UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2020

Commission File Number: 001-31528

IAMGOLD Corporation

(Translation of registrant's name into English)

401 Bay Street Suite 3200, PO Box 153

Toronto, Ontario, Canada M5H 2Y4

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [ x ]

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

IAMGOLD CORPORATION |

| |

(Registrant) |

| |

|

|

| Date: January 16, 2020 |

By: |

/s/ Tim Bradburn |

| |

|

Tim Bradburn |

| |

Title: |

Vice President, Legal and Corporate Secretary |

IAMGOLD IN LINE WITH PRODUCTION AND AISC GUIDANCE FOR 2019;

PROVIDES TWO YEAR FORWARD GUIDANCE

All 2019 numbers are preliminary and unaudited and subject to final adjustment.

All amounts are expressed in US dollars, unless otherwise indicated.

Toronto, Ontario, January 16, 2020 - IAMGOLD Corporation ("IAMGOLD" or the "Company") today announced preliminary operating results for 2019, as well as guidance for 2020 and 2021.

"Through the skill and commitment of our team and ongoing support of our stakeholders, we were able to face a number of challenges in 2019 head-on and still deliver a solid year of gold production, with the expectation that we will achieve within 1% of the range on key metrics on a consolidated basis," said IAMGOLD's President and COO, Gordon Stothart. "2019 annual production was 762,000 ounces and we expect to be at the top end of all-in sustaining cost guidance. Our 2020 guidance reflects a year of transition as we build for the future of Essakane and Rosebel, continue development of Westwood and bring Saramacca up to full production, leading to an improvement in the forecast for 2021."

Performance Highlights for 2019

- Attributable gold production of 762,000 ounces, approaching the low end of guidance of 765,000 to 810,000 ounces; fourth quarter production of 192,000 ounces.

- Attributable gold sales of 759,000 ounces for the year and 196,000 ounces for the fourth quarter.

- Total cash costs1 expected at the top end of guidance of $860 to $910 per ounce produced.

- All-in sustaining costs1 expected at the top end of guidance of $1,090 to $1,130 per ounce sold.

- In February 2019, announced a 23% annual increase in global reserves2, largely driven by conversion of resources to reserves at Saramacca in Suriname and Côté Gold in Ontario, coupled with the reserve increase at the Essakane Gold Mine in Burkina Faso. During the year, a maiden resource was declared at the Nelligan Gold Project in Quebec, comprising 3.2 million inferred ounces3.

- On October 31, 2019 we delivered the first ore from the Saramacca open pit to the mill at the Rosebel Gold Mine.

- Project development activities advanced at Boto Gold and Côté Gold, within budget.

- Capital expenditures expected to be slightly lower than guidance of $275 million.

- Cash taxes expected to be approximately $48 million.

- Approximately $865 million in cash, cash equivalents, short term investments, including restricted cash of $28 million, as at December 31, 2019. This includes the receipt of $170 million from the gold prepayment.

Guidance Highlights for 2020

- Attributable gold production between 700,000 and 760,000 ounces reflects no expected production at Sadiola.

- Cost of sales between $900 and $950 per ounce sold.

- Total cash costs1 between $840 and $890 per ounce produced.

- All-in sustaining costs1 between $1,100 and $1,150 per ounce sold.

- All-in sustaining costs1 and cash costs1 per ounce expected to trend downwards in the second half.

- Continued evaluation of satellite targets within large regional land positions surrounding existing operations, evaluation of underground potential of Saramacca and continued delineation and expansion drilling at advanced exploration and development projects.

- Capital expenditures of $315 million ± 5%, comprising sustaining capital of $120 million and non-sustaining capital of $195 million. 2020 includes the completion of development at Saramacca, development spending at Westwood and expected high capitalized stripping at both Essakane and Rosebel.

- Project development updates are expected to be provided in the first quarter of 2020; any associated capital expenditures are also expected to be provided at that time.

