GUESS INC0000912463false8/15/2024Delaware00009124632024-08-152024-08-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 15, 2024

GUESS?, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-11893 | 95-3679695 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

Strada Regina 44, Bioggio, Switzerland CH-6934

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: +41 91 809 5000

Not applicable

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| | | | | |

| Common Stock, par value $0.01 per share | | GES | | New York Stock Exchange |

| | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | | | | |

| Emerging growth company | ☐ | |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Item 5.02. Departure of Directors or Certain Principal Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Chief Financial Officer

On August 15, 2024, Markus Neubrand, the Chief Financial Officer of Guess?, Inc. (the “Company”), notified the Company that he is resigning as an officer of the Company effective August 26, 2024 and as an employee of the Company effective September 30, 2024.

Appointment of Interim Chief Financial Officer

In connection with Mr. Neubrand’s resignation, on August 17, 2024, the Company’s Board of Directors (the “Board”) appointed Dennis Secor as interim Chief Financial Officer of the Company, with such appointment to be effective on August 26, 2024. Mr. Secor, age 61, previously served as the Senior Vice President and Chief Financial Officer of the Company from July 2006 to December 2012, as interim Chief Accounting Officer of the Company from March 2022 to April 2023, and as interim Chief Financial Officer of the Company from March 2022 to July 2023. Since July 2023, Mr. Secor has served the Company as Executive Vice President, Finance.

Since 2021, Mr. Secor has also operated his own management consulting practice in New Zealand, providing financial and operational management services to small and medium sized businesses. Before that, he served as the Chief Financial Officer of Torrid Holdings Inc. (NYSE:CURV), a plus-size clothing retailer, from May 2018 to July 2019, as Chief Financial Officer of Incipio Group, a privately-held consumer technology accessories designer and manufacturer, from November 2017 to January 2018, and as Executive Vice President, Chief Financial Officer and Treasurer of Fossil Group, Inc. (Nasdaq:FOSL), a global accessories retailer and wholesaler, from December 2012 to November 2017. Before his initial service with the Company, Mr. Secor served as Vice President and Chief Financial Officer of Electronic Arts Canada, a subsidiary of Electronic Arts Inc. (Nasdaq:EA), a video game publisher, from August 2004 to July 2006. Mr, Secor holds a B.S. in Business Administration, Accounting from the University of San Diego. Mr. Secor will serve as the Company’s principal financial officer for Securities and Exchange Commission reporting purposes.

In connection with his appointment, on August 18, 2024 the Company entered into a new employment agreement with Mr. Secor (the “Employment Agreement”) which replaces, effective August 26, 2024, Mr. Secor’s current employment agreement with the Company. The Employment Agreement provides that Mr. Secor will serve the Company as an executive for an employment term that is scheduled to end August 25, 2025, subject to earlier termination as provided in the Employment Agreement, and that Mr. Secor will serve as the Company’s Chief Financial Officer for such portion of the employment term from August 26, 2024 through March 31, 2025 as is determined by the Board. The Employment Agreement provides for the following:

•Mr. Secor’s annual rate of base salary during the portion of the employment term through March 31, 2025 will be $750,000 and his annual rate of base salary during any portion of the employment term after that date will be $240,000.

•Mr. Secor will be entitled to a retention bonus of $350,000 subject to his employment through August 25, 2025, and he will be paid a pro-rated “target” bonus of $75,000 for the approximately five months of fiscal year 2025 he will have worked through the effective date of his appointment as Chief Financial Officer.

•Following the effective date of his appointment as Chief Financial Officer, the Company will grant Mr. Secor a restricted stock unit award that is scheduled to vest, subject to Mr. Secor’s continued employment, on August 25, 2025. The number of shares of the Company’s common stock subject to the restricted stock unit award will equal the difference obtained by subtracting (a) 6,462 shares, from (b) the number of shares determined by dividing $500,000 by the closing price for a share of the Company’s common stock on the date of grant of the award (or, if the grant date is not a trading day, as of the most recent trading day preceding the grant date), and rounding any fractional share up to the next whole share.

•Mr. Secor will also be entitled to certain employee benefits.

The Employment Agreement generally provides that if Mr. Secor’s employment with the Company ends before August 25, 2025 due to his death or disability, he will be entitled to a pro-rata portion of his retention bonus and pro-rata vesting of his restricted stock unit awards. The Employment Agreement generally provides that if Mr. Secor’s employment with the Company is terminated by the Company without “Cause” (as defined in the Employment Agreement), or by Mr. Secor for “Good

Reason” (as defined in the Employment Agreement), before August 25, 2025, Mr. Secor will be entitled to his full retention bonus, continued payment of base salary (as severance) through August 25, 2025 as though his employment had not terminated, and full vesting of his restricted stock unit awards, all subject to his execution of a release of claims in favor of the Company.

The Employment Agreement is attached hereto as Exhibit 10.1 and is incorporated herein by reference. The foregoing description of the Employment Agreement is qualified in its entirety by reference to such exhibit.

There are no arrangements or understandings between Mr. Secor and any other person pursuant to which Mr. Secor was appointed as interim Chief Financial Officer of the Company, there are no family relationships between Mr. Secor and any director or other executive officer of the Company, and Mr. Secor has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 7.01. Regulation FD Disclosure.

On August 19, 2024, the Company issued a press release announcing Mr. Neubrand’s resignation and Mr. Secor’s appointment as discussed in Item 5.02 herein. A copy of the press release is attached as Exhibit 99.1 hereto and is hereby incorporated by reference in its entirety.

The information in this Item 7.01 of Form 8-K and Exhibit 99.1 attached hereto is being furnished hereby and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | Description |

| | |

| | |

| | |

| | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Guess?, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | GUESS?, INC. |

| | |

Dated: | August 19, 2024 | By: | /s/ Carlos Alberini |

| | | Carlos Alberini Chief Executive Officer

|

EXECUTIVE EMPLOYMENT AGREEMENT

This EXECUTIVE EMPLOYMENT AGREEMENT (the “Agreement”) is entered into this 18th day of August, 2024 between Guess?, Inc., a Delaware corporation (the “Company”), and Dennis Secor (the “Executive”).

