HP (NYSE: HPQ)

- Second quarter GAAP diluted net earnings per share ("EPS") of

$0.53, above the previously provided outlook of $0.46 to $0.50 per

share

- Second quarter non-GAAP diluted net EPS of $0.51, within the

previously provided outlook of $0.49 to $0.53 per

share

- Second quarter net revenue of $12.5 billion, down 11.2% from

the prior-year period

- Second quarter net cash used in operating activities of $(0.5)

billion, free cash flow of $(0.6) billion

- Second quarter returned $0.4 billion to shareholders in the

form of share repurchases and dividends

| HP Inc.

fiscal 2020 second quarter financial performance |

|

|

|

|

Q2 FY20 |

|

Q2 FY19 |

|

Y/Y |

|

|

GAAP net revenue ($B) |

|

$ |

12.5 |

|

|

$ |

14.0 |

|

|

(11.2 |

)% |

|

| GAAP operating margin |

|

|

6.6% |

|

|

|

6.6% |

|

|

- |

|

|

| GAAP net earnings ($B) |

|

$ |

0.8 |

|

|

$ |

0.8 |

|

|

(2.3 |

)% |

|

| GAAP diluted net EPS |

|

$ |

0.53 |

|

|

$ |

0.51 |

|

|

3.9 |

% |

|

| Non-GAAP operating margin |

|

|

7.5% |

|

|

|

7.4% |

|

|

0.1 pts |

|

| Non-GAAP net earnings ($B) |

|

$ |

0.7 |

|

|

$ |

0.8 |

|

|

(9.7 |

)% |

|

| Non-GAAP diluted net EPS |

|

$ |

0.51 |

|

|

$ |

0.53 |

|

|

(3.8 |

)% |

|

| Net cash (used in) provided by

operating activities ($B) |

|

$ |

(0.5 |

) |

|

$ |

0.9 |

|

|

NM |

|

| Free cash flow ($B) |

|

$ |

(0.6 |

) |

|

$ |

0.7 |

|

|

NM |

|

Notes to table

- Information about HP Inc.'s use of non-GAAP financial

information is provided under "Use of non-GAAP financial

information" below.

- NM – Not Meaningful

COVID-19 ResponseThe COVID-19 pandemic has

created unprecedented global health and economic challenges. From

the start of this crisis, HP’s number one priority has been the

health and well-being of our employees. At the same time, we have

marshalled our technology and resources to help address urgent

needs in our communities.

- HP and its partners have to-date produced an estimated 2.3

million 3D printed parts for face shields, face masks, respirators,

ventilators, and other items for distribution to hospitals.

- We have leveraged the scale of our global supply chain to

source and distribute face masks to medical facilities facing

shortages.

- We have launched a series of global education partnerships to

make it easier for teachers and students to connect from a

distance.

- Together with the HP Foundation, we are donating millions of

dollars in products and grants to support response and relief

efforts.

- We have also taken actions to protect the broader HP ecosystem,

including a variety of relief initiatives to help our channel

partners weather the operational and financial challenges they

face.

Net revenue and EPS resultsHP Inc. and its

subsidiaries (“HP”) announced fiscal 2020 second quarter net

revenue of $12.5 billion, down 11.2% (down 10.1% in constant

currency) from the prior-year period.

Second quarter GAAP diluted net EPS was $0.53, up from $0.51 in

the prior-year period and above the previously provided outlook of

$0.46 to $0.50. Second quarter non-GAAP diluted net EPS was $0.51,

down from $0.53 in the prior-year period and within the previously

provided outlook of $0.49 to $0.53. Second quarter non-GAAP net

earnings and non-GAAP diluted net EPS exclude after-tax adjustments

of $23 million, or $0.02 per diluted share, related to

restructuring and other charges, acquisition-related charges

(credits), amortization of intangible assets, non-operating

retirement-related (credits)/charges, and tax adjustments.

“The strength of HP’s diversified portfolio, go-to-market

capabilities and balance sheet position us well to navigate

macroeconomic challenges and drive long-term value creation,” said

Enrique Lores, HP’s President and CEO. “We are seeing strong demand

from our customers in notebook PC orders and Instant Ink

subscriptions, as well as growing interest in 3D printing and

digital manufacturing in key verticals such as healthcare. The

current environment will be a catalyst for transformation and

innovation across HP.”

Asset managementHP’s net cash used in operating

activities in the second quarter of fiscal 2020 was $(0.5) billion.

Accounts receivable ended the quarter at $5.1 billion, up 7 days

quarter over quarter to 37 days. Inventory ended the quarter at

$6.4 billion, up 19 days quarter over quarter to 57 days. Accounts

payable ended the quarter at $14.2 billion, up 30 days quarter over

quarter to 128 days.

HP generated $(0.6) billion of free cash flow in the second

quarter. Free cash flow includes net cash used in operating

activities of $(0.5) billion adjusted for net investment in leases

of $51 million and net investment in property, plant &

equipment of $146 million.

HP’s dividend payment of $0.1762 per share in the second quarter

resulted in cash usage of $0.3 billion. HP also utilized $0.1

billion of cash during the quarter to repurchase approximately 5.6

million shares of common stock in the open market. HP exited the

quarter with $4.1 billion in gross cash, which includes cash and

cash equivalents.

Fiscal 2020 second quarter segment results

- Personal Systems net revenue was down 7% year over year (down

6% in constant currency) with a 6.6% operating margin. Commercial

net revenue decreased 7% and Consumer net revenue decreased 7%.

Total units were down 5% with Notebooks units up 5% and Desktops

units down 23%.

- Printing net revenue was down 19% year over year (down 18% in

constant currency) with a 13.2% operating margin. Total hardware

units were down 23% with Commercial hardware units down 25% and

Consumer hardware units down 22%. Supplies net revenue was down 15%

(down 15% in constant currency).

OutlookFor the fiscal 2020 third quarter, HP

estimates GAAP diluted net EPS to be in the range of $0.35 to $0.41

and non-GAAP diluted net EPS to be in the range of $0.39 to $0.45.

Fiscal 2020 third quarter non-GAAP diluted net EPS estimates

exclude $0.04 per diluted share, primarily related to restructuring

and other charges, acquisition-related charges, defined benefit

plan settlement charges, amortization of intangible assets,

non-operating retirement-related (credits)/charges, tax adjustments

and the related tax impact on these items.

