UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed

by the Registrant |

|

Filed

by a Party other than the Registrant |

| Check

the appropriate box: |

|

Preliminary

Proxy Statement |

|

Definitive

Proxy Statement |

|

Definitive

Additional Materials |

|

Soliciting

Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

|

Confidential,

for the Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

HUBBELL

INCORPORATED

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement)

| Payment

of Filing Fee (Check the appropriate box): |

|

No

fee required. |

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

(1) Title of each class of securities to which

transaction applies: |

| |

(2) Aggregate number of securities to which transaction

applies: |

| |

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| |

(set

forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) Proposed maximum aggregate value of transaction: |

| |

(5) Total

fee paid: |

|

Fee

paid previously with preliminary materials. |

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing. |

| |

(1) Amount Previously Paid: |

| |

(2) Form, Schedule or Registration Statement

No.: |

| |

(3) Filing Party: |

| |

(4) Date

Filed: |

Notice of 2020 Annual

Meeting of Shareholders

Your proxy is being solicited for the Annual Meeting of Shareholders

of Hubbell Incorporated (the “Annual Meeting”), or any adjournment, continuation or postponement of the Annual Meeting,

on behalf of the Board of Directors of the Company. Hubbell pays the cost of soliciting your proxy. On March 23, 2020, we mailed

a Notice of the Internet Availability of Proxy Materials to all shareholders of record advising that they could view all of the

proxy materials (Proxy Statement, Proxy Card and Annual Report on Form 10-K) online at www.proxyvote.com free of charge,

or request in writing a paper or email copy of the proxy materials free of charge. We encourage all shareholders to access their

proxy materials online to reduce the environmental impact and cost of our proxy solicitation. You may request a paper or email

copy of the materials using any of the following methods:

|

By Internet: Go to www.proxyvote.com |

| |

|

|

By Phone: 1-800-579-1639 |

| |

|

|

By Email: sendmaterial@proxyvote.com |

How To Vote In Advance

Your vote is important. Please vote as soon as possible

by one of the methods shown below. Make sure to have your proxy card, voting instruction form, or notice of Internet availability

in hand and follow the instructions.

|

| |

|

|

BY TELEPHONE

You can vote your shares toll-free by calling 1-800-579-1639. |

| |

|

|

BY INTERNET

You can vote your shares online at proxyvote.com. |

| |

|

|

BY MAIL

If you have requested a paper copy of the proxy materials, complete,

sign and return your proxy card in the prepaid envelope. |

| |

|

|

IN PERSON

Shareholders who attend the Annual Meeting may request a ballot and

vote in person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or record

holder and present it to the inspectors of election with your ballot to be able to vote at the meeting. |

| |

|

|

BY SCANNING

You can vote your shares online by scanning the QR code on your proxy

card. You will need the 16-digit control number on your proxy card. |

MEETING INFORMATION

Date and Time

Tuesday, May 5, 2020 at 9:00 a.m.

Location

Hubbell Incorporated

40 Waterview Drive, Shelton, CT 06484

Record Date

March 6, 2020

You may revoke your proxy at any time prior to its use by any of

the following methods:

|

Delivering to the Secretary of the Company written instructions revoking your proxy |

| |

|

|

Delivering an executed proxy bearing a later date than your prior voted proxy |

| |

|

|

If you voted by Internet or telephone, by recording a different vote on the Internet website

or by telephone |

| |

|

|

Voting in person at the Annual Meeting |

If you hold your shares in street name, you must follow the instructions of your

broker, bank or other nominee to revoke your voting instructions.

Items of Business

PROPOSAL 1

Election of 8 directors.

PROPOSAL 2

Say on Pay: advisory vote on the compensation of the named executive

officers.

PROPOSAL 3

Ratify the selection of PricewaterhouseCoopers LLP as our independent

auditor for 2020.

In addition, any other business properly presented may be acted upon

at the meeting.

Record Date

If you were a shareholder of record at the close of business on March

6, 2020, you will be entitled to notice and to vote at the Annual Meeting.

By order of the Board,

Katherine A. Lane

Vice President, General Counsel and Secretary

March 23, 2020

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 5, 2020.

This Notice of Annual Meeting and Proxy Statement and the Company’s

Annual Report on Form 10-K for the year ended 2019 are available at www.proxyvote.com. Have your Notice of the Internet Availability

of Proxy Materials or proxy card in hand when you go to the website. |

Table of contents

Proxy Summary

This Proxy Summary highlights selected information

contained in this Proxy Statement. It does not contain all the information that you should consider in deciding how to vote. You

should read the entire Proxy Statement carefully before voting.

Annual Shareholders Meeting

|

DATE: May 5, 2020

TIME: 9:00 a.m.

MEETING AGENDA: The meeting will cover the

proposals listed under voting matters and vote recommendations below, and any other business that may properly come before the

meeting.

PLACE: Hubbell Incorporated

40 Waterview Drive, Shelton, CT 06484 |

|

RECORD DATE: March 6, 2020

MAILING DATE: This Proxy Statement was first

mailed to shareholders on or about March 23, 2020.

VOTING: Shareholders as of

the record date are entitled to vote. Each share of common stock of Hubbell Incorporated (“Company”) is entitled to

one vote for each director nominee and one vote for each of the proposals. |

Voting Matters and Vote Recommendations

A quorum is required to transact business at

the Annual Meeting. The presence of the holders of Common Stock, in person or by proxy, representing a majority of the voting power

of the Company’s outstanding shares constitutes a quorum for the Annual Meeting. Abstentions and broker non-votes are counted

as present for quorum purposes.

| Proposal |

Board’s Voting

Recommendation |

Page reference |

| Proposal 1 – Election of Directors |

FOR FOR

each Nominee |

12 |

| Proposal 2 – Advisory Vote to Approve Named Executive Officer Compensation (“Say on Pay vote”) |

FOR FOR |

31 |

| Proposal 3 – Ratification of the Selection of PricewaterhouseCoopers LLP as Our Independent Auditor for Fiscal Year 2020 |

FOR FOR |

71 |

The Company does not intend to present any business

at the Annual Meeting other than the items described in the Proxy Statement and has no information that others will do so. The

proxies appointed by our Board of Directors (and named on your Proxy Card) will vote all shares as the Board recommends above,

unless you instruct otherwise when you vote. If a matter not described in this Proxy Statement is properly presented at the Annual

Meeting, the named proxies will have the discretion to vote your shares in their judgment.

Our Vision and Values

Hubbell is a global manufacturer of quality electrical and electronic

products for a broad range of applications in the Electrical and Power segments. Hubbell is committed to doing business in ways

that are principled, transparent and accountable to our shareholders. We believe doing so generates long-term value.

Our Vision is to be an exceptional

supplier, a valued investment, and a rewarding employer. Our commitment is underscored by the four pillars

that guide us as a company.

|

SERVE

OUR CUSTOMERS |

|

|

OPERATE

WITH DISCIPLINE |

|

|

GROW

THE ENTERPRISE |

|

|

DEVELOP

OUR EMPLOYEES |

| |

|

|

|

|

|

|

|

|

|

|

| We strive to exceed customer expectations by providing exceptional service and implementing processes that make it easy to do business with us. |

|

We implement industry leading processes to ensure a productive, safe and compliant organization, and maximize our footprint for operational efficiency. |

|

We continue to grow our organization, both through developing innovative new products and by acquiring complementary businesses. |

|

We recruit, hire and develop talent that meets and anticipates the ever-changing needs of our enterprise, while fostering an inclusive and diverse workplace. |

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 3 |

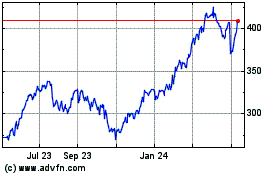

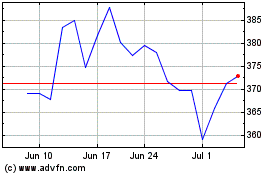

2019 Performance Highlights

We measure our progress not only in terms of our financial accomplishments,

but in the best interests of our shareholders, partners, customers, employees and the communities in which we operate.