W I T N E S E T H:

WHEREAS, the Executive is currently a party to an Executive Employment Agreement with the Company dated March 29, 2024 (the “March 2024 Agreement”), which superseded an Executive Employment Agreement between the Executive and the Company dated March 14, 2022 as amended by the parties by a letter agreement dated March 31, 2023 (such prior agreement as so amended, together with the March 2024 Agreement, collectively, the “Prior Employment Agreement”).

WHEREAS, the Company desires to continue to employ the Executive, and the Executive desires to accept such continued employment, on the terms and conditions set forth in this Agreement.

WHEREAS, this Agreement shall govern the employment relationship between the Executive and the Company from and after August 26, 2024 (the “Effective Date”), and, as of that date, supersedes and negates all previous agreements and understandings with respect to such relationship (including, without limitation, the Prior Employment Agreement).

NOW THEREFORE, in consideration of the foregoing and of the mutual promises contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.POSITION/DUTIES.

(a)During the Employment Term (as defined in Section 2 below), the Executive shall serve the Company as an executive officer, reporting to the Company’s Chief Executive Officer (the “CEO”). The Executive shall have such titles, duties, authorities and responsibilities as determined by the Company’s Board of Directors (the “Board”) or the CEO from time to time during the Employment Term. Without limiting the generality of the preceding sentence, the Executive’s position during the portion of the Employment Term through and ending on March 31, 2025 (or the entire Employment Term, if the Employment Term ends before March 31, 2025; the “First Seven Months”), or such shorter period as the Board may determine, may include serving as the Company’s Chief Financial Officer, as determined by the Board (the portion of the Employment Term during which the Executive serves as the Company’s Chief Financial Officer is referred to as the “CFO Period”). For any portion of the Employment Term other than the CFO Period, the Executive shall be an Executive Vice President, Finance of the Company.

(b)During the First Seven Months, the Executive agrees that the Executive will devote substantially all of his business time and attention to the business of the Company. During the Employment Term, the Executive agrees that the Executive will use his best efforts to perform his duties and responsibilities for the Company in a faithful and efficient manner, and

that the Executive will not engage in any other employment, consulting, business or charitable activity that would create a conflict of interest with the Company or any of its affiliates or otherwise impair the Executive’s ability to effectively perform his duties with the Company. The Executive agrees that he has no contractual commitments or other legal obligations that would prohibit him from continuing in employment with the Company, or that would in any way limit his ability to perform his duties for the Company, except for an existing consulting agreement with a New Zealand-based technology company for which he has (through his solely-owned consulting company) committed about 8 hours of consulting services per week. The Executive may serve on the board of directors or advisory boards of other for-profit companies; provided in each case that such service is approved in advance by the Board and such service does not create a potential business conflict or the appearance thereof. The Executive has agreed to serve on the same New Zealand-based technology company’s future board of advisors when that company chooses to form such a board. Nothing in this Agreement shall prevent the Executive from engaging in civic and charitable activities and managing his family’s personal investments so long as such activities do not materially interfere with the performance of the Executive’s duties hereunder or create a potential business conflict or the appearance thereof. The Board may require the Executive to resign from any board of directors (except for the New Zealand-based technology company referenced above) (or similar governing body) on which he may then serve if the Board determines that such service has created a business conflict or the appearance thereof or that such service has impaired the Executive’s ability to effectively perform his duties with the Company. The Company may require the Executive to travel from time to time during the Period of Employment.

(c)The Executive agrees that he will be present in the Company’s offices in Los Angeles, California or in Lugano, Switzerland, as directed by the Company, (i) at least one week per month, (ii) during each week in which the Company releases its quarterly earnings, and (iii) during each week immediately preceding a week in which the Company releases its quarterly earnings. During any such trip during the portion of the Employment Term outside of the First Seven Months, the Executive agrees that he will devote his full-time attention to his duties for the Company. The parties may mutually agree to modify the duration of such trips, including during earnings weeks, to make the most efficient use of the Executive’s travel time. The parties hereto acknowledge that the Executive’s compliance with the travel requirements set forth in this Section 1(c) shall be subject to the Executive’s good faith ability to reasonably do so in compliance with any applicable travel restrictions (due to residency and citizenship requirements or otherwise) and/or personal emergencies.

(d)The Company is aware that the Executive is currently domiciled in and is a resident of New Zealand. Except as provided in Section 1(c) above or as otherwise reasonably requested by the Company, the Company agrees that the Executive will have no fixed place of work and can work remotely. The Executive agrees that the remote working arrangement will not affect his ability to undertake his duties under this Agreement, including but not limited to his accountability to the Board and CEO, and the management of his team. The Executive also agrees that he will remain a U.S. employee at all times notwithstanding his remote working arrangements. The Executive’s time in Los Angeles, California and/or Lugano, Switzerland (or any other location to which Executive is requested to travel) will (when such travel is requested by the Company) be considered business trips and appropriate travel expenses (hotel, airfare, meals, etc.) will be reimbursed by the Company in accordance with prevailing policies for

executive officers. The Executive will travel to and from New Zealand on the most direct routes in business class.

(e)During the First Seven Months, the Executive’s hours of work will normally be at least 40 hours per week. During any portion of the Employment Term outside of the First Seven Months and except as provided in Section 1(c), it is expected that the Executive’s work for the Company each week will generally not require a significant amount of time. The Executive agrees to work more hours if necessary to perform the requirements of his position effectively, and his Base Salary provided for in Section 3 includes reasonable compensation for making himself available to work additional hours if required and payment for all those hours worked. There will be no reduction to the Executive’s compensation from the levels set forth herein for any week that the Executive does not devote all of the business time contemplated above to the Executive’s Company duties (and, similarly, there will be no increase to the Executive’s compensation for any week where the Executive’s duties for the Company require the Executive to spend more than the time anticipated). The Executive will be classified as “exempt” from overtime.

2.EMPLOYMENT TERM. The Executive’s term of employment under this Agreement (herein referred to as the “Employment Term”) shall be for a term commencing on the Effective Date and ending on August 25, 2025 (the “Expiry Date”). Notwithstanding the foregoing, in all cases the Employment Term is subject to earlier termination as provided in Section 7 hereof. Subject to earlier termination of the Employment Term as provided in Section 7 hereof, the Executive’s employment with the Company shall end on the Expiry Date unless the Executive and the Company mutually agree in writing, by formal amendment to this Agreement.

