Net Sales, operating profit, EPS and operating cash flow above

expectations

U.S. Innerwear sales up 8.4% over last year, excluding

protective garments; up 11.5% on rebased basis

Global Champion net sales more than doubled over previous

quarter

3Q net sales of $1.81 billion driven by improved sales trends

across apparel businesses

3Q GAAP EPS $0.29; Adjusted EPS $0.42

3Q net cash from operations of $249 million

Launches in-depth business review as it prepares long-term

growth strategy

Hanesbrands Inc. (NYSE: HBI), a leading global marketer of

branded everyday basic apparel, today announced third-quarter

results, delivering strong sales, operating profit and cash flow on

improving business trends, despite continued market disruption from

the COVID-19 pandemic.

Net sales for the third quarter ended September 26, 2020, were

$1.81 billion compared with $1.87 billion a year ago. The company

sold $179 million in personal protective garments globally. The

year-ago quarter included net sales of $119 million from the now

exited C9 Champion mass program and the DKNY intimate apparel

license. Excluding the exited programs and the effect of changes in

foreign exchange rates, total constant-currency net sales for

third-quarter 2020 increased 2.6%.

Third-quarter GAAP operating profit decreased 35% to $175

million, and the quarter’s adjusted operating profit excluding

actions decreased 9% to $227 million.

Third-quarter GAAP EPS decreased 43% to $0.29, and adjusted EPS

excluding actions decreased 11% to $0.42. (See the Note on

Reconciliation of Select GAAP Measures to Non-GAAP Measures later

in this news release for additional discussion and details of

actions, which include pandemic-related charges.)

“I want to thank our incredible team of more than 63,000 around

the globe for their commitment and dedication during these

challenging times,” said Hanes Chief Executive Officer Steve

Bratspies. “I’m pleased with our third-quarter results as we saw

significant improvements across our business and exceeded our

expectations for sales, profits and cash flow from operations. We

saw particularly strong performance in our U.S. Innerwear and

global Champion businesses, and I’m encouraged by our momentum even

as we continue to operate in a challenging environment.

“Hanesbrands has iconic brands, a strong balance sheet, global

reach, a deep commitment to sustainability and a passionate team.

We have tremendous opportunities ahead of us, and we are committed

to delivering long-term growth. We are conducting an in-depth

review of our business as we build our growth strategy. Parts of

our strategy will begin to unfold in the fourth quarter, and I look

forward to reporting on our progress in the months ahead.”

Callouts for Third-Quarter Results and

Ongoing Operations

Momentum across the business: Apparel revenue trends

improved sequentially in each business segment. Global sales of

Champion grew nearly 130% over the previous quarter, and consumer

demand remains strong.

Strong cash flow: The company delivered another strong

cash flow quarter, generating $249 million of operating cash flow.

The company expects to end the year with higher-than-anticipated

inventory of personal protective garments, but continues to expect

to generate positive operating cash flow in the second half and for

the full year.

Digital progress: For the third quarter, online sales

increased nearly 70% on a rebased basis through company e-commerce

websites, retailer websites, large internet pure-plays, and

business-to-business customers.

Improved liquidity: The company ended the third quarter

with $2 billion of liquidity, up from $1.8 billion last quarter,

while paying its regular dividend and reducing debt by

approximately $130 million.

Sustainability goals: In the quarter, Hanesbrands

announced 2030 global sustainability goals, including addressing

the use of plastics and sustainable raw materials in products and

packaging and improving the lives of 10 million people through

initiatives that focus on health, education and wellness. In

addition, the company launched a new sustainability website,

www.hbisustains.com, designed to increase transparency on key

metrics, including diversity, human rights benchmarks and risk

assessments for investors.

COVID-related uncertainty: The company continues to

operate in a highly uncertain environment due to increasing

concerns of COVID-19 and increased restrictions by governments

around the world.

Third-Quarter 2020 Business Segment

Summaries

Innerwear Segment. U.S. Innerwear sales increased 8.4%,

excluding protective garments, with growth in the basics and

intimate apparel businesses. Overall, U.S. Innerwear sales

increased 37% over prior year driven by sales of protective

garments, continued positive point-of-sale trends and inventory

restocking. When the year-ago quarter is rebased to reflect the

exit of the C9 Champion mass program and the DKNY intimate apparel

license, sales increased 11.5%, excluding protective garments, and

41% overall.

Activewear Segment. U.S. Activewear sales declined 41%, a

significant improvement from the second quarter. When the year-ago

quarter is rebased for the C9 Champion program exit, U.S Activewear

sales declined 27%.

Excluding $103 million of C9 Champion sales in mass retail in

the year-ago quarter, sales of the Champion brand, while down 27%

over the prior year, showed an 85% increase over the second

quarter, driven by strong point-of-sale trends and continued online

growth.

