Amended Statement of Beneficial Ownership (sc 13d/a)

March 18 2020 - 5:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 13)1

Hudbay Minerals Inc.

(Name

of Issuer)

Common Shares,

no par value

(Title of Class of Securities)

443628102

(CUSIP Number)

KANWALJIT TOOR

199 Bay Street, Suite 5050

Toronto, Ontario M5L 1E2

+1 416 504 3508

STEVE WOLOSKY, ESQ.

ANDREW FREEDMAN, ESQ.

OLSHAN FROME WOLOSKY LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

March 16, 2020

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Waterton Mining Parallel Fund Offshore Master, LP

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Cayman Islands

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

20,177,001

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.7%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

PN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Waterton Precious Metals Fund II Cayman, LP

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Cayman Islands

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

20,177,001

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.7%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

PN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Waterton Mining Parallel Fund Offshore GP Corp.

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Cayman Islands

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

20,177,001

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.7%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

CO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Waterton Global Resource Management, LP

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Cayman Islands

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

20,177,001

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.7%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

PN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Waterton Global Resource Management Cayman Corp.

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Cayman Islands

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

20,177,001

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

20,177,001

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.7%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

CO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Waterton Global Resource Management, Inc.

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

40,354,002

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

15.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Cheryl Brandon

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

40,354,002

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

15.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Isser Elishis

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

USA

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

40,354,002

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

15.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Kalman Schoor

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

USA

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

40,354,002

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

15.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Kanwaljit Toor

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

40,354,002

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

15.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard J. Wells

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

- 0 -

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

40,354,002

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 0 -

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

40,354,002

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

15.4%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

The following constitutes

Amendment No. 13 to the Schedule 13D filed by the undersigned (“Amendment No. 13”). This Amendment No. 13 amends the

Schedule 13D as specifically set forth herein.

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

Item 3 is hereby

amended and restated to read as follows:

The Shares purchased

by each of Waterton Mining LP and Waterton Fund II were purchased with working capital (which may, at any given time, include

margin loans made by brokerage firms in the ordinary course of business) in open market purchases, except as otherwise noted,

as set forth in Schedule A, which is incorporated by reference herein. The aggregate purchase price of the 20,177,001 Shares beneficially

owned by Waterton Mining LP is approximately C$118,309,692, excluding brokerage commissions. The aggregate purchase price of the

20,177,001 Shares beneficially owned by Waterton Fund II is approximately C$118,309,742, excluding brokerage commissions.

|

|

Item 4.

|

Purpose of Transaction.

|

Item 4 is hereby amended

to add the following:

As previously disclosed

in Amendment No. 10 to the Schedule 13D, on May 3, 2019, WGRM Inc. entered into a settlement agreement with the Issuer (the “Settlement

Agreement”), a copy of which was filed as Exhibit 99.1 to Amendment No. 10 to the Schedule 13D. On March 16, 2020, WGRM Inc.

and the Issuer entered into an amendment (the “Amendment”) to the Settlement Agreement. Pursuant to the Amendment,

WGRM Inc. and the Issuer agreed to, among other things, increase the number of Shares that may be acquired by the Reporting Persons

from 15.0% to up to 19.99% of the Shares outstanding during the standstill period. WGRM Inc. and the Issuer also agreed to amend

certain standstill provisions and to extend the standstill period for six months if the Reporting Persons acquire beneficial ownership

in excess of 16% of the Shares outstanding prior to the original termination date, with an automatic extension of a further six

months if the Reporting Persons’ beneficial ownership interest exceeds 17.5% of the Shares outstanding prior to the expiry

of such initial six-month extension period.

The foregoing description

of the Amendment is qualified in its entirety by reference to the Amendment, which is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

Items 5(a)-(c) are

hereby amended and restated to read as follows:

The aggregate percentage

of Shares reported owned by each person named herein is based upon 261,272,151 Shares outstanding, as of February 19, 2020, which

is the total number of Shares outstanding as reported in Exhibit 99.2 to the Issuer’s Report of foreign issuer on Form 6-K

filed with the Securities and Exchange Commission on February 24, 2020.

|

|

(a)

|

As of the close of business on March 18, 2020, Waterton Mining LP beneficially owned 20,177,001

Shares.