Financial Results

| (1) |

Adjusted diluted earnings per share and free

cash flow are non-GAAP financial measures. A reconciliation to the comparable GAAP financial measures can be found in our

Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 14, 2020. |

2%

Net Sales Growth |

|

5%

Adjusted Diluted EPS Growth |

|

18%

Free Cash Flow Growth |

| |

|

|

|

|

| > Growth

primarily from price realization |

|

> Includes

$0.51 restructuring and related investment |

|

> Net

Income up 11% |

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 4 |

Business Development

Hubbell has a proven history of successfully acquiring and integrating

complementary businesses and products. In 2018, Hubbell completed the largest acquisition in its history, Aclara Technologies LLC.

In 2019, Hubbell replenished its deal pipeline and closed on three acquisitions and also divested its legacy international high

voltage business.

|

|

|

|

|

| ELECTRICAL |

|

UTILITY |

|

PORTFOLIO MANAGEMENT |

| |

|

|

|

|

| Acquired a connector business that designs and manufacturers electrical connectors and accessories for power utilities and mass transit rail systems. Part of Hubbell’s Construction & Energy Group. |

|

Acquired a wildlife and asset protection manufacturing business for electrical utilities, renewable power generators and industrial customers. Part of Hubbell’s Power Systems Group. |

|

Divested our Swiss high voltage business that was no longer core to Hubbell’s overall portfolio. Formerly part of Hubbell’s Commercial & Industrial Group. |

Corporate Governance Highlights

Hubbell’s Board operates in accordance with its Corporate Governance

Guidelines (the “Guidelines”) that establish its governance framework and processes. The Board reviews the Guidelines

at least annually and in 2019 revised them to formally document the Board’s commitment to oversight of environmental, social

and governance (“ESG”) matters. The Board continues to remain focused on oversight of Company strategy, enterprise

risks, financial performance, operational planning, talent, succession, compliance and culture.

|

INDEPENDENT BOARD

8

of 9 directors are independent and the independent Lead Director

has broad authority and leads sessions of

the independent directors at every Board meeting. All Board committees

except one consist entirely of independent

directors. There are no related party transactions with our

directors. |

|

VOTING RIGHTS

Each

share of common stock is entitled to one vote. Annual

election of shareholders. |

|

OVERSIGHT AND REVIEW

Hubbell’s

Code of Conduct and Ethics applies to all directors.

The Board and each standing committee conduct

annual self-evaluations and make adjustments

and enhancements as necessary. The Board takes seriously

its oversight of the Company’s risk management,

succession, strategy and compliance programs. |

| |

|

|

|

|

|

COMMITMENT

The directors meet regularly in

Board, Committee or Special Committee meetings. In 2019, our directors reached out to investors representing 65% of our outstanding

common shares as well as proxy advisory firms and other third parties. All of our directors attended the 2019 Annual Shareholder

meeting. |

|

COMPENSATION

Director

compensation is reviewed and benchmarked annually

with our independent compensation consultant.

The majority of our directors’ compensation

is in equity. There are stock ownership requirements

in place for all directors. |

|

DIVERSITY

Director

nominees are evaluated on their background and experience, and also

gender, race and diversity. 2 of the 8 current independent

directors are diverse. 1 of the 7 independent director nominees

is diverse, as Ms. Marks is not standing for re-election. 86% of

the independent director nominees have served

for 10 years or less, with 43% serving for 7 years or less. |

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 5 |

|

INCREASED SHAREHOLDER OUTREACH AND ENGAGEMENT |

|

Enhanced existing year-round shareholder engagement programs by adding Compensation Committee Chair led sessions with shareholders in spring and fall.

|

|

Conducted a third-party shareholder perception study; modified our investor communications in response to feedback. |

|

COMMITMENT TO CORPORATE RESPONSIBILITY |

|

Expanded existing Code of Business Conduct & Ethics (applicable to all Directors, Officers, employees and third parties) to establish a new standalone Third-Party Code of Conduct for third parties. The new Third-Party Code covers areas such as conflict minerals, anti-human trafficking, business integrity, and health, safety and environmental policies. |

| ROBUST OVERSIGHT OF RISKS AND OPPORTUNITIES |

|

Board responsible for risk oversight, with specific responsibility for key risk areas (including, without limitation, cybersecurity) delegated to relevant Board committees. |

|

At least annual engagement with business leaders to discuss both short-term plans, long-term strategic opportunities and their associated risks. |

|

COMMITMENT TO SUSTAINABILITY (ES&G) |

|

Revised the Guidelines to formally include oversight of the Company’s Environmental, Social and Governance (ES&G) programs as part of the Board’s responsibilities. |

|

Further revised Nominating and Corporate Governance Committee (NCGC)’s Charter to designate NCGC with Committee oversight of ES&G related matters. |

|

2019 actions formalized the Board’s long-term interest and historic and on-going review and focus on ES&G. |

|

INCREASED DIRECTOR EDUCATION |

|

Increased investment in Board education sessions via: third party presentations; a refreshed Director on-boarding program; and membership in a national non-profit organization dedicated to director education. |

|

Additional details on

Corporate Governance on page  . . |

Corporate Social Responsibility

Hubbell operates its business and executes on

strategies that consider Hubbell’s effect on our shareholders, employees, customers, suppliers and communities. At Hubbell,

we believe that we can deliver value for our stakeholders beyond mere financial returns. In 2019, Hubbell evidenced its Corporate

Social Responsibility (CSR) commitment with a dedicated part of its website, www.hubbell.com, and formalized the Board’s

and its Committees’ review and oversight of ES&G matters.

Notable CSR achievements in 2019, include:

| COMMUNITY |

DIVERSITY |

SAFETY |

SUSTAINABILITY |

| |

|

|

|

|

170+

CHARITIES

AND NON-PROFITS THAT

EMPLOYEES, DIRECTORS AND THE COMPANY

DONATED TO OR VOLUNTEERED FOR

IN 2019 |

JOINED THE PARADIGM FOR PARITY COALITION AND PARTNERED WITH EMPLOYER SUPPORT OF THE GUARD & RESERVE |

DOWN

11%

IMPROVED

SAFETY RECORD BY DECREASING

THE TOTAL RECORDABLE INCIDENT

RATE OVER THE LAST 3 YEARS |

BASELINED ITS GREENHOUSE GAS AND WATER USAGE IN ADVANCE OF PLAN TO PUBLISH REDUCTION GOALS IN 2020 |

|

Specific details on Corporate

Social Responsibility on page  . . |

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 6 |

| Proposal

1 |

Election

of 8 Directors |

See pages 12-18

for further information. |

THE

BOARD RECOMMENDS A VOTE  FOR EACH

NOMINEE FOR A ONE-YEAR TERM.

FOR EACH

NOMINEE FOR A ONE-YEAR TERM.

The following table provides summary information

about each of the eight director nominees. Each director is elected annually by a plurality of votes cast. Existing committee assignments

of the directors are described below. Each nominee is a current Director of the Company and possesses the qualifications and experience

recommended by the Nominating and Corporate Governance Committee, and is approved by our Board to serve as a Director.

