Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

January 28 2022 - 4:17PM

Edgar (US Regulatory)

Filed

Pursuant to Rule 424(b)(3)

Registration No. 333-249649

PROSPECTUS

SUPPLEMENT NO. 1

(To

Prospectus Dated January 5, 2022)

Up

to 88,642,440 Shares of Common Stock

This

Prospectus Supplement No. 1 supplements and amends the prospectus dated January 5, 2022 (as amended and supplemented to date, the “Prospectus”)

relating to the offer and sale from time to time by the selling security holders named in the Prospectus (the “Selling Securityholders”)

of up to 88,642,440 shares of Common Stock.

This

Prospectus Supplement No. 1 is being filed to amend the Selling Securityholder information set forth in the Prospectus as set forth on

Annex A attached hereto. This Prospectus Supplement No. 1 should be read in conjunction with the Prospectus and is qualified by reference

to the Prospectus except to the extent that the information in this Prospectus Supplement No. 1 supersedes the information contained

in the Prospectus. Capitalized terms used but not defined herein shall have the meanings given to them in the Prospectus.

Our

Common Stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “HYLN.” On January 26,

2022, the closing price of our Common Stock was $4.00.

Investing

in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 3 of the Prospectus, as well as

those risk factors contained in any amendments or supplements to the Prospectus and the documents included or incorporated by reference

herein or therein.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities that may be

offered under the Prospectus and this Prospectus Supplement No. 1, nor have any of these organizations determined if this Prospectus

Supplement No. 1 is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement No. 1 is January 28, 2022.

ANNEX

A

AMENDMENT

TO SELLING SECURITYHOLDER INFORMATION

This

Prospectus Supplement No. 1 is being filed in connection with certain changes to the selling securityholder information as set forth

in the Prospectus dated January 5, 2022 (as supplemented to date, the “Prospectus”) resulting from the distribution by CRA

Fund II LLC (the “Distributing Holder”) of the shares of common stock held by the Distributing Holder on a pro rata basis.

Consequently, the selling securityholders table (the “Selling Securityholders Table”) appearing under the heading “SELLING

SECURITYHOLDERS” in the Prospectus is hereby amended and supplemented by (i) deleting the information for the Distributing Holder

in the Selling Securityholders Table, including footnote (9) thereto; and (ii) adding the information set forth in the table below to

the Selling Securityholders Table.

The

following table sets forth, based on written representations from the Selling Securityholders named herein, certain information regarding

the beneficial ownership of our Common Stock by the Selling Securityholders and the shares of Common Stock being offered by such Selling

Securityholders. The applicable percentage ownership of Common Stock is based on approximately 173,313,427 shares of Common Stock outstanding

as of November 4, 2021. Information with respect to shares of Common Stock owned beneficially after the offering assumes the sale of

all of the shares of Common Stock offered and no other purchases or sales of our Common Stock. The Selling Securityholders named herein

may offer and sell some, all or none of their shares of Common Stock.

We

have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe,

based on the information furnished to us, that the Selling Securityholders have sole voting and investment power with respect to all

shares of Common Stock that they beneficially own, subject to applicable community property laws. Except as otherwise described below,

based on the information provided to us by the Selling Securityholders, no Selling Securityholder is a broker-dealer or an affiliate

of a broker-dealer.

|

|

|

Shares of

Common Stock

Beneficially

Owned Prior to

|

|

|

Number of Shares of Common Stock Being

|

|

|

Shares of Common Stock Beneficially Owned After the Offered Shares of Common Stock are Sold

|

|

|

Name of Selling Securityholder

|

|

Offering

|

|

|

Offered(1)

|

|

|

Number

|

|

|

Percent

|

|

|

Bradley M. Bloom 2005 Revocable Trust(32)

|

|

|

1,718,515

|

|

|

|

1,718,515

|

|

|

|

—

|

|

|

|

—

|

|

|

Garth H. Greimann Revocable Trust(33)

|

|

|

547,606

|

|

|

|

547,606

|

|

|

|

—

|

|

|

|

—

|

|

|

Gideon Argov(34)

|

|

|

671,410

|

|

|

|

671,410

|

|

|

|

—

|

|

|

|

—

|

|

|

Robert J. Small Revocable Trust(35)

|

|

|

607,716

|

|

|

|

607,716

|

|

|

|

—

|

|

|

|

—

|

|

|

The David Randolph Peeler Trust – 2001(36)

|

|

|

1,235,914

|

|

|

|

1,235,914

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(1)

|

The

amounts set forth in this column are the number of shares of Common Stock that may be offered

by each Selling Securityholder using the Prospectus. These amounts do not represent any other

shares of our Common Stock that the Selling Securityholder may own beneficially or otherwise.

|

|

|

(32)

|

Bradley

M. Bloom, trustee of the Selling Securityholder, is deemed to have power to vote or dispose of the Registrable Securities.

|

|

|

(33)

|

Garth

H. Greimann, trustee of the Selling Securityholder, is deemed to have power to vote or dispose of the Registrable Securities.

|

|

|

(34)

|

Gideon

Argov served as a director of Legacy Hyliion prior to the Closing of the Business Combination.

|

|

|

(35)

|

Robert

J. Small, trustee of the Selling Securityholder, is deemed to have power to vote or dispose of the Registrable Securities.

|

|

|

(36)

|

David

R. Peeler, trustee of the Selling Securityholder, is deemed to have power to vote or dispose of the Registrable Securities.

|

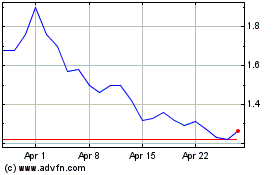

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Apr 2023 to Apr 2024