HP Rejects Sweetened Offer -- WSJ

March 06 2020 - 3:02AM

Dow Jones News

Xerox's purchase bid of $35 billion is called too low, while

adding 'irresponsible' debt

By Dave Sebastian

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 6, 2020).

HP Inc. rejected Xerox Holdings Corp.'s $35 billion bid to take

over the maker of printers, printer supplies and personal

computers, again deeming the offer as too low.

HP on Thursday said a combination would disproportionately

benefit Xerox shareholders and that Xerox doesn't have the

operational experience in HP's sectors, such as personal systems,

home printing and 3D and digital manufacturing.

Xerox didn't respond to a request for comment.

Xerox this week launched an effort to acquire all HP shares

outstanding, valuing HP at nearly $35 billion, or $24 a share in

cash and stock. It had raised the offer from $22 a share. HP said

the value of the offer's equity component poses a risk to the

company and would lead to uncertainties.

The offer would leave Xerox "burdened with an irresponsible

level of debt and which would subsequently require unrealistic,

unachievable synergies that would jeopardize the entire company,"

HP Chairman Chip Bergh said.

HP, based in Palo Alto, Calif., said Xerox's proposed

cost-cutting measures in the prospective combined company is

shortsighted and that its cost-saving estimates exceed reasonable

levels. It said Xerox's declining sales and its recent sale of its

interest in the Fuji Xerox joint venture raise concerns about the

company's future position.

HP also said it received inadequacy opinions from Goldman Sachs

& Co. and Guggenheim Securities this week.

HP President and Chief Executive Enrique Lores and Xerox Vice

Chairman and Chief Executive John Visentin have discussed

scheduling an in-person meeting next week to explore ways to revise

the deal terms, HP said in a securities filing Thursday. The two

men had spoken earlier this week, HP said.

In an interview with CNBC, Mr. Lores said his company remains

open to combining with Xerox.

"We need to agree on what are the right valuation of the two

companies, we need to make sure that the merged entity will have

the right capital structure and that the synergies are realistic,"

Mr. Lores said. "We really need to agree on the three terms before

we discuss what will be the best way of putting the two companies

together."

The two companies dominate different areas of the printer market

and have both been cutting costs as the need for printed documents

declines. Xerox, which is based in Norwalk, Conn., primarily makes

large printers and copy machines and generates revenue from renting

them to businesses and maintaining the devices. HP mainly sells

smaller printers and printing supplies, and it is also one of the

biggest PC makers in the world, though its printer business is more

lucrative.

A deal would combine those household names that have been trying

to reorient their businesses. Xerox has argued that a combination

could equip the companies to overcome those declines, potentially

yielding savings of more than $2 billion. The proposed deal has the

backing of activist investor Carl Icahn, who has stakes in both

companies.

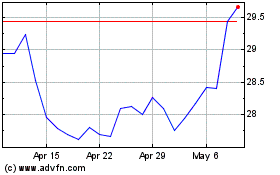

HP, which had a market value of $30.96 billion as of Wednesday's

close, is significantly larger than Xerox, whose market

capitalization was about $7.17 billion.

HP last week said it would buy back $15 billion of its stock as

it worked to block Xerox from taking over. Xerox has said it plans

to nominate 11 independent candidates to replace HP's board at the

HP's annual shareholder meeting this summer.

Xerox shares fell more than 6% Thursday, while HP shares were

down about 0.3%.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

March 06, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

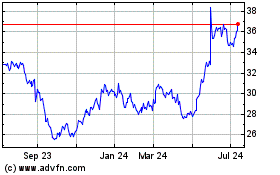

HP (NYSE:HPQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

HP (NYSE:HPQ)

Historical Stock Chart

From Apr 2023 to Apr 2024