HP Earnings Slide as Printing Business Continues to Struggle -- Update

November 26 2019 - 6:30PM

Dow Jones News

By Aaron Tilley

HP Inc. posted lower fiscal fourth-quarter earnings as its

printing business remained weak, helping to spur an increasingly

acrimonious takeover approach from rival Xerox Holdings Corp.

HP said Tuesday its net income fell to $388 million from $1.45

billion a year earlier, when the company's results were boosted by

a one-time tax benefit. For the quarter ended Oct. 31, HP reported

per-share earnings of 26 cents, down from 91 cents and short of the

51 cents analysts surveyed by FactSet expected.

Adjusted earnings, though, rose 11% to 60 cents a share, ahead

of the 58 cents analysts expected. For the current year, the

company projects adjusted per-share earnings of $2.24 to $2.32,

ahead of analysts' estimates.

HP shares rose 1.25% in after-hours trading.

The company that is focused on selling computers and printers

since Hewlett-Packard Co. split in 2015 said revenue for the

quarter edged higher to $15.41 billion compared with $15.37 billion

a year ago. The struggling printer business logged a 6%

year-over-year drop in sales. Revenue for the larger

computer-making unit rose 4%, the company said, boosting the top

line.

The financial results cap a tumultuous fiscal year for HP,

coming at a time when talks with Xerox have raised questions about

its future. In August, HP Chief Executive Dion Weisler stepped

down, citing a family health matter. HP also has been struggling

with falling demand in its printing business, which had been a key

profit driver. That has weighed on the stock.

HP veteran Enrique Lores, who has taken over as CEO, last month

announced the company would be eliminating around 7,000 to 9,000

jobs, or 16% of its workforce. The three-year restructuring program

aims to generate $1 billion in annual savings, the company has

said.

Xerox, which announced its own cost-cutting plan in February,

formally approached HP about a possible takeover earlier this

month. The $33 billion offer, first reported by The Wall Street

Journal, would combine two of the most iconic names in office and

home printing as they face pressure from reduced demand.

HP has rejected Xerox's offer, which it said undervalued the

company, though it added it was open to talks. "HP has numerous

opportunities to create value for HP shareholders on a standalone

basis," the company said in a letter to Xerox. "We will not let

aggressive tactics or hostile gestures distract us from our

responsibility to pursue the most value-creating path."

Xerox Chairman John Visentin, in a letter sent to HP on Tuesday,

said the company would now directly engage with HP shareholders to

convince them of the merits of a deal.

Activist investor Carl Icahn, who has a 10.6% stake in Xerox, is

backing the combination and has taken a 4.24% stake in HP, the

Journal has reported.

"Our strategy is working," Mr. Lores said in a statement, adding

he was confident in the business headed into the current fiscal

year. HP declined to comment further on Xerox's offer.

(END) Dow Jones Newswires

November 26, 2019 18:15 ET (23:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

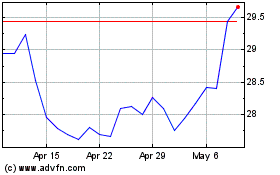

HP (NYSE:HPQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

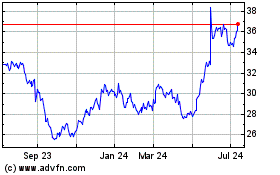

HP (NYSE:HPQ)

Historical Stock Chart

From Apr 2023 to Apr 2024