The vast majority of these declines occurred in the segment’s

sports apparel business, which was significantly impacted by

COVID-related issues, such as cancelled sporting events and the

closure of college bookstores.

International Segment. As reported, third quarter

International segment net sales declined 5% and operating profit

declined 10%. On a constant currency basis, net sales decreased 7%

and operating profit declined 12%.

Excluding sales of protective garments, core International sales

declined 7% as compared to prior year, marking a significant

improvement from the 44% decline in the second quarter.

Year over year constant currency sales growth in the company’s

Americas and Champion Europe businesses was more than offset by

declines in the company’s European innerwear, Asia and Australia

businesses, where COVID-related challenges continued to slow the

retail recovery.

Fourth-Quarter 2020 Financial

Guidance

The company’s outlook for the fourth quarter reflects continued

uncertainty due to the COVID-19 pandemic and is based on the

current business environment, including the recently implemented

COVID-related restrictions in Europe, but does not reflect any

potential impact to the consumer or operating environments should

governments or businesses institute additional lockdowns and store

closings.

For the fourth-quarter 2020, net sales are expected to be

approximately $1.60 billion to $1.66 billion. Included in our sales

outlook is approximately $50 million of protective garment sales

and approximately $10 million of foreign exchange benefit.

As reported last quarter, the company continues to face

second-half 2020 profitability headwinds. Negative manufacturing

variances and higher SG&A expense are expected to pressure both

gross and operating margins in the fourth quarter. GAAP operating

profit is expected to range from $154 million to $174 million.

Adjusted operating profit is expected to range from $160 million to

$180 million. GAAP earnings per share is expected to range from

$0.24 to $0.29 and adjusted EPS is expected to range from $0.25 to

$0.30.

For the fourth-quarter 2020, the midpoint of guidance represents

a net sales decline of 7% compared with 2019. When comparing the

midpoint of fourth-quarter 2020 guidance to 2019 results rebased to

account for the exits of the C9 Champion and DKNY programs, net

sales are expected to decline approximately 2%, GAAP operating

profit and adjusted operating profits are expected to decline

approximately 33% and 30%, respectively, and GAAP and adjusted EPS

are expected to decline approximately 47% and 39% respectively.

Full-year 2020 net cash from operations is expected to be $300

million to $400 million, which includes the impact from the

higher-than-anticipated protective garment inventory. Based on

year-to-date cash flow, this implies fourth quarter net cash from

operations of approximately $70 million to $170 million.

The fiscal year ending January 2, 2021, includes a 53rd week in

the fourth quarter, and the company’s net sales outlook includes

approximately $40 million from this week.

The tax rate for the quarter was 17.6%. The company expects its

fourth-quarter tax rate to be approximately 17.5%.

Hanesbrands has updated its quarterly frequently-asked-questions

document, which is available at www.Hanes.com/faq.

Note on Adjusted Measures, Rebased

Measures and Reconciliation to GAAP Measures

To supplement financial results prepared in accordance with

generally accepted accounting principles, the company provides

quarterly and full-year results concerning certain non‐GAAP

financial measures, including adjusted EPS, adjusted net income,

adjusted operating profit (and margin), adjusted SG&A, adjusted

gross profit (and margin), adjusted net sales, EBITDA and adjusted

EBITDA.

Adjusted EPS is defined as diluted EPS excluding actions and the

tax effect on actions. Adjusted net income is defined as net income

excluding actions and the tax effect on actions. Adjusted operating

profit is defined as operating profit excluding actions.

Adjusted SG&A is defined as selling, general and

administrative expenses excluding actions. Adjusted gross profit is

defined as gross profit excluding actions. Adjusted net sales are

defined as net sales excluding actions.

Charges for actions taken in 2019 primarily represented supply

chain network changes, program exit costs, and overhead reduction

as well as completion of outstanding acquisition integration.

Charges taken in 2020 include supply chain restructuring actions,

program exit costs and COVID-19 related non-cash charges and supply

chain re-startup charges. Acquisition and integration costs include

legal fees, consulting fees, bank fees, severance costs, certain

purchase accounting items, facility closures, inventory write-offs,

information technology integration costs and similar charges. While

these costs are not operational in nature and are not expected to

continue for any singular transaction on an ongoing basis, similar

types of costs, expenses and charges have occurred in prior periods

and may recur in future periods depending upon acquisition

activity.

Hanesbrands has chosen to present these non‐GAAP measures to

investors to enable additional analyses of past, present and future

operating performance and as a supplemental means of evaluating

operations absent the effect of acquisitions and other actions, as

well as the COVID-19 pandemic. Hanesbrands believes these non-GAAP

measures provide management and investors with valuable

supplemental information for analyzing the operating performance of

the company’s ongoing business during each period presented without

giving effect to costs associated with the execution and

integration of any of the aforementioned actions taken.

