction of the conditions in the Purchase Agreement, including that a registration statement that we agreed to file with the SEC pursuant to the Registration Rights Agreement is declared effective by the SEC and a final prospectus in connection therewith is filed with the SEC (such event, the “Commencement”), we will have the right, but not the obligation, from time to time at our sole discretion over the 24-month period from and after the Commencement, to direct Tumim to purchase up to a fixed maximum amount of shares of common stock as set forth in the Purchase Agreement on any business day on which the closing price of the common stock exceeds $1.00 (subject to adjustment as provided in the Purchase Agreement for any reorganization, recapitalization, non-cash dividend, stock split or other similar transaction occurring after the date of the Purchase Agreement); provided, that Tumim’s maximum commitment under any single fixed purchase will not exceed $1,000,000.

In addition to fixed purchases, as described above, we may also direct Tumim to purchase additional amounts as “VWAP” purchases (i.e. based on a volume weighted average price) as set forth in the Purchase Agreement, provided the closing price of the common stock exceeds $1.35 (subject to adjustment as provided in the Purchase Agreement for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring after the date of the Purchase Agreement) and as more specifically described in the section of this prospectus entitled “The Tumim Transaction.”

The purchase price of the shares of our common stock that may be sold to Tumim under the Purchase Agreement will be based on the market price of our common stock at the time of sale as computed under the Purchase Agreement. There is no upper limit on the price per share that Tumim could be obligated to pay for the common stock under the Purchase Agreement. The purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction occurring during the business days used to compute the purchase price.

From and after Commencement, we will control the timing and amount of any sales of our common stock to Tumim.

Actual sales of shares of our common stock to Tumim under the Purchase Agreement will depend on a variety of factors to be determined by us from time to time, including, among others, market conditions, the trading price of the common stock and determinations by us as to the appropriate sources of funding for our company and our operations.

Under the applicable rules of the NYSE, in no event may we issue more than 1,234,546 shares of our common stock, which represents 19.99% of the shares of our common stock outstanding immediately prior to the execution of the Purchase Agreement (the “Exchange Cap”), to Tumim under the Purchase Agreement, unless (i) we obtain stockholder approval to issue shares of our common stock in excess of the Exchange Cap or (ii) the price of all applicable sales of our common stock to Tumim under the Purchase Agreement equals or exceeds the lower of (A) the official closing price on the NYSE immediately preceding the delivery by us of an applicable purchase notice under the Purchase Agreement and (B) the average of the closing prices of our common stock on the NYSE for the five business days immediately preceding the delivery by us of an applicable purchase notice under the Purchase Agreement, in each case plus $0.128 such that the transactions contemplated by the Purchase Agreement are exempt from the Exchange Cap limitation under applicable NYSE rules. In any event, the Purchase Agreement specifically provides that we may not issue or sell any shares of our common stock under the Purchase Agreement if such issuance or sale would breach any applicable rules or regulations of the NYSE. The Company has also limited the aggregate number of shares of common stock reserved for issuance under the Purchase Agreement to 1,500,000 shares without subsequent board approval.

In all instances, we may not sell shares of our common stock to Tumim under the Purchase Agreement if it would result in Tumim beneficially owning more than 4.99% of the common stock (the “Beneficial Ownership Cap”).

The net proceeds from sales, if any, under the Purchase Agreement, will depend on the frequency and prices at which the Company sells shares to Tumim. To the extent the Company sells shares under the Purchase Agreement, the Company plans to use any proceeds therefrom for general corporate purposes, which may include prepayment of interest-bearing contingent consideration payments due to an affiliate of $3.1 million as of September 30, 2020, capital expenditures, working capital and general and administrative expenses.

There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement other than a prohibition on entering into a “Variable Rate Transaction,” as defined in the Purchase Agreement, and as more specifically described in the section of this prospectus entitled “The Tumim Transaction.” Tumim has agreed not to cause, or engage in any manner whatsoever, any direct or indirect short selling or hedging of the common stock.

B. Riley Securities, Inc., or B. Riley, acted as exclusive placement agent in connection with the transactions contemplated by the Purchase Agreement, for which the Company paid B. Riley a cash placement fee of $180,000, representing 3.6% of the $5,000,000 total commitment under the Purchase Agreement.

As consideration for Tumim’s irrevocable commitment to purchase shares of common stock upon the terms of and subject to satisfaction of the conditions set forth in the Purchase Agreement, upon execution of the Purchase Agreement, the Company paid Tumim a cash commitment fee of $100,000, representing 2.0% of the $5,000,000 total commitment under the Purchase Agreement. The Company has also agreed to reimburse Tumim for the fees and expenses of its counsel, up to a maximum of $50,000, and to reimburse Tumim for its other expenses up to $7,500.

The Purchase Agreement and the Registration Rights Agreement contain customary representations, warranties, conditions and indemnification obligations of the parties. The representations, warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

The Company has the right to terminate the Purchase Agreement at any time after Commencement, at no cost or penalty, upon 10 trading days’ prior written notice to Tumim. Neither the Company nor Tumim may assign or transfer its rights and obligations under the Purchase Agreement or the Registration Rights Agreement, and no provision of the Purchase Agreement or the Registration Rights Agreement may be modified or waived by the parties.

