Graham Holdings Company (NYSE: GHC) today

reported net income attributable to common shares of $125.1 million

($23.28 per share) for the third quarter of 2018, compared to $24.8

million ($4.42 per share) for the third quarter of 2017.

The results for the third quarter of 2018 and

2017 were affected by a number of items as described in the

following paragraphs. Excluding these items, net income

attributable to common shares was $70.9 million ($13.19 per share)

for the third quarter of 2018, compared to $23.9 million ($4.26 per

share) for the third quarter of 2017. (Refer to the Non-GAAP

Financial Information schedule at the end of this release for

additional details.)

Items included in the Company’s net income for

the third quarter of 2018:

- a $7.9 million intangible asset

impairment charge at the healthcare business (after-tax impact of

$5.8 million, or $1.08 per share);

- a $1.0 million reduction to operating

expenses from property, plant and equipment gains in connection

with the spectrum repacking mandate of the FCC (after-tax impact of

$0.8 million, or $0.14 per share);

- $45.0 million in net gains on

marketable equity securities (after-tax impact of $33.6 million, or

$6.26 per share);

- non-operating gain, net, of $10.1

million from sales, write-ups and impairments of cost method and

equity method investments, and related to sales of businesses

(after-tax impact of $8.0 million, or $1.48 per share);

- $0.1 million in non-operating foreign

currency losses (after-tax impact of $0.1 million, or $0.02 per

share); and

- a nonrecurring discrete $17.8 million

deferred state tax benefit related to the release of valuation

allowances ($3.31 per share).

Items included in the Company’s net income for

the third quarter of 2017:

- $1.4 million in non-operating foreign

currency gains (after-tax impact of $0.9 million, or $0.16 per

share).

Revenue for the third quarter of 2018 was

$674.8 million, up 3% from $657.2 million in the third quarter of

2017. Revenues grew at the television broadcasting and

manufacturing businesses, offset by lower revenue at the education

division. The Company reported operating income of $60.7 million

for the third quarter of 2018, compared to $27.0 million for the

third quarter of 2017. The operating income increase is driven by

higher earnings in television broadcasting, education and

SocialCode, offset by the decline in healthcare results, largely

due to the intangible asset impairment charge.

For the first nine months of 2018, the Company

reported net income attributable to common shares of $214.5 million

($39.54 per share), compared to $87.9 million ($15.64 per share)

for the first nine months of 2017. The results for the first nine

months of 2018 and 2017 were affected by a number of items as

described in the following paragraphs. Excluding these items, net

income attributable to common shares was $179.5 million ($33.09 per

share) for the first nine months of 2018, compared to $83.6 million

($14.87 per share) for the first nine months of 2017. (Refer to the

Non-GAAP Financial Information schedule at the end of this release

for additional details.)

Items included in the Company’s net income for

the first nine months of 2018:

- a $7.9 million intangible asset

impairment charge at the healthcare business (after-tax impact of

$5.8 million, or $1.08 per share);

- a $2.1 million reduction to operating

expenses from property, plant and equipment gains in connection

with the spectrum repacking mandate of the FCC (after-tax impact of

$1.6 million, or $0.29 per share);

- $6.2 million in interest expense

related to the settlement of a mandatorily redeemable

noncontrolling interest ($1.14 per share);

- $11.4 million in debt extinguishment

costs (after-tax impact of $8.6 million, or $1.60 per share);

- $28.3 million in net gains on

marketable equity securities (after-tax impact of $20.9 million, or

$3.86 per share);

- non-operating gain, net, of $17.0

million from sales, write-ups and impairments of cost method and

equity method investments, and related to sales of land and

businesses (after-tax impact of $13.4 million, or $2.46 per

share);

- a $4.3 million gain on the Kaplan

University Transaction (after-tax impact of $1.8 million, or $0.33

per share);

- $2.2 million in non-operating foreign

currency losses (after-tax impact of $1.7 million, or $0.31 per

share);

- a nonrecurring discrete $17.8 million

deferred state tax benefit related to the release of valuation

allowances ($3.31 per share); and

- $1.8 million in income tax benefits

related to stock compensation ($0.33 per share).

Items included in the Company’s net income for

the first nine months of 2017:

- a $9.2 million goodwill and other

long-lived asset impairment charge in other businesses (after-tax

impact of $5.8 million, or $1.03 per share);

- $6.6 million in non-operating foreign

currency gains (after-tax impact of $4.2 million, or $0.74 per

share); and

- $5.9 million in income tax benefits

related to stock compensation ($1.06 per share).