For fiscal 2020, given the level of uncertainty around the

duration of the pandemic, the timing and pace of economic recovery

and the potential impact of a resurgence in cases, HP anticipates a

much wider range of outcomes for the year. As a result, HP will not

be providing an outlook for the fiscal year 2020.

More information on HP's earnings, including additional

financial analysis and an earnings overview presentation, is

available on HP's Investor Relations website at

investor.hp.com.

HP's FY20 Q2 earnings conference call is accessible via an audio

webcast at www.hp.com/investor/2020Q2Webcast.

About HP Inc.HP Inc. (NYSE: HPQ) creates

technology that makes life better for everyone, everywhere. Through

our product and service portfolio of personal systems, printers and

3D printing solutions, we engineer experiences that amaze. More

information about HP Inc. is available at hp.com.

Use of non-GAAP financial informationTo

supplement HP’s consolidated condensed financial statements

presented on a generally accepted accounting principles (“GAAP”)

basis, HP provides net revenue on a constant currency basis,

non-GAAP total operating expense, non-GAAP operating profit,

non-GAAP operating margin, non-GAAP tax rate, non-GAAP net

earnings, non-GAAP diluted net EPS, free cash flow, gross cash and

net cash (debt) financial measures. HP also provides forecasts of

non-GAAP diluted net EPS and free cash flow. Reconciliations of

these non-GAAP financial measures to the most directly comparable

GAAP financial measures are included in the tables below or

elsewhere in the materials accompanying this news release. In

addition, an explanation of the ways in which HP’s management uses

these non-GAAP measures to evaluate its business, the substance

behind HP’s decision to use these non-GAAP measures, the material

limitations associated with the use of these non-GAAP measures, the

manner in which HP’s management compensates for those limitations,

and the substantive reasons why HP’s management believes that these

non-GAAP measures provide useful information to investors is

included under “Use of non-GAAP financial measures” after the

tables below. This additional non-GAAP financial information is not

meant to be considered in isolation or as a substitute for net

revenue, operating expense, operating profit, operating margin, tax

rate, net earnings, diluted net EPS, cash (used in)/ provided by

operating activities or cash and cash equivalents prepared in

accordance with GAAP.

Forward-Looking StatementsThis document

contains forward-looking statements based on current expectations

and assumptions that involve risks and uncertainties. If the

risks or uncertainties ever materialize or the assumptions prove

incorrect, the results of HP Inc. and its consolidated subsidiaries

may differ materially from those expressed or implied by such

forward-looking statements and assumptions.

All statements other than statements of historical fact are

statements that could be deemed forward-looking statements,

including, but not limited to, any statements regarding the

potential impact of the COVID-19 pandemic and the actions by

governments, businesses and individuals in response to the

situation; projections of net revenue, margins, expenses, effective

tax rates, net earnings, net earnings per share, cash flows,

benefit plan funding, deferred taxes, share repurchases, foreign

currency exchange rates or other financial items; any projections

of the amount, timing or impact of cost savings or restructuring

and other charges, planned structural cost reductions and

productivity initiatives; any statements of the plans, strategies

and objectives of management for future operations, including, but

not limited to, our business model and transformation, our

sustainability goals, our go-to-market strategy, the execution of

restructuring plans and any resulting cost savings, net revenue or

profitability improvements or other financial impacts; any

statements concerning the expected development, performance, market

share or competitive performance relating to products or services;

any statements regarding current or future macroeconomic trends or

events and the impact of those trends and events on HP and its

financial performance; any statements regarding pending

investigations, claims or disputes; any statements of expectation

or belief, including with respect to the timing and expected

benefits of acquisitions and other business combination and

investment transactions; and any statements of assumptions

underlying any of the foregoing. Forward-looking statements

can also generally be identified by words such as “future,”

“anticipates,” “believes,” “estimates,” “expects,” “intends,”

“plans,” “predicts,” “projects,” “will,” “would,” “could,” “can,”

“may,” and similar terms.

Risks, uncertainties and assumptions include factors

relating to the effects of the COVID-19 pandemic and the

actions by governments, businesses and individuals in response to

the situation, the effects of which may give rise to or amplify the

risks associated with many of these factors listed here; HP’s

ability to execute on its strategic plan, including the recently

announced initiatives, business model changes and transformation;

execution of planned structural cost reductions and productivity

initiatives; HP’s ability to complete any contemplated share

repurchases, other capital return programs or other strategic

transactions; the need to address the many challenges facing HP’s

businesses; the competitive pressures faced by HP’s businesses;

risks associated with executing HP’s strategy and business model

changes and transformation; successfully innovating, developing and

executing HP’s go-to-market strategy, including online, omnichannel

and contractual sales, in an evolving distribution and reseller

landscape; the development and transition of new products and

services and the enhancement of existing products and services to

meet customer needs and respond to emerging technological trends;

successfully competing and maintaining the value proposition of

HP’s products, including supplies; the need to manage third-party

suppliers, manage HP’s global, multi-tier distribution network,

limit potential misuse of pricing programs by HP’s channel

partners, adapt to new or changing marketplaces and effectively

deliver HP’s services; challenges to HP’s ability to accurately

forecast inventories, demand and pricing, which may be due to HP’s

multi-tiered channel, sales of HP’s products to unauthorized

resellers or unauthorized resale of HP’s products; integration and

other risks associated with business combination and investment

transactions; the results of the restructuring plans, including

estimates and assumptions related to the cost (including any

possible disruption of HP’s business) and the anticipated benefits

of the restructuring plans; the protection of HP’s intellectual

property assets, including intellectual property licensed from

third parties; the hiring and retention of key employees; the

impact of macroeconomic and geopolitical trends and events; risks

associated with HP’s international operations; the execution and

performance of contracts by HP and its suppliers, customers,

clients and partners; disruptions in operations from system

security risks, data protection breaches, cyberattacks, extreme

weather conditions, medical epidemics or pandemics such as the

COVID-19 pandemic, and other natural or manmade disasters or

catastrophic events; the impact of changes in tax laws; potential

liabilities and costs from pending or potential investigations,

claims and disputes; and other risks that are described in HP’s

Annual Report on Form 10-K for the fiscal year ended October 31,

2019, HP’s Quarterly Report on Form 10-Q for the fiscal quarter

ended January 31, 2020, and HP’s other filings with the Securities

and Exchange Commission.