We do not know what the purchase price for our common stock will be and therefore cannot be certain as to the number of shares we might issue to Tumim under the Purchase Agreement after the date of this prospectus. As of November 11, 2020, there were 6,175,818 shares of our common stock outstanding (5,144,806 shares held by non-affiliates) which excludes the 1,500,000 shares of common stock that we may issue to Tumim pursuant to the Purchase Agreement after the registration statement that includes this prospectus is declared effective under the Securities Act. Although the Purchase Agreement provides that we may sell up to an aggregate of $5,000,000 of our common stock to Tumim, only 1,500,000 shares of our common stock are being registered for resale under this prospectus, which represents shares of our common stock that we may issue and sell to Tumim in the future under the Purchase Agreement, if and when we elect to sell shares of our common stock to Tumim under the Purchase Agreement. Depending on the market prices of our common stock at the time we elect to issue and sell shares of our common stock to Tumim under the Purchase Agreement, we may need to register for resale under the Securities Act additional shares of our common stock in order to receive aggregate gross proceeds equal to the $5,000,000 total commitment available to us under the Purchase Agreement. If all of such 1,500,000 shares of our common stock offered hereby were issued and outstanding as of November 11, 2020, such shares would represent 29.2% of the outstanding shares of common stock held by non-affiliates as of November 11, 2020. If we elect to issue and sell to Tumim under the Purchase Agreement more than the 1,500,000 shares of our common stock being registered for resale by Tumim under this prospectus, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional shares of our common stock, which could cause additional substantial dilution to our stockholders. The number of shares of our common stock ultimately offered for sale by Tumim is dependent upon the number of shares purchased by Tumim under the Purchase Agreement.

Issuances of our common stock to Tumim under the Purchase Agreement will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of our common stock that our existing stockholders own will not decrease, the shares of our common stock owned by our existing stockholders will represent a smaller percentage of our total outstanding shares of our common stock after any such issuance of shares of our common stock to Tumim under the Purchase Agreement. There are substantial risks to our stockholders as a result of the sale and issuance of common stock to Tumim under the Purchase Agreement. See “Risk Factors.”

The number of shares of our common stock outstanding as of November 11, 2020 does not include:

•33,458 shares of our common stock issuable upon exercise of outstanding stock options as of November 11, 2020 under our Amended and Restated 2012 Long-Term Incentive Plan, with a weighted average exercise price of $254.80 per share;

•105,055 shares of our common stock available for future issuance as of November 11, 2020 under our 2019 Long-Term Incentive Plan; and

•102,456 shares of our common stock issuable upon vesting of outstanding restricted stock units and performance units as of November 11, 2020, with a weighted average grant date fair value of $22.84.

Unless otherwise indicated, all information in this prospectus assumes no exercise of our outstanding stock options or warrants and assumes no issuance of shares of our common stock pursuant to any of our outstanding restricted stock units.

RISK FACTORS

Investing in our common stock involves a high degree of risk, including the potential loss of all or part of your investment. Before making an investment decision to purchase our common stock, you should carefully read and consider all of the risks and uncertainties described below, some of which may be exacerbated by COVID-19, as well as other information included in this prospectus, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes thereto appearing at the end of this prospectus. The occurrence of any of the following risks or additional risks and uncertainties that are currently immaterial or unknown could have a material adverse effect on our business, results of operations, and financial condition. The following risk factors are not necessarily presented in order of relative importance and should not be considered to represent a complete set of all potential risks that could affect us. This prospectus also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks and uncertainties described below. See "Cautionary Note Regarding Forward-Looking Statements and Market Data."

Risks Related to this Offering

It is not possible to predict the actual number of shares we will sell under the Purchase Agreement to the selling stockholder, or the actual gross proceeds resulting from those sales.

Subject to certain limitations in the Purchase Agreement and compliance with applicable law, we have the discretion to deliver notices to the selling stockholder at any time throughout the term of the Purchase Agreement. The actual number of shares that are sold to the selling stockholder may depend based on a number of factors, including the market price of the common stock during the sales period. Actual gross proceeds may be less than $5.0 million, which may impact our future liquidity. Because the price per share of each share sold to the selling stockholder will fluctuate during the sales period, it is not currently possible to predict the number of shares that will be sold or the actual gross proceeds to be raised in connection with those sales.

Investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. In connection with the Tumim Transaction, we will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold to Tumim. Similarly, Tumim may sell such shares at different time and at different prices. Investors may experience a decline in the value of the shares they purchase from the selling stockholder in this offering as a result of sales made by us in future transactions to Tumim at prices lower than the prices they paid.

Future sales of substantial amounts of our common stock, or the possibility that such sales could occur, could adversely affect the market price of our common stock.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

Management will have broad discretion as to the use of the proceeds from the Tumim Transaction, and uses may not improve our financial condition or market value.

Because we have not designated the amount of net proceeds from the Tumim Transaction to be used for any particular purpose, our management will have broad discretion as to the application of such net proceeds and could use them for purposes other than those contemplated hereby. Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

Due to the adverse effects of the COVID-19 pandemic on the oil and gas industry, our operating rig count has dropped significantly, and we cannot assure you when it will stabilize or begin to improve. Depending upon the duration of this decline and the length of time it takes for our operating rig count to improve, this could have a material adverse effect on our business, liquidity, results of operations and financial condition.

During the first quarter of 2020, our operating rig count reached a peak of 22 rigs. Since that time, market deterioration caused by COVID-19 has caused our customers to reduce drilling activity, which has resulted in our operating rig count rapidly declining. During the third quarter of 2020, our operating rig count reached a trough of three rigs but improved to six rigs as of September 30, 2020. However, due to the lack of visibility and confidence towards customer intentions, we cannot assure you that our operating rig count will not fall below these levels. For example, our current backlog of contracts with original terms of six months or more stands at 4.4 average rigs during the fourth quarter of 2020 and 2.0 average rigs during the first half of 2021, and none of our current drilling contracts have terms extending beyond June 30, 2021. We also cannot assure you if or when market conditions will improve and if or when our operating rig count will begin to improve or reach pre-COVID-19 levels. A substantially lower operating rig count could have a materially adverse effect on our business, liquidity, results of operations and financial condition.

Due to the adverse effects of COVID-19 pandemic on the oil and gas industry, we expect our cash flows from operations to decrease dramatically, which could have a material adverse effect on our business, liquidity, results of operations and financial condition.