Revenue for the first nine months of 2018 was

$2,006.9 million, up 5% from $1,916.0 million in the first nine

months of 2017. Revenues increased at the television broadcasting

and manufacturing businesses, offset by lower revenue at the

education division. The Company reported operating income of $170.6

million for the first nine months of 2018, compared to $86.9

million for first nine months of 2017. Operating results improved

at the education, television broadcasting and manufacturing

businesses.

On April 27, 2017, certain subsidiaries of

Kaplan, Inc. (Kaplan), a subsidiary of Graham Holdings Company

entered into a Contribution and Transfer Agreement (Transfer

Agreement) to contribute the institutional assets and operations of

Kaplan University (KU) to an Indiana non-profit, public-benefit

corporation that is a subsidiary affiliated with Purdue University

(Purdue). The closing of the transactions contemplated by the

Transfer Agreement occurred on March 22, 2018. At the same time,

the parties entered into a Transition and Operations Support

Agreement (TOSA) pursuant to which Kaplan will provide key

non-academic operations support to the new university. The new

university operates largely online as an Indiana public university

affiliated with Purdue under the name Purdue University Global

(Purdue Global).

Division

Results

Education

Education division revenue totaled $358.6

million for the third quarter of 2018, down 5% from $376.8 million

for the same period of 2017. Kaplan reported operating income of

$22.3 million for the third quarter of 2018, up 61% from $13.8

million for the third quarter of 2017.

For the first nine months of 2018, education

division revenue totaled $1,104.1 million, down 3% from revenue of

$1,136.2 million for the same period of 2017. Kaplan reported

operating income of $82.5 million for the first nine months of

2018, a 46% increase from $56.6 million for the first nine months

of 2017.

As a result of the KU Transaction that closed

on March 22, 2018, the Company has revised the financial reporting

for its education division to provide operating results for Higher

Education and Professional (U.S.).

A summary of Kaplan’s operating results is as

follows:

Three Months Ended Nine Months Ended September

30 September 30 (in thousands)

2018 2017 % Change

2018 2017 % Change

Revenue Kaplan international

$ 167,668 $ 171,259 (2 )

$ 535,553 $

507,568 6 Higher education

89,269 105,210 (15 )

275,080 328,161 (16 ) Test preparation

67,749 72,680

(7 )

195,504 212,978 (8 ) Professional (U.S.)

34,302

28,249 21

98,715 88,812 11 Kaplan corporate and other

143 49 —

870 120 — Intersegment elimination

(530 ) (642 ) —

(1,617 )

(1,438 ) —

$ 358,601

$ 376,805 (5 )

$ 1,104,105

$ 1,136,201 (3 )

Operating Income

(Loss) Kaplan international

$ 8,375 $ 5,348 57

$ 52,966 $ 29,009 83 Higher education

6,042

1,493 —

18,616 17,079 9 Test preparation

10,572 7,330

44

17,213 10,207 69 Professional (U.S.)

6,768 7,316

(7 )

20,863 22,045 (5 ) Kaplan corporate and other

(6,770 ) (6,276 ) (8 )

(21,616 )

(17,941 ) (20 ) Amortization of intangible assets

(2,682

) (1,355 ) (98 )

(5,494 ) (3,798 ) (45 )

Intersegment elimination

(43 ) (59 ) —

(32 ) (36 ) —

$ 22,262

$ 13,797 61

$ 82,516

$ 56,565 46

Kaplan International includes English-language

programs, and postsecondary education and professional training

businesses largely outside the United States. Kaplan International

revenue declined 2% and increased 6% for the third quarter and

first nine months of 2018, respectively. On a constant currency

basis, revenue was flat for the third quarter and increased 2% for

the first nine months of 2018. Operating income increased to $8.4

million in the third quarter of 2018, compared to $5.3 million in

the third quarter of 2017 due to improved results at UK

Professional and English-language. Operating income increased to

$53.0 million for the first nine months of 2018, compared to $29.0

million for the same period of 2017 due largely to improved results

at Pathways, UK Professional, English-language and MPW.

Restructuring costs at Kaplan International totaled $0.9 million

for the first nine months of 2017.

Prior to the KU Transaction closing on March

22, 2018, Higher Education included Kaplan’s domestic postsecondary

education businesses, made up of fixed-facility colleges and online

postsecondary and career programs. Following the KU Transaction

closing, the Higher Education division includes the results as a

service provider to higher education institutions.