As in prior periods, the financial information set forth in this

document, including any tax-related items, reflects estimates based

on information available at this time. While HP believes these

estimates to be reasonable, these amounts could differ materially

from reported amounts in HP’s Quarterly Reports on Form 10-Q for

the fiscal quarters ended April 30, 2020 and July 31, 2020, Annual

Report on Form 10-K for the fiscal year ended October 31, 2020 and

HP’s other filings with the Securities and Exchange Commission. The

forward-looking statements in this document are made as of the date

of this document and HP assumes no obligation and does not intend

to update these forward-looking statements.

HP’s Investor Relations website at investor.hp.com contains

a significant amount of information about HP, including financial

and other information for investors. HP encourages investors to

visit its website from time to time, as information is updated, and

new information is posted. The content of HP’s website is not

incorporated by reference into this document or in any other report

or document HP files with the SEC, and any references to HP’s

website are intended to be inactive textual references only.

| |

|

HP INC. AND SUBSIDIARIESCONSOLIDATED CONDENSED STATEMENTS OF

EARNINGS(Unaudited)(In millions, except per share amounts) |

| |

| |

Three months ended |

| |

April 30, 2020 |

|

January 31, 2020 |

|

April 30, 2019 |

|

Net revenue |

$ |

12,469 |

|

|

$ |

14,618 |

|

|

$ |

14,036 |

|

| Costs and expenses: |

|

|

|

|

|

|

Cost of revenue |

9,976 |

|

|

11,746 |

|

|

11,307 |

|

|

Research and development |

338 |

|

|

400 |

|

|

353 |

|

|

Selling, general and administrative |

1,216 |

|

|

1,290 |

|

|

1,339 |

|

|

Restructuring and other charges |

81 |

|

|

291 |

|

|

69 |

|

|

Acquisition-related charges |

3 |

|

|

— |

|

|

11 |

|

|

Amortization of intangible assets |

29 |

|

|

26 |

|

|

29 |

|

|

Total costs and expenses |

11,643 |

|

|

13,753 |

|

|

13,108 |

|

| |

|

|

|

|

|

| Earnings from operations |

826 |

|

|

865 |

|

|

928 |

|

| Interest and other, net |

— |

|

|

13 |

|

|

(45 |

) |

| Earnings before taxes |

826 |

|

|

878 |

|

|

883 |

|

| Provision for taxes |

(62 |

) |

|

(200 |

) |

|

(101 |

) |

| Net earnings |

$ |

764 |

|

|

$ |

678 |

|

|

$ |

782 |

|

| |

|

|

|

|

|

| Net earnings per share: |

|

|

|

|

|

|

Basic |

$ |

0.53 |

|

|

$ |

0.47 |

|

|

$ |

0.51 |

|

|

Diluted |

$ |

0.53 |

|

|

$ |

0.46 |

|

|

$ |

0.51 |

|

| |

|

|

|

|

|

| Cash dividends declared per

share |

$ |

— |

|

|

$ |

0.35 |

|

|

$ |

— |

|

| |

|

|

|

|

|

| Weighted-average shares used to

compute net earnings per share: |

|

|

|

|

|

|

Basic |

1,435 |

|

|

1,454 |

|

|

1,529 |

|

|

Diluted |

1,440 |

|

|

1,460 |

|

|

1,536 |

|

| |

|

HP INC. AND SUBSIDIARIESCONSOLIDATED CONDENSED STATEMENTS OF

EARNINGS(Unaudited)(In millions, except per share amounts) |

| |

| |

Six months ended |

| |

April 30, 2020 |

|

April 30, 2019 |

|

Net revenue |

$ |

27,087 |

|

|

$ |

28,746 |

|

| Costs and expenses: |

|

|

|

|

Cost of revenue |

21,722 |

|

|

23,405 |

|

|

Research and development |

738 |

|

|

697 |

|

|

Selling, general and administrative |

2,506 |

|

|

2,587 |

|

|

Restructuring and other charges |

372 |

|

|

124 |

|

|

Acquisition-related charges |

3 |

|

|

21 |

|

|

Amortization of intangible assets |

55 |

|

|

58 |

|

|

Total costs and expenses |

25,396 |

|

|

26,892 |

|

| |

|

|

|

| Earnings from operations |

1,691 |

|

|

1,854 |

|

| Interest and other, net |

13 |

|

|

(71 |

) |

| Earnings before taxes |

1,704 |

|

|

1,783 |

|

| Provision for taxes |

(262 |

) |

|

(198 |

) |

| Net earnings |

$ |

1,442 |

|

|

$ |

1,585 |

|

| |

|

|

|

| Net earnings per share: |

|

|

|

|

Basic |

$ |

1.00 |

|

|

$ |

1.03 |

|

|

Diluted |

$ |

0.99 |

|

|

$ |

1.02 |

|

| |

|

|

|

| Cash dividends declared per

share |

$ |

0.35 |

|

|

$ |

0.32 |

|

| |

|

|

|

| Weighted-average shares used to

compute net earnings per share: |

|

|

|

|

Basic |

1,444 |

|

|

1,543 |

|

|

Diluted |

1,450 |

|

|

1,551 |

|

| |

| HP INC. AND

SUBSIDIARIESADJUSTMENTS TO GAAP NET EARNINGS, EARNINGS FROM

OPERATIONS,OPERATING MARGIN AND DILUTED NET EARNINGS PER

SHARE(Unaudited)(In millions, except per share amounts) |

| |

| |

Three months ended |

| |

April 30, 2020 |

|

January 31, 2020 |

|

April 30, 2019 |

| |

Amounts |

|

Diluted net earnings per share |

|

Amounts |

|

Diluted net earnings per share |

|

Amounts |

|

Diluted net earnings per share |

|

GAAP net earnings |

$ |

764 |

|

|

$ |

0.53 |

|

|

$ |

678 |

|

|

$ |

0.46 |

|

|

$ |

782 |

|

|

$ |

0.51 |

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring and other charges |

81 |

|