3.BASE SALARY. During the Employment Term, the Company agrees to pay the Executive a base salary (the “Base Salary”), payable in accordance with the regular payroll practices of the Company, but not less frequently than monthly. During the First Seven Months, the Executive’s Base Salary shall be paid at a rate of $750,000 annually. During any portion of the Employment Term outside of the First Seven Months, the Executive’s Base Salary shall be paid at a rate of $240,000 annually. Base Salary and any other payments made to the Executive under this Agreement are inclusive of any compulsory employer contributions to any superannuation or retirement savings scheme that may apply.

4.BONUS.

(a)The Executive will be entitled to receive a bonus in the amount of $350,000 (the “Retention Bonus”) in the event the Executive remains employed with the Company through the Expiry Date (if earned, to be paid on or promptly after that date). Except as expressly provided in Sections 8(a) and 8(c), in no event shall the Executive be considered to have earned the Retention Bonus (or any portion thereof) if the Executive’s employment with the Company ends before the Expiry Date.

(b)The Company shall pay the Executive $75,000 (which, for clarity, represents a pro-rated “target” bonus for the approximate five months of fiscal year 2025 the Executive worked prior to the Effective Date), such amount to be paid when the Company pays

its executive bonuses for fiscal year 2025 generally (and in all events within two and one-half months after the end of such fiscal year) (the “Fiscal 2025 Bonus”).

(c)Except as provided above in this Section 4 and in Section 5, the Executive shall not be entitled to any bonus, award or other incentive with respect to the Company’s fiscal year 2025 or with respect to any portion of any other fiscal year that occurs during the Employment Term.

5.RESTRICTED STOCK UNIT AWARD. Following the Effective Date, the Company shall (subject to the Executive’s continued employment by the Company through such date of grant) grant the Executive a restricted stock unit award (the “Restricted Stock Unit Award”) under the Company’s 2004 Equity Incentive Plan (or any successor thereto and as the applicable plan may be amended from time to time (the “Equity Plan”)). The number of shares of the Company’s common stock granted subject to the Restricted Stock Unit Award shall equal the difference (not less than zero) obtained by subtracting (a) 6,462 shares, from (b) the number of shares determined by dividing $500,000 by the closing price (in regular trading on the New York Stock Exchange) for a share of the Company’s common stock on the date of grant of such award (or, if such date is not a trading day on the New York Stock Exchange, as of the most recent New York Stock Exchange trading day preceding such date), and rounding any fractional share up to the next whole share. The Restricted Stock Unit Award will be scheduled to vest as to 100% of the stock units subject to such award on the Expiry Date, subject (except as otherwise expressly provided in Sections 8(a) and 8(c)) to the Executive’s continued employment by the Company through such date. The Restricted Stock Unit Award will be evidenced by a restricted stock unit award agreement using the Company’s standard form for employee restricted stock unit award grants under the Equity Plan, and will be subject to the terms and conditions of such restricted stock unit award agreement and the Equity Plan. For clarity and except as set forth in Section 8, this Agreement does not change any of the terms and conditions of any prior restricted stock unit award granted to the Executive by the Company.

6.EMPLOYEE BENEFITS.

(a) VACATION. Except as provided below in this Section 6(a) as to the First Seven Months, the Executive is not entitled to, and will not (and has not since August 31, 2023), accrue vacation time. The Executive acknowledges receiving payment in full for all of the Executive’s vacation time that he accrued with the Company with respect to his employment with the Company through August 31, 2023. During the First Seven Months, the Executive shall accrue paid vacation in accordance with the Company’s policy applicable to senior executives at an accurate rate equal to twenty (20) vacation days per calendar year (as prorated for partial years), which vacation may be taken at such times as the Executive elects with due regard to the needs of the Company. The Executive shall not be permitted to accrue more than a total of twenty five (25) vacation days at any time. Once the Executive reaches the maximum accrual, the Executive shall not accrue any additional vacation days until a portion of the Executive’s accrued vacation time is used. Promptly following the end of the First Seven Months, the Company shall pay the Executive for Executive’s accrued and unused vacation time that exists as of the end of the First Seven Months (for clarity, with such payment calculated in accordance with the Company’s usual practices based on the Executive’s rate of Base Salary in effect for the

First Seven Months rather than the rate of the Executive’s Base Salary in effect at the time the payment is actually made).

(b) ALLOWANCE. Promptly following the Effective Time, the Company will pay the Executive a one-time fixed allowance of $2,500.

(c) BENEFITS. During the Employment Term, the Executive will continue to be eligible to participate in medical, dental, life, and disability benefits and perquisites on terms not less favorable to the Executive than the terms of the applicable arrangement as applied to officers of the Company generally. Participation in any benefit plan remains subject to satisfying the applicable eligibility requirements. The Company reserves the right to amend or modify the terms and conditions of its benefits plans, and to terminate any benefit plan, from time to time.

7.TERMINATION. This Agreement is for a fixed period from the Effective Date to the Expiry Date to provide support for the Company’s finance function; subject to earlier termination as provided in this Section 7. This Agreement does not constitute a contract of employment for any specific period of time, but creates an employment at-will relationship that may be terminated at any time by Executive or the Company, with or without cause and with or without advance notice and without the need to be paid the balance of the Employment Term. For clarity, Section 8 below provides for termination benefits that Executive shall be entitled to receive upon certain termination events. The Executive’s employment and the Employment Term shall terminate on the Expiry Date or, if earlier, the first of the following set forth below in this Section 7 to occur (the date that the Executive’s employment by the Company terminates is referred to as the “Severance Date”). The Executive’s Employment Term will be ending on the Expiry Date because this is the date it is intended that the Executive’s support for the Company’s finance function will no longer be needed. The Executive acknowledges that he will receive, in terms of the remuneration package contained in this Agreement, consideration for entering into a fixed term agreement:

(a)DISABILITY. Upon written notice by the Company to the Executive of termination due to Disability, while the Executive remains Disabled. For purposes of this Agreement, “Disabled” and “Disability” shall (i) have the meaning defined under the Company’s then-current long-term disability insurance plan, policy, program or contract as entitles the Executive to payment of disability benefits thereunder, or (ii) if there shall be no such plan, policy, program or contract, mean permanent and total disability as defined in Section 22(e)(3) of the United States Internal Revenue Code (the “Code”).