Our Director Nominees

Age 62

|

CARLOS M. CARDOSO

INDEPENDENT

Director since: 2013

Chairman, Garrett Motion Inc.

Committees:

Audit, Compensation

|

Age 56

|

ANTHONY J. GUZZI

INDEPENDENT, LEAD DIRECTOR

Director since: 2006

Chairman, President and CEO, EMCOR Group, Inc.

Committees:

Executive, Finance, Nominating and Corporate Governance

|

Age 64

|

NEAL J. KEATING

INDEPENDENT

Director since: 2010

Chairman, President and CEO, Kaman Corporation

Committees:

Compensation, Executive, Nominating and Corporate Governance (Chair)

|

| |

|

|

|

|

|

Age 61

|

BONNIE C. LIND

INDEPENDENT

Director since: 2019

SVP, CFO and Treasurer, Neenah, Inc.

Committees:

Audit, Finance

|

Age 65

|

JOHN F. MALLOY

INDEPENDENT

Director since: 2011

Chairman, President and CEO, Victaulic Company

Committees:

Audit, Executive, Finance (Chair)

|

Age 62

|

DAVID G. NORD

NOT INDEPENDENT

Director since: 2013

Chairman and CEO, Hubbell Incorporated

Committees:

Executive (Chair)

|

| |

|

|

|

|

|

Age 62

|

JOHN G. RUSSELL

INDEPENDENT

Director since: 2011

Chairman of the Boards of CMS Energy Corporation, Consumers Energy Company

Committees:

Compensation (Chair), Executive, Finance, Nominating and Corporate Governance

|

Age 67

|

STEVEN R. SHAWLEY

INDEPENDENT

Director since: 2014

Former SVP and CFO, Ingersoll Rand Inc.

Committees:

Audit (Chair), Executive, Finance

|

|

|

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 7 |

| Proposal

2 |

Say on pay: advisory vote on the compensation of

the named executive officers.

|

See

pages 31-57

for further information. |

THE BOARD RECOMMENDS A VOTE  FOR THIS PROPOSAL.

FOR THIS PROPOSAL.

Shareholder Engagement

Hubbell’s 2019 advisory Say on Pay

vote on executive compensation was 58%, significantly lower than the votes we have previously received on Say on Pay, which averaged

over 97% support for the last 10 years. The Board of Directors and Hubbell’s management team took these voting results very

seriously and intensely engaged with our shareholders in both the spring and the fall on the topic of Hubbell’s executive

compensation programs and pay for performance philosophy.

JOHN

G. RUSSELL

Compensation

Committee, Chair

|

Compensation Committee Chair Led Engagements

Hubbell reached out to our top

25 shareholders (representing approximately 65% of Hubbell’s share ownership) during both the spring and fall of

2019. The spring calls were led by Hubbell’s now-retired Compensation Committee Chair, Mr. Richard J. Swift,

and the fall calls were led by Hubbell’s current Compensation Committee Chair, Mr. John G. Russell, and included

senior management from Human Resources, Legal and Finance. The calls were extremely beneficial and helped inform the Compensation

Committee’s approach and review of the Company’s compensation programs, along with further advice and benchmarking

from Hubbell’s independent compensation consultant, Exequity, LLP.

|

Shareholder Outreach

In addition to the Say on Pay related calls,

the Company regularly engages with its shareholders over the course of a year on diverse topics such as financial performance,

compensation and pay for performance matters, corporate governance and corporate social responsibility. These meetings and calls

can be in person or via teleconference, management only, or led by one of our independent directors with management present. We

are committed to not just continued engagement with our shareholders, but to reviewing and applying the substance of the engagement.

Hubbell management routinely reports out to the Board and specific Board committees on the substance and nature of its shareholder

communications.

Hubbell values the input and

insight it receives from its investors.

| How

we engaged with investors |

|

|

We invited our largest 25 shareholders (representing 65% of our share ownership) to discuss Hubbell’s pay for performance program, compensation design, sustainability programs, governance matters and strategy with our Compensation Committee Chair. |

|

|

We regularly report our investors’ views to our Board of Directors, and the Compensation Committee considers these views when developing our executive compensation program. |

|

|

We engage with analysts through quarterly conference calls, our investor relations website, meetings, conferences and calls. |

|

|

We conducted a third-party investor perception study, led by our investor relations team, that reached out to approximately 120 investor contacts, generating qualitative and quantitative feedback. |

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 8 |

As a part of our shareholder outreach in

2019, we heard many different points of view from our various shareholders. We listened intently to the feedback we heard,

sought to understand the perspective of our shareholders and endeavored to be responsive to their input, as outlined in the following

table.

| What

We Heard |

|

How

We Responded |

| Our Proxy could be clearer. |

|

Enhanced the Proxy and Compensation Discussion and Analysis (CD&A) summary sections; added additional graphics and revisions to improve readability. |

| Provide more details on the metrics and calculations for the incentive plans. |

|

Highlighted the Long-Term Incentive (LTI ) metrics in the summaries and detailed their linkage to Hubbell’s business strategy and results. |

| Better explain any compensation design or program changes. |

|

Because we are moving all LTI grants from Q4 2019 to Q1 2020 (and Q1 going forward), we have dedicated sections explaining this timing change and are including a pro forma chart that further clarifies the impact of this change. |

| Provide more operational and performance details. |

|

Increased disclosures on Company performance and the linkage of performance measures to Hubbell’s compensation program. |

| Compensation program is good; no need for a complete overhaul. |

|

Made important, but modest adjustments to the compensation design, including increasing the linkage between Total Shareholder Return (TSR) performance and reward value. |

| Ensure that the compensation programs are performance oriented. |

|

Increased the weighting of the performance-oriented equity from 70% to 75% by increasing the weighting of performance shares from 40% to 50% and changing stock appreciation rights from 30% to 25%, thereby ensuring greater pay for performance alignment. |

| Need to understand that pay is aligned with performance. |

|

Included new charts comparing our CEO’s pay vs a Realized Pay metric, demonstrating how Hubbell’s compensation is aligned with performance. |

|

Additional details on our compensation related shareholder engagement on page 33 . |

Executive Compensation Highlights

Elements of Compensation

Hubbell compensated its named executive officers (“NEOs”)

using the following elements for total direct compensation in 2019:

| |

|

|

Target Compensation Mix |

| Targeted at 50th percentile of peers |

Element |

Description |

CEO |

Other NEOs |

| Salary |

A competitive level of cash is provided to attract and retain executive talent. |

|

|

| Annual Cash Incentive |

Amounts awarded based on achievements with respect to the Company’s financial goals and individual performance against strategic objectives (CEO’s design is 100% based on financial goals). |

|

|

| Long-term Equity Incentive |

A mix of equity awards designed to drive Hubbell’s performance, and align executives’ interests with shareholders. 75% of equity awards are performance-based. |

|

|

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 9 |

Pay for Performance

We have executed a strong pay for performance

program, with the following principles:

Hubbell’s compensation program is designed

to achieve the following pay for performance objectives:

|

Align executive pay to our company performance and drive our business strategy. |

|

Attract and retain key talent. |

|

Align the interests of executives with our shareholders with effective pay for performance. |

|

Deliver competitive and fair compensation. |

Long-Term Incentive

Hubbell made changes to its Long-Term Incentive

program based on Shareholder feedback:

|

|

Increased weight of performance shares from 40% to 50% |

|

Increased overall weight of performance-oriented equity from 70% to 75% |

|

Enhanced TSR Modifier |

Performance Share Metrics – Relevant to our strategy

and aligned with investors

| SALES

GROWTH |

Drives Hubbell’s growth initiatives, including organic growth, new product development and acquisition performance. |

| |

|

OPERATING

PROFIT MARGIN |

Focuses NEOs on improving pricing, productivity and cost while executing operational objectives including footprint optimization and product rationalization. |

| |

|

TRADE WORKING

CAPITAL |

Provides focus on activities that increase Hubbell’s operational effectiveness and cash generation, specifically inventory management and accounts payable/receivables. |

| |

|

| TSR MODIFIER |

Ensures a direct link to shareholders. |

|

Specific

details on these metrics may be found on pages 50-51 in the Compensation Discussion

& Analysis section. |

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 10 |

Management conducted a comprehensive analysis

of potential internal metrics based on our strategic plan and the correlation of these metrics with TSR performance in our competitive

financial peer set of companies. The Compensation Committee determined these metrics for the long-term plan based on our current

and future objectives of growth, productivity and capital management, while ensuring alignment with shareholders through TSR. The

Compensation Committee believes that focusing our NEOs to execute on these metrics will drive shareholder value.

Long-Term Incentive Timing Change

In 2019, Hubbell made the decision to move

the timing of our annual equity grant from the fourth quarter of each year into the first quarter of the year, effective in 2020.

This change is intended to align all of Hubbell’s compensation discussions with its executives to the first quarter of the

calendar year, as merit salary changes and short-term incentive bonuses are already delivered in the first quarter.

The result of this change for 2019 is that

there were no equity grants delivered to the NEOs in 2019 including Chairman and CEO, David G. Nord, except for those certain mid-year

grants associated with 2019 promotions to new roles (including Messrs. Bakker, Sperry, Connolly and Ms. Lane). The equity grants

that would have been historically delivered in December of 2019 will now be delivered in February of 2020. To ensure transparency

and clarity to our shareholders, we are providing a supplemental Compensation Table in the CD&A (see page 49), as well as providing

the detail in the footnotes of the Summary Compensation Table (see the footnotes of page 58), to show the compensation for 2019

including the grant to be made in 2020, as a more “normalized” look at the true annual pay for the NEOs.

|

Additional

details on the timing change can be found on page 49 . |

| Proposal

3 |

Ratification of the selection of Pricewaterhouse

Coopers LLP as the Independent Registered Public

Accountant for 2020. |

See

pages 71-73

for further information. |

THE BOARD RECOMMENDS A VOTE  FOR THIS PROPOSAL.

FOR THIS PROPOSAL.

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 11 |

| Proposal 1 | Election

Of Directors |

The Board has fixed the number of Directors

who shall be elected by the shareholders at the 2020 Annual Meeting at eight.

| |

|

| |

Each Director nominee possesses the appropriate qualifications and experience for membership

on the Board of Directors. |

| |

|

Director Qualifications and Experience

The Nominating and Corporate Governance Committee

(NCGC) works with the Board at least annually to determine the appropriate characteristics, skills and experience for the Board

and its individual members to properly oversee the interests of the Company and its shareholders.

The NCGC recommends candidates for Board

membership using the selection criteria outlined in the Corporate Governance Guidelines (the “Guidelines”) and other

factors it deems necessary to fulfill its objectives. Candidates are evaluated on the basis of their individual qualifications

and experience and in the context of the Board as a whole. The NCGC considers diversity when creating the pool of candidates from

which it selects potential director nominees. Such diversity includes gender, race and ethnicity and also diversity of experience,

professional background, industry exposure and other areas. The objective is to assemble a diverse Board that can best facilitate

the success of the business and represent shareholder interests through the exercise of sound judgment.

Below is a list of certain of the qualifications

and experience sought by the NCGC in recommending candidates for nomination to the Board:

|

Ability to make independent analytical inquiries |

|

Marketing, finance, operations, manufacturing or other relevant public company experience |

|

Financial literacy |

|

Professional background |

|

Education |

|

Corporate governance experience |

|

Experience as a current or former public company officer |

|

Experience in the Company’s industry |

|

Public company board service |

|

Academic expertise in areas of the Company’s operations |

In determining whether to recommend a current

Director for re-election, the NCGC will also consider past attendance at meetings, service on other boards and participation in

and contributions to Board activities.

Each Director nominee possesses the appropriate

qualifications and experience for membership on the Board of Directors. As a result, the Board is comprised of individuals with

strong and unique backgrounds, giving the Board competence and experience in a wide variety of areas to serve the interests of

the Company and its shareholders.

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 12 |

| |

|

| |

The Board is committed to integrity, diversity and independence. |

| |

|

Commitment to Board Integrity, Diversity and

Independence

In addition to ensuring that our director

nominees possess the requisite skills and qualifications, the NCGC places an emphasis on ensuring that the nominees demonstrate

the right leadership traits, personality, work ethic, independence, and diversity of background to align with our performance culture

and our long-term strategic vision. Specifically, these criteria include:

|

Exemplification of the highest standards of personal and professional integrity |

|

Potential contribution to the diversity and culture of the Board, including by virtue of age, educational background, global perspective, gender, ethnicity or nationality |

|

Ability to devote sufficient time to performing their Board and committee duties |

|

Independence from management |

|

Willingness to constructively challenge management through active participation in Board and committee meetings |

|

Subject matter expertise |

The NCGC also believes that, in addition

to diversity of personal characteristics and experiences, diversity of service tenures also facilitates effective Board oversight.

Though Ms. Marks will not stand for re-election to the Board of Directors at the expiration of her current term, the NCGC remains

committed to ensuring its continued focus on selecting diverse nominees.

| |

|

| |

The Board nominated eight candidates for election as Directors. |

| |

|

Nomination and Election Process

Hubbell’s Directors are elected at

each Annual Meeting of Shareholders and hold office for one-year terms or until their successors are duly elected and qualified.

The Board of Directors nominated eight candidates for election as Directors. In the event that any of the nominees for Director

should become unavailable, it is intended that the shares represented by the proxies will be voted for any substitutes nominated

by the Board of Directors, unless the number of Directors constituting the full Board is reduced.

In searching for qualified Director candidates

for election to the Board and to fill vacancies on the Board, the Board may solicit current Directors or members of executive management

for the names of potentially qualified candidates, consult with outside advisors, retain a Director search firm or consider nominees

suggested by shareholders. All Director candidates, including any Director candidates recommended by shareholders, are reviewed

and evaluated by the NCGC in relation to the specific qualifications and experience sought by the Board for membership (as discussed

in the “Director Qualifications and Experience” section on page 12), and the Board’s needs at that time. A candidate

whose qualifications and experience align with this criteria is then interviewed by members of the NCGC, other Board members and

executive management to further assess the candidate’s qualifications and experience and determine if the candidate is an

appropriate fit. Candidates may be asked to submit additional information to support their potential nomination and references

may be requested. If the Board approves of the NCGC recommendation, the candidate is then nominated for election by the Company’s

shareholders or appointed by the Board to fill a vacancy, as applicable.

Any shareholder who intends to recommend

a candidate to the NCGC for consideration as a Director nominee should deliver written notice, which must include the same information

requested by Article I, Section 11(A) (2) of our By-Laws, to the Secretary of the Company. Any such notice should be delivered

to the Company sufficiently in advance of the Company’s annual meeting to permit the NCGC to complete its review in a timely

fashion.

Directors are elected by plurality vote.