As a result of the ongoing decline in our operating rig count and associated dayrate pressure and margin contraction in the current oil and gas operating environment, we expect that our cash flows from operations will decrease dramatically, and that we will need to draw on our existing sources of available liquidity until market conditions begin to improve in order to maintain operations and make required non-operating expenditures. Current sources of liquidity at September 30, 2020 include $18.8 million of cash, other net working capital of $17.5 million, $5.2 million of availability under our revolving credit facility and $15 million available under our term loan accordion. We currently believe that these sources of liquidity are sufficient to fund our operations for the next twelve months. On April 27, 2020, we entered into the $10 million PPP Loan pursuant to the Paycheck Protection Program (the “PPP”). Proceeds of the loan are used for payroll costs, rent, utilities, mortgage interests, and other permitted purposes. We may not be able to obtain full or partial forgiveness of the PPP Loan and in such case, we would be obligated to repay any portion of the PPP Loan that is not forgiven, together with interest accrued and accruing thereon, until such unforgiven portion is paid in full. However, due to the uncertainty regarding the duration of the COVID-19 pandemic and its effects on the oil and gas industry, we cannot predict the length of time that the market disruptions resulting from the COVID-19 pandemic will continue or when, or if, oil and gas prices and demand for our contract drilling services will begin to improve or return to pre-COVID-19 levels. As a result, we cannot assure you that our current sources of financial liquidity will be sufficient to fund our operations, and any failure to do so could have a material adverse effect on our business, liquidity, results of operations and financial condition.

As a result of the significant downturn in the oil and gas business and demand for our contract drilling services caused by the COVID-19 pandemic, we may lose our listing on the NYSE, which could have a material adverse effect on the market value of our common stock.

Under NYSE listing requirements, in order to maintain our listing status we are required to maintain at all times a minimum 30-day trading average public market capitalization of $15 million. Unlike certain other listing standards tied to minimum share price, there is no cure period or grace period associated with this listing standard. In response to the substantial negative impact the COVID-19 pandemic has caused, the NYSE granted a temporary waiver from compliance with this standard through June 30, 2020. As of November 11, 2020, we believe that our 30-day average public market capitalization was approximately $15.4 million, and was declining as a result of stock price declines over the past 30 trading days. On November 12, 2020, our closing stock price was $2.45 per share. Because we cannot predict future prices for our common stock and the length of time that the market disruptions resulting from the COVID-19 pandemic will continue or when, or if, oil and gas prices and demand for our contract drilling services will begin to improve or return to pre-COVID-19 levels, we cannot assure you that our common stock will remain listed on the NYSE, which could have a material adverse effect on the trading value of our common stock and our ability to raise additional funds through new issuances.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this prospectus supplement, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future revenues, income and capital spending. Our forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “plan,” “goal,” “will” or other words that convey the uncertainty of future events or outcomes. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. These risks, contingencies and uncertainties include, but are not limited to, the following:

•inability to predict the duration or magnitude of the effects of the COVID-19 pandemic on our business, operations, and financial condition and when or if worldwide oil demand will stabilize and begin to improve;

•a decline in or substantial volatility of crude oil and natural gas commodity prices;

•a sustained decrease in domestic spending by the oil and natural gas exploration and production industry;

•fluctuation of our operating results and volatility of our industry;

•inability to maintain or increase pricing of our contract drilling services, or early termination of any term contract for which early termination compensation is not paid;

•our backlog of term contracts declining rapidly;

•the loss of any of our customers, financial distress or management changes of potential customers or failure to obtain contract renewals and additional customer contracts for our drilling services;

•overcapacity and competition in our industry;

•an increase in interest rates and deterioration in the credit markets;

•our inability to comply with the financial and other covenants in debt agreements that we may enter into as a result of reduced revenues and financial performance;

•unanticipated costs, delays and other difficulties in executing our long-term growth strategy;

•the loss of key management personnel;

•new technology that may cause our drilling methods or equipment to become less competitive;

•labor costs or shortages of skilled workers;

•the loss of or interruption in operations of one or more key vendors;

•the effect of operating hazards and severe weather on our rigs, facilities, business, operations and financial results, and limitations on our insurance coverage;

•increased regulation of drilling in unconventional formations;

•the incurrence of significant costs and liabilities in the future resulting from our failure to comply with new or existing environmental regulations or an accidental release of hazardous substances into the environment; and

•the potential failure by us to establish and maintain effective internal control over financial reporting.

All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus supplement, the accompanying prospectus and the documents incorporated herein by reference. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

USE OF PROCEEDS

This prospectus relates to shares of common stock that may be offered and sold from time to time by Tumim. We will not receive any proceeds from the resale of shares of common stock by Tumim.

We may receive up to $5.0 million in gross proceeds if we issue to Tumim shares issuable pursuant to the Purchase Agreement. We estimate that the net proceeds to us from the sale of our common stock to Tumim pursuant to the Purchase Agreement would be up to $4.5 million over an approximately 24-month period, assuming that we sell the full amount of our common stock that we have the right, but not the obligation, to sell to Tumim under the Purchase Agreement, and after other estimated fees and expenses. See “Plan of Distribution” elsewhere in this prospectus for more information.

Any proceeds from the selling stockholder that we receive under the Purchase Agreement are currently expected to be used for general corporate purposes, which may include, without limitation, prepayment of interest-bearing contingent consideration payments due to an affiliate of $3.1 million (including interest) as of September 30, 2020, capital expenditures, working capital and general and administrative expenses. As we are unable to predict the timing or amount of potential issuances of all of the additional shares issuable purchase to the Purchase Agreement, we cannot specify with certainty all of the particular uses for the net proceeds that we will have from the sale of such additional shares. Accordingly, our management will have broad discretion in the application of the net proceeds. We may use the proceeds for purposes that are not contemplated at the time of this offering. It is possible that no shares will be issued under the Purchase Agreement.

We will incur all costs associated with this prospectus and the registration statement of which it is a part.