In the third quarter and first nine months of

2018, Higher Education revenue was down 15% and 16%, respectively,

due largely to the sale of KU on March 22, 2018 and fewer average

enrollments at KU prior to the sale. The Company recorded the

service fee with Purdue Global beginning in the second quarter of

2018, based on an assessment of its collectability under the TOSA.

The service fee recorded in the second quarter has since been

collected from Purdue Global for its fiscal year ended June 30,

2018. In the third quarter of 2018, the Company recorded a portion

of the service fee with Purdue Global based on an assessment of its

collectability under the TOSA. The Company will continue to assess

the collectability of the service fee with Purdue Global on a

quarterly basis to make a determination as to whether to record all

or part of the service fee in the future and whether to make

adjustments to service fee amounts recognized in earlier

periods.

Kaplan Test Preparation (KTP) includes Kaplan’s

standardized test preparation programs. In September 2018, KTP

acquired the test preparation and study guide assets of Barron’s

Educational Series, a New York-based education publishing company.

KTP revenue declined 7% and 8% for the third quarter and first nine

months of 2018, respectively due to lower enrollments in certain

test preparation programs and the disposition of Dev Bootcamp,

which made up the majority of KTP’s new economy skills training

programs. KTP operating results improved in the third quarter and

first nine months of 2018, due primarily to decreased losses from

the new economy skills training programs. Operating losses for the

new economy skills training programs were $2.8 million and $11.2

million for the first nine months of 2018 and 2017, respectively,

including $1.3 million in restructuring costs in the third quarter

of 2017. Dev Bootcamp was closed in the second half of 2017.

Kaplan Professional (U.S.) includes the

domestic professional and other continuing education businesses. In

the third quarter and first nine months of 2018, Kaplan

Professional (U.S.) revenue was up 21% and 11%, respectively, due

partly to the May 2018 acquisition of Professional Publications,

Inc. (PPI), an independent publisher of professional licensing exam

review materials that provides engineering, surveying,

architecture, and interior design licensure exam review products,

and the July 2018 acquisition of College for Financial Planning

(CFFP), a provider of financial education and training to

individuals through programs of study for professionals pursuing a

career in Financial Planning. Kaplan Professional (U.S) operating

results declined 7% and 5% for the third quarter and first nine

months of 2018, respectively, due mostly to a delay in the CFA exam

release and registration dates and increased spending on sales and

technology, offset in part by income from PPI and CFFP.

Kaplan corporate and other represents

unallocated expenses of Kaplan, Inc.’s corporate office, other

minor businesses and certain shared activities, with increased

healthcare expense in 2018.

Television Broadcasting

Revenue at the television broadcasting division

increased 28% to $130.0 million in the third quarter of 2018, from

$101.3 million in the same period of 2017 due to a $20.7 million

increase in political advertising revenue and a $10.2 million

increase in retransmission revenues. Operating income for the third

quarter of 2018 increased 66% to $55.5 million, from $33.5 million

in the same period of 2017 due to higher revenues.

Revenue at the television broadcasting division

increased 18% to $352.9 million in the first nine months of 2018,

from $298.9 million in the same period of 2017. The revenue

increase is due to $27.1 million in higher retransmission revenues,

a $26.8 million increase in political advertising revenue and $8.6

million in 2018 incremental winter Olympics-related advertising

revenue at the Company’s NBC stations. Operating income for the

first nine months of 2018 increased 37% to $137.1 million, from

$99.7 million in the same period of 2017 due to higher

revenues.

In the third quarter and first nine months of

2018, the television broadcasting division recorded $1.0 million

and $2.1 million, respectively, in reductions to operating expenses

related to non-cash property, plant and equipment gains due to new

equipment received at no cost in connection with the spectrum

repacking mandate of the FCC.

In the third quarter of 2017, the Company’s

television stations in Texas and Florida ran extensive news

programming coverage of hurricanes Harvey and Irma; this adversely

impacted revenues by an estimated $2.1 million and resulted in $0.6

million in additional expenses during the third quarter of

2017.

Manufacturing

Manufacturing includes four businesses: Dekko,

a manufacturer of electrical workspace solutions, architectural

lighting and electrical components and assemblies; Joyce/Dayton

Corp., a manufacturer of screw jacks and other linear motion

systems; Forney, a global supplier of products and systems that

control and monitor combustion processes in electric utility and

industrial applications; and Hoover Treated Wood Products, Inc., a

supplier of pressure impregnated kiln-dried lumber and plywood

products for fire retardant and preservative applications that the

Company acquired in April 2017. In July 2018, Dekko acquired

Furnlite, Inc., a Fallston, NC-based manufacturer of power and data

solutions for the hospitality and residential furniture

industry.