Plurality means that the nominees who receive the most votes cast “FOR” their election are elected as directors. Votes

withheld and broker non-votes will not affect the election of Directors. Pursuant to the terms of our Director Resignation Policy,

any director in an uncontested election who receives more votes “withheld” from his or her election than votes “for”

his or her election must promptly tender his or her resignation to the Board. See page 24 for additional details on this Policy.

Broker discretionary voting is not allowed, so if your shares are held by a broker and you have not instructed the broker how to

vote, your shares will not be voted with respect to Proposal 1.

THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE  FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES FOR A ONE-YEAR TERM.

FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES FOR A ONE-YEAR TERM.

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 13 |

| |

|

| |

All of the nominees are current Directors previously elected by the Company’s shareholders. |

| |

|

Director Nominees

The nominees are proposed by the Board to

stand for election at the 2020 Annual Meeting of Shareholders and to serve as Directors until the 2021 Annual Meeting.

All of the nominees are current Directors

previously elected by the Company’s shareholders. During the five years ended December 31, 2019, Mr. Keating, Ms. Lind,

Mr. Malloy and Mr. Shawley have held the principal occupation listed in their biographies below or been retired for that

period of time, as applicable. The employment history of each of the other Director nominees during such time period is reflected

in their biographies. The following biographies provide information on the principal occupation of each of the Director nominees.

|

|

CARLOS M. CARDOSO |

| |

Age 62

Director

since: 2013

INDEPENDENT

AUDIT COMMITTEE FINANCIAL EXPERT

Committees:

Audit Audit

Compensation Compensation

|

|

Skills and Qualifications:

Mr. Cardoso brings to the Board CEO, COO, manufacturing,

international business and public company board experience, including:

Significant

manufacturing and operations experience having served as President of the Pump Division of Flowserve Corporation, a manufacturer/provider

of flow management products and services; Vice President and General Manager, Engine Systems and Accessories, for Honeywell

International, Inc., a technology and manufacturing company; and Vice President Manufacturing Operations for Colt’s

Manufacturing Company, LLC, a maker of firearms. Significant

manufacturing and operations experience having served as President of the Pump Division of Flowserve Corporation, a manufacturer/provider

of flow management products and services; Vice President and General Manager, Engine Systems and Accessories, for Honeywell

International, Inc., a technology and manufacturing company; and Vice President Manufacturing Operations for Colt’s

Manufacturing Company, LLC, a maker of firearms.

Membership

on the board of Stanley Black & Decker, Inc., a public company and a diversified global provider of hand and

power tools and accessories. Membership

on the board of Stanley Black & Decker, Inc., a public company and a diversified global provider of hand and

power tools and accessories.

Chairman

of the Board of Garrett Motion Inc., a public company and a provider of transportation systems. Chairman

of the Board of Garrett Motion Inc., a public company and a provider of transportation systems.

Directorships:

Stanley

Black & Decker, Inc., since 2007; Stanley

Black & Decker, Inc., since 2007;

Garrett

Motion Inc., since 2018 Garrett

Motion Inc., since 2018

|

| Mr. Cardoso has served as Chairman of Garrett Motion Inc. since July 2018 and as the principal of CMPC Advisors

LLC, an investment advisory firm, since January 2015. He previously served as Chairman of Kennametal, Inc. (publicly traded

manufacturer of metalworking tools and wear-resistant products) from January 2008 until December 2014. He also served as President

and Chief Executive Officer of Kennametal from January 2006 until December 2014. Mr. Cardoso joined Kennametal in 2003 and

served as Vice President, Metalworking Solutions and Services Group and then as Executive Vice President and Chief Operating

Officer before he became President and Chief Executive Officer. Mr. Cardoso was appointed Chairman of the Board of Garrett

Motion Inc. in July 2018. |

| |

|

|

|

|

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 14 |

|

|

ANTHONY J. GUZZI |

| |

Age 56

Director

since: 2006

INDEPENDENT

LEAD DIRECTOR

Committees:

Executive Executive

Finance Finance

Nominating and Corporate Governance Nominating and Corporate Governance

|

|

Skills and Qualifications:

Mr. Guzzi brings to the Board CEO, COO, manufacturing,

strategic development, operations, consulting and public company board experience, including:

Serving

as Chairman, President and CEO and a Director of EMCOR Group, Inc., a publicly traded mechanical, electrical construction

and facilities services company. Serving

as Chairman, President and CEO and a Director of EMCOR Group, Inc., a publicly traded mechanical, electrical construction

and facilities services company.

Extensive

experience in manufacturing and distribution having served as President, North American Distribution and Aftermarket and

President, Commercial Systems and Services of Carrier Corporation, a subsidiary of United Technologies Corporation. Extensive

experience in manufacturing and distribution having served as President, North American Distribution and Aftermarket and

President, Commercial Systems and Services of Carrier Corporation, a subsidiary of United Technologies Corporation.

Past

experience as an engagement manager with McKinsey & Company, a prominent management consulting firm. Past

experience as an engagement manager with McKinsey & Company, a prominent management consulting firm.

Directorship:

EMCOR

Group, Inc., since 2009 EMCOR

Group, Inc., since 2009

|

| Mr. Guzzi has served as Chairman of the Board, President and Chief Executive Officer of EMCOR Group, Inc.

(a publicly traded mechanical, electrical construction and facilities services company) since June 2018. Previously, he was

President and Chief Executive Officer of EMCOR from January 2011 to June 2018 and President and Chief Operating Officer from

2004 to 2010. He also served as President, North American Distribution and Aftermarket of Carrier Corporation (HVAC and refrigeration

systems), a subsidiary of United Technologies Corporation from 2001 to 2004 and President, Commercial Systems and Services

in 2001. |

| |

|

|

|

|

|

|

NEAL J. KEATING |

| |

Age 64

Director

since: 2010

INDEPENDENT

Committees:

Compensation Compensation

Executive Executive

Nominating

and Corporate Governance (Chair) Nominating

and Corporate Governance (Chair)

|

|

Skills and Qualifications:

Mr. Keating brings to the Board an extensive history

of senior executive leadership and board experience and a strong background in international operations, distribution,

and mergers and acquisitions, including:

Serving

as Chairman of the Board, President and CEO of Kaman Corporation, a publicly traded aerospace and industrial distribution

company. Serving

as Chairman of the Board, President and CEO of Kaman Corporation, a publicly traded aerospace and industrial distribution

company.

Past

experience as COO of Hughes Supply and Executive Vice President and COO of Rockwell Collins, Commercial Systems. Past

experience as COO of Hughes Supply and Executive Vice President and COO of Rockwell Collins, Commercial Systems.

Former

Managing Director and CEO of GKN Aerospace and Director of GKN plc, an international aerospace, automotive and land systems

business. Former

Managing Director and CEO of GKN Aerospace and Director of GKN plc, an international aerospace, automotive and land systems

business.

Member

of the Executive Committee of the Board of Trustees of the Manufacturers Alliance for Productivity and Innovation (MAPI). Member

of the Executive Committee of the Board of Trustees of the Manufacturers Alliance for Productivity and Innovation (MAPI).

Membership

on the board of governors of the Aerospace Industry Association (AIA). Membership

on the board of governors of the Aerospace Industry Association (AIA).

Member

of the Board of Trustees of Embry-Riddle Aeronautical University. Member

of the Board of Trustees of Embry-Riddle Aeronautical University.