|

0.06 |

|

|

291 |

|

|

0.20 |

|

|

69 |

|

|

0.03 |

|

|

Acquisition-related charges |

3 |

|

|

— |

|

|

— |

|

|

— |

|

|

11 |

|

|

0.01 |

|

|

Amortization of intangible assets |

29 |

|

|

0.02 |

|

|

26 |

|

|

0.02 |

|

|

29 |

|

|

0.02 |

|

|

Non-operating retirement-related credits |

(56 |

) |

|

(0.04 |

) |

|

(57 |

) |

|

(0.04 |

) |

|

(10 |

) |

|

(0.01 |

) |

|

Tax adjustments(a) |

(80 |

) |

|

(0.06 |

) |

|

18 |

|

|

0.01 |

|

|

(60 |

) |

|

(0.03 |

) |

| Non-GAAP net earnings |

$ |

741 |

|

|

$ |

0.51 |

|

|

$ |

956 |

|

|

$ |

0.65 |

|

|

$ |

821 |

|

|

$ |

0.53 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| GAAP earnings from

operations |

$ |

826 |

|

|

|

|

$ |

865 |

|

|

|

|

$ |

928 |

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring and other charges |

81 |

|

|

|

|

291 |

|

|

|

|

69 |

|

|

|

|

Acquisition-related charges |

3 |

|

|

|

|

— |

|

|

|

|

11 |

|

|

|

|

Amortization of intangible assets |

29 |

|

|

|

|

26 |

|

|

|

|

29 |

|

|

|

| Non-GAAP earnings from

operations |

$ |

939 |

|

|

|

|

$ |

1,182 |

|

|

|

|

$ |

1,037 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating margin |

7 |

% |

|

|

|

6 |

% |

|

|

|

7 |

% |

|

|

| Non-GAAP adjustments |

1 |

% |

|

|

|

2 |

% |

|

|

|

0 |

% |

|

|

| Non-GAAP operating margin |

8 |

% |

|

|

|

8 |

% |

|

|

|

7 |

% |

|

|

(a) Includes tax impact on non-GAAP adjustments.

| |

| HP INC. AND

SUBSIDIARIESADJUSTMENTS TO GAAP NET EARNINGS, EARNINGS FROM

OPERATIONS,OPERATING MARGIN AND DILUTED NET EARNINGS PER

SHARE(Unaudited)(In millions, except per share amounts) |

| |

| |

Six months ended |

| |

April 30, 2020 |

|

April 30, 2019 |

| |

Amounts |

|

Diluted net earnings per share |

|

Amounts |

|

Diluted net earnings per share |

|

GAAP net earnings |

$ |

1,442 |

|

|

$ |

0.99 |

|

|

$ |

1,585 |

|

|

$ |

1.02 |

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Restructuring and other charges |

372 |

|

|

0.26 |

|

|

124 |

|

|

0.07 |

|

|

Acquisition-related charges |

3 |

|

|

— |

|

|

21 |

|

|

0.01 |

|

|

Amortization of intangible assets |

55 |

|

|

0.04 |

|

|

58 |

|

|

0.04 |

|

|

Non-operating retirement-related credits |

(113 |

) |

|

(0.08 |

) |

|

(22 |

) |

|

(0.01 |

) |

|

Tax adjustments(a) |

(62 |

) |

|

(0.04 |

) |

|

(136 |

) |

|

(0.08 |

) |

| Non-GAAP net earnings |

$ |

1,697 |

|

|

$ |

1.17 |

|

|

$ |

1,630 |

|

|

$ |

1.05 |

|

| |

|

|

|

|

|

|

|

| GAAP earnings from

operations |

$ |

1,691 |

|

|

|

|

$ |

1,854 |

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Restructuring and other charges |

372 |

|

|

|

|

124 |

|

|

|

|

Acquisition-related charges |

3 |

|

|

|

|

21 |

|

|

|

|

Amortization of intangible assets |

55 |

|

|

|

|

58 |

|

|

|

| Non-GAAP earnings from

operations |

$ |

2,121 |

|

|

|

|

$ |

2,057 |

|

|

|

| |

|

|

|

|

|

|

|

| GAAP operating margin |

6 |

% |

|

|

|

6 |

% |

|

|

| Non-GAAP adjustments |

2 |

% |

|

|

|

1 |

% |

|

|

| Non-GAAP operating margin |

8 |

% |

|

|

|

7 |

% |

|

|

(a) Includes tax impact on non-GAAP adjustments.

|

|

|

HP INC. AND SUBSIDIARIESCONSOLIDATED CONDENSED BALANCE

SHEETS(Unaudited)(In millions) |

|

|

|

|

As

of |

| |

April 30, 2020 |

|

October 31, 2019 |

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

4,054 |

|

|

$ |

4,537 |

|

|

Accounts receivable, net |

5,146 |

|

|

6,031 |

|

|

Inventory |

6,354 |

|

|

5,734 |

|

|

Other current assets |

4,106 |

|

|

3,875 |

|

|

Total current assets |

19,660 |

|

|

20,177 |

|

| Property, plant and equipment,

net |

2,714 |

|

|

2,794 |

|

| Goodwill |

6,370 |

|

|

6,372 |

|

| Other non-current assets |

5,029 |

|

|

4,124 |

|

| Total assets |

$ |

33,773 |

|

|

$ |

33,467 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

| Current liabilities: |

|

|

|

|

Notes payable and short-term borrowings |

$ |

1,551 |

|

|

$ |

357 |

|

|

Accounts payable |

14,195 |

|

|

14,793 |

|

|

Other current liabilities |

9,530 |

|

|

10,143 |

|

|

Total current liabilities |

25,276 |

|

|

25,293 |

|

| Long-term debt |

3,941 |

|

|

4,780 |

|

| Other non-current

liabilities |

5,299 |

|

|

4,587 |

|

| Stockholders' deficit |

(743 |

) |

|

(1,193 |

) |

| Total liabilities and

stockholders' deficit |

$ |

33,773 |

|

|

$ |

33,467 |

|

| |

|

HP INC. AND SUBSIDIARIESCONSOLIDATED CONDENSED STATEMENTS OF

CASH FLOWS(Unaudited)(In millions) |

| |

| |

Three months

ended |

| |

April 30, 2020 |

|

April 30, 2019 |

| |

|

|

|

| Cash flows from operating

activities: |

|

|

|

|

Net earnings |

$ |

764 |

|

|

$ |

782 |

|

|

Adjustments to reconcile net earnings to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