Manufacturing revenues increased in the first

nine months of 2018 due to the Hoover acquisition. Manufacturing

operating income decreased in the third quarter of 2018 due largely

to a decline at Hoover from the adverse impact of lower wood prices

on inventory values. Operating income increased in the first nine

months of 2018 due largely to the Hoover acquisition. Also, in the

second quarter of 2017, the Company recorded a $9.2 million

goodwill and other long-lived asset impairment charge at Forney,

due to lower than expected revenues resulting from sluggish overall

demand for its energy products.

Healthcare

The Graham Healthcare Group (GHG) provides home

health and hospice services in three states. At the end of June

2017, GHG acquired Hometown Home Health and Hospice, a Lapeer,

MI-based healthcare services provider. Healthcare revenues were

down 12% and 4% in the third quarter and first nine months of 2018,

respectively. The revenue declines are primarily due to a new

management services agreement (MSA) with one of GHG’s joint

ventures that was effective in the third quarter of 2018. In the

third quarter of 2018, GHG recorded a $7.9 million intangible asset

impairment charge related to the Celtic trademark, which is in the

process of being phased-out. The decline in GHG operating results

in 2018 is due to the intangible asset impairment charge and a

decline in results from the MSA with one of GHG’s joint

ventures.

SocialCode

SocialCode is a provider of marketing solutions

on social, mobile and video platforms. In the third quarter of

2018, SocialCode acquired Marketplace Strategy (MPS), a

Cleveland-based Amazon sales acceleration agency. SocialCode’s

revenue decreased 5% in the third quarter of 2018 and was flat for

the first nine months of 2018. SocialCode reported operating income

of $5.1 million and an operating loss of $0.4 million in the third

quarter and first nine months of 2018, respectively, compared to

operating losses of $6.2 million and $8.2 million in the third

quarter and first nine months of 2017, respectively. The improved

results include a $7.5 million and $7.2 million credit related to

SocialCode’s phantom equity plans in the third quarter and first

nine months of 2018, respectively; 2017 results included $5.1

million and $1.2 million in expense related to SocialCode’s phantom

equity plans in the third quarter and first nine months,

respectively.

Other Businesses

Other businesses include Slate and Foreign

Policy, which publish online and print magazines and websites; and

two investment stage businesses, Panoply and CyberVista. Losses

from each of these businesses in the first nine months of 2018

adversely affected operating results.

Corporate Office

Corporate office includes the expenses of the

Company’s corporate office and certain continuing obligations

related to prior business dispositions.

Equity in Earnings

(Losses) of Affiliates

At September 30, 2018, the Company held

interests in a number of home health and hospice joint ventures,

and interests in several other affiliates. In the second half of

2017, the Company acquired approximately 11% of Intersection

Holdings, LLC, which provides digital marketing and advertising

services and products for cities, transit systems, airports,

and other public and private spaces. The Company recorded equity in

earnings of affiliates of $9.5 million for the third quarter of

2018, compared to equity in losses of affiliates of $0.5 million

for the third quarter of 2017. In the third quarter of 2018, the

Company recorded $7.9 million in gains in equity in earnings of

affiliates related to two of its investments. The Company recorded

equity in earnings of affiliates of $13.0 million for the first

nine months of 2018, compared to $1.4 million for the first nine

months of 2017.

Net Interest Expense,

Debt Extinguishment Costs and Related Balances

On May 30, 2018, the Company issued 5.75%

unsecured eight-year fixed-rate notes due June 1, 2026. Interest is

payable semi-annually on June 1 and December 1, beginning on

December 1, 2018. On June 29, 2018, the Company used the net

proceeds from the sale of the notes and other cash to repay $400

million of 7.25% notes that were due February 1, 2019. The Company

incurred $11.4 million in debt extinguishment costs related to the

early termination of the 7.25% notes.

The Company incurred net interest expense of

$5.5 million and $27.5 million for the third quarter and first nine

months of 2018, compared to $7.8 million and $22.4 million for the

third quarter and first nine months of 2017. The Company incurred

$6.2 million in interest expense related to the mandatorily

redeemable noncontrolling interest at GHG settled in the second

quarter of 2018.

At September 30, 2018, the Company had

$479.6 million in borrowings outstanding at an average interest

rate of 5.1% and cash, marketable equity securities and other

investments of $794.7 million.