(b)DEATH. Automatically on the date of death of the Executive.

(c)CAUSE. Immediately upon written notice by the Company to the Executive of a termination for Cause. “Cause” shall mean (i) the Executive’s conviction or plea of guilty or nolo contendere to a felony or any crime involving moral turpitude; (ii) a willful act of theft, embezzlement or misappropriation from the Company; (iii) sexual misconduct; or (iv) a determination by the Board that the Executive has willfully and continuously failed to perform substantially the Executive’s duties (other than any such failure resulting from the Executive’s Disability or incapacity due to bodily injury or physical or mental illness), has willfully failed to

follow a reasonable and lawful directive of the Board, or otherwise has materially breached this Agreement or any Company policy applicable to the Executive, after (A) a written demand for substantial performance is delivered to the Executive by the Board which specifically identifies the manner in which the Board believes that the Executive has not substantially performed the Executive’s duties, failed to follow a directive of the Board, or has materially breached this Agreement or any material Company policy applicable to the Executive and provides the Executive with the opportunity to correct such failure or breach if, and only if, such failure or breach is capable of cure, and (B) the Executive’s failure to correct such failure or breach which is capable of cure within thirty (30) days of receipt of the demand for performance or correction. For the avoidance of doubt, the parties expressly agree that only Cause pursuant to Section 7(c)(iv) shall be deemed capable of cure. For purposes of Section 7(c)(iv), any act, or failure to act, by the Executive in accordance with a specific directive given by the Board or based upon the advice of counsel for the Company shall not be considered to have been a willful failure by the Executive. In the event that the Board has so determined in good faith that Cause exists, the Board shall have no obligation to terminate the Executive’s employment if the Board determines in its sole discretion that such a decision not to terminate the Executive’s employment is in the best interest of the Company.

(d)WITHOUT CAUSE. Upon written notice by the Company to the Executive of an involuntary termination without Cause and other than due to death or Disability.

(e)GOOD REASON. Upon written notice by the Executive to the Company of termination for Good Reason unless the reasons for any proposed termination for Good Reason are remedied in all material respects by the Company within thirty (30) days following written notification by the Executive to the Company. “Good Reason” means the occurrence of any one or more of the following events unless the Executive specifically agrees in writing that such event shall not be Good Reason:

(i) Any material breach of this Agreement by the Company,

including, but not limited to:

(A) the failure of the Company to pay the compensation and benefits set forth in Sections 3, 4 and 5 of this Agreement;

(B) any reduction in the rate of the Executive’s Base Salary from the applicable rate provided for in Section 3; or

(ii) the failure of the Company to assign this Agreement to a successor to all or substantially all of the business or assets of the Company or failure of such a successor to the Company to explicitly assume and agree to be bound by this Agreement.

In addition, in order to constitute a termination for Good Reason, the Executive’s notification to the Company of the circumstance(s) giving rise to Good Reason must be given within 90 days following the initial existence of such circumstance(s).

(f)VOLUNTARY TERMINATION WITHOUT GOOD REASON. Upon written notice by the Executive to the Company of the Executive’s termination of

employment without Good Reason; provided that the Executive agrees to, to the extent practicable, provide the Company with at least sixty (60) days’ written notice of any such resignation (which the Company may, in its sole discretion, make effective earlier than any notice date and the Company may place the Executive on paid leave during any such notice period).

8.CONSEQUENCES OF TERMINATION. The Executive agrees to resign and hereby irrevocably does resign, effective on the Severance Date, from each and every position (whether as an officer, director, member, manager or otherwise) that the Executive may then have with the Company and any subsidiary of the Company, and as a fiduciary of any benefit plan of the Company or any subsidiary of the Company, and to promptly execute and provide to the Company any further documentation, as requested by the Company, to confirm such resignations, and to remove himself as a signatory on any accounts maintained by the Company or any of its subsidiaries (or any of their respective benefit plans). The Executive agrees to promptly execute and return to the Company any documents that the Company may reasonably request in order to confirm such resignations. Any termination payments made and benefits provided under this Agreement to the Executive shall be in lieu of any termination or severance payments or benefits for which the Executive may be eligible under any of the plans, policies or programs of the Company or its affiliates (for clarity, except as to Accrued Amounts as defined below). The Executive shall not be eligible for severance under any severance plan, program, policy or arrangement of the Company. Except to the extent otherwise provided in this Agreement, all benefits and awards under the Company’s compensation and benefit programs shall be subject to the terms and conditions of the plan or arrangement under which such benefits accrue, are granted or are awarded. The following amounts and benefits shall be due to the Executive:

(a)DISABILITY OR DEATH. Upon termination of the Executive’s employment with the Company pursuant to Section 7(a), or Section 7(b), before the Expiry Date:

(i) The Company shall pay or provide the Executive with the Accrued Amounts (defined in Section 8(e) below).

(ii) The Company shall pay the Executive a pro-rated portion of the Retention Bonus, which shall be paid within seventy-four (74) days after the Severance Date (determined by multiplying the Retention Bonus amount the Executive would have received had the Executive’s employment with the Company continued through the Expiry Date by a fraction, the numerator of which is the number of days during the Employment Term that the Executive is employed by the Company and the denominator of which is 365 (such fraction, the “Pro-Rata Fraction”)).

(iii) The Restricted Stock Unit Award provided for in Section 5, to the extent it is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary, will vest as of the Severance Date as to a pro-rata portion of the total number of stock units subject to the award. The pro-ration shall be determined by multiplying the total number of stock units subject to the award by the Pro-Rata Fraction.

(iv) In addition, the Restricted Stock Unit Award granted pursuant to the March 2024 Agreement, to the extent it is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary, will vest as of the Severance Date as to a pro-rata portion of the total number of stock units subject to the award. The pro-ration shall be determined by multiplying the total number of stock units subject to the award by a fraction (not greater than one), the numerator of which is the total number of days the Executive was employed by the Company from and including April 1, 2024 through and including the Severance Date and the denominator of which is the total number of days from and including April 1, 2024 through and including March 31, 2025.