THE TUMIM TRANSACTION

General

On November 11, 2020, we entered into the Purchase Agreement and the Registration Rights Agreement with Tumim. Pursuant to the terms of the Purchase Agreement, Tumim has agreed to purchase from us up to $5,000,000 of our common stock (subject to certain limitations) from time to time during the term of the Purchase Agreement. Pursuant to the terms of the Registration Rights Agreement, we have filed with the SEC the registration statement that includes this prospectus to register for resale under the Securities Act the shares that may be issued to Tumim under the Purchase Agreement.

We do not have the right to commence any sales of our common stock to Tumim under the Purchase Agreement until all of the conditions set forth in the Purchase Agreement have been satisfied, including that the SEC has declared effective the registration statement that includes this prospectus registering the resale by Tumim of the shares of our common stock that may be issued and sold to Tumim under the Purchase Agreement. From and after Commencement, we will control the timing and amount of any sales of our common stock to Tumim. Actual sales of shares of our common stock to Tumim under the Purchase Agreement will depend on a variety of factors to be determined by us from time to time, including, among others, market conditions, the trading price of the common stock and determinations by us as to the appropriate sources of funding for our company and our operations. The purchase price of the shares of our common stock that may be sold to Tumim under the Purchase Agreement will be based on the market price of our common stock at the time of sale as computed under the Purchase Agreement. There is no upper limit on the price per share that Tumim could be obligated to pay for the common stock under the Purchase Agreement.

We do not know what the purchase price for our common stock will be and therefore cannot be certain as to the number of shares we might issue to Tumim under the Purchase Agreement after the date of this prospectus. As of November 11, 2020, there were 6,175,818 shares of our common stock outstanding (5,144,806 shares held by non-affiliates) which excludes the 1,500,000 shares of common stock that we may issue to Tumim pursuant to the Purchase Agreement after the registration statement that includes this prospectus is declared effective under the Securities Act. Although the Purchase Agreement provides that we may sell up to an aggregate of $5,000,000 of our common stock to Tumim, only 1,500,000 shares of our common stock are being registered for resale under this prospectus, which represents shares of our common stock that we may issue and sell to Tumim in the future under the Purchase Agreement, if and when we elect to sell shares of our common stock to Tumim under the Purchase Agreement. Depending on the market prices of our common stock at the time we elect to issue and sell shares of our common stock to Tumim under the Purchase Agreement, we may need to register for resale under the Securities Act additional shares of our common stock in order to receive aggregate gross proceeds equal to the $5,000,000 total commitment available to us under the Purchase Agreement. If all of such 1,500,000 shares of our common stock offered hereby were issued and outstanding as of November 11, 2020, such shares would represent 29.2% of the outstanding shares of common stock held by non-affiliates as of November 11, 2020. If we elect to issue and sell to Tumim under the Purchase Agreement more than the 1,500,000 shares of our common stock being registered for resale by Tumim under this prospectus, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional shares of our common stock, which could cause additional substantial dilution to our stockholders. The number of shares of our common stock ultimately offered for sale by Tumim is dependent upon the number of shares purchased by Tumim under the Purchase Agreement.

Under the applicable rules of the NYSE, in no event may we issue or sell to Tumim under the Purchase Agreement shares of our common stock in excess of the Exchange Cap, unless (i) we obtain stockholder approval to issue shares of our common stock in excess of the Exchange Cap or (ii) the price of all applicable sales of our common stock to Tumim under the Purchase Agreement equals or exceeds the lower of (A) the official closing price on the NYSE immediately preceding the delivery by us of a Fixed Purchase Notice or a VWAP Purchase Notice under the Purchase Agreement and (B) the average of the closing prices of our common stock on the NYSE for the five business days immediately preceding the delivery by us of a Fixed Purchase Notice or a VWAP Purchase Notice under the Purchase Agreement, in each case plus $0.128, such that the transactions contemplated by the Purchase Agreement are exempt from the Exchange Cap limitation under applicable NYSE rules. In any event, the Purchase Agreement specifically provides that we may not issue or sell any shares of our common stock under the Purchase Agreement if such issuance or sale would breach any applicable rules or regulations of the NYSE.

The Purchase Agreement also prohibits us from directing Tumim to purchase any shares of our common stock if those shares, when aggregated with all other shares of our common stock then beneficially owned by Tumim, would result in Tumim and its affiliates exceeding the Beneficial Ownership Cap.

Issuances of our common stock to Tumim under the Purchase Agreement will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing stockholders will be diluted as a

result of any such issuance. Although the number of shares of our common stock that our existing stockholders own will not decrease, the shares of our common stock owned by our existing stockholders will represent a smaller percentage of our total outstanding shares of our common stock after any such issuance of shares of our common stock to Tumim under the Purchase Agreement.

B. Riley Securities, Inc. acted as exclusive placement agent in connection with the transactions contemplated by the Purchase Agreement, for which the Company paid B. Riley a cash placement fee of $180,000, representing 3.6% of the $5,000,000 total commitment under the Purchase Agreement.

As consideration for Tumim’s irrevocable commitment to purchase shares of common stock upon the terms of and subject to satisfaction of the conditions set forth in the Purchase Agreement, upon execution of the Purchase Agreement, the Company paid Tumim a cash commitment fee of $100,000, representing 2.0% of the $5,000,000 total commitment under the Purchase Agreement. The Company has also agreed to reimburse Tumim for the fees and expenses of its counsel, up to a maximum of $50,000, and to reimburse Tumim for its other expenses up to $7,500.

The Purchase Agreement and the Registration Rights Agreement contain customary representations, warranties, conditions and indemnification obligations of the parties. The representations, warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

Neither the Company nor Tumim may assign or transfer its rights and obligations under the Purchase Agreement or the Registration Rights Agreement, and no provision of the Purchase Agreement or the Registration Rights Agreement may be modified or waived by the parties.

Purchase of Shares under the Purchase Agreement

Fixed Purchases

Under the Purchase Agreement, on any business day selected by us on which the closing price of the common stock exceeds $1.00 (subject to adjustment as provided in the Purchase Agreement for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring after the date of the Purchase Agreement), which we refer to as the “purchase date,” we may direct Tumim to purchase up to a maximum amount of fixed shares of our common stock on such purchase date, which we refer to as a “Fixed Purchase.”