198 |

|

|

181 |

|

|

Stock-based compensation expense |

63 |

|

|

66 |

|

|

Restructuring and other charges |

81 |

|

|

69 |

|

|

Deferred taxes on earnings |

(3 |

) |

|

15 |

|

|

Other, net |

99 |

|

|

118 |

|

|

Changes in operating assets and liabilities, net of

acquisitions: |

|

|

|

|

Accounts receivable |

(311 |

) |

|

(314 |

) |

|

Inventory |

(1,406 |

) |

|

171 |

|

|

Accounts payable |

1,401 |

|

|

(779 |

) |

|

Net investment in leases |

(51 |

) |

|

— |

|

|

Taxes on earnings |

(122 |

) |

|

(11 |

) |

|

Restructuring and other |

(228 |

) |

|

(33 |

) |

|

Other assets and liabilities |

(995 |

) |

|

596 |

|

|

Net cash (used in) provided by operating activities |

(510 |

) |

|

861 |

|

| Cash flows from investing

activities: |

|

|

|

|

Investment in property, plant and equipment |

(149 |

) |

|

(114 |

) |

|

Proceeds from the sale of property, plant and equipment |

3 |

|

|

— |

|

|

Purchases of available-for-sale securities and other

investments |

(3 |

) |

|

— |

|

|

Maturities and sales of available-for-sale securities and other

investments |

292 |

|

|

410 |

|

|

Collateral posted for derivative instruments |

— |

|

|

(2 |

) |

|

Collateral returned for derivative instruments |

— |

|

|

2 |

|

|

Payment made in connection with business acquisition, net of cash

acquired |

(25 |

) |

|

— |

|

|

Net cash provided by investing activities |

118 |

|

|

296 |

|

| Cash flows from financing

activities: |

|

|

|

|

Proceeds from (Payment of) short-term borrowings with original

maturities less than 90 days, net |

613 |

|

|

(1 |

) |

|

Proceed from short-term borrowings with original maturities greater

than 90 days |

9 |

|

|

— |

|

|

Proceeds from debt, net of issuance costs |

49 |

|

|

24 |

|

|

Payment of debt |

(59 |

) |

|

(62 |

) |

|

Stock-based award activities |

4 |

|

|

7 |

|

|

Repurchase of common stock |

(123 |

) |

|

(691 |

) |

|

Cash dividends paid |

(252 |

) |

|

(245 |

) |

|

Net cash provided by (used in) financing activities |

241 |

|

|

(968 |

) |

| (Decrease) Increase in cash

and cash equivalents |

(151 |

) |

|

189 |

|

| Cash and cash equivalents at

beginning of period |

4,205 |

|

|

3,367 |

|

| Cash and cash equivalents at

end of period |

$ |

4,054 |

|

|

$ |

3,556 |

|

| |

|

HP INC. AND SUBSIDIARIESCONSOLIDATED CONDENSED STATEMENTS OF

CASH FLOWS(Unaudited)(In millions) |

| |

| |

Six months

ended |

| |

April 30, 2020 |

|

April 30, 2019 |

| |

|

|

|

| Cash flows from operating

activities: |

|

|

|

|

Net earnings |

$ |

1,442 |

|

|

$ |

1,585 |

|

|

Adjustments to reconcile net earnings to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