|

Percentage: Approximately

7.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 20,177,001

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 20,177,001

|

|

|

(c)

|

The transactions in the Shares by Waterton Mining LP during the past sixty days are set forth in

Schedule A and are incorporated herein by reference.

|

|

|

(a)

|

As of the close of business on March 18, 2020, Waterton Fund II beneficially owned 20,177,001 Shares.

|

Percentage: Approximately

7.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 20,177,001

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 20,177,001

|

|

|

(c)

|

The transactions in the Shares by Waterton Fund II during the past sixty days are set forth in

Schedule A and are incorporated herein by reference.

|

|

|

(a)

|

Waterton Mining GP, as the general partner of Waterton Mining LP, may be deemed the beneficial

owner of the 20,177,001 Shares owned by Waterton Mining LP.

|

Percentage: Approximately

7.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 20,177,001

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 20,177,001

|

|

|

(c)

|

Waterton Mining GP has not entered into any transactions in the Shares during the past sixty days.

The transactions in the Shares on behalf of Waterton Mining LP during the past sixty days are set forth in Schedule A and are incorporated

herein by reference.

|

|

|

(a)

|

WGRM LP, as the general partner of Waterton Fund II, may be deemed the beneficial owner of the

20,177,001 Shares owned by Waterton Fund II.

|

Percentage: Approximately

7.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 20,177,001

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 20,177,001

|

|

|

(c)

|

WGRM LP has not entered into any transactions in the Shares during the past sixty days. The transactions

in the Shares on behalf of Waterton Fund II during the past sixty days are set forth in Schedule A and are incorporated herein

by reference.

|

|

|

(a)

|

WGRM Corp., as the general partner of WGRM LP, may be deemed the beneficial owner of the 20,177,001

Shares owned by Waterton Fund II.

|

Percentage: Approximately

7.7%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 20,177,001

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 20,177,001

|

|

|

(c)

|

WGRM Corp. has not entered into any transactions in the Shares during the past sixty days. The

transactions in the Shares on behalf of Waterton Fund II during the past sixty days are set forth in Schedule A and are incorporated

herein by reference.

|

|

|

(a)

|

WGRM Inc., as the investment adviser to each of Waterton Mining LP and Waterton Fund II, may be

deemed the beneficial owner of the (i) 20,177,001 Shares owned by Waterton Mining LP and (ii) 20,177,001 Shares owned by Waterton

Fund II.

|

Percentage:

Approximately 15.4%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 40,354,002

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 40,354,002

|

|

|

(c)

|

WGRM Inc. has not entered into any transactions in the Shares during the past sixty days. The transactions

in the Shares on behalf of each of Waterton Mining LP and Waterton Fund II during the past sixty days are set forth in Schedule

A and are incorporated herein by reference.

|

|

|

G.

|

Messrs. Elishis, Schoor, Toor and Wells and Ms. Brandon

|

|

|

(a)

|

Each of Messrs. Elishis, Schoor, Toor and Wells and Ms. Brandon, as a senior executive of WGRM

Inc., may be deemed the beneficial owner of the (i) 20,177,001 Shares owned by Waterton Mining LP and (ii) 20,177,001 Shares owned

by Waterton Fund II.

|

Percentage: Approximately

15.4%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 40,354,002

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 40,354,002

|

|

|

(c)

|

None of Messrs. Elishis, Schoor, Toor and Wells and Ms. Brandon has entered into any transactions

in the Shares during the past sixty days. The transactions in the Shares on behalf of each of Waterton Mining LP and Waterton Fund

II during the past sixty days are set forth in Schedule A and are incorporated herein by reference.

|

The filing of this

Schedule 13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities Exchange

Act of 1934, as amended, the beneficial owners of any securities of the Issuer that he, she or it does not directly own. Each of

the Reporting Persons specifically disclaims beneficial ownership of the securities reported herein that he, she or it does not

directly own.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

|

Item 6 is hereby amended

to add the following:

On March 16, 2020,

WGRM Inc. entered into the Amendment as further described in Item 4. A copy of the Amendment is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

|

|

Item 7.

|

Material to be Filed as Exhibits.

|

Item 7 is hereby amended

to add the following exhibit:

|

|

99.1

|

Amending Agreement by and between Waterton Global Resource Management, Inc. and Hudbay Minerals

Inc., dated March 16, 2020.