The company has also chosen to present EBITDA and adjusted

EBITDA to investors because it considers these measures to be an

important supplemental means of evaluating operating performance.

EBITDA is defined as earnings before interest, taxes, depreciation

and amortization. Adjusted EBITDA is defined as EBITDA excluding

actions and stock compensation expense. Hanesbrands believes that

EBITDA and adjusted EBITDA are frequently used by securities

analysts, investors and other interested parties in the evaluation

of companies in the industry, and management uses EBITDA and

adjusted EBITDA for planning purposes in connection with setting

its capital allocation strategy. EBITDA and adjusted EBITDA should

not, however, be considered as measures of discretionary cash

available to invest in the growth of the business.

In addition, with respect to 2020 financial performance,

Hanesbrands has chosen to present certain year-over-year

comparisons with respect to the company’s rebased 2019 business,

which excludes the exited C9 Champion program at mass retail and

DKNY intimate apparel license. Hanes believes this information is

useful to management and investors to facilitate a more meaningful

comparison of the results of the company’s ongoing business between

2019 and 2020. The company has provided rebased 2019 quarterly

income statements in Supplemental Table B dated February 7, 2020,

which is available online at www.hanes.com/investors.

Hanesbrands is a global company that reports financial

information in U.S. dollars in accordance with GAAP. As a

supplement to the company’s reported operating results, Hanes also

presents constant-currency financial information, which is a

non-GAAP financial measure that excludes the impact of translating

foreign currencies into U.S. dollars. The company uses

constant-currency information to provide a framework to assess how

the business performed excluding the effects of changes in the

rates used to calculate foreign currency translation.

To calculate foreign currency translation on a constant currency

basis, operating results for the current-year period for entities

reporting in currencies other than the U.S. dollar are translated

into U.S. dollars at the average exchange rates in effect during

the comparable period of the prior year (rather than the actual

exchange rates in effect during the current year period).

Hanes believes constant-currency information is useful to

management and investors to facilitate comparison of operating

results and better identify trends in the company’s businesses.

Non-GAAP financial measures have limitations as analytical tools

and should not be considered in isolation or as an alternative to,

or substitute for, financial results prepared in accordance with

GAAP. Further, the non-GAAP measures presented may be different

from non-GAAP measures with similar or identical names presented by

other companies.

Reconciliations of these non-GAAP measures to the most directly

comparable GAAP financial measures are presented in the

supplemental financial information included with this news

release.

Webcast Conference Call

Hanes will host an internet webcast of its third-quarter

investor conference call at 8:30 a.m. EST today, November 5, 2020.

The webcast of the call, which will consist of prepared remarks

followed by a question-and-answer session, may be accessed at

www.Hanes.com/investors. The call is expected to conclude by 9:30

a.m.

An archived replay of the conference call webcast will be

available in the investors section of the Hanes corporate website.

A telephone playback will be available from noon EST today through

midnight EST November 12, 2020. The replay will be available by

calling toll-free (855) 859-2056 or by toll call at (404) 537-3406.

The replay ID is 8793586.

Cautionary Statement Concerning Forward-Looking

Statements

This press release contains certain forward-looking statements,

as defined under U.S. federal securities laws, with respect to our

long-term goals and trends associated with our business, as well as

guidance as to future performance. In particular, among others,

statements regarding the potential impact of the COVID-19 outbreak

on our business and financial performance; guidance and predictions

regarding expected operating results, including related to our new

business line for cotton face masks and other personal protection

garments; our belief that we have sufficient liquidity to fund our

ongoing business operations; and statements made in the

Fourth-Quarter 2020 Financial Guidance section of this news

release, are forward-looking statements. These forward-looking

statements are based on our current intent, beliefs, plans and

expectations. Readers are cautioned not to place any undue reliance

on any forward-looking statements. Forward-looking statements

necessarily involve risks and uncertainties, many of which are

outside of our control, that could cause actual results to differ

materially from such statements and from our historical results and

experience. These risks and uncertainties include such things as:

the potential effects of the COVID-19 outbreak, including on

consumer spending, global supply chains and the financial markets;

the highly competitive and evolving nature of the industry in which

we compete; the rapidly changing retail environment; any

inadequacy, interruption, integration failure or security failure

with respect to our information technology; the impact of

significant fluctuations and volatility in various input costs,

such as cotton and oil-related materials, utilities, freight and

wages; our ability to attract and retain a senior management team

with the core competencies needed to support growth in global

markets; our ability to properly manage strategic projects in order

to achieve the desired results; significant fluctuations in foreign

exchange rates; our reliance on a relatively small number of

customers for a significant portion of our sales; legal,

regulatory, political and economic risks related to our

international operations; our ability to effectively manage our

complex multinational tax structure; the existence of a material

weakness in our internal control over financial reporting; and

other risks identified from time to time in our most recent

Securities and Exchange Commission reports, including our annual

report on Form 10-K and quarterly reports on Form 10-Q. Since it is

not possible to predict or identify all of the risks, uncertainties

and other factors that may affect future results, the above list

should not be considered a complete list. Any forward-looking

statement speaks only as of the date on which such statement is

made, and Hanesbrands undertakes no obligation to update or revise

any forward-looking statement, whether as a result of new

information, future events or otherwise, other than as required by

law.