396 |

|

|

349 |

|

|

Stock-based compensation expense |

172 |

|

|

173 |

|

|

Restructuring and other charges |

372 |

|

|

124 |

|

|

Deferred taxes on earnings |

114 |

|

|

118 |

|

|

Other, net |

153 |

|

|

113 |

|

|

Changes in operating assets and liabilities, net of

acquisitions: |

|

|

|

|

Accounts receivable |

856 |

|

|

(103 |

) |

|

Inventory |

(645 |

) |

|

362 |

|

|

Accounts payable |

(518 |

) |

|

(963 |

) |

|

Net investment in leases |

(85 |

) |

|

— |

|

|

Taxes on earnings |

(149 |

) |

|

— |

|

|

Restructuring and other |

(337 |

) |

|

(79 |

) |

|

Other assets and liabilities |

(996 |

) |

|

44 |

|

|

Net cash provided by operating activities |

775 |

|

|

1,723 |

|

| Cash flows from investing

activities: |

|

|

|

|

Investment in property, plant and equipment |

(347 |

) |

|

(303 |

) |

|

Proceeds from the sale of property, plant and equipment |

3 |

|

|

— |

|

|

Purchases of available-for-sale securities and other

investments |

(303 |

) |

|

(69 |

) |

|

Maturities and sales of available-for-sale securities and other

investments |

303 |

|

|

754 |

|

|

Collateral posted for derivative instruments |

— |

|

|

(32 |

) |

|

Collateral returned for derivative instruments |

— |

|

|

32 |

|

|

Payment made in connection with business acquisitions, net of cash

acquired |

(36 |

) |

|

(404 |

) |

|

Net cash used in investing activities |

(380 |

) |

|

(22 |

) |

| Cash flows from financing

activities: |

|

|

|

|

Proceeds from (Payment of) short-term borrowings with original

maturities less than 90 days, net |

613 |

|

|

(856 |

) |

|

Proceed from short-term borrowings with original maturities greater

than 90 days |

11 |

|

|

— |

|

|

Proceeds from debt, net of issuance costs |

58 |

|

|

64 |

|

|

Payment of debt |

(126 |

) |

|

(538 |

) |

|

Stock-based award activities |

(112 |

) |

|

(76 |

) |

|

Repurchase of common stock |

(814 |

) |

|

(1,411 |

) |

|

Cash dividends paid |

(508 |

) |

|

(494 |

) |

|

Net cash used in financing activities |

(878 |

) |

|

(3,311 |

) |

| Decrease in cash and cash

equivalents |

(483 |

) |

|

(1,610 |

) |

| Cash and cash equivalents at

beginning of period |

4,537 |

|

|

5,166 |

|

| Cash and cash equivalents at

end of period |

$ |

4,054 |

|

|

$ |

3,556 |

|

| |

|

HP INC. AND SUBSIDIARIESSEGMENT/BUSINESS UNIT

INFORMATION(Unaudited)(In millions) |

| |

| |

Three months

ended |

|

Change

(%) |

| |

April 30, 2020 |

|

January 31, 2020 |

|

April 30, 2019 |

|

Q/Q |

|

Y/Y |

| Net revenue: |

|

|

|

|

|

|

|

|

|

|

Notebooks |

$ |

5,083 |

|

|

$ |

5,974 |

|

|

$ |

5,099 |

|

|

(15 |

)% |

|

— |

% |

|

Desktops |

2,409 |

|

|

2,923 |

|

|

2,940 |

|

|

(18 |

)% |

|

(18 |

)% |

|

Workstations |

439 |

|

|

594 |

|

|

569 |

|

|

(26 |

)% |

|

(23 |

)% |

|

Other |

382 |

|

|

401 |

|

|

313 |

|

|

(5 |

)% |

|

22 |

% |

|

Personal Systems |

8,313 |

|

|

9,892 |

|

|

8,921 |

|

|

(16 |

)% |

|

(7 |

)% |

|

Supplies |

2,841 |

|

|

3,041 |

|

|

3,331 |

|

|

(7 |

)% |

|

(15 |

)% |

|

Commercial Hardware |

808 |

|

|

1,076 |

|

|

1,179 |

|

|

(25 |

)% |

|

(31 |

)% |

|

Consumer Hardware |

509 |

|

|

607 |

|

|

606 |

|

|

(16 |

)% |

|

(16 |

)% |

|

Printing |

4,158 |

|

|

4,724 |

|

|

5,116 |

|

|

(12 |

)% |

|

(19 |

)% |

| Corporate Investments(a) |

— |

|

|

1 |

|

|

— |

|

|

NM |

|

NM |

|

Total segment net revenue |

12,471 |

|

|

14,617 |

|

|

14,037 |

|

|

(15 |

)% |

|

(11 |

)% |

| Other(a) |

(2 |

) |

|

1 |

|

|

(1 |

) |

|

NM |

|

NM |

|

Total net revenue |

$ |

12,469 |

|

|

$ |

14,618 |

|

|

$ |

14,036 |

|

|

(15 |

)% |

|

(11 |

)% |

| |

|

|

|

|

|

|

|

|

|

| Earnings before taxes: |

|

|

|

|

|

|

|

|

|

|

Personal Systems |

$ |

552 |

|

|

$ |

662 |

|

|

$ |

385 |

|

|

|

|

|

|

Printing |

548 |

|

|

754 |

|

|

839 |

|

|

|

|

|

|

Corporate Investments |

(14 |

) |

|

(13 |

) |

|

(24 |

) |

|

|

|

|

|

Total segment earnings from operations |

1,086 |

|

|

1,403 |

|

|

1,200 |

|

|

|

|

|

|

Corporate and unallocated cost and other |

(84 |

) |

|

(112 |

) |

|

(97 |

) |

|

|

|

|

|

Stock-based compensation expense |

(63 |

) |

|

(109 |

) |

|

(66 |

) |

|

|

|

|

|

Restructuring and other charges |

(81 |

) |

|

(291 |

) |

|

(69 |

) |

|

|

|

|

|

Acquisition-related charges |

(3 |

) |

|

— |

|

|

(11 |

) |

|

|

|

|

|

Amortization of intangible assets |

(29 |

) |

|

(26 |

) |

|

(29 |

) |

|

|

|

|

|

Interest and other, net |

— |

|

|

13 |

|

|

(45 |

) |

|

|

|

|

|

Total earnings before taxes |

$ |

826 |

|

|

$ |

878 |

|

|

$ |

883 |

|

|

|

|

|

(a) "NM" represents not meaningful.

| |

|

HP INC. AND SUBSIDIARIESSEGMENT/BUSINESS UNIT

INFORMATION(Unaudited)(In millions) |

| |

| |

Six months

ended |

|

Change (%) |

| |

April 30, 2020 |

|

April 30, 2019 |

|

Y/Y |

| Net revenue: |

|

|

|

|

|

|

Notebooks |

$ |

11,057 |

|

|

$ |

11,018 |

|

|

— |

% |

|

Desktops |

5,332 |

|

|

5,797 |

|

|

(8 |

)% |

|

Workstations |

1,033 |

|

|

1,131 |

|

|

(9 |

)% |

|

Other |

783 |

|

|

632 |

|

|

24 |

% |

|

Personal Systems |

18,205 |

|

|

18,578 |

|

|

(2 |

)% |

|

Supplies |

5,882 |

|

|

6,598 |

|

|

(11 |

)% |

|

Commercial Hardware |

1,884 |

|

|

2,269 |

|

|

(17 |

)% |

|

Consumer Hardware |

1,116 |

|

|

1,305 |

|

|

(14 |

)% |

|

Printing |

8,882 |

|

|

10,172 |

|

|

(13 |

)% |

| Corporate Investments(a) |

1 |

|

|

1 |

|

|

NM |

|

Total segment net revenue |

27,088 |

|

|

28,751 |

|

|

(6 |

)% |

| Other(a) |

(1 |

) |

|

(5 |

) |

|

NM |

|

Total net revenue |

$ |

27,087 |

|

|

$ |

28,746 |

|

|

(6 |

)% |

| |

|

|

|

|

|

| Earnings before taxes: |

|

|

|

|

|

|

Personal Systems |

$ |

1,214 |

|

|

$ |

795 |

|

|

|

|

Printing |

1,302 |

|

|

1,660 |

|

|

|

|

Corporate Investments |

(27 |

) |

|

(48 |

) |

|

|

|

Total segment earnings from operations |

2,489 |

|

|

2,407 |

|

|

|

|

Corporate and unallocated cost and other |

(196 |

) |

|

(177 |

) |

|

|

|

Stock-based compensation expense |

(172 |

) |

|

(173 |

) |

|

|

|

Restructuring and other charges |

(372 |

) |

|

(124 |

) |

|

|

|

Acquisition-related charges |

(3 |

) |

|

(21 |

) |

|

|

|

Amortization of intangible assets |

(55 |

) |

|

(58 |

) |

|

|

|

Interest and other, net |

13 |

|

|

(71 |

) |

|

|

|

Total earnings before taxes |

$ |

1,704 |

|

|

$ |

1,783 |

|

|

|

(a) "NM" represents not meaningful.

| |

|

HP INC. AND SUBSIDIARIESSEGMENT OPERATING MARGIN

SUMMARY(Unaudited) |

| |

| |

Three months ended |

|

Change (pts) |

| |

April 30, 2020 |

|

January 31, 2020 |

|

April 30, 2019 |

|

Q/Q |

|

Y/Y |

| Segment operating margin: |

|

|

|

|

|

|

|

|

|

|

Personal Systems |

6.6 |

% |

|

6.7 |

% |

|

4.3 |

% |

|

(0.1 |

)pts |

|

2.3 |

pts |

|

Printing |

13.2 |

% |

|

16.0 |

% |

|

16.4 |

% |

|

(2.8 |

)pts |

|

(3.2 |

)pts |

|

Corporate Investments(a) |

NM |

|

|

NM |

|

|

NM |

|

|

NM |

|

|

NM |

|

|

Total segment |

8.7 |

% |

|

9.6 |

% |

|

8.5 |

% |

|

(0.9 |

)pts |

|

0.2 |

pts |

(a) "NM" represents not meaningful.