|

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Dated: March 18, 2020

|

|

WATERTON MINING PARALLEL FUND OFFSHORE MASTER, LP

|

|

|

|

|

|

By:

|

Waterton Mining Parallel Fund Offshore GP Corp., its general partner

|

|

|

|

|

|

|

By:

|

/s/ Richard J. Wells

|

|

|

|

Name:

|

Richard J. Wells

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

Waterton Precious Metals Fund II Cayman, LP

|

|

|

|

|

|

By:

|

Waterton Global Resource Management, LP, its general partner

|

|

|

By:

|

Waterton Global Resource Management Cayman Corp., its general partner

|

|

|

|

|

|

|

By:

|

/s/ Richard J. Wells

|

|

|

|

Name:

|

Richard J. Wells

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

Waterton Mining Parallel Fund Offshore GP Corp.

|

|

|

|

|

|

By:

|

/s/ Richard J. Wells

|

|

|

|

Name:

|

Richard J. Wells

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

Waterton Global Resource Management, LP

|

|

|

|

|

|

By:

|

Waterton Global Resource Management Cayman Corp., its general partner

|

|

|

|

|

|

|

By:

|

/s/ Richard J. Wells

|

|

|

|

Name:

|

Richard J. Wells

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

Waterton Global Resource Management Cayman Corp.

|

|

|

|

|

|

By:

|

/s/ Richard J. Wells

|

|

|

|

Name:

|

Richard J. Wells

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

WATERTON GLOBAL RESOURCE MANAGEMENT, INC.

|

|

|

|

|

|

By:

|

/s/ Richard J. Wells

|

|

|

|

Name:

|

Richard J. Wells

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

|

|

|

/s/ Cheryl Brandon

|

|

|

Cheryl Brandon

|

|

|

|

|

|

/s/ Isser Elishis

|

|

|

Isser Elishis

|

|

|

|

|

|

/s/ Kalman Schoor

|

|

|

Kalman Schoor

|

|

|

|

|

|

/s/ Kanwaljit Toor

|

|

|

Kanwaljit Toor

|

|

|

|

|

|

/s/ Richard J. Wells

|

|

|

Richard J. Wells

|

SCHEDULE A

Transactions in the Shares During

the Past Sixty Days

|

Nature of the Transaction

|

Amount of Securities

Purchased/(Sold)

|

Price (US$)*

|

Date of

Purchase/Sale

|

Waterton

Mining Parallel Fund Offshore Master, LP

|

Purchase of Common Shares

|

250,000

|

2.8542

|

02/21/2020

|

|

Purchase of Common Shares

|

327,113

|

2.7159

|

02/24/2020

|

|

Purchase of Common Shares

|

301,021

|

2.6750

|

02/25/2020

|

|

Purchase of Common Shares

|

70,000

|

2.3060

|

02/27/2020

|

|

Purchase of Common Shares

|

584,001

|

1.4194

|

03/18/2020

|

Waterton

Precious Metals Fund II Cayman, LP

|

Purchase of Common Shares

|

250,000

|

2.8542

|

02/21/2020

|

|

Purchase of Common Shares

|

327,113

|

2.7159

|

02/24/2020

|

|

Purchase of Common Shares

|

301,022

|

2.6750

|

02/25/2020

|

|

Purchase of Common Shares

|

70,000

|

2.3060

|

02/27/2020

|

|

Purchase of Common Shares

|

583,988

|

1.4194

|

03/18/2020

|

*

The price reported is a weighted average price. These shares were

purchased in multiple transactions at prices ranging from US$1.27 to US$2.87. The Reporting Persons undertake to provide to the

Issuer, any security holder of the Issuer or the staff of the Securities and Exchange Commission, upon request, full information

regarding the number of shares purchased at each separate price within the range set forth herein.

HudBay Minerals (NYSE:HBM)

Historical Stock Chart

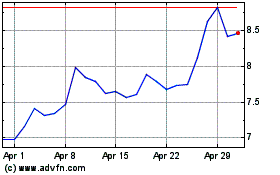

From Mar 2024 to Apr 2024

HudBay Minerals (NYSE:HBM)

Historical Stock Chart

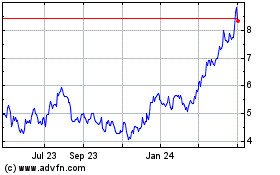

From Apr 2023 to Apr 2024