The maximum amount of any single Fixed Purchase may not exceed (i) with respect to a Fixed Purchase made on a trading day where our common stock is listed on the NYSE (or any nationally recognized successor thereto), a number of shares equal to 10% of the average daily trading volume in our common stock on the NYSE for the 30 trading day period ending on (and including) the applicable purchase date for such Fixed Purchase and (ii) with respect to a Fixed Purchase made on a trading day where our common stock is listed on The Nasdaq Capital Market, The Nasdaq Global Market, The Nasdaq Global Select Market, the NYSE American, the NYSE Arca, or the OTCQX Best Market or OTCQB Venture Market operated by OTC Markets Group Inc. (or any nationally recognized successor to any of the foregoing) (each an “Eligible Market”), a number of shares equal to 10% of the average daily trading volume in our common stock on such Eligible Market for the 30 trading day period (or, in the event our common stock has not been listed on such Eligible Market for 30 trading days, such shorter period during which our common stock is listed on such Eligible Market) ending on (and including) the applicable purchase date for such Fixed Purchase. Notwithstanding the foregoing, Tumim’s maximum commitment under any single Fixed Purchase will not exceed $1,000,000.

In addition to the conditions described elsewhere in this prospectus, we may direct Tumim to purchase shares in a Fixed Purchase as often as every business day, so long as (i) the closing price of the common stock on such business day exceeds $1.00 (subject to adjustment as provided in the Purchase Agreement for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring after the date of the Purchase Agreement) and (ii) we have delivered and Tumim has received all shares of common stock purchased in all prior Fixed Purchases or VWAP Purchases in accordance with the terms of the Purchase Agreement.

The purchase price per share for such Fixed Purchase will be equal to the lower of:

•the lowest sale price for our common stock on the purchase date of such shares; and

•the arithmetic average of the three lowest closing sale prices for our common stock during the 10 consecutive business days immediately preceding the purchase date of such shares.

VWAP Purchases

We may also direct Tumim, on any business day selected by us on which (i) we have properly submitted to Tumim a Fixed Purchase notice for the applicable maximum number of shares of common stock that we may sell to Tumim in such Fixed Purchase and (ii) the closing price of the common stock exceeds $1.35 (subject to adjustment as provided in the Purchase Agreement for any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring after the date of the Purchase Agreement), to purchase an additional amount of our common stock on the immediately following business day, which we refer to as a VWAP Purchase, of up to the lesser of:

•200% of the number of shares to be purchased by Tumim pursuant to the corresponding Fixed Purchase; and

•20% of the aggregate number of shares of our common stock traded during all, or, if certain trading volume or market price thresholds specified in the Purchase Agreement are crossed on the applicable VWAP Purchase date, which is defined as the next business day following the purchase date for the corresponding Fixed Purchase, the portion of the normal trading hours on the applicable VWAP Purchase Date prior to such time that any one of such thresholds is crossed, which period of time on the applicable VWAP Purchase Date we refer to as the “VWAP Purchase Measurement Period.”

The purchase price per share for each such VWAP Purchase will be equal to the lower of:

•94% of the VWAP of our common stock during the applicable VWAP Purchase Measurement Period during the applicable VWAP Purchase Date; and

•the closing sale price of our common stock on the applicable VWAP Purchase Date.

In addition to the conditions described above and elsewhere in this prospectus, we may direct Tumim to purchase shares in a VWAP Purchase so long as we have delivered and Tumim has received all shares of common stock purchased in all prior Fixed Purchases or VWAP Purchases in accordance with the terms of the Purchase Agreement.

In the case of Fixed Purchases and VWAP Purchases, the purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction occurring during the business days used to compute the purchase price.

Other than as described above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Tumim.

Conditions to Commencement and for Delivery of Fixed Purchase Notices and VWAP Purchase Notices

The Company’s ability to deliver Fixed Purchase notices and VWAP Purchase notices to Tumim under the Purchase Agreement are subject to the satisfaction, both at the time of Commencement and at the time of delivery by the Company of any Fixed Purchase notice and any VWAP Purchase notice to Tumim, of certain conditions, all of which are entirely outside of Tumim’s control, including the following:

•the accuracy in all material respects of the representations and warranties of the Company included in the Purchase Agreement;

•the Company having performed, satisfied and complied in all material respects with all covenants, agreements and conditions required by the Purchase Agreement to be performed, satisfied or complied with by the Company;

•the registration statement that includes this prospectus (and any one or more additional registration statements filed with the SEC that include shares of common stock that may be issued and sold by the Company to Tumim under the Purchase Agreement) having been declared effective under the Securities Act by the SEC, and Tumim being able to utilize this prospectus (and the prospectus included in any one or more additional registration statements filed with the SEC under the Registration Rights Agreement) to resell all of the shares of common stock included in this prospectus (and included in any such additional prospectuses);

•the SEC shall not have issued any stop order suspending the effectiveness of the registration statement that includes this prospectus (or any one or more additional registration statements filed with the SEC that include shares of common stock that may be issued and sold by the Company to Tumim under the Purchase Agreement) or prohibiting or suspending the use of this prospectus (or the prospectus included in any one or more additional registration statements filed with the SEC under the Registration Rights Agreement), and the absence of any suspension of qualification or exemption from qualification of the common stock for offering or sale in any jurisdiction;

•there shall not have occurred any event and there shall not exist any condition or state of facts, which makes any statement of a material fact made in the registration statement that includes this prospectus (or in any one or more additional registration statements filed with the SEC that include shares of common stock that may be issued and sold by the Company to Tumim under the Purchase Agreement) untrue or which requires the making of any additions to or changes to the statements contained therein in order to state a material fact required by the Securities Act to be stated therein or necessary in order to make the statements then made therein (in the case of this prospectus or the prospectus included in any one or more additional registration statements filed with the SEC under the Registration Rights Agreement, in light of the circumstances under which they were made) not misleading;

