0001657853--12-312020Q3false0000047129--12-312020Q3false00016578532020-01-012020-09-300001657853htz:TheHertzCorporationMember2020-01-012020-09-30xbrli:shares00016578532020-11-020001657853htz:TheHertzCorporationMember2020-11-02iso4217:USD00016578532020-09-3000016578532019-12-310001657853htz:VehicleRelatedServiceMember2020-09-300001657853htz:VehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMember2020-09-300001657853htz:NonVehicleRelatedServiceMember2019-12-31iso4217:USDxbrli:shares0001657853htz:TheHertzCorporationMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-09-300001657853htz:TheHertzCorporationMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-3100016578532020-07-012020-09-3000016578532019-07-012019-09-3000016578532019-01-012019-09-300001657853htz:VehicleRelatedServiceMember2020-07-012020-09-300001657853htz:VehicleRelatedServiceMember2019-07-012019-09-300001657853htz:VehicleRelatedServiceMember2020-01-012020-09-300001657853htz:VehicleRelatedServiceMember2019-01-012019-09-300001657853htz:NonVehicleRelatedServiceMember2020-07-012020-09-300001657853htz:NonVehicleRelatedServiceMember2020-01-012020-09-300001657853htz:NonVehicleRelatedServiceMember2019-07-012019-09-300001657853htz:NonVehicleRelatedServiceMember2019-01-012019-09-300001657853htz:U.S.CarRentalMember2020-07-012020-09-300001657853htz:U.S.CarRentalMember2019-07-012019-09-300001657853htz:U.S.CarRentalMember2020-01-012020-09-300001657853htz:U.S.CarRentalMember2019-01-012019-09-300001657853us-gaap:PreferredStockMember2018-12-310001657853us-gaap:CommonStockMember2018-12-310001657853us-gaap:AdditionalPaidInCapitalMember2018-12-310001657853us-gaap:RetainedEarningsMember2018-12-310001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001657853us-gaap:TreasuryStockMember2018-12-310001657853us-gaap:ParentMember2018-12-310001657853us-gaap:NoncontrollingInterestMember2018-12-3100016578532018-12-310001657853us-gaap:RetainedEarningsMember2019-01-012019-03-310001657853us-gaap:ParentMember2019-01-012019-03-310001657853us-gaap:NoncontrollingInterestMember2019-01-012019-03-3100016578532019-01-012019-03-310001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310001657853us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310001657853us-gaap:PreferredStockMember2019-03-310001657853us-gaap:CommonStockMember2019-03-310001657853us-gaap:AdditionalPaidInCapitalMember2019-03-310001657853us-gaap:RetainedEarningsMember2019-03-310001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310001657853us-gaap:TreasuryStockMember2019-03-310001657853us-gaap:ParentMember2019-03-310001657853us-gaap:NoncontrollingInterestMember2019-03-3100016578532019-03-310001657853us-gaap:RetainedEarningsMember2019-04-012019-06-300001657853us-gaap:ParentMember2019-04-012019-06-300001657853us-gaap:NoncontrollingInterestMember2019-04-012019-06-3000016578532019-04-012019-06-300001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300001657853us-gaap:AdditionalPaidInCapitalMember2019-04-012019-06-300001657853us-gaap:PreferredStockMember2019-06-300001657853us-gaap:CommonStockMember2019-06-300001657853us-gaap:AdditionalPaidInCapitalMember2019-06-300001657853us-gaap:RetainedEarningsMember2019-06-300001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300001657853us-gaap:TreasuryStockMember2019-06-300001657853us-gaap:ParentMember2019-06-300001657853us-gaap:NoncontrollingInterestMember2019-06-3000016578532019-06-300001657853us-gaap:RetainedEarningsMember2019-07-012019-09-300001657853us-gaap:ParentMember2019-07-012019-09-300001657853us-gaap:NoncontrollingInterestMember2019-07-012019-09-300001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012019-09-300001657853us-gaap:AdditionalPaidInCapitalMember2019-07-012019-09-300001657853us-gaap:CommonStockMember2019-07-012019-09-300001657853us-gaap:PreferredStockMember2019-09-300001657853us-gaap:CommonStockMember2019-09-300001657853us-gaap:AdditionalPaidInCapitalMember2019-09-300001657853us-gaap:RetainedEarningsMember2019-09-300001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-300001657853us-gaap:TreasuryStockMember2019-09-300001657853us-gaap:ParentMember2019-09-300001657853us-gaap:NoncontrollingInterestMember2019-09-3000016578532019-09-300001657853us-gaap:PreferredStockMember2019-12-310001657853us-gaap:CommonStockMember2019-12-310001657853us-gaap:AdditionalPaidInCapitalMember2019-12-310001657853us-gaap:RetainedEarningsMember2019-12-310001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001657853us-gaap:TreasuryStockMember2019-12-310001657853us-gaap:ParentMember2019-12-310001657853us-gaap:NoncontrollingInterestMember2019-12-310001657853us-gaap:RetainedEarningsMember2020-01-012020-03-310001657853us-gaap:ParentMember2020-01-012020-03-310001657853us-gaap:NoncontrollingInterestMember2020-01-012020-03-3100016578532020-01-012020-03-310001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001657853us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001657853us-gaap:PreferredStockMember2020-03-310001657853us-gaap:CommonStockMember2020-03-310001657853us-gaap:AdditionalPaidInCapitalMember2020-03-310001657853us-gaap:RetainedEarningsMember2020-03-310001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001657853us-gaap:TreasuryStockMember2020-03-310001657853us-gaap:ParentMember2020-03-310001657853us-gaap:NoncontrollingInterestMember2020-03-3100016578532020-03-310001657853us-gaap:RetainedEarningsMember2020-04-012020-06-300001657853us-gaap:ParentMember2020-04-012020-06-300001657853us-gaap:NoncontrollingInterestMember2020-04-012020-06-3000016578532020-04-012020-06-300001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001657853us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300001657853us-gaap:CommonStockMember2020-04-012020-06-300001657853us-gaap:PreferredStockMember2020-06-300001657853us-gaap:CommonStockMember2020-06-300001657853us-gaap:AdditionalPaidInCapitalMember2020-06-300001657853us-gaap:RetainedEarningsMember2020-06-300001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001657853us-gaap:TreasuryStockMember2020-06-300001657853us-gaap:ParentMember2020-06-300001657853us-gaap:NoncontrollingInterestMember2020-06-3000016578532020-06-300001657853us-gaap:RetainedEarningsMember2020-07-012020-09-300001657853us-gaap:ParentMember2020-07-012020-09-300001657853us-gaap:NoncontrollingInterestMember2020-07-012020-09-300001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-300001657853us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-300001657853us-gaap:PreferredStockMember2020-09-300001657853us-gaap:CommonStockMember2020-09-300001657853us-gaap:AdditionalPaidInCapitalMember2020-09-300001657853us-gaap:RetainedEarningsMember2020-09-300001657853us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001657853us-gaap:TreasuryStockMember2020-09-300001657853us-gaap:ParentMember2020-09-300001657853us-gaap:NoncontrollingInterestMember2020-09-300001657853htz:TheHertzCorporationMember2020-09-300001657853htz:TheHertzCorporationMember2019-12-310001657853htz:TheHertzCorporationMemberhtz:VehicleRelatedServiceMember2020-09-300001657853htz:TheHertzCorporationMemberhtz:VehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2019-12-310001657853htz:TheHertzCorporationMember2020-07-012020-09-300001657853htz:TheHertzCorporationMember2019-07-012019-09-300001657853htz:TheHertzCorporationMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:VehicleRelatedServiceMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:VehicleRelatedServiceMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:VehicleRelatedServiceMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:VehicleRelatedServiceMember2019-01-012019-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2020-07-012020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2020-01-012020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:U.S.CarRentalMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:U.S.CarRentalMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:U.S.CarRentalMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:U.S.CarRentalMember2019-01-012019-09-300001657853us-gaap:CommonStockMemberhtz:TheHertzCorporationMember2018-12-310001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2018-12-310001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2018-12-310001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2018-12-310001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2018-12-310001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2018-12-310001657853htz:TheHertzCorporationMember2018-12-310001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2019-01-012019-03-310001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2019-01-012019-03-310001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2019-01-012019-03-310001657853htz:TheHertzCorporationMember2019-01-012019-03-310001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2019-01-012019-03-310001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2019-01-012019-03-310001657853us-gaap:CommonStockMemberhtz:TheHertzCorporationMember2019-03-310001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2019-03-310001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2019-03-310001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2019-03-310001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2019-03-310001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2019-03-310001657853htz:TheHertzCorporationMember2019-03-310001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2019-04-012019-06-300001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2019-04-012019-06-300001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2019-04-012019-06-300001657853htz:TheHertzCorporationMember2019-04-012019-06-300001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2019-04-012019-06-300001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2019-04-012019-06-300001657853us-gaap:CommonStockMemberhtz:TheHertzCorporationMember2019-06-300001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2019-06-300001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2019-06-300001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2019-06-300001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2019-06-300001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2019-06-300001657853htz:TheHertzCorporationMember2019-06-300001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2019-07-012019-09-300001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012019-09-300001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853us-gaap:CommonStockMemberhtz:TheHertzCorporationMember2019-09-300001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2019-09-300001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2019-09-300001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2019-09-300001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-300001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2019-09-300001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2019-09-300001657853htz:TheHertzCorporationMember2019-09-300001657853us-gaap:CommonStockMemberhtz:TheHertzCorporationMember2019-12-310001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2019-12-310001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2019-12-310001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2019-12-310001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2019-12-310001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2019-12-310001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2020-01-012020-03-310001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2020-01-012020-03-310001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2020-01-012020-03-310001657853htz:TheHertzCorporationMember2020-01-012020-03-310001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2020-01-012020-03-310001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001657853us-gaap:CommonStockMemberhtz:TheHertzCorporationMember2020-03-310001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2020-03-310001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2020-03-310001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2020-03-310001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2020-03-310001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2020-03-310001657853htz:TheHertzCorporationMember2020-03-310001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2020-04-012020-06-300001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2020-04-012020-06-300001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2020-04-012020-06-300001657853htz:TheHertzCorporationMember2020-04-012020-06-300001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2020-04-012020-06-300001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2020-04-012020-06-300001657853us-gaap:CommonStockMemberhtz:TheHertzCorporationMember2020-06-300001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2020-06-300001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2020-06-300001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2020-06-300001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2020-06-300001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2020-06-300001657853htz:TheHertzCorporationMember2020-06-300001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2020-07-012020-09-300001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-300001657853us-gaap:CommonStockMemberhtz:TheHertzCorporationMember2020-09-300001657853us-gaap:AdditionalPaidInCapitalMemberhtz:TheHertzCorporationMember2020-09-300001657853htz:DueFromAffiliateMemberhtz:TheHertzCorporationMember2020-09-300001657853htz:TheHertzCorporationMemberus-gaap:RetainedEarningsMember2020-09-300001657853htz:TheHertzCorporationMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001657853htz:TheHertzCorporationMemberus-gaap:ParentMember2020-09-300001657853us-gaap:NoncontrollingInterestMemberhtz:TheHertzCorporationMember2020-09-30htz:employee0001657853us-gaap:OtherRestructuringMemberhtz:RestructuringPlanImpactofCOVID19Member2020-03-012020-03-310001657853htz:USRentalCarSegmentAndUSCorporateOperationsMemberus-gaap:OtherRestructuringMemberhtz:RestructuringPlanImpactofCOVID19Member2020-03-012020-03-310001657853htz:U.S.CarRentalMember2020-04-012020-06-30xbrli:pure0001657853htz:HVFIISeries2013ANotesMember2020-05-0400016578532020-05-0400016578532020-07-240001657853srt:ScenarioForecastMember2020-07-012020-12-31htz:numberOfVehicles0001657853srt:ScenarioForecastMember2020-06-012020-12-3100016578532020-06-012020-09-30htz:numberOfLeases00016578532020-09-012020-09-300001657853us-gaap:SubsequentEventMember2020-10-012020-10-31htz:debtorClaims0001657853us-gaap:SubsequentEventMember