HanesBrands

HanesBrands, based in Winston-Salem, N.C., is a socially

responsible leading marketer of everyday basic innerwear and

activewear apparel in the Americas, Europe, Australia and

Asia-Pacific. The company sells its products under some of the

world’s strongest apparel brands, including Hanes, Champion, Bonds,

DIM, Maidenform, Bali, Playtex, Lovable, Bras N Things, Nur Die/Nur

Der, Alternative, L’eggs, JMS/Just My Size, Wonderbra, Berlei, and

Gear for Sports. The company sells T-shirts, bras, panties,

shapewear, underwear, socks, hosiery, and activewear produced in

the company’s low-cost global supply chain. A Fortune 500 company

and member of the S&P 500 stock index (NYSE: HBI), Hanes has

approximately 63,000 employees in more than 40 countries. For more

information, visit the company’s corporate website at

www.Hanes.com/corporate and newsroom at

https://newsroom.hanesbrands.com/. Connect with the company via

social media: Twitter (@hanesbrands), Facebook

(www.facebook.com/hanesbrandsinc), Instagram

(@hanesbrands_careers), and LinkedIn (@Hanesbrandsinc).

TABLE 1

HANESBRANDS INC.

Condensed Consolidated

Statements of Income and Supplemental Financial Information

(in thousands, except

per-share amounts)

(Unaudited)

Quarters Ended

Nine Months Ended

September 26,

2020

September 28,

2019

% Change

September 26,

2020

September 28,

2019

% Change

Net sales

$

1,808,266

$

1,866,967

(3.1)

%

$

4,863,507

$

5,215,918

(6.8)

%

Cost of sales

1,191,553

1,149,934

3,140,050

3,203,331

Gross profit

616,713

717,033

(14.0)

%

1,723,457

2,012,587

(14.4)

%

As a % of net sales

34.1

%

38.4

%

35.4

%

38.6

%

Selling, general and administrative

expenses

442,142

449,962

1,273,220

1,366,272

As a % of net sales

24.5

%

24.1

%

26.2

%

26.2

%

Operating profit

174,571

267,071

(34.6)

%

450,237

646,315

(30.3)

%

As a % of net sales

9.7

%

14.3

%

9.3

%

12.4

%

Other expenses

5,309

8,066

16,849

23,766

Interest expense, net

43,868

43,091

122,376

137,672

Income before income tax expense

125,394

215,914

311,012

484,877

Income tax expense

22,116

30,823

54,427

69,143

Net income

$

103,278

$

185,091

(44.2)

%

$

256,585

$

415,734

(38.3)

%

Earnings per share:

Basic

$

0.29

$

0.51

$

0.73

$

1.14

Diluted

$

0.29

$

0.51

$

0.72

$

1.14

Weighted average shares outstanding:

Basic

350,703

364,743

353,419

364,650

Diluted

351,604

365,597

353,956

365,478

The following tables present a

reconciliation of reported results on a constant currency basis for

the quarter and nine months ended September 26, 2020 and a

comparison to prior year:

Quarter Ended September 26,

2020

As Reported

Impact from Foreign

Currency1

Constant Currency

Quarter Ended September

28, 2019

% Change, As

Reported

% Change, Constant

Currency

As reported under GAAP:

Net sales

$

1,808,266

$

14,064

$

1,794,202

$

1,866,967

(3.1)

%

(3.9)

%

Gross profit

616,713

7,394

609,319

717,033

(14.0)

(15.0)

Operating profit

174,571

1,922

172,649

267,071

(34.6)

(35.4)

Diluted earnings per share

$

0.29

$

0.00

$

0.29

$

0.51

(43.1)

%

(43.1)

%

As adjusted:2

Net sales

$

1,808,266

$

14,064

$

1,794,202

$

1,748,269

3.4

%

2.6

%

Gross profit

664,349

7,394

656,955

690,167

(3.7)

(4.8)

Operating profit

227,140

1,922

225,218

249,736

(9.0)

(9.8)

Diluted earnings per share

$

0.42

$

0.00

$

0.41

$

0.47

(10.6)

%

(12.8)

%

Nine Months Ended September

26, 2020

As Reported

Impact from Foreign

Currency1

Constant Currency

Nine Months Ended

September 28, 2019

% Change, As

Reported

% Change, Constant

Currency

As reported under GAAP:

Net sales

$

4,863,507

$

(19,790)

$

4,883,297

$

5,215,918

(6.8)