| |

|

HP INC. AND SUBSIDIARIESCALCULATION OF DILUTED NET EARNINGS

PER SHARE(Unaudited)(In millions, except per share amounts) |

| |

| |

Three months

ended |

| |

April 30, 2020 |

|

January 31, 2020 |

|

April 30, 2019 |

| Numerator: |

|

|

|

|

|

|

GAAP net earnings |

$ |

764 |

|

|

$ |

678 |

|

|

$ |

782 |

|

|

Non-GAAP net earnings |

$ |

741 |

|

|

$ |

956 |

|

|

$ |

821 |

|

| |

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

Weighted-average shares used to compute basic net earnings per

share |

1,435 |

|

|

1,454 |

|

|

1,529 |

|

|

Dilutive effect of employee stock plans(a) |

5 |

|

|

6 |

|

|

7 |

|

|

Weighted-average shares used to compute diluted net earnings per

share |

1,440 |

|

|

1,460 |

|

|

1,536 |

|

| |

|

|

|

|

|

| GAAP diluted net earnings per

share |

$ |

0.53 |

|

|

$ |

0.46 |

|

|

$ |

0.51 |

|

| Non-GAAP diluted net earnings per

share |

$ |

0.51 |

|

|

$ |

0.65 |

|

|

$ |

0.53 |

|

(a) Includes any dilutive effect of restricted stock units,

stock options and performance-based awards.

| |

|

HP INC. AND SUBSIDIARIESCALCULATION OF DILUTED NET EARNINGS

PER SHARE(Unaudited)(In millions, except per share amounts) |

| |

| |

Six months

ended |

| |

April 30, 2020 |

|

April 30, 2019 |

| Numerator: |

|

|

|

|

GAAP net earnings |

$ |

1,442 |

|

|

$ |

1,585 |

|

|

Non-GAAP net earnings |

$ |

1,697 |

|

|

$ |

1,630 |

|

| |

|

|

|

| Denominator: |

|

|

|

|

Weighted-average shares used to compute basic net earnings per

share |

1,444 |

|

|

1,543 |

|

|

Dilutive effect of employee stock plans(a) |

6 |

|

|

8 |

|

|

Weighted-average shares used to compute diluted net earnings per

share |

1,450 |

|

|

1,551 |

|

| |

|

|

|

| GAAP diluted net earnings per

share |

$ |

0.99 |

|

|

$ |

1.02 |

|

| Non-GAAP diluted net earnings per

share |

$ |

1.17 |

|

|

$ |

1.05 |

|

(a) Includes any dilutive effect of restricted stock units,

stock options and performance-based awards.

Use of non-GAAP financial measuresTo supplement

HP’s consolidated condensed financial statements presented on a

GAAP basis, HP provides net revenue on a constant currency basis,

non-GAAP total operating expense, non-GAAP operating profit,

non-GAAP operating margin, non-GAAP tax rate, non-GAAP net

earnings, non-GAAP diluted net EPS, free cash flow, gross cash and

net cash (debt). HP also provides forecasts of non-GAAP diluted net

EPS and free cash flow.

These non-GAAP financial measures are not computed in accordance

with, or as an alternative to, GAAP in the United States.

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in the

tables above or elsewhere in the materials accompanying this news

release.

Use and economic substance of non-GAAP financial

measuresNet revenue on a constant currency basis excludes

the effect of foreign currency exchange fluctuations calculated by

translating current period revenues using monthly average exchange

rates from the comparative period and excluding any hedging impact

recognized in the current period. Non-GAAP operating margin is

defined to exclude the effects of any amounts relating to

restructuring and other charges, acquisition-related charges,

amortization of intangible assets. Non-GAAP net earnings and

non-GAAP diluted net EPS consist of net earnings or diluted net EPS

excluding those same charges, defined benefit plan settlement

charges, non-operating retirement related (credits)/charges, tax

adjustments and the amount of additional taxes or tax benefits

associated with each non-GAAP item. HP’s management uses these

non-GAAP financial measures for purposes of evaluating HP’s

historical and prospective financial performance, as well as HP’s

performance relative to its competitors. HP’s management also uses

these non-GAAP measures to further its own understanding of HP’s

segment operating performance. HP believes that excluding the items

mentioned above for these non-GAAP financial measures allows HP’s

management to better understand HP’s consolidated financial

performance in relation to the operating results of HP’s segments,

as HP’s management does not believe that the excluded items are

reflective of ongoing operating results. More specifically, HP’s

management excludes each of those items mentioned above for the

following reasons:

- Restructuring and other charges are (i) costs associated with a

formal restructuring plan and are primarily related to employee

termination and early retirement costs and related benefits, costs

of real estate consolidation and other non-labor charges; and (ii)

other charges, which include non-recurring costs that are distinct

from ongoing operational costs. HP excludes these restructuring and

other charges (and any reversals of charges recorded in prior

periods) for purposes of calculating these non-GAAP measures

because HP believes that these costs do not reflect expected future

operating expenses and do not contribute to a meaningful evaluation

of HP's current operating performance or comparisons to HP's

operating performance in other periods.

- HP incurs cost related to its acquisitions, which it would not

have otherwise incurred as part of its operations. The charges are

direct expenses such as third-party professional and legal fees,

and integration-related costs, as well as non-cash adjustments to

the fair value of certain acquired assets such as inventory. These

charges related to acquisitions are inconsistent in amount and

frequency and are significantly impacted by the timing and nature

of HP's acquisitions. HP believes that eliminating such expenses

for purposes of calculating these non-GAAP measures facilitates a

more meaningful evaluation of HP's current operating performance

and comparisons to HP's past operating performance in other

periods.

- HP incurs charges relating to the amortization of intangible

assets. Those charges are included in HP’s GAAP earnings, operating

margin, net earnings and diluted net EPS. Such charges are

significantly impacted by the timing and magnitude of HP’s

acquisitions and any related impairment charges. Consequently, HP

excludes these charges for purposes of calculating these non-GAAP

measures to facilitate a more meaningful evaluation of HP’s current

operating performance and comparisons to HP’s operating performance

in other periods.