(b)TERMINATION FOR CAUSE OR ON THE EXPIRY DATE. If the Executive’s employment should be terminated (i) by the Company for Cause before the Expiry Date, (ii) by the Executive without Good Reason before the Expiry Date, or (iii) for any reason on the Expiry Date, the Company shall pay to the Executive any Accrued Amounts.

(c)TERMINATION WITHOUT CAUSE OR FOR GOOD REASON. If the Executive’s employment by the Company is terminated by the Company other than for Cause (and other than a termination due to Disability or death) before the Expiry Date, or by the Executive for Good Reason before the Expiry Date, then subject to Section 8(d), the Company shall pay or provide the Executive with the following:

(i) The Accrued Amounts.

(ii) The Executive will be entitled to receive the full amount of the Retention Bonus to be paid on, or within ten (10) business days following, the date that is sixty (60) days after the Executive’s Severance Date.

(iii) Continued payment of Base Salary (as severance pay) through the Expiry Date, with such payments to be made based on the rate of Base Salary that would be payable for the corresponding period of time pursuant to Section 3 had the Executive continued to be employed by the Company through the Expiry Date (for illustration, if the Severance Date occurred at the end of the First Seven Months, the payments pursuant to this clause (iii) would total $100,000 in the aggregate, which represents five months of Base Salary at an annualized rate of $240,000).

(iv) Notwithstanding anything contained in the Restricted Stock Unit Award or the Equity Plan to the contrary, to the extent that the Restricted Stock Unit Award granted pursuant to Section 5 is then outstanding and otherwise unvested, the Restricted Stock Unit Award shall be fully vested upon the Severance Date.

(v) In addition, the Restricted Stock Unit Award granted pursuant to the March 2024 Agreement, to the extent it is outstanding and otherwise unvested on the Severance Date, and notwithstanding anything contained in the applicable award agreement or the Equity Plan (or any successor equity compensation plan) to the contrary, shall be fully vested upon the Severance Date.

(d)RELEASE OF CLAIMS. Notwithstanding anything to the contrary contained herein, the Company shall have no obligation to provide any of the payments and/or benefits provided for in Section 8(c) (other than Accrued Amounts) unless and until (x) the Executive executes an effective general release of all claims in in the form provided by and reasonably acceptable to the Company (the “Release”) on or after the Severance Date, (y) the Executive delivers such executed Release to the Company not more than twenty-one (21) days following the Severance Date, and (z) such Release become irrevocable by the Executive. The Company may withhold any payment otherwise provided for in Section 8(c)(iii) until such conditions are satisfied, and the first payment after such conditions are satisfied shall include the payments that would have otherwise been made pursuant to such section but for this delay. Further, in the event that the period of time that the Executive has to consider, execute, and revoke the Release spans two calendar years, in no event will any payments that are conditioned upon such Release be made before the start of the second such calendar year.

(e)DEFINITION OF ACCRUED AMOUNTS. As used in this Agreement, “Accrued Amounts” shall mean (in each case, without duplication to the extent that such amount would otherwise be required to be paid in the circumstances):

(i) any unpaid Base Salary through the date of the Executive’s termination (together with any payment for any of the Executive’s accrued and unused vacation time pursuant to Section 6(a), to the extent not previously paid), which shall be paid not later than the next regularly scheduled payroll date following the date of termination;

(ii) the Fiscal 2025 Bonus (to the extent not previously paid), to be paid at the time provided for in Section 4(b); and

(iii) all other vested payments, benefits or perquisites to which the Executive may be entitled under the terms of any applicable compensation arrangement or benefit, equity or perquisite plan or program or grant or this Agreement, which in each case shall be paid in accordance with the terms and conditions of the applicable arrangement, plan, program, grant or agreement; provided, however, that the Executive shall not be entitled to benefits under any severance plan, policy, program or arrangement of the Company.

9.SECTION 4999 EXCISE TAX. If any payments, rights or benefits (whether pursuant to the terms of this Agreement or any other plan, arrangement or agreement of the Executive with the Company or any person affiliated with the Company) (the “Payments”) received or to be received by the Executive will be subject to the tax (the “Excise Tax”) imposed by Section 4999 of the Code (or any similar tax that may hereafter be imposed), then the Payments shall be reduced to the extent necessary so that no portion thereof shall be subject to the Excise Tax, but only if, by reason of such reduction, the net after-tax benefit received by the Executive shall exceed the net after-tax benefit that would be received by the Executive if no such reduction was made. The process for calculating the Excise Tax, and other procedures relating to this Section, are set forth in Exhibit A attached hereto. For purposes of making the determinations and calculations required herein, the Accounting Firm (as defined in Exhibit A) may rely on reasonable, good faith interpretations concerning the application of Section 280G

and 4999 of the Code, provided that the Accounting Firm shall make such determinations and calculations on the basis of “substantial authority” (within the meaning of Section 6662 of the Code) and shall provide opinions to that effect to both the Company and the Executive.

10.CONFIDENTIALITY. The Executive previously entered into a Confidentiality Agreement with the Company (the “Confidentiality Agreement”). The Confidentiality Agreement continues in effect. The Executive agrees that he will not bring onto the Company premises or otherwise provide to the Company any unpublished documents or property belonging to any former employer or other person with respect to whom the Executive has an obligation of confidentiality. During the Employment Term, the Executive agrees to disclose to the Company in writing any outside relationships with entities with whom the Executive is working or will work (whether or not for compensation), as well as any potential conflicts of interest, sources of income or other business activities.