%

(6.4)

%

Gross profit

1,723,457

(9,166)

1,732,623

2,012,587

(14.4)

(13.9)

Operating profit

450,237

1,148

449,089

646,315

(30.3)

(30.5)

Diluted earnings per share

$

0.72

$

0.00

$

0.72

$

1.14

(36.8)

%

(36.8)

%

As adjusted:2

Net sales

$

4,863,507

$

(19,790)

$

4,883,297

$

4,884,406

(0.4)

%

(0.0)

%

Gross profit

1,819,440

(9,166)

1,828,606

1,950,954

(6.7)

(6.3)

Operating profit

595,301

1,148

594,153

616,582

(3.5)

(3.6)

Diluted earnings per share

$

1.06

$

0.00

$

1.06

$

1.07

(0.9)

%

(0.9)

%

1

Effect of the change in foreign currency

exchange rates year-over-year. Calculated by applying prior period

exchange rates to the current year financial results.

2

Results for the quarters and nine months

ended September 26, 2020 and September 28, 2019 reflect adjustments

for restructuring and other action-related charges. Results for the

quarter and nine months ended September 28, 2019 also reflect

adjustments for the exited C9 Champion mass program and DKNY

intimate apparel license. See “Reconciliation of Select GAAP

Measures to Non-GAAP Measures” in Table 5.

TABLE 2

HANESBRANDS INC.

Supplemental Financial

Information

(in thousands)

(Unaudited)

Quarters Ended

Nine Months Ended

September 26,

2020

September 28, 2019

Rebased1

% Change

September 26,

2020

September 28, 2019

Rebased1

% Change

Segment net sales:

Innerwear

$

792,600

$

562,285

41.0

%

$

2,309,816

$

1,686,176

37.0

%

Activewear

324,921

445,587

(27.1)

781,300

1,117,048

(30.1)

International

632,117

663,525

(4.7)

1,644,893

1,878,568

(12.4)

Other

58,628

76,872

(23.7)

127,498

202,614

(37.1)

Total net sales

$

1,808,266

$

1,748,269

3.4

%

$

4,863,507

$

4,884,406

(0.4)

%

Segment operating profit:

Innerwear

$

172,000

$

117,771

46.0

%

$

558,075

$

367,894

51.7

%

Activewear

29,568

73,738

(59.9)

31,925

143,763

(77.8)

International

96,076

107,168

(10.4)

227,218

288,019

(21.1)

Other

1,006

9,643

(89.6)

(17,389)

16,429

(205.8)

General corporate expenses/other

(71,510)

(58,584)

22.1

(204,528)

(199,523)

2.5

Total operating profit before

restructuring and other action-related charges

227,140

249,736

(9.0)

595,301

616,582

(3.5)

Restructuring and other action-related

charges

(52,569)

(9,937)

429.0

(145,064)

(43,919)

230.3

Total operating profit

$

174,571

$

239,799

(27.2)

%

$

450,237

$

572,663

(21.4)

%

1

Results for the quarter and nine months

ended September 28, 2019 reflect adjustments for the exited C9

Champion mass program and DKNY intimate apparel license. See

“Reconciliation of Select GAAP Measures to Non-GAAP Measures” in

Table 5.

The following table presents a

reconciliation of reported net sales adjusted for personal

protective equipment (“PPE”) sales for the quarter and nine months

ended September 26, 2020 and a comparison to prior year.

Quarter Ended September 26,

2020

As Reported

% Change1

PPE

Adjusted for PPE

% Change1

Segment net sales:

Innerwear

$

792,600

41.0

%

$

165,518

$

627,082

11.5

%

Activewear

324,921

(27.1)

—

324,921

(27.1)

International

632,117

(4.7)

13,108

619,009

(6.7)

Other

58,628

(23.7)

—

58,628

(23.7)

Net sales

$

1,808,266

3.4

%

$

178,626

$

1,629,640

(6.8)

%

Nine Months Ended September

26, 2020

As Reported

% Change1

PPE

Adjusted for PPE

% Change1

Segment net sales:

Innerwear

$

2,309,816

37.0

%

$

779,034

$

1,530,782

(9.2)

%

Activewear

781,300

(30.1)

—

781,300

(30.1)

International

1,644,893

(12.4)

151,815

1,493,078

(20.5)

Other

127,498

(37.1)

—

127,498

(37.1)

Net sales

$

4,863,507

(0.4)

%

$

930,849

$

3,932,658

(19.5)

%

1

The comparison to the quarter and nine

months ended September 28, 2019 reflects adjustments for the exited

C9 Champion mass program and DKNY intimate apparel license. See

“Reconciliation of Select GAAP Measures to Non-GAAP Measures” in

Table 5.

Including the favorable foreign currency

impact of $8 million, global Champion sales outside the mass

channel decreased approximately 9% in the third quarter of 2020

compared to the third quarter of 2019. On a constant currency

basis, global Champion sales decreased approximately 10%.