Guidance Highlights for 2021

As a result of pushbacks in 2020, Rosebel is expected to have higher ore availability and higher grades in 2021, while Westwood continues to advance. Essakane is expected to have another high stripping year with slightly lower production but slightly better grades. For 2021, we anticipate:

- Increased attributable gold production, expected to be approximately 10% higher than 2020 production levels at 760,000 to 840,000 ounces,

- Lower all-in sustaining costs1, and

- Lower capital expenditures of approximately $250 million with the completion of development at Saramacca in 2020 and lower capitalized stripping.

- Capital referenced is only for current operations and does not include development projects.

2019 PRELIMINARY OPERATING RESULTS

Full year attributable production of 762,000 ounces was slightly below the low end of guidance of 765,000 to 810,000 ounces. Attributable gold production for the fourth quarter 2019 was 192,000 ounces. Of note, Essakane production was 12,000 ounces below guidance due to several factors, including: an extended maintenance shutdown in Q4, higher grades not realized in a satellite pit, mine sequencing, and slightly lower recoveries due to graphitic ore content.

The following table presents attributable production by operating site:

|

Attributable Gold Production

|

|

(000s oz)

|

Q1 2019

|

Q2 2019

|

Q3 2019

|

Q4 2019

|

2019

|

2019 Guidance

|

|

Owner-Operator

|

|

|

|

|

|

|

|

Essakane (90%)

|

90

|

88

|

96

|

94

|

368

|

380 - 390

|

|

Rosebel (95%)

|

68

|

72

|

55

|

56

|

251

|

240 - 260

|

|

Westwood (100%)

|

15

|

24

|

23

|

29

|

91

|

95 - 105

|

|

Total Owner-Operator

|

173

|

184

|

174

|

179

|

710

|

715 - 755

|

|

Joint Ventures

|

12

|

14

|

13

|

13

|

52

|

50 - 55

|

|

TOTAL

|

185

|

198

|

187

|

192

|

762

|

765 - 810

|

Total cash costs for 2019 are expected at the top end of guidance of $860 to $910 per ounce produced, and all-in sustaining costs are expected to be at the top end of guidance of $1,090 to $1,130 per ounce sold.

As a result of an updated Westwood production profile and the pending sale of Sadiola, the Company is conducting a review of the carrying value of these assets.

2020 ATTRIBUTABLE PRODUCTION AND COST GUIDANCE

|

Full Year Guidance1

|

2020

|

|

Essakane (000s oz)

|

365 - 385

|

|

Rosebel (000s oz)

|

245 - 265

|

|

Westwood (000s oz)

|

90 - 110

|

|

Total attributable owner-operator production (000s oz)

|

700 - 760

|

|

|

|

|

Total cost of sales2 ($/oz)

|

$900 - $950

|

|

|

|

|

Total cash costs3,4 - owner-operator ($/oz)

|

$840 - $890

|

|

|

|

|

All-in sustaining costs3,4 - owner-operator ($/oz)

|

$1,100 - $1,150

|

1 Guidance is based on 2020 full year assumptions with an average gold price per ounce of $ 1,350, average crude oil price per

barrel of $62, U.S. dollar value of the Euro of $1.15, and Canadian dollar value of the U.S. dollar of $1.30.

2 Cost of sales, excluding depreciation, is on an attributable ounce sold basis (excluding the non-controlling interest of 10% at

Essakane and 5% at Rosebel).

3 Non-GAAP measure.

4 Consists of Rosebel, Essakane, and Westwood on an attributable basis.

As noted in the above table, our production guidance of 700,000 to 760,000 ounces reflects no assumed production from Sadiola, the inclusion of production from Saramacca at Rosebel, as well as the ongoing advancement at Westwood.

All-in sustaining cost guidance of $ 1,100 to $ 1,150 per ounce for 2020 reflects ongoing efforts to improve productivity and optimize performance across the sites. Readers are reminded that the guidance we provide is annual and that quarterly variation is normal. We expect 2020 production to be lighter in the first half of the year, with the second half benefiting from the ramp-up of Saramacca production.

