Home Depot's 2020 Guidance Disappoints -- 2nd Update

December 11 2019 - 5:11PM

Dow Jones News

By Sarah Nassauer and Allison Prang

Home Depot Inc. tempered its sales targets for next year, saying

the long U.S. economic expansion is expected to cool and the

home-improvement chain will need more time for some investments to

pay off in sales gains.

The company's 2020 forecast reflects slower growth in gross

domestic product and a housing market that is positive but "not at

a level that we've seen in prior years," Chief Executive Craig

Menear told investors on Wednesday.

"We will continue to gain outsized share in our market," he

said.

Buoyed by a strong housing market and low unemployment, Home

Depot has enjoyed several years of robust sales growth even as some

retailers, including its rival Lowe's Cos., have struggled. More

recently, its growth has slowed.

For fiscal 2020, Home Depot said it expects total sales and

comparable sales to rise by 3.5% to 4%. Analysts polled by FactSet,

on average, were expecting same-store sales to increase 4.3%. Two

years ago, executives were projecting comparable sales would rise

4.5% to 6% in 2020.

The Atlanta-based company, which operates nearly 2,300 stores,

has missed same-store sales expectations for the last four fiscal

quarters, according to FactSet, and hasn't reported annual

same-store sales below 4% since fiscal 2012.

Home Depot executives said heading into 2020 U.S. consumer

spending is healthy, boosted by low unemployment and rising wages.

They also said the overall housing market is healthy, with

home-equity rising and Americans staying in homes longer, making

them more willing to spend on improvements.

"While we don't expect to see the same tailwinds in prior years,

we do expect to see a positive influence from housing," said

Richard McPhail, who recently took over as finance chief. The

company estimates a 1.8% rise in GDP next year.

The company also lowered its operating profit forecasts for next

year, citing in part higher theft from stores. Executives said they

were working with law enforcement to counter what they said were

organized crime groups. "We all hypothesize that this ties to the

opioid crisis, but we're not positive about that," Mr. Menear

said.

Home Depot's disappointing outlook comes not long after the

company lowered its sales expectations for the current fiscal

year.

The company has been working on revamping its supply chain to

deliver products to customers faster. For example, it is investing

$1.2 billion over five years on its supply chain and distribution

centers to automate more of the delivery of lumber and other

building materials rather than fulfill such online orders from

stores.

Mr. Menear said in November that it was taking longer than

expected for some of the company's strategic plans to show

results

The company said it still expects fiscal 2019 sales to rise

about 1.8%, with comparable sales on a 52-week basis up about 3.5%.

It also backed its full-year earnings forecast of $10.03 a

share.

Shares closed down 1.8% Wednesday at $212. The stock has gained

about 18% over the past year.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Allison

Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

December 11, 2019 16:56 ET (21:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

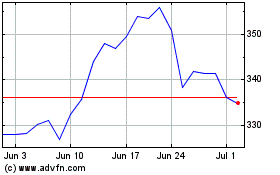

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024