11.COOPERATION. During the Employment Term and for twelve (12) months thereafter, whether or not then employed by the Company, the Executive agrees to reasonably cooperate with and make himself available to the Company and its representatives and legal advisors in connection with any material matters in which the Executive is or was involved or any existing or future claims, investigations, administrative proceedings, lawsuits and other legal and business matters, as reasonably requested by the Company. The Company will reimburse Executive’s reasonable travel, lodging and incidental out-of-pocket expenses incurred in connection with any such cooperation, provided that the Executive agrees to obtain advance approval from the Company as to any material travel or expense. The Executive also agrees that within five (5) business days of receipt (or more promptly if reasonably required by the circumstances) the Executive shall send the Company copies of all correspondence (for example, but not limited to, subpoenas) received by the Executive in connection with any legal proceedings involving or relating to the Company, unless the Executive is expressly prohibited by law from so doing. Subject to the next sentence, the Executive agrees that he will not voluntarily cooperate with any third party in any actual or threatened claim, charge, or cause of action of any nature whatsoever against the Company and/or any of the Company’s subsidiaries and/or affiliates. The Executive understands that nothing in this Agreement prevents the Executive from cooperating with any government investigation or otherwise complying with applicable law.

12.NO ASSIGNMENT.

(a)This Agreement is personal to each of the parties hereto. Except as provided in Section 12(b) below, no party may assign or delegate any rights or obligations hereunder without first obtaining the written consent of the other party hereto.

(b)The Company may assign this Agreement to any successor to all or substantially all of the business and/or assets of the Company provided the Company shall require such successor to expressly assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place and shall deliver a copy of such assignment to the Executive.

13.NOTICE. For the purpose of this Agreement, notices and all other communications provided for in this Agreement shall be in writing and shall be deemed to have been duly given (a) on the date of delivery if delivered by hand, (b) on the date of transmission, if delivered by confirmed facsimile, (c) on the first business day following the date of deposit if delivered by guaranteed overnight delivery service, or (d) on the fourth business day following the date delivered or mailed by United States registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

If to the Executive:

At the address (or to the facsimile number) shown on the records of the Company

If to the Company:

Guess?, Inc.

1444 South Alameda Street

Los Angeles, California 90021

Attention: General Counsel

Facsimile No.: (213) 765-0911

or to such other address as either party may have furnished to the other in writing in accordance herewith, except that notices of change of address shall be effective only upon receipt.

14.SECTION HEADINGS. The section headings used in this Agreement are included solely for convenience and shall not affect, or be used in connection with, the interpretation of this Agreement.

15.SEVERABILITY. The provisions of this Agreement shall be deemed severable and the invalidity of unenforceability of any provision shall not affect the validity or enforceability of the other provisions hereof.

16.COUNTERPARTS. This Agreement may be executed in several counterparts, each of which shall be deemed to be an original but all of which together will constitute one and the same instruments. One or more counterparts of this Agreement may be delivered by facsimile, with the intention that delivery by such means shall have the same effect as delivery of an original counterpart thereof.

17.DISPUTE RESOLUTION. Except as provided in the Confidentiality Agreement and in the following paragraph, any non-time barred, legally actionable controversy or claim arising out of or relating to this Agreement, its enforcement, arbitrability or interpretation, or because of an alleged breach, default, or misrepresentation in connection with any of its provisions, or any other non-time barred, legally actionable controversy or claim arising out of or relating to the Executive’s employment or association with the Company or termination of the same, including, without limiting the generality of the foregoing, any alleged violation of state or federal statute, common law or constitution, shall be submitted to individual, final and binding arbitration, to be held in Los Angeles County, California, before a single arbitrator selected from Judicial Arbitration and Mediation Services, Inc. (“JAMS”), in accordance with the then-current JAMS Arbitration Rules and Procedures for employment

disputes, as modified by the terms and conditions in this Section (which may be found at www.jamsadr.com under the Rules/Clauses tab). The parties will select the arbitrator by mutual agreement or, if the parties cannot agree, then by obtaining a list of nine qualified arbitrators supplied by JAMS from their labor and employment law panel, with each party confidentially submitting a “rank and strike” list that ranks in order of priority six arbitrators and strikes three arbitrators, and the most favored arbitrator based on the cumulative rankings who was not struck by either party shall be appointed arbitrator. Final resolution of any dispute through arbitration may include any remedy or relief that is provided for through any applicable state or federal statutes, or common law. Statutes of limitations shall be the same as would be applicable were the action to be brought in court. The arbitrator selected pursuant to this Agreement may order such discovery as is necessary for a full and fair exploration of the issues and dispute, consistent with the expedited nature of arbitration. At the conclusion of the arbitration, the arbitrator shall issue a written decision that sets forth the essential findings and conclusions upon which the arbitrator’s award or decision is based. Any award or relief granted by the arbitrator under this Agreement shall be final and binding on the parties to this Agreement and may be enforced by any court of competent jurisdiction. The Company will pay those arbitration costs that are unique to arbitration, including the arbitrator’s fee (recognizing that each side bears its own deposition, witness, expert and attorneys’ fees and other expenses to the same extent as if the matter were being heard in court). If, however, any party prevails on a statutory claim, which affords the prevailing party attorneys’ fees and costs, then the arbitrator may award reasonable fees and costs to the prevailing party. The arbitrator may not award attorneys’ fees to a party that would not otherwise be entitled to such an award under the applicable statute. The arbitrator shall resolve any dispute as to the reasonableness of any fee or cost. Except as provided in the Confidentiality Agreement and in the following paragraph, the parties acknowledge and agree that they are hereby waiving any rights to trial by jury or a court in any action or proceeding brought by either of the parties against the other in connection with any matter whatsoever arising out of or in any way connected with this Agreement or the Executive’s employment.

Each of the parties to this Agreement and any person or entity granted rights hereunder whether or not such person or entity is a signatory hereto shall be entitled to enforce its rights under this Agreement specifically to recover damages and costs for any breach of any provision of this Agreement and to exercise all other rights existing in its favor. The parties hereto agree and acknowledge that money damages may not be an adequate remedy for any breach of the provisions of this Agreement and that each party (as well as each other person or entity granted rights hereunder) may in its sole discretion obtain permanent injunctive or equitable relief in any arbitration filed pursuant to the preceding paragraph and enforce any such relief awarded by the arbitrator in any court of competent jurisdiction. In addition, each party may also apply to any court of law or equity of competent jurisdiction for provisional injunctive or equitable relief, including a temporary restraining or preliminary injunction (without any requirement to post any bond or deposit), to ensure that the relief sought in arbitration is not rendered ineffectual by interim harm. Each party shall be responsible for paying its own attorneys’ fees, costs and other expenses pertaining to any such legal proceeding and enforcement regardless of whether an award or finding or any judgment or verdict thereon is entered against either party.