- Non-operating retirement-related (credits)/charges includes

certain market-related factors such as interest cost, expected

return on plan assets, amortized actuarial gains or losses, and

impacts from other market-related factors associated with HP’s

defined benefit pension and post-retirement benefit plans. The

market-driven retirement-related adjustments are primarily due to

the changes in pension plan assets and liabilities which are tied

to financial market performance and HP considers these adjustments

to be outside the operational performance of the business.

Non-operating retirement-related (credits)/charges also include

certain plan curtailments, settlements and special termination

benefits related to HP’s defined benefit pension and

post-retirement benefit plans. HP believes that eliminating such

adjustments for purposes of calculating non-GAAP measures

facilitates a more meaningful evaluation of HP's current operating

performance and comparisons to HP's operating performance in other

periods.

- HP incurred defined benefit plan settlement charges relating to

the U.S. HP pension plan. The charges are associated with the net

settlement and remeasurement resulting from voluntary lump sum

payments offered to certain terminated vested participants. HP

excludes these charges for the purposes of calculating these

non-GAAP measures to facilitate a more meaningful evaluation of

HP’s current operating performance and comparisons to HP’s

operating performance in other periods.

- Tax adjustments include U.S. tax reform adjustment and net tax

indemnification amounts.

- HP recorded U.S. tax reform adjustments as one-time charges

relating to the enactment of the Tax Cuts and Jobs Act of 2017 and

has completed the accounting for the tax effects of the Tax Cuts

and Jobs Act within the one year measurement period. Additional

guidance is periodically issued by regulators and new positions

taken or elections made by HP impact the income tax expense and

effective tax rate in the period in which the adjustments are

made.

- HP also recorded other tax adjustment including tax benefits

and expenses related to the realizability of certain deferred tax

assets, various tax rate and regulatory changes and tax settlements

across various jurisdictions. HP excludes these adjustments for the

purposes of calculating these non-GAAP measures to facilitate a

more meaningful evaluation of HP's current operating performance

and comparisons to HP's operating performance in other

periods.

Free cash flow is a non-GAAP measure that is defined as cash

flow from operations adjusted for net investment in leases and net

investments in property, plant, and equipment. Gross cash is a

non-GAAP measure that is defined as cash and cash equivalents plus

short-term investments and certain long-term investments that may

be liquidated within 90 days pursuant to the terms of existing put

options or similar rights. HP’s management uses free cash flow and

gross cash for the purpose of determining the amount of cash

available for investment in HP’s businesses, repurchasing stock and

other purposes. HP’s management also uses free cash flow and gross

cash to evaluate HP’s historical and prospective liquidity. Because

gross cash includes liquid assets that are not included in cash and

cash equivalents, HP believes that gross cash provides a helpful

assessment of HP’s liquidity. Because free cash flow includes net

cash (used in)/ provided by operating activities adjusted for net

investment in leases and, net investments in property, plant and

equipment, HP believes that free cash flow provides a more accurate

and complete assessment of HP’s liquidity and capital resources.

Net cash (debt) is defined as gross cash less gross debt after

adjusting the effect of unamortized premium/discount on debt

issuance, debt issuance costs and gains/losses on interest rate

swaps.

Material limitations associated with use of non-GAAP

financial measuresThese non-GAAP financial measures may

have limitations as analytical tools, and these measures should not

be considered in isolation or as a substitute for analysis of HP’s

results as reported under GAAP. Some of the limitations in relying

on these non-GAAP financial measures are:

- Items such as amortization of intangible assets, though not

directly affecting HP’s cash position, represent the loss in value

of intangible assets over time. The expense associated with this

change in value is not included in non-GAAP operating margin,

non-GAAP net earnings and non-GAAP diluted net EPS, and therefore

does not reflect the full economic effect of the change in value of

those intangible assets.

- Items such as restructuring and other charges,

acquisition-related charges, non-operating retirement-related

(credits)/charges, defined benefit plan settlement charges, and tax

adjustments that are excluded from non-GAAP operating margin,

non-GAAP net earnings and non-GAAP diluted net EPS can have a

material impact on the equivalent GAAP earnings measure and cash

flows.

- HP may not be able to immediately liquidate the short-term and

certain long-term investments included in gross cash, which may

limit the usefulness of gross cash as a liquidity measure.

Other companies may calculate the non-GAAP financial measures

differently than HP, limiting the usefulness of those measures for

comparative purposes.

Compensation for limitations associated with use of

non-GAAP financial measuresHP compensates for the

limitations on its use of non-GAAP financial measures by relying

primarily on its GAAP results and using non-GAAP financial measures

only supplementally. HP also provides robust and detailed

reconciliations of each non-GAAP financial measure to its most

directly comparable GAAP measure within this news release and in

other written materials that include these non-GAAP financial

measures, and HP encourages investors to review those

reconciliations carefully.

Usefulness of non-GAAP financial measures to

investorsHP believes that providing net revenue on a

constant currency basis, non-GAAP total operating expense, non-GAAP

operating profit, non-GAAP operating margin, non-GAAP tax rate,

non-GAAP net earnings, non-GAAP diluted net EPS, free cash flow,

gross cash and net cash (debt) to investors in addition to the

related GAAP financial measures provides investors with greater

transparency to the information used by HP’s management in its

financial and operational decision making and allows investors to

see HP’s results “through the eyes” of management. HP further

believes that providing this information better enables HP’s

investors to understand HP’s operating performance and financial

condition and to evaluate the efficacy of the methodology and

information used by HP’s management to evaluate and measure such

performance and financial condition. Disclosure of these non-GAAP

financial measures also facilitates comparisons of HP’s operating

performance with the performance of other companies in HP’s

industry that supplement their GAAP results with non-GAAP financial

measures that may be calculated in a similar manner.

Editorial contacts

HP Inc. Media

RelationsMediaRelations@hp.com

HP Inc. Investor

RelationsInvestorRelations@hp.com

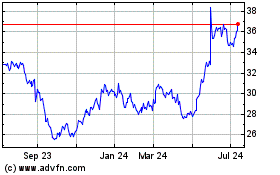

HP (NYSE:HPQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

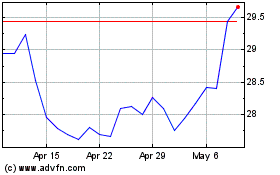

HP (NYSE:HPQ)

Historical Stock Chart

From Apr 2023 to Apr 2024