By Dave Sebastian

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 27, 2020).

Roadside inns are faring better than Ritz-Carltons as Americans

start to travel again with loosened Covid-19 restrictions.

Though the pandemic has severely hurt the lodging industry

overall, budget and midlevel hotels -- the kind often found just

off the highway -- have taken a milder hit than many luxury hotels

and resorts. Road trippers aren't the only ones checking in:

Midrange and budget hotels are also housing more essential workers

on the go.

A key measure of hotel performance, revenue per available room,

plunged 80.6% for the second quarter at luxury hotels in the U.S.,

after a 21.3% decline in the first quarter, according to data

analytics firm STR, owned by CoStar Group Inc. Budget hotels, by

contrast, saw a 44.4% decline in the second quarter, after falling

13.3% in the first quarter, STR data show.

Though big hotel chains have seen steep declines this year due

to the pandemic, their lower-priced hotels have generally fared

better. Marriott International Inc., which recorded its largest

loss ever for the June quarter, posted a 75.6% decline in revenue

per available room at its North American limited-service hotels,

which include Courtyard and Residence Inn. That was slightly better

than the 93.3% decline at its North American luxury hotels, which

include JW Marriott, Ritz-Carlton and W Hotels.

The average daily rate at Marriott's limited-service hotels in

North America was $99.63, compared with $293.47 at luxury hotels.

Much of Marriott, Hilton Worldwide Holdings Inc. and Hyatt Hotels

Corp.'s occupancy before the pandemic came from business and group

travel, including at luxury hotels in big cities.

Hyatt, which saw an 89.4% drop in revenue per available room for

the second quarter from a year earlier, pointed to more spontaneous

travel. Three-quarters of bookings at its select-service hotels are

being made just four days out from the stay.

"This is the shortest transient booking window we have seen,"

Chief Executive Mark Hoplamazian said on a call with analysts.

Tony Rojas was FaceTiming one Friday night in August with four

friends who were en route from Massachusetts to New Jersey for

their annual Six Flags trip, which Mr. Rojas had never missed in

the years before the pandemic.

Afraid of missing out, Mr. Rojas hopped in his car at 11 p.m.

that night and drove 2 1/2 hours from Lancaster, Pa., to East

Windsor, N.J., where he shared a Holiday Inn room with his friends

for about $130 altogether.

"I basically didn't sleep because we were all excited," said Mr.

Rojas, 27 years old.

InterContinental Hotels Group PLC, which oversees luxury hotels

under its namesake and lower-priced hotels such as Holiday Inn,

cited a positive impact from road travelers like Mr. Rojas as it

reported an overall 75% decline in revenue per available room

during the second quarter. The company expects business travel to

pick up, thanks to meeting-dependent corporate sectors such as

banking, Chief Executive Keith Barr said.

"I think you'll see a slight resurgence of [business travel]

coming into the fall," Mr. Barr said in an interview.

Choice Hotels International Inc., whose brands include Econo

Lodge and Cambria Hotels, has more than 4,000 hotels within a mile

of an interstate exit and 2,000 hotels near beaches and national

parks in the U.S., making it suitable for outdoor activities that

allow for social distancing.

It is attracting leisure travelers who "just want to get out of

the house while staying closer to home," Chief Executive Patrick

Pacious told analysts. The hotel franchiser sourced a quarter of

its June revenue from customers who traveled less than 25 miles to

a hotel, he said.

While much of corporate travel hasn't resumed, budget and

midscale properties cater to a different kind of business

travelers: essential workers.

Wyndham Hotels & Resorts Inc., which estimates that 90% of

its U.S. hotels are in suburban, interstate or small metro markets,

got 30% of its second-quarter bookings from those workers, Chief

Executive Geoffrey Ballotti told analysts. They include medical

personnel, government employees, construction and utility workers

and truck drivers.

"We are also seeing increasing demand from the military, from

the government, medical and small social segments like family

reunions, birthdays, anniversaries and small weddings," Mr.

Ballotti said.

Leisure travel usually tapers off after the summer as students

return to school, but Marriott and Hilton expect families to

continue making trips as they work and study remotely.

"You're going to see leisure trail off, as you always do, but I

think a little less so," Hilton Chief Executive Christopher

Nassetta said on a conference call. "It will take a little longer

for that to bleed off because a lot of kids aren't going back to

school -- or they are, but virtually."

While budget-friendly properties are performing better than

others, there are some resorts and higher-end places that also

benefited from road trips.

After Melody Van Ess's European cruise got canceled, she decided

to road trip from Scottsdale, Ariz., to Yellowstone National Park

and other sights. She and her husband paid about $5,000 to stay at

five hotels from late July to early August, including a Hyatt in

Salt Lake City, a Four Seasons in Jackson Hole, Wyo., and a lodge

in Keystone, S.D., under Ascend Hotel Collection, a Choice Hotels

brand.

"I'm going to travel the way I traveled before, understanding

that most people are not serious about [wearing masks] as they

should be," noting her biggest travel frustration. "I'm going to

carry my Clorox, and I'm going to carry my wipes," said Ms. Van

Ess.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

August 27, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

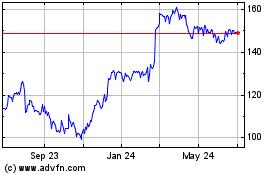

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Mar 2024 to Apr 2024

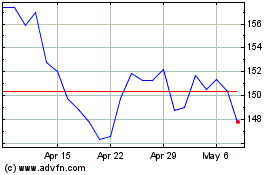

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Apr 2023 to Apr 2024