MARKET SNAPSHOT: U.S. Stock Futures Edge Lower, Threaten To Snap Dow's Three-day Win Streak

August 20 2019 - 7:41AM

Dow Jones News

By Mark DeCambre, MarketWatch

Investors eye Home Depot earnings for signs of consumer

health

U.S. stocks looked set for modest losses Tuesday morning as

investors contend with worries about the strength the of the U.S.

economy and quarterly reports from the some of the last remaining

major companies, including Dow-component Home Depot, which could

offer some clues about the health of the American consumer.

How are the major benchmarks faring?

Futures for the Dow Jones Industrial Average fell 28 points, or

0.1%, at 26,104, those for the S&P 500 fell 2.45 points, or

0.1% to 2,921, while Nasdaq-100 futures lost 4 points, or 0.1%, to

reach 7,723.25.

On Monday, the Dow rose 249.78 points, or 1%, to end at

26,135.79, while the S&P 500 index added 34.97 points, or 1.2%,

to close at 2,923.65. The Nasdaq Composite Index advanced 106.82

points, or 1.4%, to finish at 8,002.81.

A fourth consecutive gain for the Dow and the S&P 500 would

represent those indexes' longest since the period ended July

15.

Read:Stock-market investors rattled by bond market's 'warning

shot' -- here's what's next

(http://www.marketwatch.com/story/stock-market-investors-rattled-by-bond-markets-recession-warning-heres-whats-next-2019-08-17)

What's driving the market?

U.S. equity futures were treading water on Tuesday, with

investors digesting earnings

(http://www.marketwatch.com/story/home-depot-warns-lumber-prices-possible-tariffs-to-weigh-on-sales-2019-08-20)

from Home Depot Inc.(HD), which warned that lumber price deflation,

as well as the impact of possible tariffs, will impact its fiscal

year sales.

The report from the home-improvement giant highlights that

Sino-American trade tensions remain a headwind for U.S.

corporations. Although Home Depot said it still sees earnings

rising 3.1% for the year, it now says annual sales will rise 2.3%

and comparable-store sales will rise 4%. Analysts had forecast

earnings-per-share growth of 2.1% on sales growth of 2.8%.

Home Depot earnings come a day after the Commerce Department

said it has given Chinese telecom giant Huawei Technologies Co.

Ltd. another 90-day reprieve during which it can continue to do

business with American companies, without the granting of

case-by-case licenses that would otherwise be needed, after the

Commerce Department added it to its "entity list" in May

(http://www.marketwatch.com/story/stock-futures-slip-after-trump-appears-to-crack-down-on-chinas-huawei-2019-05-16).

Meanwhile, President Donald Trump late Monday leveled fresh

criticism against the Federal Reserve, asking that the central bank

consider deeper cuts to key interest rates, of around 1%. Trump

did, however, declare the U.S. economy in good shape, despite the

trade clash with China, which economists, strategists and many

executives from American companies highlight as a problem for

business planning, one that could throw the U.S. into a recession.

"We're doing tremendously well. Our consumers are rich. I gave a

tremendous tax cut and they're loaded up with money," Trump said on

Monday.

Stock-market investors have been focused on what the bond-market

has been communicating about the overall health of the economy.

Bond prices rise as yields fall and a yield curve inversion that

briefly occurred last week added to concerns about the health of

the market. Such inversions, where the shorter-dated yields rise

above their longer-dated counterparts, have coincided with the past

seven recessions in the months or years following its

occurrence.

"We see a mixed trading session as the movement in yields

suggest the bond market is not convinced of the administrations

pitch to dampen recession fears," said Peter Cardillo, chief market

economist at Spartan Capital Securities in a Tuesday research

note.

The 10-year Treasury note's yield stood at 1.565%, while the

2-year Treasury note yielded 1.525% early Tuesday.

Looking ahead, investors will watch for comments from Fed

officials later in the day, including San Francisco Federal

President Mary Daly, who will speak at 4 p.m. at an online

question-and-answer session, and Federal Gov. Vice Chairman for

Supervision Randal Quarles, who is slated to speak at 6 p.m.

Those speeches come ahead of minutes from the most recent Fed

gathering on July 31, which concluded with the first interest-rate

cut in more than a decade. A gathering of central bankers in

Jackson Hole

(http://www.marketwatch.com/story/investors-might-be-disappointed-in-feds-message-from-jackson-hole-2019-08-16)

that starts on Thursday will also be in focus.

Check out: Stocks could fall another 8% as 'Trump put' and 'Fed

put' expire, says Morgan Stanley's Mike Wilson

(http://www.marketwatch.com/story/the-fed-trump-puts-have-expired-says-morgan-stanleys-mike-wilson-leaving-stocks-vulnerable-to-another-8-decline-2019-08-19)

(END) Dow Jones Newswires

August 20, 2019 07:26 ET (11:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

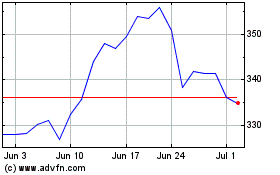

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024