18.MISCELLANEOUS. No provision of this Agreement may be modified, waived or discharged unless such waiver, modification or discharge is agreed to in writing and signed by the Executive and such officer or director as may be designated by the Board. No waiver by

either party hereto at any time of any breach by the other party hereto of, or compliance with, any condition or provision of this Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time. This Agreement together with all exhibits hereto sets forth the entire agreement of the parties hereto in respect of the subject matter contained herein. No agreements or representations, oral or otherwise, express or implied, with respect to the subject matter hereof, have been made by either party which are not expressly set forth in this Agreement. This Agreement replaces the Prior Employment Agreement in its entirety effective on the Effective Date. The validity, interpretation, construction and performance of this Agreement shall be governed exclusively by the laws of the State of California without regard to its conflicts of law principles. Notwithstanding the foregoing, the Company’s rights pursuant to any confidentiality, proprietary information, assignment of inventions or similar agreement shall survive and continue in effect. This Agreement shall be null and void (and the applicable provisions of the Prior Employment Agreement shall apply) if the Executive’s employment with the Company terminates for any reason prior to the Effective Date.

19.SECTION 409A. Notwithstanding anything in this Agreement or elsewhere to the contrary:

(a)If the Executive is a “specified employee” as determined pursuant to Section 409A of the Code as of the date of the Executive’s “separation from service” (within the meaning of Section 409A of the Code) and if any payment or benefit provided for in this Agreement or otherwise both (x) constitutes a “deferral of compensation” within the meaning of Section 409A of the Code and (y) cannot be paid or provided in the manner otherwise provided without subjecting the Executive to additional tax, interest or penalties under Section 409A of the Code, then any such payment or benefit shall be delayed until the earlier of (i) the date which is six (6) months after his “separation from service” for any reason other than death, or (ii) the date of the Executive’s death. The provisions of this paragraph shall only apply if, and to the extent, required to avoid the imputation of any tax, penalty or interest pursuant to Section 409A of the Code. Any payment or benefit otherwise payable or to be provided to the Executive upon or in the six (6) month period following the Executive’s “separation from service” that is not so paid or provided by reason of this Section 19(a) shall be accumulated and paid or provided to the Executive in a single lump sum, not later than the fifth day after the date that is six (6) months after the Executive’s “separation from service” (or, if earlier, the fifteenth day after the date of the Executive’s death) together with interest for the period of delay, compounded annually, equal to the prime rate (as published in The Wall Street Journal), and in effect as of the date the payment or benefit should otherwise have been provided.

(b)It is intended that any amounts payable under this Agreement and the Company’s and the Executive’s exercise of authority or discretion hereunder shall comply with and avoid the imputation of any tax, penalty or interest under Section 409A of the Code. This Agreement shall be construed and interpreted consistent with that intent.

(c)Any reimbursement payment due to the Executive shall be paid to the Executive on or before the last day of the Executive’s taxable year following the taxable year in which the related expense was incurred, and Executive agrees to submit prompt documentation of such reimbursement payments due in accordance with the Company’s reimbursement policy

in order to facilitate the timely reimbursement of the same. Any such benefits and reimbursements are not subject to liquidation or exchange for another benefit and the amount of such amounts eligible for reimbursement or such benefits that the Executive receives in one taxable year shall not affect the amounts eligible for reimbursement or the amount of such benefits that the Executive receives in any other taxable year.

(d)Each item of remuneration referred to in this Agreement shall be treated as a separate payment for purposes of Section 409A of the Code.

20.FULL SETTLEMENT. Except as set forth in this Agreement, the Company’s obligation to make the payments provided for in this Agreement and otherwise to perform its obligations hereunder shall not be affected by any circumstances, including without limitation, set-off, counterclaim, recoupment, defense or other claim, right or action which the Company may have against the Executive or others, except to the extent any amounts are due the Company or its subsidiaries or affiliates pursuant to a judgment against the Executive. In no event shall the Executive be obliged to seek other employment or take any other action by way of mitigation of the amounts payable to the Executive under any of the provisions of this Agreement, nor shall the amount of any payment hereunder be reduced by any compensation earned by the Executive as a result of employment by another employer, except as set forth in this Agreement.

21.REPRESENTATIONS. Except as otherwise disclosed to the Company in writing, the Executive represents and warrants to the Company that the Executive has the legal right to enter into this Agreement and to perform all of the obligations on the Executive’s part to be performed hereunder in accordance with its terms and that the Executive is not a party to any agreement or understanding, written or oral, which could prevent the Executive from entering into this Agreement or performing all of the Executive’s obligations hereunder.

22.WITHHOLDING. The Company may withhold from any and all amounts payable under this Agreement such federal, state and local taxes as may be required to be withheld pursuant to any applicable law or regulation.

23.PRIVACY. The Company may collect and retain personal information relating to the Executive’s employment directly from him or any third party. The Company may, from time to time, share personal information about the Executive (including his duties and salary and other compensation details) with third parties. The Executive expressly consents to the public disclosure of the Executive’s appointment and remuneration in accordance with the Company’s obligations as a publicly listed company. The Company may transfer personal information about the Executive to its parent and/or affiliated entities to increase efficiencies in its human resources systems and/or for other operational purposes.

24.SURVIVAL. The respective obligations of, and benefits afforded to, the Company and the Executive that by their express terms or clear intent survive termination of the Executive’s employment with the Company, including, without limitation, the provisions of Sections 8, 9, 10, 11, 12, 17, 19, 20, 22 and 23 of this Agreement, will survive termination of the Executive’s employment with the Company, and will remain in full force and effect according to their terms.

25.AGREEMENT OF THE PARTIES. The language used in this Agreement will be deemed to be the language chosen by the parties hereto to express their mutual intent, and no rule of strict construction will be applied against any party hereto. Neither the Executive nor the Company shall be entitled to any presumption in connection with any determination made hereunder in connection with any arbitration, judicial or administrative proceeding relating to or arising under this Agreement.

[The remainder of this page has intentionally been left blank.]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first written above.

GUESS?, INC.