TABLE 3

HANESBRANDS INC.

Condensed Consolidated Balance

Sheets

(in thousands)

(Unaudited)

September 26,

2020

December 28,

2019

Assets

Cash and cash equivalents

$

731,481

$

328,876

Trade accounts receivable, net

984,571

815,210

Inventories

2,170,552

1,905,845

Other current assets

210,617

174,634

Total current assets

4,097,221

3,224,565

Property, net

553,748

587,896

Right-of-use assets

461,117

487,787

Trademarks and other identifiable

intangibles, net

1,501,161

1,520,800

Goodwill

1,246,113

1,235,711

Deferred tax assets

200,877

203,331

Other noncurrent assets

99,447

93,896

Total assets

$

8,159,684

$

7,353,986

Liabilities

Accounts payable

$

1,144,190

$

959,006

Accrued liabilities

716,590

531,184

Lease liabilities

156,709

166,091

Notes payable

5,257

4,244

Accounts Receivable Securitization

Facility

—

—

Current portion of long-term debt

—

110,914

Total current liabilities

2,022,746

1,771,439

Long-term debt

3,972,212

3,256,870

Lease liabilities - noncurrent

347,604

358,281

Pension and postretirement benefits

371,330

403,458

Other noncurrent liabilities

296,259

327,343

Total liabilities

7,010,151

6,117,391

Stockholders’ equity

Preferred stock

—

—

Common stock

3,483

3,624

Additional paid-in capital

306,157

304,395

Retained earnings

1,454,676

1,546,224

Accumulated other comprehensive loss

(614,783)

(617,648)

Total stockholders’ equity

1,149,533

1,236,595

Total liabilities and stockholders’

equity

$

8,159,684

$

7,353,986

TABLE 4

HANESBRANDS INC.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(Unaudited)

Quarters Ended

Nine Months Ended

September 26,

2020

September 28,

2019

September 26,

2020

September 28,

2019

Operating Activities:

Net income

$

103,278

$

185,091

$

256,585

$

415,734

Adjustments to reconcile net income to net

cash from operating activities:

Depreciation

22,277

24,723

67,676

71,612

Amortization of acquisition

intangibles

6,304

6,172

18,503

18,709

Other amortization

2,984

2,458

8,091

7,521

Impairment of intangible assets

—

—

20,319

—

Amortization of debt issuance costs

3,184

2,263

8,303

7,021

Stock compensation expense

4,612

1,547

13,801

8,794

Deferred taxes

9,054

(1,079)

6,853

(3,661)

Other

(4,255)

(3,813)

5,004

1,662

Changes in assets and liabilities:

Accounts receivable

216,255

(32,903)

(175,879)

(170,348)

Inventories

(197,958)

109,042

(259,367)

(56,470)

Other assets

(11,789)

2,548

(43,359)

(26,031)

Accounts payable

(20,772)

(19,668)

189,566

(11,969)

Accrued pension and postretirement

benefits

353

3,960

(18,965)

(14,361)

Accrued liabilities and other

115,488

21,722

134,091

(3,513)

Net cash from operating activities

249,015

302,063

231,222

244,700

Investing Activities:

Capital expenditures

(2,521)

(21,665)

(49,033)

(79,950)

Proceeds from sales of assets

265

3,012

331

3,530

Acquisition of business

—

(21,360)

—

(21,360)

Other

1,795

—

7,618

—

Net cash from investing activities

(461)

(40,013)

(41,084)

(97,780)

Financing Activities:

Borrowings on notes payable

49,889

88,120

166,558

250,712

Repayments on notes payable

(53,735)

(88,381)

(166,108)

(252,084)

Borrowings on Accounts Receivable

Securitization Facility

—

83,293

227,061

207,105

Repayments on Accounts Receivable

Securitization Facility

—

(65,000)

(227,061)

(160,110)

Borrowings on Revolving Loan

Facilities

—

981,777

1,638,000

2,584,277

Repayments on Revolving Loan

Facilities

(118,189)

(1,163,092)

(1,756,189)

(2,585,592)

Borrowings on Senior Notes

—

—

700,000

—

Repayments on Term Loan Facilities

—

(10,625)

—

(152,248)

Borrowings on International Debt

—

20,539

31,222

27,680

Repayments on International Debt

(36,383)

(13,483)

(36,383)

(41,424)

Share repurchases

—

—

(200,269)

—

Cash dividends paid

(52,236)

(54,240)

(158,132)

(162,689)

Payments of debt issuance costs

(104)

(330)

(14,938)

(1,098)

Taxes paid related to net shares

settlement of equity awards

(1,535)

(366)

(1,615)

(1,523)

Other

416

393

1,295

1,378

Net cash from financing activities

(211,877)

(221,395)

203,441

(285,616)

Effect of changes in foreign exchange

rates on cash

11,721

(3,274)

9,052

1,008

Change in cash, cash equivalents and

restricted cash

48,398

37,381

402,631

(137,688)

Cash, cash equivalents and restricted cash

at beginning of period

684,156

280,663

329,923

455,732

Cash, cash equivalents and restricted cash

at end of period

732,554

318,044

732,554

318,044

Less restricted cash at end of period

1,073

1,020

1,073

1,020

Cash and cash equivalents per balance

sheet at end of period

$

731,481

$

317,024

$

731,481

$

317,024

TABLE 5

HANESBRANDS INC.

