UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2023

Commission File Number 001-15170

GSK plc

(Translation of registrant's name into English)

980 Great West Road, Brentford, Middlesex, TW8 9GS

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

THIS ANNOUNCEMENT AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE, TRANSMISSION DISTRIBUTION OR FORWARDING, DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY JURISDICTION IN WHICH

SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION

PURPOSES ONLY AND IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

GSK plc

GSK announces intention to sell

up to 240m shares in Haleon

Following the successful demerger and premium

listing of Haleon plc (“Haleon”) as announced on 18 July 2022, GSK has retained a 12.94%1 stake in Haleon.

GSK today announces that it intends to sell

up to 240m ordinary shares in Haleon, equivalent to up to 2.5% of Haleon’s issued share capital.

The disposal will be conducted through a placing

of ordinary shares in Haleon to institutional investors (the "Offering"). The offer price will be determined by means

of an accelerated bookbuild offering process which is to start immediately.

A further announcement will be made following

completion of the bookbuild and pricing of the Offering.

GSK has entered into a secondary block trade

agreement with BofA Securities under which BofA Securities has been appointed to act as the Sole Global Coordinator of the Offering.

GSK and Pfizer, Inc. (which holds a 32% stake

in Haleon), have each undertaken to BofA Securities not to dispose of any shares in Haleon for a period of 60 days after the date of settlement

of the Offering, subject to certain customary exceptions and waiver by BofA Securities.

(1) Excluding shares in Haleon held

by the GSK employee share ownership trust.

About GSK

GSK is a global biopharma company with a purpose to

unite science, technology, and talent to get ahead of disease together. Find out more at gsk.com/company.

GSK Enquiries

| Media enquiries: |

Tim Foley |

+44 (0) 20 8047 5502 |

(London) |

| |

Simon Moore |

+44 (0) 20 8047 5502 |

(London) |

| |

Kathleen Quinn |

+1 202 603 5003 |

(Washington DC) |

| |

Alison Hunt |

+1 540 742 3391 |

(Washington DC) |

| |

|

| Analyst/Investor enquiries: |

Nick Stone

James Dodwell

Mick Readey

Joshua Williams

Camilla Campbell

Steph Mountifield

Jeff McLaughlin

Frannie DeFranco |

+44 (0) 7717 618834

+44 (0) 20 8047 2406

+44 (0) 7990 339653

+44 (0) 7385 415719

+44 (0) 7803 050238

+44 (0) 7736 063933

+1 215 751 7002

+1 215 751 4855

|

(London)

(London)

(London)

(London)

(London)

(London)

(Philadelphia)

(Philadelphia)

|

Disclaimer

The contents of this announcement have been

prepared by and are the sole responsibility of GSK.

GSK makes no representation or warranty as to

the appropriateness, accuracy, completeness or reliability of the information in this announcement.

This announcement is for information purposes

only and is not intended to and does not constitute or form part of any offer or invitation to purchase, otherwise acquire, subscribe

for, sell, otherwise dispose of or issue, or any solicitation of any offer to sell, otherwise dispose of, issue, purchase, otherwise acquire

or subscribe for, any security.

This announcement does not represent the announcement

of a definitive agreement to proceed with the Offering and, accordingly, there can be no certainty that the Offering will proceed. GSK

reserves the right not to proceed with the Offering or to vary the terms of the Offering in any way.

Information regarding forward-looking statements

GSK cautions investors that any forward-looking

statements or projections made by GSK, including those made in this announcement, are subject to risks and uncertainties that may cause

actual results to differ materially from those projected. Such factors include, but are not limited to, those described in the Company's

Annual Report on Form 20-F for 2022, GSK's Q1 Results for 2023 and any impacts of the COVID-19 pandemic.

This Announcement does not constitute a recommendation

to acquire any ordinary shares in Haleon. This Announcement does not identify or suggest, or purport to identify or suggest, the risks

(direct or indirect) that may be associated with an investment in Haleon. Any investment must be made solely on the basis of publicly

available information, which has not been independently verified by Merrill Lynch International.

No offer

Neither this announcement nor anything contained

herein shall form the basis of, or be relied upon in connection with, any offer or purchase whatsoever in any jurisdiction and shall not

constitutes or form part of an offer to sell or the solicitation of an offer to buy any securities in the United States or in any other

jurisdiction. The securities referred to herein may not be offered or sold in the United States absent registration with the United States

Securities and Exchange Commission or an exemption from registration under the U.S. Securities Act of 1933, as amended. The securities

referred to herein may not be deposited in an unrestricted depositary receipt facility for 40 days following the commencement of the Offering.