2020-10-302020-10-300001657853us-gaap:SubsequentEventMemberhtz:DFLFSeries20201NotesMemberhtz:VehicleRelatedServiceMember2020-10-160001657853htz:DebtorInPossessionCreditAgreementMemberus-gaap:SubsequentEventMember2020-10-300001657853htz:DebtorInPossessionCreditAgreementMemberus-gaap:SubsequentEventMemberhtz:VehicleRelatedServiceMember2020-10-300001657853htz:DebtorInPossessionCreditAgreementMemberus-gaap:SubsequentEventMemberhtz:NonVehicleRelatedServiceMember2020-10-300001657853htz:DebtorInPossessionCreditAgreementMemberus-gaap:SubsequentEventMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-10-300001657853htz:SecuredFleetFinancingMemberus-gaap:SubsequentEventMemberhtz:VehicleRelatedServiceMember2020-11-050001657853us-gaap:SubsequentEventMemberhtz:DebtorInPossessionCreditAgreementAndSecuredFleetFinancingMemberhtz:VehicleRelatedServiceMember2020-11-050001657853htz:NonvehicleCapitalAssetsMemberus-gaap:OtherOperatingIncomeExpenseMember2019-10-012019-12-310001657853us-gaap:OtherOperatingIncomeExpenseMember2020-01-012020-03-310001657853htz:TechnologyRelatedIntangibleAssetsMemberhtz:U.S.CarRentalMember2020-04-012020-06-300001657853htz:U.S.CarRentalMemberus-gaap:OtherAssetsMember2020-04-012020-06-300001657853us-gaap:TradeNamesMemberhtz:U.S.CarRentalMember2020-06-300001657853us-gaap:TradeNamesMemberhtz:InternationalCarRentalMember2020-06-300001657853us-gaap:SeniorLoansMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853us-gaap:SeniorLoansMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:SeniorCreditFacilityMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:SeniorCreditFacilityMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberus-gaap:SeniorNotesMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberus-gaap:SeniorNotesMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:SeniorSecondPrioritySecuredNotesMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:SeniorSecondPrioritySecuredNotesMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:PromissoryNotesMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:PromissoryNotesMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:AlternativeLetterOfCreditFacility3Point25PercentDueNovember2023Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:AlternativeLetterOfCreditFacility3Point25PercentDueNovember2023Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:SeniorRCFLetterOfCreditFacility3Point25PercentDueJune2021Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:SeniorRCFLetterOfCreditFacility3Point25PercentDueJune2021Member2019-12-310001657853htz:OtherCorporateDebtMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:OtherCorporateDebtMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853us-gaap:CorporateDebtSecuritiesMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853us-gaap:CorporateDebtSecuritiesMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:HVFIISeries2013ANotesMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:HVFIISeries2013ANotesMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:HVFIIUSFleetVariableFundingNotesMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:HVFIIUSFleetVariableFundingNotesMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2015Series1Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2015Series1Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2015Series3Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2015Series3Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2016Series2Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2016Series2Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2016Series4Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2016Series4Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2017Series1Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2017Series1Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2017Series2Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2017Series2Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2018Series1Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2018Series1Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2018Series2Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2018Series2Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2018Series3Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2018Series3Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2019Series1Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UsFleetMediumTermNotes2019Series1Member2019-12-310001657853htz:UsFleetMediumTermNotes2019Series2Memberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:UsFleetMediumTermNotes2019Series2Memberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:UsFleetMediumTermNotes2019Series3Memberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:UsFleetMediumTermNotes2019Series3Memberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:HVFIIUsFleetVariableMediumTermNotesMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:HVFIIUsFleetVariableMediumTermNotesMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:HFLFSeries20132NotesMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:HFLFSeries20132NotesMember2019-12-310001657853htz:DonlenABSProgramMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:DonlenABSProgramMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:HFLFSeries20161Memberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:HFLFSeries20161Memberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:HFLFSeries20171NotesMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:HFLFSeries20171NotesMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:HFLFSeries20181Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:HFLFSeries20181Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:HFLFSeries20191Member2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:HFLFSeries20191Member2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:HFLFMediumTermNotesMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:HFLFMediumTermNotesMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:USVehicleRCFMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:USVehicleRCFMember2019-12-310001657853htz:EuropeanFleetNotesMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:EuropeanFleetNotesMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:EuropeanSecuritizationMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:EuropeanSecuritizationMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:CanadianSecuritizationMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:CanadianSecuritizationMember2019-12-310001657853htz:DonlenCanadianSecuritizationDueDecember2022Memberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:DonlenCanadianSecuritizationDueDecember2022Memberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:AustralianSecuritizationMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:AustralianSecuritizationMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:NewZealandRevolvingCreditFacilityMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:NewZealandRevolvingCreditFacilityMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:UkLeveragedFinancingMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:UkLeveragedFinancingMember2019-12-310001657853htz:OtherVehicleDebtMemberhtz:NonVehicleRelatedServiceMember2020-09-300001657853