Supplemental Financial

Information

Reconciliation of Select GAAP

Measures to Non-GAAP Measures

(in thousands, except

per-share amounts)

(Unaudited)

Quarters Ended

Nine Months Ended

September 26, 2020

September 28, 2019

September 26, 2020

September 28, 2019

Net sales, as reported under GAAP

$

1,808,266

$

1,866,967

$

4,863,507

$

5,215,918

Net sales from exited programs

—

(118,698)

—

(331,512)

Net sales, rebased

$

1,808,266

$

1,748,269

$

4,863,507

$

4,884,406

Gross profit, as reported under GAAP

$

616,713

$

717,033

$

1,723,457

$

2,012,587

Restructuring and other action-related

charges

47,636

9,424

95,983

39,714

Gross profit on exited programs

—

(36,290)

—

(101,347)

Adjusted gross profit, rebased

$

664,349

$

690,167

$

1,819,440

$

1,950,954

As a % of net sales, rebased

36.7

%

39.5

%

37.4

%

39.9

%

Selling, general and administrative

expenses, as reported under GAAP

$

442,142

$

449,962

$

1,273,220

$

1,366,272

Restructuring and other action-related

charges

(4,933)

(513)

(49,081)

(4,205)

Selling, general and administrative

expenses related to exited programs

—

(9,018)

—

(27,695)

Adjusted selling, general and

administrative expenses, rebased

$

437,209

$

440,431

$

1,224,139

$

1,334,372

As a % of net sales, rebased

24.2

%

25.2

%

25.2

%

27.3

%

Operating profit, as reported under

GAAP

$

174,571

$

267,071

$

450,237

$

646,315

Restructuring and other action-related

charges included in gross profit

47,636

9,424

95,983

39,714

Restructuring and other action-related

charges included in SG&A

4,933

513

49,081

4,205

Gross profit on exited programs

—

(36,290)

—

(101,347)

Selling, general and administrative

expenses related to exited programs

—

9,018

—

27,695

Adjusted operating profit, rebased

$

227,140

$

249,736

$

595,301

$

616,582

As a % of net sales, rebased

12.6

%

14.3

%

12.2

%

12.6

%

Net income, as reported under GAAP

$

103,278

$

185,091

$

256,585

$

415,734

Restructuring and other action-related

charges included in gross profit

47,636

9,424

95,983

39,714

Restructuring and other action-related

charges included in SG&A

4,933

513

49,081

4,205

Gross profit on exited programs

—

(36,290)

—

(101,347)

Selling, general and administrative

expenses related to exited programs

—

9,018

—

27,695

Tax effect on actions

(8,737)

2,446

(25,386)

4,195

Adjusted net income, rebased

$

147,110

$

170,202

$

376,263

$

390,196

Diluted earnings per share, as reported

under GAAP1

$

0.29

$

0.51

$

0.72

$

1.14

Restructuring and other action-related

charges

0.12

0.02

0.34

0.10

Exited programs

—

(0.06)

—

(0.17)

Adjusted diluted earnings per share,

rebased

$

0.42

$

0.47

$

1.06

$

1.07

1

Amounts may not be additive due to

rounding.

Quarter Ended September 28,

2019

As Reported

Less: Exited Programs

Adjusted for Exited

Programs

Less: Restructuring and other

action-related charges

Rebased

Segment net sales:

Innerwear

$

578,453

$

16,168

$

562,285

$

—

$

562,285

Activewear

548,117

102,530

445,587

—

445,587

International

663,525

—

663,525

—

663,525

Other

76,872

—

76,872

—

76,872

Total net sales

$

1,866,967

$

118,698

$

1,748,269

$

—

$

1,748,269

Segment operating profit:

Innerwear

$

121,467

$

3,696

$

117,771

$

—

$

117,771

Activewear

97,314

23,576

73,738

—

73,738

International

107,168

—

107,168

—

107,168

Other

9,643

—

9,643

—

9,643

General corporate expenses/other

(58,584)

—

(58,584)

—

(58,584)

Restructuring and other action-related

charges

(9,937)

—

(9,937)

(9,937)

—

Total operating profit

$

267,071

$

27,272

$

239,799

$

(9,937)

