UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2018

Commission File Number: 001-31528

IAMGOLD Corporation

(Translation of registrant's name into English)

401 Bay Street Suite 3200, PO Box 153

Toronto, Ontario, Canada M5H 2Y4

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule

101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely

to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule

101(b)(7) only permits the submission in paper of a Form 6-K if submitted to

furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the

registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the

registrant’s securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already

been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes [ ]

No [ x ]

If "Yes" is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- ________

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

IAMGOLD CORPORATION |

| |

(Registrant) |

| |

|

|

| Date: November 15, 2018 |

By: |

/s/ Tim Bradburn |

| |

|

Tim Bradburn |

| |

Title: |

Vice President, Legal and Corporate Secretary |

|

| TSX:

IMG NYSE: IAG |

NEWS RELEASE

IAMGOLD DOUBLES CREDIT FACILITY TO $500

MILLION

AND EXTENDS TO 2023

All monetary amounts are expressed in US dollars, unless otherwise indicated.

Toronto, Ontario, November 15, 2018 – IAMGOLD Corporation

(“IAMGOLD” or the “Company”) announces today that it has amended its revolving

credit facility (the “Corporate Facility’), with the amount increased to $500

million from $250 million and the term extended to 2023. The commitments are

secured by a syndicate of lenders led by National Bank of Canada and Deutsche

Bank AG, Canada Branch, and including Citibank, N.A., Canadian Branch, Morgan

Stanley Senior Funding Inc., Royal Bank of Canada, The Toronto-Dominion Bank,

BNP Paribas, Canadian Imperial Bank of Commerce, Ressources Québec Inc., and

Export Development Canada.

To provide additional financial flexibility, the terms of the

Corporate Facility were also modified to provide the option of securing a

further $100 million through an accordion feature, as well as providing leasing

for up to $250 million, up from $125 million.

“The doubling of our credit facility, together with the other

financing options available, provide us with ample financial flexibility at a

time when our organic growth projects have gained significant traction,” said

Carol Banducci, EVP and Chief Financial Officer. “Our balance sheet is strong

with $715 million in cash, cash equivalents and short-term investments, and our

long-term debt of $400 million is not due until 2025.”

The $500 million Corporate Facility will expire in January 2023

and the $100 million accordion is available under the same terms and conditions.

About IAMGOLD

IAMGOLD (www.iamgold.com) is a mid-tier

mining company with four operating gold mines on three continents. A solid base

of strategic assets in North and South America and West Africa is complemented

by development and exploration projects and continued assessment of accretive

acquisition opportunities. IAMGOLD is in a strong financial position with

extensive management and operational expertise.

For further information please contact:

Ken Chernin, VP Investor Relations, IAMGOLD

Corporation

Tel: (416) 360-4743 Mobile: (416) 388-6883

Laura Young, Director, Investor Relations, IAMGOLD

Corporation

Tel: (416) 933-4952 Mobile: (416) 670-3815

Martin Dumont, Senior Analyst Investor Relations,

IAMGOLD Corporation

Tel: (416) 933-5783 Mobile: (647) 967-9942

Toll-free: 1-888-464-9999 info@iamgold.com

Please note:

This entire news release may be accessed via fax, e-mail,

IAMGOLD's website at www.iamgold.com and through Newsfile’s website at www.newsfilecorp.com. All material information on

IAMGOLD can be found at www.sedar.com or at

www.sec.gov.

Si vous désirez obtenir la version française de ce communiqué,

veuillez consulter le

http://www.iamgold.com/French/accueil/default.aspx.

This regulatory filing also includes additional resources:

exhibit99-1.pdf

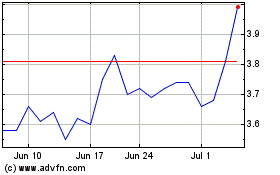

Iamgold (NYSE:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024