By: /s/ Carlos Alberini

Name: Carlos Alberini

Its: Chief Executive Officer

I DENNIS SECOR, agree, and acknowledge that I agree, to the terms of this Agreement. I further acknowledge and agree that the laws of the State of California will exclusively govern my employment relationship with Guess?, Inc. now and in the future. I confirm that I have had a reasonable opportunity to seek independent legal, financial, tax and accounting advice before signing this Agreement.

DENNIS SECOR

/s/ Dennis Secor

EXHIBIT A

EXCISE TAX RULES AND PROCEDURES

1. All determinations required to be made under Section 9 of this Agreement and this Exhibit A shall be made by an accounting firm (the “Accounting Firm”) selected by the Company. The Accounting Firm shall provide detailed supporting calculations both to the Company and the Executive within fifteen (15) business days of the event that results in the potential for an excise tax liability for the Executive, which could include but is not limited to a Change in Control and the subsequent vesting of any cash payments or awards, or the Executive’s termination of employment, or such earlier time as is required by the Company.

2. The Company shall pay the Accounting Firm’s fee.

3. If the Accounting Firm determines that one or more reductions are required under Section 9 of this Agreement, the Accounting Firm shall also determine which Payments shall be reduced (first from cash payments and then from non-cash payments) to the extent necessary so that no portion thereof shall be subject to the excise tax imposed by Section 4999 of the Code, and the Company shall pay such reduced amount to the Executive. The Accounting Firm shall make reductions required under Section 9 of this Agreement in a manner that maximizes the net after-tax amount payable to the Executive.

4. As a result of the uncertainty in the application of Section 280G at the time that the Accounting Firm makes its determinations under this Section, it is possible that amounts will have been paid or distributed to the Executive that should not have been paid or distributed (collectively, the “Overpayments”), or that additional amounts should be paid or distributed to the Executive (collectively, the “Underpayments”). If the Accounting Firm determines, based on either the assertion of a deficiency by the Internal Revenue Service against the Company or the Executive, which assertion the Accounting Firm believes has a high probability of success or controlling precedent or substantial authority, that an Overpayment has been made, the Executive must repay to the Company, without interest, the amount of the Overpayment; provided, however, that no loan will be deemed to have been made and no amount will be payable by the Executive to the Company unless, and then only to the extent that, the deemed loan and payment would either reduce the amount on which the Executive is subject to tax under Section 4999 of the Code or generate a refund of tax imposed under Section 4999 of the Code. If the Accounting Firm determines, based upon controlling precedent or substantial authority, that an Underpayment has occurred, the Accounting Firm will notify the Executive and the Company of that determination and the amount of that Underpayment will be paid to the Executive promptly by the Company.

5. The parties will provide the Accounting Firm access to and copies of any books, records, and documents in their possession as reasonably requested by the Accounting Firm, and otherwise cooperate with the Accounting Firm in connection with the preparation and issuance of the determinations and calculations contemplated by this Exhibit A.

* * *

Exhibit 99.1

Guess?, Inc. Announces CFO Transition

LOS ANGELES – August 19, 2024 – Guess?, Inc. (NYSE: GES) today announced that Dennis Secor has been appointed Interim Chief Financial Officer of Guess?, effective August 26, 2024. Mr. Secor is a proven finance leader with deep knowledge of the apparel industry, and has previously served as Guess? CFO from 2006 to 2012. He will succeed Markus Neubrand, who is stepping down to pursue another opportunity that will bring him closer to his family.

Guess? has initiated a search for its next Chief Financial Officer, who is expected to be based out of the Company’s headquarters in Lugano, Switzerland, with the assistance of an executive search firm. Mr. Neubrand will remain at Guess? through September 30, 2024, to facilitate a seamless transition.

“On behalf of the entire Guess? team, I want to thank Markus for his contributions to the growth and success of the Company,” said Carlos Alberini, Guess? Chief Executive Officer. “We wish him all the best as he embarks on his next professional opportunity.”

Mr. Alberini continued, “We are again thankful to Dennis for taking on this important interim role as we conduct our search for our next CFO. With Dennis’s extensive experience and leadership and our strong finance team, we are confident that we will not miss a beat.”

Mr. Secor said, “It’s a transformative time at Guess?, and I am ready to hit the ground running as the team works to build on our forward momentum, strengthen our brands and continue to deliver value for our shareholders.”

About Dennis Secor

Mr. Secor currently serves as Executive Vice President, Finance at Guess?. Throughout his career, Mr. Secor has held numerous Chief Financial Officer positions at both publicly-listed and privately-held companies across a range of industries, including Fossil Group, Electronic Arts Canada, Torrid and Guess?. As Chief Financial Officer of Guess? Between 2006 and 2012, he managed all finance and accounting functions globally and implemented multiple growth and profitability initiatives, maintained a strong capital structure, supported global growth expansion and developed a strong global finance team. He also served as Interim CFO at Guess? from April 2022-July 2023.

About GUESS?, Inc.

Guess?, Inc. designs, markets, distributes and licenses a lifestyle collection of contemporary apparel, denim, handbags, watches, eyewear, footwear and other related consumer products. Guess? products are distributed through branded Guess? stores as well as better department and specialty stores around the world. On April 2, 2024, the Company acquired all the operating assets and a 50% interest in the intellectual property assets of New York-based fashion brand rag & bone, a leader in the American fashion scene, directly operating stores in the U.S. and in the U.K., and also available in high-end boutiques, department stores and through e-commerce globally. As of May 4, 2024, the Company directly operated 1,048 retail stores in Europe, the Americas and Asia. The Company’s partners and distributors operated 533 additional retail stores worldwide. As of May 4, 2024, the Company and its partners and distributors operated in approximately 100 countries worldwide. For more information about the Company, please visit www.guess.com.

Contacts

Guess?, Inc.

Fabrice Benarouche

Senior Vice President Finance, Investor Relations and Chief Accounting Officer

(213) 765-5578

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

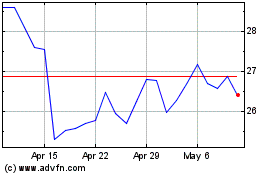

Guess (NYSE:GES)

Historical Stock Chart

From Aug 2024 to Sep 2024

Guess (NYSE:GES)

Historical Stock Chart

From Sep 2023 to Sep 2024