$

249,736

Nine Months Ended September

28, 2019

As Reported

Less: Exited Programs

Adjusted for Exited

Programs

Less: Restructuring and other

action-related

charges

Rebased

Segment net sales:

Innerwear

$

1,733,002

$

46,826

$

1,686,176

$

—

$

1,686,176

Activewear

1,401,734

284,686

1,117,048

—

1,117,048

International

1,878,568

—

1,878,568

—

1,878,568

Other

202,614

—

202,614

—

202,614

Total net sales

$

5,215,918

$

331,512

$

4,884,406

$

—

$

4,884,406

Segment operating profit:

Innerwear

$

375,623

$

7,729

$

367,894

$

—

$

367,894

Activewear

209,686

65,923

143,763

—

143,763

International

288,019

—

288,019

—

288,019

Other

16,429

—

16,429

—

16,429

General corporate expenses/other

(199,523)

—

(199,523)

—

(199,523)

Restructuring and other action-related

charges

(43,919)

—

(43,919)

(43,919)

—

Total operating profit

$

646,315

$

73,652

$

572,663

$

(43,919)

$

616,582

Quarters Ended

Nine Months Ended

September 26,

2020

September 28,

2019

September 26,

2020

September 28,

2019

Restructuring and other action-related

charges by category:

Supply chain actions - 2019

$

934

$

9,424

$

6,632

$

39,714

Supply chain actions - 2020

1,201

—

14,705

—

Program exit costs

356

—

9,856

—

Other restructuring costs

1,185

513

12,799

4,205

COVID-19 related charges:

Supply chain re-startup1

48,893

—

48,893

—

Bad debt

—

—

11,375

—

Inventory

—

—

20,485

—

Intangible assets

—

—

20,319

—

Tax effect on actions

(8,737)

(1,402)

(25,386)

(6,193)

Total restructuring and other

action-related charges

$

43,832

$

8,535

$

119,678

$

37,726

1

Supply chain re-startup charges primarily

relate to incremental costs incurred (freight, sourcing premiums,

etc.) to expedite product to meet customer demand following the

extended shut-down of parts of our manufacturing network.

Last Twelve Months

September 26,

2020

September 28,

2019

EBITDA1:

Net income

$

441,571

$

565,762

Interest expense, net

163,283

185,359

Income tax expense

64,291

108,772

Depreciation and amortization

127,395

130,324

Total EBITDA

796,540

990,217

Total restructuring and other

action-related charges (excluding tax effect on actions)

164,631

58,603

Stock compensation expense

14,284

25,589

Total EBITDA, as adjusted

$

975,455

$

1,074,409

Net debt:

Debt (current and long-term debt and

Accounts Receivable Securitization Facility)

$

3,972,212

$

3,828,104

Notes payable

5,257

4,275

(Less) Cash and cash equivalents

(731,481)

(317,024)

Net debt

$

3,245,988

$

3,515,355

Net debt/EBITDA, as adjusted

3.3

3.3

1

Earnings before interest, taxes,

depreciation and amortization (EBITDA) is a non-GAAP financial

measure.

Quarters Ended

Nine Months Ended

September 26,

2020

September 28,

2019

September 26,

2020

September 28,

2019

Free cash flow:

Net cash from operating activities

$

249,015

$

302,063

$

231,222

$

244,700

Capital expenditures

(2,521)

(21,665)

(49,033)

(79,950)

Free cash flow

$

246,494

$

280,398

$

182,189

$

164,750

TABLE 6

HANESBRANDS INC.

Supplemental Financial

Information

Reconciliation of GAAP Outlook

to Adjusted Outlook

(in thousands, except

per-share amounts)

(Unaudited)

Quarter Ended

January 2, 2021

Operating profit outlook, as calculated

under GAAP

$154,000 to $174,000

Restructuring and other action-related

charges

$6,000

Operating profit outlook, as adjusted

$160,000 to $180,000

Diluted earnings per share, as calculated

under GAAP1

$0.24 to $0.29

Restructuring and other action-related

charges

$0.01

Diluted earnings per share, as

adjusted

$0.25 to $0.30

1

The company expects approximately 352

million diluted weighted average shares outstanding for the quarter

ended January 2, 2021.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201105005149/en/

News Media contact: Kirk Saville (336) 519-6192

Analysts and Investors contact: T.C. Robillard (336)

519-2115

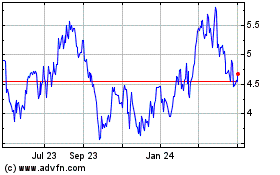

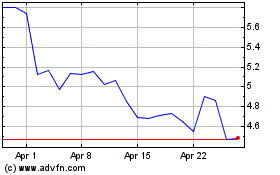

Hanesbrands (NYSE:HBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hanesbrands (NYSE:HBI)

Historical Stock Chart

From Apr 2023 to Apr 2024