•this prospectus, in final form, shall have been filed with the SEC under the Securities Act prior to Commencement, and all reports, schedules, registrations, forms, statements, information and other documents required to have been filed by the Company with the SEC pursuant to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), shall have been filed with the SEC;

•trading in the common stock shall not have been suspended by the SEC or the NYSE, the Company shall not have received any final and non-appealable notice that the listing or quotation of the common stock on the NYSE shall be terminated on a date certain (unless, prior to such date, the common stock is listed or quoted on any other Eligible Market), and there shall be no suspension of, or restriction on, accepting additional deposits of the common stock, electronic trading or book-entry services by DTC with respect to the common stock;

•the Company shall have complied with all applicable federal, state and local governmental laws, rules, regulations and ordinances in connection with the execution, delivery and performance of the Purchase Agreement and the Registration Rights Agreement;

•the absence of any statute, regulation, order, decree, writ, ruling or injunction by any court or governmental authority of competent jurisdiction which prohibits the consummation of or that would materially modify or delay any of the transactions contemplated by the Purchase Agreement or the Registration Rights Agreement;

•the absence of any action, suit or proceeding before any arbitrator or any court or governmental authority seeking to restrain, prevent or change the transactions contemplated by the Purchase Agreement or the Registration Rights Agreement, or seeking material damages in connection with such transactions;

•all of the shares of common stock that may be issued pursuant to the Purchase Agreement shall have been approved for listing or quotation on the NYSE (or any Eligible Market), subject only to notice of issuance;

•no condition, occurrence, state of facts or event constituting a material adverse effect shall have occurred and be continuing;

•the absence of any bankruptcy proceeding against the Company commenced by a third party, and the Company shall not have commenced a voluntary bankruptcy proceeding, consented to the entry of an order for relief against it in an involuntary bankruptcy case, consented to the appointment of a custodian of the Company or for all or substantially all of its property in any bankruptcy proceeding, or made a general assignment for the benefit of its creditors; and

•the receipt by Tumim of the opinions, bring-down opinions and negative assurances from outside counsel to the Company in the forms mutually agreed to by the Company and Tumim prior to the date of the Purchase Agreement.

Termination of the Purchase Agreement

Unless earlier terminated as provided in the Purchase Agreement, the Purchase Agreement will terminate automatically on the earliest to occur of:

•the first day of the month next following the 24-month anniversary of the effective date of the registration statement that includes this prospectus (which term may not be extended by the parties);

•the date on which Tumim shall have purchased an aggregate of $5,000,000 of shares of common stock pursuant to the Purchase Agreement;

•the date on which the common stock shall have failed to be listed or quoted on the NYSE or any other Eligible Market; and

•the date on which the Company commences a voluntary bankruptcy case or any third party commences a bankruptcy proceeding against the Company, a custodian is appointed for the Company in a bankruptcy proceeding for all or substantially all of its property, or the Company makes a general assignment for the benefit of its creditors.

We have the right to terminate the Purchase Agreement at any time after Commencement, at no cost or penalty, upon 10 trading days’ prior written notice to Tumim.

No Short-Selling or Hedging by Tumim

Tumim has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior to the termination of the Purchase Agreement.

Prohibition on Variable Rate Transactions

Subject to specified exceptions included in the Purchase Agreement, we are limited in our ability to enter into specified variable rate transactions during the term of the Purchase Agreement. Such transactions include, among others, the issuance of convertible securities with a conversion or exercise price that is based upon or varies with the trading price of our common stock after the date of issuance.

Effect of Performance of the Purchase Agreement on our Stockholders

All shares registered in this offering that may be issued or sold by us to Tumim under the Purchase Agreement are expected to be freely tradable. Shares registered in this offering may be sold by us to Tumim over a period of up to 24 months commencing on the date of this registration statement of which this prospectus is a part becomes effective. The resale by Tumim of a significant amount of shares registered in this offering at any given time, or the perception that these sales may occur, could cause the market price of our common stock to decline and to be highly volatile. Sales of our common stock to Tumim, if any, will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Tumim all, some or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell shares to Tumim, after Tumim has acquired the shares, Tumim may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to Tumim by us under the Purchase Agreement may result in substantial dilution to the interests of other holders of our common stock. In addition, if we sell a substantial number of shares to Tumim under the Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with Tumim may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales. However, we have the right to control the timing and amount of any additional sales of our shares to Tumim and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

Pursuant to the terms of the Purchase Agreement, we have the right, but not the obligation, to direct Tumim to purchase up to $5,000,000 of our common stock, subject to certain limitations. We have registered only a portion of the shares issuable under the Purchase Agreement and, therefore, we may seek to issue and sell to Tumim under the Purchase Agreement more shares of our common stock than are offered under this prospectus. If we choose to do so, we must first register for resale under the Securities Act any such additional shares, which could cause additional substantial dilution to our stockholders. The number of shares ultimately offered for resale under this prospectus is dependent upon the number of shares we direct Tumim to purchase under the Purchase Agreement.

The following table sets forth the amount of gross proceeds we would receive from Tumim from our sale of shares of common stock to Tumim under the Purchase Agreement at varying purchase prices:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumed Average Purchase Price Per Share

|

|

Number of Registered Shares to be Issued if Full Purchase (1)

|

|

Percentage of Outstanding Shares After Giving Effect to the Issuance to Tumim (2)

|

|

Gross Proceeds from the Sale of Shares to Tumim Under the Purchase Agreement

|

|

$1.00

|

|

1,500,000

|

|

19.5%

|

|

$1,500,000

|

|

$2.00

|

|

1,500,000

|

|

19.5%

|

|

$3,000,000

|

|

$2.45 (3)

|

|

1,500,000

|

|

19.5%

|

|

$3,675,000

|

|

$3.00

|

|

1,500,000

|

|

19.5%

|

|

$4,500,000

|

|

$4.00

|

|

1,250,000

|

|

16.8%

|

|

$5,000,000

|

|

$5.00

|

|

1,000,000

|

|

13.9%

|

|

$5,000,000

|

(1) Although the Purchase Agreement provides that we may sell up to $5,000,000 of our common stock to Tumim, we are only registering 1,500,000 shares under this prospectus, which may or may not cover all of the shares we ultimately sell to Tumim under the Purchase Agreement. We have reserved only an aggregate of 1,500,000 shares of common stock for issuance under the Purchase Agreement and will not issue more than an aggregate of 1,500,000 shares of our common stock unless

otherwise approved by our board of directors. The number of registered shares to be issued as set forth in this column (i) gives effect to the Exchange Cap and (ii) is without regard for the Beneficial Ownership Cap.