htz:OtherVehicleDebtMemberhtz:NonVehicleRelatedServiceMember2019-12-310001657853htz:NonVehicleRelatedServiceMemberhtz:OtherFleetDebtMember2020-09-300001657853htz:NonVehicleRelatedServiceMemberhtz:OtherFleetDebtMember2019-12-310001657853htz:FleetDebtMember2020-09-300001657853htz:FleetDebtMember2019-12-310001657853htz:SeniorNotes6250PercentDue2022Member2020-09-300001657853htz:SeniorNotes6250PercentDue2022Member2019-12-310001657853htz:SeniorNotes5.50PercentDue2024Member2020-09-300001657853htz:SeniorNotes5.50PercentDue2024Member2019-12-310001657853htz:SeniorNotes7Point125PercentDue2026Member2020-09-300001657853htz:SeniorNotes7Point125PercentDue2026Member2019-12-310001657853htz:SeniorNotes6Point000PercentDue2028Member2020-09-300001657853htz:SeniorNotes6Point000PercentDueJanuary2028Member2020-09-300001657853htz:SeniorNotes6Point000PercentDueJanuary2028Member2019-12-310001657853us-gaap:SeniorNotesMember2020-09-300001657853us-gaap:SeniorNotesMember2019-12-31iso4217:EURiso4217:USD0001657853htz:EuropeanFleetNotesMember2020-09-300001657853htz:EuropeanFleetNotesMember2019-12-310001657853htz:EuropeanFleetNotes4.125PercentDueOctober2021Member2020-09-300001657853htz:EuropeanFleetNotes4.125PercentDueOctober2021Member2019-12-310001657853htz:EuropeanFleetNotes5.500PercentDueMarch2023Member2020-09-300001657853htz:EuropeanFleetNotes5.500PercentDueMarch2023Member2019-12-310001657853htz:HVFIISeries2013ANotesMember2020-02-012020-02-250001657853htz:HVFIISeries2013ANotesMember2020-02-250001657853htz:HVFIISeries2013ANotesDueMarch2021Member2020-02-250001657853htz:HVFIISeries20172ClassDMember2020-01-012020-09-300001657853htz:HVFIISeries20181ClassDMember2020-01-012020-09-300001657853htz:HVFIISeries20182ClassDNotesMember2020-01-012020-09-300001657853htz:HVFIISeries20183ClassDNotesMember2020-01-012020-09-300001657853htz:HVFIISeries20191ClassDNotesMember2020-01-012020-09-300001657853htz:HVFIISeries20192ClassDNotesMember2020-01-012020-09-300001657853htz:HVFIISeriesClassDNotesMember2020-01-012020-09-300001657853htz:HFLFSeries20132NotesMember2020-02-012020-02-290001657853htz:HFLFSeries20132NotesDueMarch2022Member2020-09-300001657853us-gaap:SubsequentEventMembersrt:MaximumMemberhtz:DFLFSeries20201NotesMemberhtz:VehicleRelatedServiceMember2020-10-160001657853us-gaap:RevolvingCreditFacilityMemberhtz:USVehicleRCFMember2020-08-012020-08-31iso4217:EUR0001657853htz:EuropeanFleetNotes5.500PercentDueMarch2023Member2020-04-300001657853htz:EuropeanFleetNotes5.500PercentDueMarch2023Member2020-05-310001657853us-gaap:SubsequentEventMemberhtz:EuropeanABSExtensionWaiverMembersrt:ScenarioForecastMember2020-10-012020-10-300001657853us-gaap:SubsequentEventMemberhtz:EuropeanABSExtensionWaiverMembersrt:ScenarioForecastMember2020-11-012020-11-050001657853us-gaap:SubsequentEventMemberhtz:EuropeanABSExtensionWaiverMembersrt:ScenarioForecastMember2020-11-062020-11-290001657853us-gaap:SubsequentEventMemberhtz:EuropeanABSExtensionWaiverMembersrt:ScenarioForecastMember2020-11-302020-12-030001657853us-gaap:SubsequentEventMemberhtz:EuropeanABSExtensionWaiverMembersrt:ScenarioForecastMember2020-12-042020-12-04iso4217:CAD0001657853htz:CanadianSecuritizationMember2020-05-310001657853htz:CanadianSecuritizationMember2020-09-30iso4217:AUD0001657853htz:AustralianSecuritizationMember2020-05-310001657853htz:AustralianSecuritizationMember2020-09-30iso4217:GBP0001657853htz:UkLeveragedFinancingMember2020-05-310001657853htz:UkLeveragedFinancingMember2020-09-300001657853us-gaap:SubsequentEventMemberhtz:UkLeveragedFinancingMember2020-10-020001657853htz:SeniorAssetsBasedLineOfCreditFacilityMember2020-09-300001657853us-gaap:LetterOfCreditMember2020-09-300001657853htz:AlternativeLetterofCreditFacilityMember2020-09-300001657853us-gaap:CorporateDebtSecuritiesMember2020-09-300001657853htz:HVFIIU.S.ABSProgramMember2020-09-300001657853htz:HFLFMediumTermNotesMember2020-09-300001657853htz:EuropeanSecuritizationMember2020-09-300001657853htz:DonlenCanadianSecuritizationDueDecember2022Member2020-09-300001657853htz:UsFleetFinancingFacilityMember2020-09-300001657853htz:NewZealandRevolvingCreditFacilityMember2020-09-300001657853us-gaap:LetterOfCreditMember2020-09-300001657853htz:SeniorCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2020-09-300001657853htz:LetterOfCreditFacilityMember2020-09-300001657853htz:AlternativeLetterofCreditFacilityMember2020-09-300001657853htz:InternationalFleetFinancingNo.2B.V.Member2020-01-012020-09-300001657853htz:InternationalFleetFinancingNo.2B.V.Member2020-09-300001657853htz:InternationalFleetFinancingNo.2B.V.Member2019-12-310001657853htz:SeniorRevolvingCreditFacilityandLetterofCreditFacilityMember2020-09-300001657853htz:RentAbatementAndPaymentDeferralsMemberhtz:RestructuringPlanImpactofCOVID19Member2020-07-012020-09-300001657853htz:RentAbatementAndPaymentDeferralsMemberhtz:RestructuringPlanImpactofCOVID19Member2020-01-012020-09-300001657853htz:VehicleRentalsOperatingLeaseMember2020-07-012020-09-300001657853htz:VehicleRentalsOperatingLeaseMember2019-07-012019-09-300001657853htz:VehicleRentalsOperatingLeaseMember2020-01-012020-09-300001657853htz:VehicleRentalsOperatingLeaseMember2019-01-012019-09-300001657853htz:FleetLeasingOperatingLeaseMember2020-07-012020-09-300001657853htz:FleetLeasingOperatingLeaseMember2019-07-012019-09-300001657853htz:FleetLeasingOperatingLeaseMember2020-01-012020-09-300001657853htz:FleetLeasingOperatingLeaseMember2019-01-012019-09-300001657853htz:VariableOperatingLeaseMember2020-07-012020-09-300001657853htz:VariableOperatingLeaseMember2019-07-012019-09-300001657853htz:VariableOperatingLeaseMember2020-01-012020-09-300001657853htz:VariableOperatingLeaseMember2019-01-012019-09-300001657853us-gaap:EmployeeSeveranceMemberhtz:RestructuringPlanImpactofCOVID19Member2020-04-012020-09-300001657853us-gaap:EmployeeSeveranceMemberhtz:RestructuringPlanImpactofCOVID19Member2020-09-300001657853htz:DirectVehicleAndOperatingMemberus-gaap:EmployeeSeveranceMemberhtz:RestructuringPlanImpactofCOVID19Member2020-01-012020-09-300001657853us-gaap:EmployeeSeveranceMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberhtz:RestructuringPlanImpactofCOVID19Member2020-01-012020-09-300001657853us-gaap:EmployeeSeveranceMemberhtz:RestructuringPlanImpactofCOVID19Member2020-01-012020-09-300001657853us-gaap:EmployeeSeveranceMemberhtz:U.S.CarRentalMemberhtz:RestructuringPlanImpactofCOVID19Member2020-01-012020-09-300001657853us-gaap:CorporateNonSegmentMemberus-gaap:EmployeeSeveranceMemberhtz:RestructuringPlanImpactofCOVID19Member2020-01-012020-09-300001657853us-gaap:EmployeeSeveranceMemberhtz:RestructuringPlanImpactofCOVID19Member2019-12-3100016578532019-06-1200016578532019-07-012019-07-310001657853htz:OpenMarketSaleAgreementMember2020-06-150001657853htz:OpenMarketSaleAgreementMember2020-06-152020-06-180001657853us-gaap:StockCompensationPlanMember2020-07-012020-09-300001657853us-gaap:StockCompensationPlanMember2019-07-012019-09-300001657853us-gaap:StockCompensationPlanMember2020-01-012020-09-300001657853us-gaap:StockCompensationPlanMember2019-01-012019-09-300001657853country:USus-gaap:PensionPlansDefinedBenefitMemberhtz:RestructuringandRestructuringRelatedChargesMember2020-09-300001657853country:UShtz:RestructuringandRestructuringRelatedChargesMemberus-gaap:OtherPensionPlansDefinedBenefitMember2020-09-3000016578532019-01-012019-12-310001657853us-gaap:SubsequentEventMember2020-10-012020-10-010001657853us-gaap:SegmentContinuingOperationsMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-07-012020-09-300001657853us-gaap:SegmentContinuingOperationsMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-07-012019-09-300001657853us-gaap:SegmentContinuingOperationsMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2020-01-012020-09-300001657853us-gaap:SegmentContinuingOperationsMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-09-300001657853us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300001657853us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-09-300001657853us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300001657853us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300001657853us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001657853us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001657853us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001657853us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001657853us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2020-09-300001657853us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2020-09-300001657853us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2020-09-300001657853us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2020-09-300001657853us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2019-12-310001657853us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2019-12-310001657853us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2019-12-310001657853us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2019-12-310001657853us-gaap:FairValueInputsLevel2Memberhtz:OtherCorporateDebtMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-300001657853us-gaap:FairValueInputsLevel2Memberhtz:OtherCorporateDebtMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001657853us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberhtz:FleetDebtMember2020-09-300001657853us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberhtz:FleetDebtMember2019-12-310001657853us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-09-300001657853us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001657853srt:AffiliatedEntityMember2020-01-012020-05-310001657853srt:AffiliatedEntityMember2019-07-012019-09-300001657853srt:AffiliatedEntityMember2020-01-012020-09-300001657853htz:MasterLoanAgreementMember2019-12-310001657853htz:TaxRelatedLiabilityMember2020-09-300001657853htz:MasterLoanAgreementMember2020-05-220001657853htz:MasterLoanAgreementDueMay2021Member2020-05-230001657853htz:MasterLoanAgreementDueMay2021Member2020-09-300001657853htz:A767AutoLeasingLLCMember2020-09-300001657853htz:TheHertzCorporationMemberhtz:A767AutoLeasingLLCMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:A767AutoLeasingLLCMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:A767AutoLeasingLLCMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:A767AutoLeasingLLCMember2019-01-012019-09-300001657853htz:A767AutoLeasingLLCMemberhtz:MasterMotorVehicleLeaseandManagementAgreementMember2020-01-012020-09-30htz:segment0001657853us-gaap:AllOtherSegmentsMemberus-gaap:SalesRevenueSegmentMemberus-gaap:ProductConcentrationRiskMember2020-01-012020-09-300001657853us-gaap:AllOtherSegmentsMemberus-gaap:ProductConcentrationRiskMemberus-gaap:CostOfGoodsSegmentMember2020-01-012020-09-300001657853htz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300001657853htz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300001657853htz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300001657853htz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300001657853htz:InternationalCarRentalMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300001657853htz:InternationalCarRentalMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300001657853htz:InternationalCarRentalMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300001657853htz:InternationalCarRentalMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300001657853us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300001657853us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300001657853us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300001657853us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300001657853us-gaap:CorporateNonSegmentMember2020-07-012020-09-300001657853us-gaap:CorporateNonSegmentMember2019-07-012019-09-300001657853us-gaap:CorporateNonSegmentMember2020-01-012020-09-300001657853us-gaap:CorporateNonSegmentMember2019-01-012019-09-300001657853htz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2020-09-300001657853htz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2019-12-310001657853htz:InternationalCarRentalMemberus-gaap:OperatingSegmentsMember2020-09-300001657853htz:InternationalCarRentalMemberus-gaap:OperatingSegmentsMember2019-12-310001657853us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2020-09-300001657853us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2019-12-310001657853us-gaap:CorporateNonSegmentMember2020-09-300001657853us-gaap:CorporateNonSegmentMember2019-12-310001657853us-gaap:CorporateNonSegmentMemberhtz:TheHertzCorporationMember2020-09-300001657853us-gaap:CorporateNonSegmentMemberhtz:TheHertzCorporationMember2019-12-310001657853us-gaap:OperatingSegmentsMember2020-07-012020-09-300001657853us-gaap:OperatingSegmentsMember2019-07-012019-09-300001657853us-gaap:OperatingSegmentsMember2020-01-012020-09-300001657853us-gaap:OperatingSegmentsMember2019-01-012019-09-300001657853htz:NonvehicleDeprecationandAmortizationMemberhtz:NonVehicleRelatedServiceMember2020-07-012020-09-300001657853htz:NonvehicleDeprecationandAmortizationMemberhtz:NonVehicleRelatedServiceMember2019-07-012019-09-300001657853htz:NonvehicleDeprecationandAmortizationMemberhtz:NonVehicleRelatedServiceMember2020-01-012020-09-300001657853htz:NonvehicleDeprecationandAmortizationMemberhtz:NonVehicleRelatedServiceMember2019-01-012019-09-300001657853htz:NonCashDebtChargesMemberhtz:NonVehicleRelatedServiceMember2020-07-012020-09-300001657853htz:NonCashDebtChargesMemberhtz:NonVehicleRelatedServiceMember2019-07-012019-09-300001657853htz:NonCashDebtChargesMemberhtz:NonVehicleRelatedServiceMember2020-01-012020-09-300001657853htz:NonCashDebtChargesMemberhtz:NonVehicleRelatedServiceMember2019-01-012019-09-300001657853htz:NonCashDebtChargesMemberhtz:VehicleRelatedServiceMember2020-07-012020-09-300001657853htz:NonCashDebtChargesMemberhtz:VehicleRelatedServiceMember2019-07-012019-09-300001657853htz:NonCashDebtChargesMemberhtz:VehicleRelatedServiceMember2020-01-012020-09-300001657853htz:NonCashDebtChargesMemberhtz:VehicleRelatedServiceMember2019-01-012019-09-300001657853htz:RestructuringandRestructuringRelatedChargesMember2020-07-012020-09-300001657853htz:RestructuringandRestructuringRelatedChargesMember2019-07-012019-09-300001657853htz:RestructuringandRestructuringRelatedChargesMember2020-01-012020-09-300001657853htz:RestructuringandRestructuringRelatedChargesMember2019-01-012019-09-300001657853htz:TechnologyRelatedIntangibleAndOtherAssetsImpairmentsMember2020-07-012020-09-300001657853htz:TechnologyRelatedIntangibleAndOtherAssetsImpairmentsMember2019-07-012019-09-300001657853htz:TechnologyRelatedIntangibleAndOtherAssetsImpairmentsMember2020-01-012020-09-300001657853htz:TechnologyRelatedIntangibleAndOtherAssetsImpairmentsMember2019-01-012019-09-300001657853htz:FinanceandInformationTechnologyTransformationCostsMember2020-07-012020-09-300001657853htz:FinanceandInformationTechnologyTransformationCostsMember2019-07-012019-09-300001657853htz:FinanceandInformationTechnologyTransformationCostsMember2020-01-012020-09-300001657853htz:FinanceandInformationTechnologyTransformationCostsMember2019-01-012019-09-300001657853htz:ReorganizationItemsNetMember2020-07-012020-09-300001657853htz:ReorganizationItemsNetMember2019-07-012019-09-300001657853htz:ReorganizationItemsNetMember2020-01-012020-09-300001657853htz:ReorganizationItemsNetMember2019-01-012019-09-300001657853htz:COVID19ChargesMember2020-07-012020-09-300001657853htz:COVID19ChargesMember2019-07-012019-09-300001657853htz:COVID19ChargesMember2020-01-012020-09-300001657853htz:COVID19ChargesMember2019-01-012019-09-300001657853htz:OtherIncomeExpenseMember2020-07-012020-09-300001657853htz:OtherIncomeExpenseMember2019-07-012019-09-300001657853htz:OtherIncomeExpenseMember2020-01-012020-09-300001657853htz:OtherIncomeExpenseMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:U.S.CarRentalMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300001657853htz:InternationalCarRentalMemberhtz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300001657853htz:InternationalCarRentalMemberhtz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300001657853htz:InternationalCarRentalMemberhtz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300001657853htz:InternationalCarRentalMemberhtz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300001657853us-gaap:AllOtherSegmentsMemberhtz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300001657853us-gaap:AllOtherSegmentsMemberhtz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300001657853us-gaap:AllOtherSegmentsMemberhtz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300001657853us-gaap:AllOtherSegmentsMemberhtz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberus-gaap:OperatingSegmentsMember2019-01-012019-09-300001657853us-gaap:CorporateNonSegmentMemberhtz:TheHertzCorporationMember2020-07-012020-09-300001657853us-gaap:CorporateNonSegmentMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853us-gaap:CorporateNonSegmentMemberhtz:TheHertzCorporationMember2020-01-012020-09-300001657853us-gaap:CorporateNonSegmentMemberhtz:TheHertzCorporationMember2019-01-012019-09-300001657853htz:NonvehicleDeprecationandAmortizationMemberhtz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2020-07-012020-09-300001657853htz:NonvehicleDeprecationandAmortizationMemberhtz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853htz:NonvehicleDeprecationandAmortizationMemberhtz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2020-01-012020-09-300001657853htz:NonvehicleDeprecationandAmortizationMemberhtz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2019-01-012019-09-300001657853htz:NonCashDebtChargesMemberhtz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2020-07-012020-09-300001657853htz:NonCashDebtChargesMemberhtz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853htz:NonCashDebtChargesMemberhtz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2020-01-012020-09-300001657853htz:NonCashDebtChargesMemberhtz:NonVehicleRelatedServiceMemberhtz:TheHertzCorporationMember2019-01-012019-09-300001657853htz:NonCashDebtChargesMemberhtz:TheHertzCorporationMember2020-07-012020-09-300001657853htz:NonCashDebtChargesMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853htz:NonCashDebtChargesMemberhtz:TheHertzCorporationMember2020-01-012020-09-300001657853htz:NonCashDebtChargesMemberhtz:TheHertzCorporationMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:RestructuringandRestructuringRelatedChargesMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:RestructuringandRestructuringRelatedChargesMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:RestructuringandRestructuringRelatedChargesMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:RestructuringandRestructuringRelatedChargesMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:TechnologyRelatedIntangibleAndOtherAssetsImpairmentsMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:TechnologyRelatedIntangibleAndOtherAssetsImpairmentsMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:TechnologyRelatedIntangibleAndOtherAssetsImpairmentsMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:TechnologyRelatedIntangibleAndOtherAssetsImpairmentsMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:WriteOffIntercompanyLoanMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:WriteOffIntercompanyLoanMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:WriteOffIntercompanyLoanMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:WriteOffIntercompanyLoanMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:FinanceandInformationTechnologyTransformationCostsMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:FinanceandInformationTechnologyTransformationCostsMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:FinanceandInformationTechnologyTransformationCostsMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:FinanceandInformationTechnologyTransformationCostsMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:ReorganizationItemsNetMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:ReorganizationItemsNetMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:ReorganizationItemsNetMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:ReorganizationItemsNetMember2019-01-012019-09-300001657853htz:COVID19ChargesMemberhtz:TheHertzCorporationMember2020-07-012020-09-300001657853htz:COVID19ChargesMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853htz:COVID19ChargesMemberhtz:TheHertzCorporationMember2020-01-012020-09-300001657853htz:COVID19ChargesMemberhtz:TheHertzCorporationMember2019-01-012019-09-300001657853htz:TheHertzCorporationMemberhtz:OtherIncomeExpenseMember2020-07-012020-09-300001657853htz:TheHertzCorporationMemberhtz:OtherIncomeExpenseMember2019-07-012019-09-300001657853htz:TheHertzCorporationMemberhtz:OtherIncomeExpenseMember2020-01-012020-09-300001657853htz:TheHertzCorporationMemberhtz:OtherIncomeExpenseMember2019-01-012019-09-300001657853htz:NonvehicleCapitalAssetsMemberhtz:TheHertzCorporationMember2019-01-012019-09-300001657853htz:NonvehicleCapitalAssetsMemberhtz:TheHertzCorporationMember2019-07-012019-09-300001657853us-gaap:AccruedLiabilitiesMember2020-07-012020-09-300001657853us-gaap:AccruedLiabilitiesMember2020-01-012020-09-300001657853us-gaap:AccruedLiabilitiesMember2020-09-300001657853us-gaap:AccountsPayableMember2020-09-300001657853htz:HertzGlobalHoldingsAndSubsidiariesInBankruptcyProceedingsMember2020-09-300001657853htz:HertzGlobalHoldingsAndSubsidiariesInBankruptcyProceedingsMember2020-01-012020-09-300001657853htz:HertzGlobalHoldingsAndSubsidiariesInBankruptcyProceedingsMember2019-01-012019-09-300001657853htz:HertzGlobalHoldingsAndSubsidiariesInBankruptcyProceedingsMemberhtz:VehicleRelatedServiceMember2020-01-012020-09-300001657853htz:HertzGlobalHoldingsAndSubsidiariesInBankruptcyProceedingsMemberhtz:NonVehicleRelatedServiceMember2020-01-012020-09-300001657853htz:HertzGlobalHoldingsAndSubsidiariesInBankruptcyProceedingsMember2019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________________________________