Directorship:

Kaman

Corporation, since 2007 Kaman

Corporation, since 2007

|

| Mr. Keating has served as the Chairman of the Board, President and Chief Executive Officer of Kaman Corporation

(a publicly traded aerospace and industrial distribution company), since 2008. Previously, he held the position of President

and Chief Operating Officer of Kaman from 2007 to 2008. From 2004 to 2007, he held the position of Chief Operating Officer

of Hughes Supply (a wholesale distributor acquired by Home Depot). |

| |

|

|

|

|

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 15 |

|

|

BONNIE C. LIND |

| |

Age 61

Director

since: 2019

INDEPENDENT

AUDIT COMMITTEE FINANCIAL EXPERT

Committees:

Audit Audit

Finance Finance

|

|

Skills and Qualifications:

Ms. Lind brings to the Board CFO, Treasurer, financing,

manufacturing, mergers and acquisitions, and public company board experience, including:

Serving

as Senior Vice President, CFO and Treasurer of Neenah, Inc., a global manufacturer of technical specialties products,

fine paper and packaging. Serving

as Senior Vice President, CFO and Treasurer of Neenah, Inc., a global manufacturer of technical specialties products,

fine paper and packaging.

Past

experience as Assistant Treasurer of Kimberly-Clark Corporation, a manufacturer of personal care, consumer tissue and

health care products. Past

experience as Assistant Treasurer of Kimberly-Clark Corporation, a manufacturer of personal care, consumer tissue and

health care products.

Membership

on the Board of U.S. Silica Holdings, a publicly traded performance materials company and one of the largest domestic

producers of commercial silica. Membership

on the Board of U.S. Silica Holdings, a publicly traded performance materials company and one of the largest domestic

producers of commercial silica.

Formerly

served on the Board of Empire District Electric Company, a utility generating, transmitting and distributing power to

southwestern Missouri and adjacent areas. Formerly

served on the Board of Empire District Electric Company, a utility generating, transmitting and distributing power to

southwestern Missouri and adjacent areas.

Formerly

served on the Board of Federal Signal Corporation, a publicly traded international designer and manufacturer of products

and solutions that serves municipal, governmental, industrial and commercial customers. Formerly

served on the Board of Federal Signal Corporation, a publicly traded international designer and manufacturer of products

and solutions that serves municipal, governmental, industrial and commercial customers.

Directorship:

U.S.

Silica Holdings, Inc., since 2019 U.S.

Silica Holdings, Inc., since 2019

Prior Directorships:

Federal

Signal Corporation, 2014-2018; Federal

Signal Corporation, 2014-2018;

Empire

District Electric Company, 2009-2017 Empire

District Electric Company, 2009-2017

|

| Ms. Lind has served as Senior Vice President, CFO and Treasurer of Neenah, Inc. (a publicly traded technical

specialties and fine paper company), since June 2004. Previously, Ms. Lind held a variety of increasingly senior financial

and operations positions with Kimberly-Clark Corporation from 1982 until 2004. |

| |

|

|

|

|

|

|

JOHN F. MALLOY |

| |

Age 65

Director

since: 2011

INDEPENDENT

AUDIT COMMITTEE FINANCIAL EXPERT

Committees:

Audit Audit

Executive Executive

Finance

(Chair) Finance

(Chair)

|

|

Skills and Qualifications:

Mr. Malloy brings to the Board many years of senior

management, operations, economic and strategic planning experience having served as the CEO and COO of a global manufacturing

and distribution company, including:

Thirteen

years of executive management experience at a leading worldwide manufacturing company. Thirteen

years of executive management experience at a leading worldwide manufacturing company.

Over

fifteen years of experience in various senior level strategic planning positions at United Technologies Corporation. Over

fifteen years of experience in various senior level strategic planning positions at United Technologies Corporation.

Membership

on the Board of Trustees of the Manufacturers Alliance for Productivity and Innovation (MAPI). Membership

on the Board of Trustees of the Manufacturers Alliance for Productivity and Innovation (MAPI).

Holds

a Ph.D. in economics and has taught courses in Economics at Hamilton College. Holds

a Ph.D. in economics and has taught courses in Economics at Hamilton College.

Directorship:

Victaulic

Company, since 2006 Victaulic

Company, since 2006

|

| Mr. Malloy has served as the Chairman of the Board, President and Chief Executive Officer of Victaulic Company

(a privately held mechanical pipe joining systems company) since 2006. Previously, he held the position of President and Chief

Executive Officer from 2004 to 2006 at Victaulic and also President and Chief Operating Officer from 2002 to 2004. |

| |

|

|

|

|

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 16 |

|

|

DAVID G. NORD |

| |

Age 62

Director

since: 2013

NOT INDEPENDENT

Committee:

Executive

(Chair) Executive

(Chair)

|

|

Skills and Qualifications:

Mr. Nord brings to the Board extensive financial,

operational and strategic planning experience and a strong background in the manufacturing industry having served as a

senior executive at two global manufacturing companies, including:

Served

as the Company’s Senior Vice President and CFO for 7 years and as COO prior to his appointment to CEO in 2013. Served

as the Company’s Senior Vice President and CFO for 7 years and as COO prior to his appointment to CEO in 2013.

Ten

years in various senior leadership positions at United Technologies Corporation including Vice President-Finance and CFO

of Hamilton Sundstrand Corporation, one of its principal subsidiaries. Ten

years in various senior leadership positions at United Technologies Corporation including Vice President-Finance and CFO

of Hamilton Sundstrand Corporation, one of its principal subsidiaries.

Held

roles of increasing responsibility at The Pittston Company, a publicly held multinational corporation and Deloitte &

Touche. Held

roles of increasing responsibility at The Pittston Company, a publicly held multinational corporation and Deloitte &

Touche.

Chairman

of the Board of Trustees of the Manufacturers Alliance for Productivity and Innovation (MAPI) and Member and Immediate-Past

Chairman of the Board of Governors of the National Electrical Manufacturing Association. Chairman

of the Board of Trustees of the Manufacturers Alliance for Productivity and Innovation (MAPI) and Member and Immediate-Past

Chairman of the Board of Governors of the National Electrical Manufacturing Association.

Directorship:

Ryder

Systems, Inc., since 2018 Ryder

Systems, Inc., since 2018

|

| Mr. Nord has served as Chairman and Chief Executive Officer of the Company since June 2019 and Chairman, President

and Chief Executive Officer since May 2014. Previously, he served as the Company’s President and Chief Executive Officer

from January 2013 to May 2014, President and Chief Operating Officer from June 2012 to January 2013 and Senior Vice President

and Chief Financial Officer from September 2005 to June 2012. |

| |

|

|

|

|

|

|

JOHN G. RUSSELL |

| |

Age 62

Director

since: 2011

INDEPENDENT

Committees:

Compensation

(Chair) Compensation

(Chair)

Executive Executive

Finance Finance

Nominating

and Corporate Governance Nominating

and Corporate Governance

|

|

Skills and Qualifications:

Mr. Russell brings to the Board many years of

experience as a public company executive officer and Director in the utility industry and possesses a strong background

in operations, regulated utilities and governance, including:

Serving

as Chairman of the boards of CMS Energy Corporation (“CMS”) and Consumers Energy Company (“Consumers”)

and as Director for over fifteen years in the aggregate. Serving

as Chairman of the boards of CMS Energy Corporation (“CMS”) and Consumers Energy Company (“Consumers”)

and as Director for over fifteen years in the aggregate.

Serving

as the President and CEO of CMS and Consumers and previously as COO. Serving

as the President and CEO of CMS and Consumers and previously as COO.

Over

thirty years of both hands-on and leadership experience in the utility industry, an industry that represents a significant

part of the Company’s overall business. Over

thirty years of both hands-on and leadership experience in the utility industry, an industry that represents a significant

part of the Company’s overall business.

