Current Report Filing (8-k)

July 30 2021 - 9:47AM

Edgar (US Regulatory)

0000049826false00000498262021-07-302021-07-300000049826us-gaap:CommonStockMemberexch:XNYS2021-07-302021-07-300000049826itw:A1.75EuroNotesdue2022Memberexch:XNYS2021-07-302021-07-300000049826itw:A1.25EuroNotesdue2023Memberexch:XNYS2021-07-302021-07-300000049826itw:A0.250EuroNotesdue2024Memberexch:XNYS2021-07-302021-07-300000049826itw:A0.625EuroNotesdue2027Memberexch:XNYS2021-07-302021-07-300000049826itw:A2.125EuroNotesdue2030Memberexch:XNYS2021-07-302021-07-300000049826itw:A1.00EuroNotesdue2031Memberexch:XNYS2021-07-302021-07-300000049826itw:A3.00EuroNotesdue2034Memberexch:XNYS2021-07-302021-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 30, 2021

_________________________

ILLINOIS TOOL WORKS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-4797

|

|

36-1258310

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File No.)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

155 Harlem Avenue

|

Glenview

|

IL

|

|

|

|

|

60025

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant's telephone number, including area code: 847-724-7500

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

ITW

|

New York Stock Exchange

|

|

1.75% Euro Notes due 2022

|

ITW22

|

New York Stock Exchange

|

|

1.25% Euro Notes due 2023

|

ITW23

|

New York Stock Exchange

|

|

0.250% Euro Notes due 2024

|

ITW24A

|

New York Stock Exchange

|

|

0.625% Euro Notes due 2027

|

ITW27

|

New York Stock Exchange

|

|

2.125% Euro Notes due 2030

|

ITW30

|

New York Stock Exchange

|

|

1.00% Euro Notes due 2031

|

ITW31

|

New York Stock Exchange

|

|

3.00% Euro Notes due 2034

|

ITW34

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 30, 2021, Illinois Tool Works Inc. (the “Company”) announced its 2021 second quarter results of operations in the press release furnished as Exhibit 99.1.

Non-GAAP Financial Measures

The Company uses free cash flow to measure cash flow generated by operations that is available for dividends, share repurchases, acquisitions and debt repayment. The Company believes this non-GAAP financial measure is useful to investors in evaluating the Company’s financial performance and measures the Company's ability to generate cash internally to fund Company initiatives. Free cash flow represents net cash provided by operating activities less additions to plant and equipment. Free cash flow is a measurement that is not the same as net cash flow from operating activities per the statement of cash flows and may not be consistent with similarly titled measures used by other companies. A reconciliation of free cash flow to net cash provided by operating activities is included in the press release furnished as Exhibit 99.1.

The Company uses after-tax return on average invested capital ("After-tax ROIC") to measure the effectiveness of its operations' use of invested capital to generate profits. After-tax ROIC is a non-GAAP financial measure that the Company believes is a meaningful metric to investors in evaluating the Company's financial performance and may be different than the method used by other companies to calculate After-tax ROIC. Average invested capital represents the net assets of the Company, excluding cash and equivalents and outstanding debt, which are excluded as they do not represent capital investment in the Company's operations. Average invested capital is calculated using balances at the start of the period and at the end of each quarter. A calculation of After-tax ROIC is included in the press release furnished as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(d)

|

Exhibits

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

|

|

|

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ILLINOIS TOOL WORKS INC.

|

|

|

|

|

|

|

|

|

|

Dated: July 30, 2021

|

|

By: /s/ Randall J. Scheuneman

|

|

|

|

Randall J. Scheuneman

|

|

|

|

Vice President & Chief Accounting Officer

|

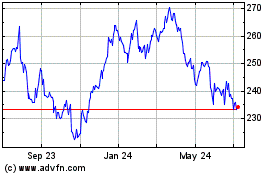

Illinois Tool Works (NYSE:ITW)

Historical Stock Chart

From Mar 2024 to Apr 2024

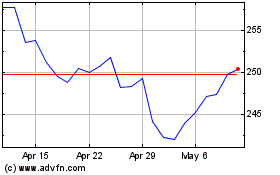

Illinois Tool Works (NYSE:ITW)

Historical Stock Chart

From Apr 2023 to Apr 2024