FORM 10-Q

|

|

|

|

|

|

|

|

|

|

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended

|

September 30, 2020

|

|

OR

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-37665

|

|

61-1770902

|

|

Delaware

|

|

001-07541

|

|

13-1938568

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

8501 Williams Road

|

|

|

|

|

|

Estero,

|

Florida

|

33928

|

|

|

|

|

|

239

|

301-7000

|

|

|

|

|

|

(Address, including Zip Code, and

telephone number, including area code,

of registrant's principal executive offices)

|

|

|

|

|

|

|

|

|

|

|

|

Not Applicable

|

|

|

|

|

|

(Former name, former address and

former fiscal year, if changed since last report.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which Registered

|

|

|

Hertz Global Holdings, Inc.

|

|

Common Stock

|

par value $0.01 per share

|

|

HTZ

|

|

New York Stock Exchange

|

*

|

|

The Hertz Corporation

|

|

None

|

|

None

|

|

None

|

|

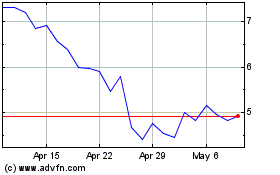

*On October 29, 2020, Hertz Global Holdings, Inc. ("Hertz Global") received notification from the New York Stock Exchange ("NYSE") that Hertz Global's common stock is no longer suitable for listing on the NYSE and that the NYSE suspended trading in Hertz Global's common stock after the market close on October 29, 2020. On October 30, 2020, the NYSE applied to the Securities and Exchange Commission pursuant to Form 25 to remove the common stock of Hertz Global from listing and registration on the NYSE at the opening of business on November 10, 2020. Upon deregistration of Hertz Global's common stock under Section 12(b) of the Exchange Act, Hertz Global's common stock will remain registered under Section 12(g) of the Exchange Act. As a result of the suspension and expected delisting, Hertz Global's common stock began trading exclusively on the over-the-counter market on October 30, 2020 under the symbol HTZGQ.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Hertz Global Holdings, Inc. Yes ☒ No ☐

The Hertz Corporation Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Hertz Global Holdings, Inc. Yes ☒ No ☐

The Hertz Corporation Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hertz Global Holdings, Inc.

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

Non-accelerated filer

|

☐

|

|

|

Smaller reporting company

|

☐

|

Emerging growth company

|

☐

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

|

|

|

The Hertz Corporation

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

Non-accelerated filer

|

☒

|

|

|

Smaller reporting company

|

☐

|

Emerging growth company

|

☐

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Hertz Global Holdings, Inc. Yes ☐ No ☒

The Hertz Corporation Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class

|

|

Shares Outstanding as of

|

November 2, 2020

|

|

Hertz Global Holdings, Inc.

|

|

Common Stock,

|

par value $0.01 per share

|

|

156,206,478

|

|

The Hertz Corporation(1)

|

|

Common Stock,

|

par value $0.01 per share

|

|

100

|

|

|

|

|

|

|

(1)(100% owned by

Rental Car Intermediate Holdings, LLC)

|

|

|

|

|

|

|

|

|

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

(DEBTORS-IN-POSSESSION)

TABLE OF CONTENTS

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

(DEBTORS-IN-POSSESSION)

PART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Index

|

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

Hertz Global Holdings, Inc. and Subsidiaries (Debtor-in-Possession)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Hertz Corporation and Subsidiaries (Debtor-in-Possession)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to the Condensed Consolidated Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED BALANCE SHEETS

Unaudited

(In millions, except par value and share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2020

|

|

December 31,

2019

|

|

ASSETS

|

|

|

|

|

Cash and cash equivalents

|

$

|

1,137

|

|

|

$

|

865

|

|

|

Restricted cash and cash equivalents:

|

|

|

|

|

Vehicle

|

382

|

|

|

466

|

|

|

Non-vehicle

|

363

|

|

|

29

|

|

|

Total restricted cash and cash equivalents

|

745

|

|

|

495

|

|

|

Total cash, cash equivalents, restricted cash and restricted cash equivalents

|

1,882

|

|

|

1,360

|

|

|

Receivables:

|

|

|

|

|

Vehicle

|

629

|

|

|

791

|

|

|

Non-vehicle, net of allowance of $63 and $35, respectively

|

787

|

|

|

1,049

|

|

|

Total receivables, net

|

1,416

|

|

|

1,840

|

|

|

Prepaid expenses and other assets

|

429

|

|

|

689

|

|

|

Revenue earning vehicles:

|

|

|

|

|

Vehicles

|

11,462

|

|

|

17,085

|

|

|

Less: accumulated depreciation

|

(3,011)

|

|

|

(3,296)

|

|

|

Total revenue earning vehicles, net

|

8,451

|

|

|

13,789

|

|

|

Property and equipment, net

|

699

|

|

|

757

|

|

|

Operating lease right-of-use assets

|

1,737

|

|

|

1,871

|

|

|

Intangible assets, net

|

3,062

|

|

|

3,238

|

|

|

Goodwill

|

1,081

|

|

|

1,083

|

|

|

Total assets(a)

|

$

|

18,757

|

|

|

$

|

24,627

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

Accounts payable:

|

|

|

|

|

Vehicle

|

$

|

84

|

|

|

$

|

289

|

|

|

Non-vehicle

|

501

|

|

|

654

|

|

|

Total accounts payable

|

585

|

|

|

943

|

|

|

Accrued liabilities

|

810

|

|

|

1,032

|

|

|

Accrued taxes, net

|

119

|

|

|

150

|

|

|

Debt:

|

|

|

|

|

Vehicle

|

8,753

|

|

|

13,368

|

|

|

Non-vehicle

|

18

|

|

|

3,721

|

|

|

Total debt

|

8,771

|

|

|

17,089

|

|

|

Operating lease liabilities

|

1,703

|

|

|

1,848

|

|

|

Self-insured liabilities

|

481

|

|

|

553

|

|

|

Deferred income taxes, net

|

887

|

|

|

1,124

|

|

|

Total liabilities not subject to compromise

|

13,356

|

|

|

22,739

|

|

|

Liabilities subject to compromise

|

5,001

|

|

|

—

|

|

|

Total liabilities(a)

|

18,357

|

|

|

22,739

|

|

|

Commitments and contingencies

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

Preferred stock, $0.01 par value, no shares issued and outstanding

|

—

|

|

|

—

|

|

|

Common stock, $0.01 par value, 158,235,410 and 144,153,444 shares issued, respectively and 156,206,478 and 142,124,512 shares outstanding, respectively

|

2

|

|

|

1

|

|

|

Additional paid-in capital

|

3,047

|

|

|

3,024

|

|

|

Accumulated deficit

|

(2,392)

|

|

|

(967)

|

|

|

Accumulated other comprehensive income (loss)

|

(216)

|

|

|

(189)

|

|

|

Treasury stock, at cost, 2,028,932 and 2,028,932 shares, respectively

|

(100)

|

|

|

(100)

|

|

|

Stockholders' equity attributable to Hertz Global

|

341

|

|

|

1,769

|

|

|

Noncontrolling interests

|

59

|

|

|

119

|

|

|

Total stockholders' equity

|

400

|

|

|

1,888

|

|

|

Total liabilities and stockholders' equity

|

$

|

18,757

|

|

|

$

|

24,627

|

|

(a)Hertz Global Holdings, Inc.'s consolidated total assets as of September 30, 2020 and December 31, 2019 include total assets of variable interest entities (“VIEs”) of $705 million and $1.3 billion, respectively, which can only be used to settle obligations of the VIEs. Hertz Global Holdings, Inc.'s consolidated total liabilities as of September 30, 2020 and December 31, 2019 include total liabilities of VIEs of $647 million and $1.1 billion, respectively, for which the creditors of the VIEs have no recourse to Hertz Global Holdings, Inc. See "Special Purpose Entities" in Note 6, "Debt," and "767 Auto Leasing LLC" in Note 14, "Related Party Transactions," for further information.