Directorships:

CMS Energy Corporation, since 2010 CMS Energy Corporation, since 2010

Consumers

Energy Company, since 2010 Consumers

Energy Company, since 2010

|

| Mr. Russell has served as the Chairman of the Boards of CMS and Consumers (a publicly traded electric and

natural gas utility) since May 2016. Previously he served as the President and Chief Executive Officer of CMS and Consumers

from 2010-2016. He also held the position of President and Chief Operating Officer of Consumers from 2004 to 2010. |

| |

|

|

|

|

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 17 |

|

|

STEVEN R. SHAWLEY |

| |

Age 67

Director

since: 2014

INDEPENDENT

AUDIT COMMITTEE FINANCIAL EXPERT

Committees:

Audit

(Chair) Audit

(Chair)

Executive Executive

Finance Finance

|

|

Skills and Qualifications:

Mr. Shawley brings to the Board extensive leadership

experience as a public company executive officer and Director and a strong background in finance, accounting and audit,

including:

Over

fourteen years of experience as a public company officer, including serving as the Senior Vice President and CFO of Ingersoll

Rand Inc. and President of one of its major business sectors. Over

fourteen years of experience as a public company officer, including serving as the Senior Vice President and CFO of Ingersoll

Rand Inc. and President of one of its major business sectors.

Holding

multiple financial roles of increasing responsibility over the course of 30+ years including audit, accounting, financial

planning and as the controller of Westinghouse Electric Corporation’s largest manufacturing division and CFO of

its Thermo King subsidiary. Holding

multiple financial roles of increasing responsibility over the course of 30+ years including audit, accounting, financial

planning and as the controller of Westinghouse Electric Corporation’s largest manufacturing division and CFO of

its Thermo King subsidiary.

Served

on the board of a public company and as Chair of its Audit Committee. Served

on the board of a public company and as Chair of its Audit Committee.

Prior Directorship:

GrafTech

International (2010 - 2014) GrafTech

International (2010 - 2014)

|

| Mr. Shawley served as the Senior Vice President and Chief Financial Officer of Ingersoll-Rand Company (a publicly

traded manufacturer of climate solutions and industrial and security technologies) from 2008 to 2013. Previously, he held

the position of Senior Vice President and President of Ingersoll-Rand’s Climate Control Technologies business from 2005

to 2008. |

| |

|

|

|

|

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 18 |

Corporate Governance

| |

|

| |

The Board exercises strong corporate governance practices and principles. |

| |

|

The Board of Directors has adopted the Company’s

Corporate Governance Guidelines (the “Guidelines”) to assist the Board in the exercise of its responsibilities and

to best serve the interests of the Company and its shareholders. The Guidelines reflect the Board’s commitment to good governance

through the establishment of policies and procedures in areas it believes are critical to the enhancement of shareholder value.

It is the Board’s intention that these Guidelines serve as a framework within which the Board can discharge its duties and

foster the effective governance of the Company. The Board of Directors met 11 times in 2019.

| Governance Snapshot |

| |

|

|

Shareholders have identical economic and voting rights -

each share of Common Stock is entitled to one vote. |

| |

|

|

Directors are elected annually by shareholders to serve

a one-year term. |

| |

|

|

Corporate funds or resources are not used for direct contributions

to political candidates or campaigns. |

| |

|

|

Independent Board members meet regularly in Executive Sessions,

without management present. |

| |

|

|

56% of our Board has a tenure of seven years or

less. |

| |

|

|

To maintain a diverse Board, Director nominees are evaluated

on their background and experience and also gender, race and ethnicity. |

| |

|

|

Director compensation is reviewed annually with advice

from our independent compensation consultant and benchmarked for competitiveness. |

| |

|

|

There are no related party transactions with our Directors,

officers and significant shareholders. |

| |

|

|

Our Director Resignation Policy requires any director

who fails to receive a majority of the votes cast to promptly tender his or her resignation. |

| |

|

|

Board and Committees may hire outside advisors independent

from management. |

| |

|

Board Leadership Structure

| |

|

| |

An independent Lead Director counterbalances a unified Chairman/CEO and fosters effective collaboration and communication

among independent directors. |

| |

|

Chairman

The Company’s By-Laws require the

Board to choose the Chairman of the Board from among the Directors and provide the Board with the ability to appoint the CEO of

the Company as the Chairman of the Board. This approach gives the Board the necessary flexibility to determine whether these positions

should be held by the same person or by separate persons based on the leadership needs of the Company at any particular time.

The Board believes that there is no single, generally accepted approach to providing board leadership, and that each of the possible

leadership structures for a board must be considered in the context of the individuals involved and the specific circumstances

facing a company at any given time.

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 19 |

Mr. Nord has served as Chairman and Chief

Executive Officer of the Company since June 2019. Previously, Mr. Nord served as Chairman, President and Chief Executive Officer

from May 2014 to June 2019. The Board has determined that combining the roles of CEO and Chairman is best for the Company and

its shareholders at this time because it promotes unified leadership from Mr. Nord and allows for a single, clear focus for management

to execute the Company’s strategic and business plans.

Independent Lead Director

The Board has established the position of

an independent Lead Director to serve a three-year term. The Board believes that a three-year term is appropriate for the Lead

Director as it affords greater continuity and allows the Lead Director to gain a better understanding of Board and management

dynamics and build relationships with the other Directors. The Lead Director is responsible for:

| Board Leadership |

Providing leadership to the Board in situations where the Chairman’s role may

be perceived to be in conflict. |

| Executive Sessions |

Coordinating the agenda and chairing executive sessions of the independent directors regularly

throughout the year and at each regularly scheduled Board meeting. |

| Liaison |

Regularly meeting with the Chairman and facilitating communications among the Chairman, management

and the independent Directors. |

| Spokesperson |

Upon request, acting as the spokesperson for the Board in interactions

with third parties. |

| Succession |

Working with the NCGC and the Chairman to review and maintain

the Company’s succession plans. |

Currently, Mr. Guzzi is the Lead Director

and is expected to hold this position until the 2022 Annual Meeting. Following the 2022 Annual Meeting, the Board shall, upon

recommendation from the NCGC, appoint a director for the next three year Lead Director term. The Board believes that its present

leadership structure and composition provides for independent and effective oversight of the Company’s business and affairs

as further demonstrated by the fact that its members are current or former CEOs, CFOs or COOs of major companies in similar industries,

its Audit, Compensation, and Nominating and Corporate Governance Committees are composed entirely of Directors who meet the independence

requirements of the NYSE and Mr. Nord is the only Director who is a member of executive management. Given the strong leadership

of Mr. Nord as Chairman and CEO, the counterbalancing role of the Lead Director, and a Board comprised of effective and independent

Directors, the Board believes that its current leadership structure is appropriate at this time.

Director Independence

| |

|

| |

Our Board consists of a majority of independent Directors and our Audit, Compensation, Finance and NCGC Board

committees are 100% independent. |

| |

|

The Guidelines indicate that the Board shall

be composed of a majority of independent Directors. Eight of our nine directors are independent. In evaluating the independence

of Directors, each year the NCGC reviews all direct and indirect relationships between Directors (either directly or as a partner,

shareholder or officer of an organization that has a relationship with the Company or any of its subsidiaries) and the Company

and its subsidiaries in accordance with the rules of the New York Stock Exchange (“NYSE”) and the SEC and considers

whether any relationship is material. The NCGC also reviews responses to annual questionnaires completed by each of the Directors,

a report of transactions with Director-affiliated entities, Code of Conduct compliance certifications, case submissions filed

with the Company’s confidential communication resource and Company donations to charitable organizations with which a Director

may be affiliated (noting that The Harvey Hubbell Foundation’s various matching gift programs are available to all Directors,

officers and employees and that such programs match eligible gifts made to qualifying charitable organizations and educational

institutions up to $25,000 in the aggregate in a calendar year).