2020 CAPITAL EXPENDITURE GUIDANCE

|

($ millions)

|

Sustaining1

|

Non-Sustaining

(Development/

Expansion)

|

Total2

|

|

Essakane

|

$ 40

|

$ 100

|

$ 140

|

|

Rosebel

|

55

|

60

|

115

|

|

Westwood

|

25

|

25

|

50

|

|

Owner-operator

|

120

|

185

|

305

|

|

Corporate and Development Projects

|

-

|

10

|

10

|

|

Total3,4 (±5%)

|

$ 120

|

$ 195

|

$ 315

|

| |

|

|

|

1 Sustaining capital includes capitalized stripping of $15 million for Rosebel. In accordance with the World Gold Council guidance on all-in sustaining costs, non-sustaining capital includes capitalized stripping of $80 million at Essakane, and $35 million at Rosebel.

2 Includes $11 million of capitalized exploration expenditures. See Exploration Plan 2020 table in the following section.

3 Capitalized borrowing costs are not included.

4 In addition to the above capital expenditures, $20 million in total principal lease payments are expected.

In 2020, we expect capital spending to be $315 million ± 5%. The increase in spending over 2019 reflects the completion of development at Saramacca, higher development spending at Westwood and expected higher capitalized stripping at both Essakane and Rosebel. Development project updates are expected to be provided in the first quarter of 2020, with any associated capital expenditures expected to be provided at that time.

Non-Sustaining

Rosebel's non-sustaining capital of $60 million is for the development of Saramacca targeted for completion in the first half of 2020, and non-sustaining capitalized stripping. Essakane's non-sustaining capital of $100 million primarily comprises $80 million in capitalized stripping unlocking ore zones for production in future years. Westwood's non-sustaining capital of $25 million is primarily for expansion and development. The $10 million for corporate and development projects primarily relates to progressing the Côté Gold and Boto Gold projects.

Sustaining Capital

Sustaining capital guidance of $120 million is expected to be slightly higher than 2019. Total sustaining capitalized stripping of $15 million is included in sustaining capital and similar to 2019.

2020 EXPLORATION PLAN

Through an active and sustained exploration program, we have continued to successfully increase our Mineral Resources over the past several years, as well as maintain the increases in our Mineral Reserves, net of depletion, over the same period. In 2020, implementing our self-funding model, we have reduced the budget for our near-mine and exploration projects to $47 million, which includes continued evaluation of satellite targets within large regional land positions surrounding our operations, evaluation of underground potential of Saramacca and continued delineation and expansion drilling at our various advanced exploration and development projects including: Côté Gold, Boto Gold, the Rouyn Project near Westwood and the Nelligan Gold Project in Quebec. In addition, we plan to continue exploration of various targets seeking new discoveries in our industry leading portfolio of advanced to early-stage Greenfield projects.

| |

|

2019 Actual |

|

|

2020 Plan |

|

| ($ millions) |

|

Capitalized |

|

|

Expensed |

|

|

Total |

|

|

Capitalized4 |

|

|

Expensed |

|

|

Total |

|

| Exploration projects - greenfield1 |

$ |

2 |

|

$ |

26 |

|

$ |

28 |

|

$ |

- |

|

$ |

26 |

|

$ |

26 |

|

| Exploration projects - brownfield2 |

|

11 |

|

|

9 |

|

|

20 |

|

|

11 |

|

|

10 |

|

|

21 |

|

| Exploration Projects |

$ |

13 |

|

$ |

35 |

|

$ |

48 |

|

$ |

11 |

|

$ |

36 |

|

$ |

47 |

|

| Feasibility and other studies3 |

|

4 |

|

|

- |

|

|

4 |

|

|

- |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Exploration |

$ |

17 |

|

$ |

35 |

|

$ |

52 |

|

$ |

11 |

|

$ |

36 |

|

$ |

47 |

|

1 Greenfield expenses include expenditures related to the Boto Gold Project of $2 million for 2019.

2 Brownfield includes expenditures related to near mine exploration and resource development of $11 million for 2019 and $11 million

for the 2020 Plan.

3 Feasibility and other studies includes expenditures related to the Boto Gold Project of $4 million for 2019. Starting in 2020, capital

costs related to the Boto Gold Project will be capitalized to Property, plant and equipment - Construction in progress.

4 The capitalized portion of the 2020 Plan of $11 million is included in our capital spending guidance of $315 million ± 5%.