GSK does not intend to register any part of the Offering in the United States or to conduct a public offering in the United States of

the shares to which this announcement relates.

This announcement does not constitute a prospectus

or an offer or invitation to purchase securities. This announcement is only addressed to, and directed at, persons who are “qualified

investors”, being persons falling within the meaning of Article 2(e) of Regulation (EU) 2017/1129 as it forms part of domestic law

in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 and who: (i) have professional experience in matters relating

to investments falling within the definition of "investment professionals" in article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005, as amended (the "Order"); or (ii) are persons falling within article 49(2)(a)

to (d) ("high net worth companies, unincorporated associations, etc") of the Order; or (b) persons to whom it may otherwise

lawfully be communicated, (each such persons in (a) and (b) together being referred to as "Relevant Persons").

In addition, this announcement is not being

distributed, nor has it been approved for the purposes of Section 21 of the Financial Services and Markets Act 2000 ("FSMA"),

by a person authorised under FSMA.

This document is directed only at Relevant Persons

and must not be acted on or relied on by persons who are not Relevant Persons. Under no circumstances should persons who are not Relevant

Persons rely or act upon the contents of this announcement. Any investment or investment activity to which this announcement relates in

the United Kingdom is available only to, and will be engaged only with, Relevant Persons. Persons distributing this announcement must

satisfy themselves that it is lawful to do so.

The Offering and the distribution of this announcement

and other information in connection with the Offering in certain jurisdictions may be restricted by law. No action has been taken that

would permit the Offering or distribution of this announcement in any jurisdiction where action for such purpose is required. Persons

into whose possession any document or other information referred to herein comes should inform themselves about and observe any such restriction.

Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

Merrill Lynch International and its affiliates

may take up a portion of the securities referenced herein in the Offering as a principal position at any stage at their sole discretion,

inter alia, to take account of the objectives of GSK, MiFID II/ UK MiFID II requirements and in accordance with allocation policies, and

in that capacity may retain, purchase, sell, offer to sell for their own accounts such shares and other securities of the Company or related

investments in connection with the Offering or otherwise. Accordingly, references in this announcement to shares being sold, offered,

subscribed, acquired, placed or otherwise dealt in should be read as including any issue or offer to, or subscription, acquisition, placing

or dealing by, Merrill Lynch International its affiliates acting in such capacity. In addition, Merrill Lynch International and its affiliates

may enter into financing arrangements (including swaps or contracts for differences) with investors in connection with which Merrill Lynch

International and its affiliates may from time to time acquire, hold or dispose of the securities referenced herein. Merrill Lynch International

does not intend to disclose the extent of any such investment or transactions otherwise than in accordance with any legal or regulatory

obligations to do so.

Any communications that a transaction is or

that the book is “covered” (i.e. indicated demand from investors in the book equals or exceeds the amount of the securities

being offered) is not any indication or assurance that the book will remain covered or that the transaction and securities will be fully

distributed by Merrill Lynch International.

None of Merrill Lynch International or any of

its or its affiliates’ directors, officers, employees, advisers or agents accepts any responsibility or liability whatsoever for

or makes any representation or warranty, express or implied, as to the truth, accuracy or completeness of the information in this announcement

(or whether any information has been omitted from the announcement) or any other information relating to Haleon, GSK, their respective

subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available

or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith.

Merrill Lynch International is authorised by

the Prudential Regulatory Authority and regulated in the United Kingdom by the Prudential Regulation Authority and the Financial Conduct

Authority.is acting for GSK and for no one else in connection with the Offering and will not be responsible to anyone other than GSK for

providing the protections afforded to their customers or for affording advice in relation to the Offering, the contents of this announcement

or any transaction, arrangement or other matter referred to in this announcement.

Registered in England & Wales:

No. 3888792

Registered Office:

980 Great West Road

Brentford, Middlesex

TW8 9GS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| |

GSK plc |

| |

(Registrant) |

| |

|

| Date: May 11, 2023 |

|

| |

|

| |

By: |

/s/ Victoria Whyte |

| |

|

| |

Victoria Whyte |

| |

Authorised Signatory for and on |

| |

behalf of GSK plc |

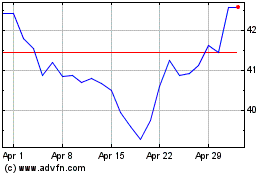

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024