The accompanying notes are an integral part of these financial statements.

2

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

(In millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30,

|

|

Nine Months Ended

September 30,

|

|

|

2020

|

|

2019

|

|

2020

|

|

2019

|

|

Revenues:

|

|

|

|

|

|

|

|

|

Worldwide vehicle rental

|

$

|

1,119

|

|

|

$

|

2,664

|

|

|

$

|

3,535

|

|

|

$

|

6,961

|

|

|

All other operations

|

149

|

|

|

172

|

|

|

488

|

|

|

493

|

|

|

Total revenues

|

1,268

|

|

|

2,836

|

|

|

4,023

|

|

|

7,454

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

Direct vehicle and operating

|

832

|

|

|

1,492

|

|

|

2,777

|

|

|

4,147

|

|

|

Depreciation of revenue earning vehicles and lease charges

|

347

|

|

|

667

|

|

|

1,634

|

|

|

1,892

|

|

|

Selling, general and administrative

|

143

|

|

|

232

|

|

|

519

|

|

|

723

|

|

|

Interest expense, net:

|

|

|

|

|

|

|

|

|

Vehicle

|

110

|

|

|

134

|

|

|

360

|

|

|

372

|

|

|

Non-vehicle (excludes contractual interest of $53 million and $75 million for the three and nine months ended September 30, 2020, respectively)

|

17

|

|

|

70

|

|

|

118

|

|

|

214

|

|

|

Total interest expense, net

|

127

|

|

|

204

|

|

|

478

|

|

|

586

|

|

|

Technology-related intangible and other asset impairments

|

—

|

|

|

—

|

|

|

193

|

|

|

—

|

|

|

Other (income) expense, net

|

—

|

|

|

(6)

|

|

|

(15)

|

|

|

(37)

|

|

|

Reorganization items, net

|

78

|

|

|

—

|

|

|

101

|

|

|

—

|

|

|

Total expenses

|

1,527

|

|

|

2,589

|

|

|

5,687

|

|

|

7,311

|

|

|

Income (loss) before income taxes

|

(259)

|

|

|

247

|

|

|

(1,664)

|

|

|

143

|

|

|

Income tax (provision) benefit

|

36

|

|

|

(74)

|

|

|

232

|

|

|

(78)

|

|

|

Net income (loss)

|

(223)

|

|

|

173

|

|

|

(1,432)

|

|

|

65

|

|

|

Net (income) loss attributable to noncontrolling interests

|

1

|

|

|

(4)

|

|

|

7

|

|

|

(4)

|

|

|

Net income (loss) attributable to Hertz Global

|

$

|

(222)

|

|

|

$

|

169

|

|

|

$

|

(1,425)

|

|

|

$

|

61

|

|

|

Weighted-average shares outstanding:

|

|

|

|

|

|

|

|

|

Basic

|

156

|

|

|

133

|

|

|

148

|

|

|

109

|

|

|

Diluted

|

156

|

|

|

134

|

|

|

148

|

|

|

109

|

|

|

Earnings (loss) per share:

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share

|

$

|

(1.42)

|

|

|

$

|

1.26

|

|

|

$

|

(9.65)

|

|

|

$

|

0.56

|

|

|

Diluted earnings (loss) per share

|

$

|

(1.42)

|

|

|

$

|

1.26

|

|

|

$

|

(9.65)

|

|

|

$

|

0.56

|

|

The accompanying notes are an integral part of these financial statements.

3

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

Unaudited

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30,

|

|

Nine Months Ended

September 30,

|

|

|

2020

|

|

2019

|

|

2020

|

|

2019

|

|

Net income (loss)

|

$

|

(223)

|

|

|

$

|

173

|

|

|

$

|

(1,432)

|

|

|

$

|

65

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

(6)

|

|

|

(13)

|

|

|

(32)

|

|

|

(11)

|

|

|

Net gain (loss) on defined benefit pension plans

|

15

|

|

|

1

|

|

|

1

|

|

|

1

|

|

|

Reclassification to other (income) expense for amortization of actuarial (gains) losses on defined benefit pension plans

|

1

|

|

|

2

|

|

|

6

|

|

|

5

|

|

|

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss) before income taxes

|

10

|

|

|

(10)

|

|

|

(25)

|

|

|

(5)

|

|

|

Income tax (provision) benefit related to net gains and losses on defined benefit pension plans

|

(4)

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Income tax (provision) benefit related to reclassified amounts of net periodic costs on defined benefit pension plans

|

(1)

|

|

|

(1)

|

|

|

(2)

|

|

|

(1)

|

|

|

Total other comprehensive income (loss)

|

5

|

|

|

(11)

|

|

|

(27)

|

|

|

(6)

|

|

|

Total comprehensive income (loss)

|

(218)

|

|

|

162

|

|

|

(1,459)

|

|

|

59

|

|

|

Comprehensive (income) loss attributable to noncontrolling interests

|

1

|

|

|

(4)

|

|

|

7

|

|

|

(4)

|

|

|

Comprehensive income (loss) attributable to Hertz Global

|

$

|

(217)

|

|

|

$

|

158

|

|

|

$

|

(1,452)

|

|

|

$

|

55

|

|

The accompanying notes are an integral part of these financial statements.

4

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

Unaudited

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock

Shares

|

|

Common Stock Shares

|

|

Common Stock Amount

|

|

Additional

Paid-In Capital

|

|

Accumulated

Deficit(1)

|

|

Accumulated

Other

Comprehensive

Income (Loss)

|

|

Treasury Stock Shares

|

|

Treasury Stock Amount

|

|

Stockholders'

Equity

Attributable to

Hertz Global

|

|

Non-

controlling Interests(1)

|

|

Total Stockholders' Equity

|

|

Balance as of:

|

|

|

|

|

|

|

December 31, 2018

|

—

|

|

|

84

|

|

|

$

|

1

|

|

|

$

|

2,261

|

|

|

$

|

(909)

|

|

|

$

|

(192)

|

|

|

2

|

|

|

$

|

(100)

|

|

|

$

|

1,061

|

|

|

$

|

59

|

|

|

$

|

1,120

|

|

|

Net income (loss)

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(147)

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(147)

|

|

|

(1)

|

|

|

(148)

|

|

|

Other comprehensive income (loss)

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

7

|

|

|

—

|

|

|

—

|

|

|

7

|

|

|

—

|

|

|

7

|

|

|

Net settlement on vesting of restricted stock

|

—

|

|

|

—

|

|

|

—

|

|

|

(2)

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(2)

|

|

|

—

|

|

|

(2)

|

|

|

Stock-based compensation charges

|

—

|

|

|

—

|

|

|

—

|

|

|

3

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—