2021 ATTRIBUTABLE PRODUCTION INDICATIVE GUIDANCE

As a result of pushbacks in 2020, Rosebel is expected to have higher ore availability and higher grades in 2021, while Westwood continues to advance. Essakane is expected to have another high capitalized stripping year in 2021, with slightly lower production but slightly better grades.

|

Full Year Guidance

|

2021

|

|

Essakane (000s oz)

|

355 - 385

|

|

Rosebel (000s oz)

|

305 - 335

|

|

Westwood (000s oz)

|

100 - 120

|

|

Total owner-operator production (000s oz)

|

760 - 840

|

2021 CAPITAL EXPENDITURE INDICATIVE GUIDANCE

Capital expenditures are expected to be approximately $250 million with the expected completion of the development of Saramacca in 2020 and lower capitalized stripping compared to 2020. Capital is included only for current operations and does not include development projects.

End Notes (excluding Tables)

1. This is a non-GAAP measure. Refer to cautionary language in the most recent version of the MD&A.

2. Refer to February 19, 2019 news release

3. Refer to October 22, 2019 news release.

CONFERENCE CALL

IAMGOLD will release its fourth quarter and full year 2019 financial results after market hours on Wednesday, February 19, 2020. A conference call will be held on Thursday, February 20, 2020 at 8:30 a.m. (Eastern Standard Time) for a discussion with management regarding IAMGOLD's 2019 fourth quarter and full-year operating performance and financial results. A webcast of the conference call will be available through IAMGOLD's website - www.iamgold.com.

Conference Call Information: North America Toll-Free: 1-800-319-4610 or International Number: 1-604-638-5340.

A replay of this conference call will be accessible for one month following the call by dialing: North America toll-free: 1-800-319-6413 or International Number: 1-604-638-9010, passcode: 3973#.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "may", "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "prospective", "significant", "significant potential", "substantial", transformative", "intend", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, failure to meet expected, estimated or planned gold production, unexpected increases in all-in sustaining costs or other costs, unexpected increases in capital expenditures and exploration expenditures, variation in the mineral content within the material identified as Mineral Resources and Mineral Reserves from that predicted, changes in development or mining plans due to changes in logistical, technical or other factors, the possibility that future exploration results will not be consistent with the Company's expectations, changes in world gold markets and other risks disclosed in IAMGOLD's most recent Form 40-F/Annual Information Form on file with the United States Securities and Exchange Commission and Canadian securities regulatory authorities. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable law.

Qualified Person Information

The technical information relating to exploration activities disclosed in this news release was prepared under the supervision of, and reviewed and verified by, Craig MacDougall, P.Geo., Senior Vice President, Exploration, IAMGOLD. Mr. MacDougall is a Qualified Person as defined by National Instrument 43-101.

About IAMGOLD

IAMGOLD (www.iamgold.com) is a mid-tier mining company with four operating gold mines on three continents. A solid base of strategic assets in North and South America and West Africa is complemented by development and exploration projects and continued assessment of accretive acquisition opportunities. IAMGOLD is in a strong financial position with extensive management and operational expertise.

For further information please contact:

Indi Gopinathan, Investor Relations Lead, IAMGOLD Corporation

Tel: (416) 360-4743 Mobile: (416) 388-6883

Martin Dumont, Senior Analyst, Investor Relations, IAMGOLD Corporation

Tel: (416) 933-5783 Mobile: (647) 967-9942

Toll-free: 1-888-464-9999 info@iamgold.com

Please note:

This entire news release may be accessed via fax, e-mail, IAMGOLD's website at www.iamgold.com and through Newsfile's website at www.newsfilecorp.com. All material information on IAMGOLD can be found at www.sedar.com or at www.sec.gov.

Si vous désirez obtenir la version française de ce communiqué de presse, veuillez consulter le http://www.iamgold.com/French/accueil/default.aspx.

This regulatory filing also includes additional resources:

exhibit99-1.pdf

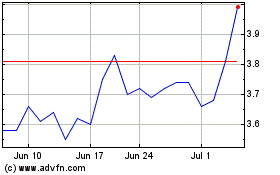

Iamgold (NYSE:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024