Volatility for Retailers Isn't Over, Options Indicate -- Update

August 20 2019 - 5:11PM

Dow Jones News

By Gunjan Banerji

It has been a wild earnings season for retailers, and options

traders are bracing for bigger stock swings for some shops.

Shares of big retailers such as Home Depot, Inc. and Kohl's

Corp. recorded large moves in trading Tuesday and were some of the

biggest winners and losers in the S&P 500.

Home Depot climbed 4.4% after the home-improvement retailer

reported second-quarter earnings, for its largest single-day jump

this year. Meanwhile, Kohl's lost 6.9% after it released quarterly

results, making it one of the biggest losers in the S&P 500

Tuesday.

Some investors expect this type of volatility in the sector to

continue, forecasting big moves up or down for retail companies

reporting earnings in coming days. Investors have had to parse the

impact of escalating tariffs with China as well as evolving

consumer tastes in recent reports.

Home Depot warned Tuesday that tariffs could weigh on growth,

but its quarterly profit still topped analyst expectations.

Options traders are forecasting a roughly 11% move in Nordstrom

Inc. shares after the retailer reports its latest financials

Wednesday, above the average 6.7% over the past eight earnings

releases, according to data provider Trade Alert. The stock has

been volatile over the past month, falling roughly 24% in

August.

That projection is based on a trade known as a straddle, which

measures the size of the swing in either direction rather than the

direction of the move itself. The trade involves buying both

bullish and bearish options contracts that allow investors to buy

or sell stock at a specific price.

Similarly, options traders are also betting on up to a 13.6%

move in BJ's Wholesale Club Holdings Inc. shares after the company

reports results on Thursday. Historically, the stock has swung an

average of 4.7%, Trade Alert data showed. Traders are wagering on

bigger moves than historically recorded for Ross Stores Inc., too,

according to Trade Alert.

Retailers are undergoing a volatile earnings season that has

separated some strong winners from losers. The latest earnings

reports have been punishing to companies that investors weren't

pleased with, such as Tapestry Inc. Investors have cheered other

companies like Walmart Inc. after their earnings, driving some

share prices higher.

It looks like these divergences could continue.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

August 20, 2019 16:56 ET (20:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

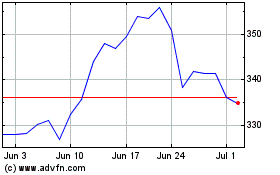

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024