(2) The denominator is based on 6,175,818 shares of our common stock outstanding as of November 11, 2020, and the number of shares set forth in the adjacent column that we would have sold to Tumim, assuming the average purchase price in the first column. The numerator is based on the number of shares of our common stock issuable under the Purchase Agreement (that are the subject of this offering) at the corresponding assumed average purchase price set forth in the first column.

(3) The closing sale price of our common stock on November 12, 2020.

SELLING STOCKHOLDER

This prospectus relates to the possible resale from time to time by Tumim of any or all of the shares of common stock that may be issued by us to Tumim under the Purchase Agreement. We are registering the shares of common stock pursuant to the provisions of the Registration Rights Agreement we entered into with Tumim on November 11, 2020 in order to permit the selling stockholder to offer the shares for resale from time to time. Except for the transactions contemplated by the Purchase Agreement and the Registration Rights Agreement, Tumim has not had any material relationship with us within the past three years. As used in this prospectus, the term “selling stockholder” means Tumim Stone Capital, LLC.

The table below presents information regarding the selling stockholder and the shares of common stock that it may offer from time to time under this prospectus. This table is prepared based on information supplied to us by the selling stockholder, and reflects holdings as of November 11, 2020. The number of shares in the column “Maximum Number of Shares of Common Stock to be Offered Pursuant to this Prospectus” represents all of the shares of common stock that the selling stockholder may offer under this prospectus. The selling stockholder may sell some, all or none of its shares in this offering. We do not know how long the selling stockholder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale of any of the shares.

Beneficial ownership is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act, and includes shares of common stock with respect to which the selling stockholder has voting and investment power. The percentage of shares of common stock beneficially owned by the selling stockholder prior to the offering shown in the table below is based on an aggregate of 6,175,818 shares of our common stock outstanding on November 11, 2020. Because the purchase price of the shares of common stock issuable under the Purchase Agreement is determined on each Fixed Purchase Date, with respect to a Fixed Purchase, and on each VWAP Purchase Date, with respect to a VWAP Purchase, the number of shares that may actually be sold by the Company under the Purchase Agreement may be fewer than the number of shares being offered by this prospectus. The fourth column assumes the sale of all of the shares offered by the selling stockholder pursuant to this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Stockholder

|

|

Number of Shares Beneficially Owned Prior to this Offering

|

|

Shares of Common Stock Offered Hereby

|

|

Number of Shares Beneficially Owned After Giving Effect to this Offering (3)

|

|

|

|

Number (1)

|

|

Percent (2)

|

|

|

|

Number (1)

|

|

Percent (2)

|

|

Tumim Stone Capital, LLC (4)

|

|

—

|

|

—%

|

|

1,500,000

|

|

—

|

|

—%

|

_______________________

* less than 1%

(1) In accordance with Rule 13d-3(d) under the Exchange Act, we have excluded from the number of shares beneficially owned prior to the offering all of the shares that Tumim may be required to purchase under the Purchase Agreement, because the issuance of such shares is solely at our discretion and is subject to conditions contained in the Purchase Agreement, the satisfaction of which are entirely outside of Tumim’s control, including the registration statement that includes this prospectus becoming and remaining effective. Furthermore, the Fixed Purchases and VWAP Purchases of common stock are subject to certain agreed upon maximum amount limitations set forth in the Purchase Agreement. Also, the Purchase Agreement prohibits us from issuing and selling any shares of our common stock to Tumim to the extent such shares, when aggregated with all other shares of our common stock then beneficially owned by Tumim, would cause Tumim’s beneficial ownership of our common stock to exceed the 4.99% Beneficial Ownership Cap. The Purchase Agreement also prohibits us from issuing or selling shares of our common stock under the Purchase Agreement in excess of the 19.99% Exchange Cap, unless (i) we obtain stockholder approval to issue shares of our common stock in excess of the Exchange Cap or (ii) the price of all applicable sales of our common stock to Tumim under the Purchase Agreement equals or exceeds the lower of (A) the official closing price on the NYSE immediately preceding the delivery by us of a Fixed Purchase Notice or a VWAP Purchase Notice under the Purchase Agreement and (B) the average of the closing prices of our common stock on the NYSE for the five business days immediately preceding the delivery by us of a Fixed Purchase Notice or a VWAP Purchase Notice under the Purchase Agreement, in each case plus $0.128, such that the transactions contemplated by the Purchase Agreement are exempt from the Exchange Cap limitation under applicable NYSE rules. Neither the Beneficial Ownership Limitation nor the Exchange Cap (to the extent applicable under NYSE rules) may be amended or waived under the Purchase Agreement. We have reserved only an aggregate of 1,500,000 shares of common stock for issuance under the Purchase Agreement and will not issue more than an aggregate of 1,500,000 shares of our common stock unless otherwise approved by our board of directors.

(2) Applicable percentage ownership is based on 6,175,818 shares of our common stock outstanding as of November 11, 2020.

(3) Assumes the sale of all shares being offered pursuant to this prospectus.