The NCGC considered the nature and dollar

amounts of the transactions with Directors and determined that none was required to be disclosed or otherwise impaired the applicable

Director’s independence as all of these ordinary course transactions were significantly below the NYSE bright-line independence

thresholds. As a result of this review, the Board determined that each of the current Directors is independent other than Mr.

Nord. In addition, the Board determined that Mr. Swift, who served as a director during 2019 but did not stand for re-election

at the 2019 Annual Meeting, was independent. In evaluating and determining the independence of the Directors, the NCGC considered

that in the ordinary course of business, transactions may occur between the Company and its subsidiaries and entities with which

some of the Directors are or have been affiliated.

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 20 |

Board Oversight of Risk

| | |

| | Our Board oversees risk management activities. |

| | |

Members of senior management assist the

Board and its committees with their risk oversight responsibilities through routine discussions of risks involved in their specific

areas of responsibility. For example, our principal business leaders will report to the Board at regular intervals during the

year on the Company’s strategic planning activities and risks relevant to execution of the strategy. In addition, from time

to time, independent consultants with specific areas of expertise are engaged to discuss topics that the Board and management

have determined may present a material risk to the Company’s operations, plans or reputation.

In 2019, as part of our risk management

activities, the Company reviewed with the Compensation Committee its compensation policies and practices applicable to all employees

that could affect the Company’s assessment of risk and risk management and determined that such compensation policies and

practices do not create risks that are reasonably likely to have a material adverse effect on the Company. The Board does not

believe that its role in the oversight of the Company’s risks affects the Board’s leadership structure.

| |

HUBBELL INCORPORATED | 2020 Proxy Statement 21 |

Board Committees

The Board of Directors has established the

following standing Committees to assist it in fulfilling its responsibilities: Audit, Compensation, Executive, Finance and Nominating

and Corporate Governance. The principal responsibilities of each of these Committees are described generally below and in detail

in their respective Committee Charters which are available on the Company’s website at www.hubbell.com, or in

the case of the Executive Committee Charter, in Article III, Section 1, of the Company’s By-Laws. The Board has determined

that each member of the Audit, Compensation and Nominating and Corporate Governance Committees is independent for purposes of

the NYSE listing standards and Security and Exchange Commission (“SEC”) regulations.

Audit Committee

STEVEN R. SHAWLEY (CHAIR)

Members:

Carlos M. Cardoso

Bonnie C. Lind

John F. Malloy

|

|

9

Meetings in 2019

|

98%

Attendance

|

Independence 4/4 |

| |

Key Oversight Responsibilities

Oversees

the Company’s accounting and financial reporting and disclosure processes. Oversees

the Company’s accounting and financial reporting and disclosure processes.

Appoints

the independent auditor and evaluates its independence and performance annually. Appoints

the independent auditor and evaluates its independence and performance annually.

Reviews

the audit plans and results of the independent auditors. Reviews

the audit plans and results of the independent auditors.

Approves

all audit and non-audit fees for services performed by the independent auditors. Approves

all audit and non-audit fees for services performed by the independent auditors.

Reviews

and discusses with management and the independent auditors matters relating to the quality and integrity of the Company’s

financial statements, the adequacy of its internal controls processes and compliance with legal and regulatory requirements. Reviews

and discusses with management and the independent auditors matters relating to the quality and integrity of the Company’s

financial statements, the adequacy of its internal controls processes and compliance with legal and regulatory requirements.

Reviews

the Company’s cybersecurity plans, policies, threats and prevention strategies with management. Reviews

the Company’s cybersecurity plans, policies, threats and prevention strategies with management.

|

The Board of Directors has determined that

all members of the Audit Committee are financially literate and meet the NYSE standard of having accounting or related financial

management expertise. Each member of the Audit committee is an “audit committee financial expert” as defined by the

SEC.

Compensation Committee

JOHN G. RUSSELL (CHAIR)

Members:

Carlos M. Cardoso

Neal J. Keating

Judith F. Marks(1)

|

|

5

Meetings in 2019

|

95%

Attendance

|

Independence 4/4 |

| |

Key Oversight Responsibilities

Determines

and oversees the Company’s execution of its compensation programs and employee benefit plans. Determines

and oversees the Company’s execution of its compensation programs and employee benefit plans.

Reviews

and approves all compensation of the CEO and officers of the Company, with input from the independent compensation consultant. Reviews

and approves all compensation of the CEO and officers of the Company, with input from the independent compensation consultant.

Appoints

the independent compensation consultant and evaluates its independence and performance annually. Appoints

the independent compensation consultant and evaluates its independence and performance annually.

Determines

stock ownership guidelines for the CEO and officers of the Company. Determines

stock ownership guidelines for the CEO and officers of the Company.

Reviews

and approves of the Company’s peer companies. Reviews

and approves of the Company’s peer companies.

|

| |

|

| (1) |

Ms. Marks will not stand for re-election to the Board of Directors at the expiration of her current

term. |

| |

|

| www.hubbell.com |

HUBBELL INCORPORATED | 2020 Proxy Statement 22 |

Executive Committee

DAVID G. NORD (CHAIR)

Members:

Anthony J. Guzzi

Neal J. Keating

John F. Malloy

John G. Russell

Steven R. Shawley

|

|

Did not meet in 2019 |

Did not meet in 2019 |

Independence 5/6 |

| |

Key Oversight Responsibilities

The

Executive Committee may meet during intervals between meetings of the Board of Directors and may exercise all the

powers of the Board of Directors in the management of the business and affairs of the Company, except certain powers

set forth in the By-Laws of the Company. The

Executive Committee may meet during intervals between meetings of the Board of Directors and may exercise all the

powers of the Board of Directors in the management of the business and affairs of the Company, except certain powers

set forth in the By-Laws of the Company.

|

Finance Committee

JOHN F. MALLOY (CHAIR)

Members:

Anthony J. Guzzi

Bonnie C. Lind

John G. Russell

Steven R. Shawley

|

|

4

Meetings in 2019

|

95%

Attendance

|

Independence 5/5 |

| |

Key Oversight Responsibilities

Oversees

the Company’s financial and fiscal affairs and reviews proposals regarding long-term and short-term financing, material

acquisitions, dividend policies, stock repurchase programs and changes in the Company’s capital structure. Oversees

the Company’s financial and fiscal affairs and reviews proposals regarding long-term and short-term financing, material

acquisitions, dividend policies, stock repurchase programs and changes in the Company’s capital structure.

Reviews

the Company’s major capital expenditure plans and monitors the Company’s insurance programs. Reviews

the Company’s major capital expenditure plans and monitors the Company’s insurance programs.

Reviews

the administration and management of the Company’s pension plans and investment portfolios. Reviews

the administration and management of the Company’s pension plans and investment portfolios.

|

Nominating and Corporate Governance Committee

NEAL J. KEATING (CHAIR)

Members:

Anthony J. Guzzi

Judith F. Marks(1)

John G. Russell

|

|

5

Meetings in 2019

|

95%

Attendance

|

Independence 4/4 |

| |

Key Oversight Responsibilities

Develops

the Company’s corporate governance guidelines and monitors adherence to its principles. Develops

the Company’s corporate governance guidelines and monitors adherence to its principles.

Approves