(4) The business address of Tumim Stone Capital, LLC is 140 Broadway, 38th Floor, New York, NY 10005. Tumim Stone Capital, LLC’s principal business is that of a private investor. Maier Joshua Tarlow is the manager of 3i Management, LLC, the general partner of 3i LP, which is the sole member of Tumim Stone Capital LLC, and has sole voting control and investment discretion over securities beneficially owned directly by Tumim Stone Capital LLC and indirectly by 3i Management, LLC and 3i, LP. 3i Management, LLC is also the manager of Tumim Stone Capital LLC. We have been advised that none of Mr. Tarlow, 3i Management, LLC, 3i, LP or Tumim Stone Capital LLC is a member of the Financial Industry Regulatory Authority, or FINRA, or an independent broker-dealer, or an affiliate or associated person of a FINRA member or independent broker-dealer. The foregoing should not be construed in and of itself as an admission by Mr. Tarlow as to beneficial ownership of the securities beneficially owned directly by Tumim Stone Capital LLC and indirectly by 3i Management, LLC and 3i, LP.

PLAN OF DISTRIBUTION

An aggregate of up to 1,500,000 shares of our common stock may be offered by this prospectus by Tumim pursuant to the Purchase Agreement. The shares of common stock may be sold or distributed from time to time by Tumim directly to one or more purchasers or through brokers, dealers or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the common stock offered by this prospectus could be effected in one or more of the following methods:

•ordinary brokers’ transactions;

•transactions involving cross or block trades;

•through brokers, dealers, or underwriters who may act solely as agents;

•“at the market” into an existing market for the common stock;

•in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;

•in privately negotiated transactions; or

•any combinations of the foregoing.

In order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the state’s registration or qualification requirement is available and complied with.

Tumim is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

Tumim has informed us that it intends to use one or more registered broker-dealers to effectuate all sales, if any, of our common stock that it has acquired and may in the future acquire from us pursuant to the Purchase Agreement. Such sales will be made at prices and at terms then prevailing or at prices related to the then current market price. Each such registered broker-dealer will be an underwriter within the meaning of Section 2(a)(11) of the Securities Act. Tumim has informed us that each such broker-dealer will receive commissions from Tumim that will not exceed customary brokerage commissions.

Brokers, dealers, underwriters or agents participating in the distribution of the shares of our common stock offered by this prospectus may receive compensation in the form of commissions, discounts, or concessions from the purchasers, for whom the broker-dealers may act as agent, of the shares sold by the selling stockholder through this prospectus. The compensation paid to any such particular broker-dealer by any such purchasers of shares of our common stock sold by the selling stockholder may be less than or in excess of customary commissions. Neither we nor the selling stockholder can presently estimate the amount of compensation that any agent will receive from any purchasers of shares of our common stock sold by the selling stockholder.

We know of no existing arrangements between the selling stockholder or any other stockholder, broker, dealer, underwriter or agent relating to the sale or distribution of the shares of our common stock offered by this prospectus.

We may from time to time file with the SEC one or more supplements to this prospectus or amendments to the registration statement of which this prospectus forms a part to amend, supplement or update information contained in this prospectus, including, if and when required under the Securities Act, to disclose certain information relating to a particular sale of shares offered by this prospectus by the selling stockholder, including the names of any brokers, dealers, underwriters or agents participating in the distribution of such shares by the selling stockholder, any compensation paid by the selling stockholder to any such brokers, dealers, underwriters or agents, and any other required information.

We will pay the expenses incident to the registration under the Securities Act of the offer and sale of the shares of our common stock covered by this prospectus by the selling stockholder. As consideration for its irrevocable commitment to purchase our common stock under the Purchase Agreement, we have agreed to pay Tumim a commitment fee of $100,000, representing 2.0% of Tumim’s $5,000,000 total commitment under the Purchase Agreement. We also have agreed to reimburse Tumim for the fees and disbursements of its counsel, payable upon execution of the Purchase Agreement, in an amount not to exceed $50,000, and to reimburse Tumim for its reasonable, documented out-of-pocket expenses (other than legal fees and disbursements of its counsel) incurred in connection with the transactions contemplated by the Purchase Agreement, in an amount not to exceed $7,500.

We also have agreed to indemnify Tumim and certain other persons against certain liabilities in connection with the offering of shares of our common stock offered hereby, including liabilities arising under the Securities Act or, if such

indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities. Tumim has agreed to indemnify us against liabilities under the Securities Act that may arise from certain written information furnished to us by Tumim specifically for use in this prospectus or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons, we have been advised that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act and is therefore, unenforceable.

We have entered into an agreement with B. Riley Securities, Inc., or B. Riley, a registered broker-dealer and member of the Financial Industry Regulatory Authority, Inc., or FINRA, pursuant to which B. Riley agreed to act as the placement agent in connection with the transactions contemplated by the Purchase Agreement with the Investor, or the placement agent Engagement Agreement. Pursuant to the placement agent Engagement Agreement, we have agreed to pay B. Riley a cash placement fee of $180,000, representing 3.6% of Tumim’s $5,000,000 total commitment under the Purchase Agreement. B. Riley shall not be entitled to any other compensation upon the closing of any subsequent stock sales effected pursuant to the Purchase Agreement and, accordingly, B. Riley shall not be deemed a “participating member” (as such term is defined in FINRA Rule 5110(j)(15)) in connection with any subsequent sales of stock pursuant to this prospectus. We have also agreed to provide indemnification and contribution to B. Riley with respect to certain civil liabilities, including liabilities under the Securities Act.

We estimate that the total expenses for the offering, including compensation payable to B. Riley under the terms of the placement agent Engagement Agreement, will be approximately $500,000.

Tumim has represented to us that at no time prior to the date of the Purchase Agreement has Tumim or its agents, representatives or affiliates engaged in or effected, in any manner whatsoever, directly or indirectly, any short sale (as such term is defined in Rule 200 of Regulation SHO of the Exchange Act) of our common stock or any hedging transaction, which establishes a net short position with respect to our common stock. Tumim has agreed that during the term of the Purchase Agreement, neither Tumim, nor any of its agents, representatives or affiliates will enter into or effect, directly or indirectly, any of the foregoing transactions.