Non-operating Pension

and Postretirement Benefit Income, net

In the first quarter of 2018, the Company

adopted new accounting guidance that changes the income statement

classification of net periodic pension and postretirement pension

cost. Under the new guidance, service cost is included in operating

income, while the other components (including expected return on

assets) are included in non-operating income. The new guidance was

required to be applied retrospectively, with prior period financial

information revised to reflect the reclassification. From a segment

reporting perspective, this change had a significant impact on

Corporate office reporting, with minimal impact on the television

broadcasting and Kaplan corporate reporting.

The Company recorded net non-operating pension

and postretirement benefit income of $22.2 million and $66.6

million for the third quarter and first nine months of 2018,

compared to $17.6 million and $55.0 million for the third quarter

and first nine months of 2017.

Gain on Marketable

Equity Securities, net

In the first quarter of 2018, the Company

adopted new guidance that requires changes in the fair value of

marketable equity securities to be included in non-operating income

(expense) on a prospective basis. Overall, the Company recognized

$45.0 million and $28.3 million in net gains on marketable equity

securities in the third quarter and first nine months of 2018,

respectively.

Other Non-Operating

Income (Expense)

The Company recorded total other non-operating

income, net, of $3.1 million for the third quarter of 2018,

compared to $2.0 million for the third quarter of 2017. The 2018

amounts included $8.5 million in fair value increases on cost

method investments and other items, partially offset by a $3.3

million net loss related to sales of businesses and contingent

consideration; a $2.5 million impairment of a cost method

investment; and $0.1 million in foreign currency losses. The 2017

amounts included $1.4 million in foreign currency gains and other

items.

The Company recorded total other non-operating

income, net, of $14.7 million for the first nine months of 2018,

compared to $6.9 million for the first nine months of 2017. The

2018 amounts included $8.5 million in fair value increases on cost

method investments; $4.0 million net gain related to sales of

businesses and contingent consideration; a $2.8 million gain on

sale of a cost method investment; a $2.5 million gain on sale of

land; and other items, partially offset by a $2.5 million

impairment of a cost method investment and $2.2 million in foreign

currency losses. The 2017 amounts included $6.6 million in foreign

currency gains and other items.

Provision for Income

Taxes

The Company’s effective tax rate for the first

nine months of 2018 was 15.6%. In the third quarter of 2018, the

Company recorded a $17.8 million deferred state tax benefit related

to the release of valuation allowances. Excluding this $17.8

million benefit and a $1.8 million income tax benefit related to

stock compensation, the overall income tax rate for the first nine

months of 2018 was 23.3%. The Tax Cuts and Jobs Act was enacted in

December 2017, which included lowering the federal corporate income

tax rate from 35% to 21%.

The Company's effective tax rate for the first

nine months of 2017 was 31.3%. This low effective tax rate is due

to a $5.9 million income tax benefit related to the vesting of

restricted stock awards. In the first quarter of 2017, the Company

adopted a new accounting standard that requires all excess income

tax benefits and deficiencies from stock compensation to be

recorded as discrete items in the provision for income taxes.

Excluding this $5.9 million benefit, the overall income tax rate

for the first nine months of 2017 was 35.9%.

Earnings Per

Share

The calculation of diluted earnings per share

for the third quarter and first nine months of 2018 was based on

5,336,612 and 5,390,049 weighted average shares outstanding,

compared to 5,554,458 and 5,566,874 for the third quarter and first

nine months of 2017. At September 30, 2018, there were

5,316,329 shares outstanding. On November 9, 2017, the Board of

Directors authorized the Company to acquire up to 500,000 shares of

its Class B common stock; the Company has remaining authorization

for 286,025 shares as of September 30, 2018.

Adoption of Revenue

Recognition Standard

On January 1, 2018, the Company adopted the new

revenue recognition guidance using the modified retrospective

approach. In connection with the KU Transaction, Kaplan recognized

$4.5 million in service fee revenue and operating income in the

third quarter of 2018. Under the previous guidance, this would not

have been recognized as a determination would not have been made

until the end of Purdue Global’s fiscal year (June 30, 2019). If

the company applied the accounting policies under the previous

guidance for all other revenue streams, revenue would have been

$1.2 million lower and operating expenses would have been $2.6

million lower for the first nine months of 2018.

Forward-Looking

Statements

This press release contains certain

forward-looking statements that are based largely on the Company’s

current expectations. Forward-looking statements are subject to

certain risks and uncertainties that could cause actual results and

achievements to differ materially from those expressed in the

forward-looking statements. For more information about these

forward-looking statements and related risks, please refer to the

section titled “Forward-Looking Statements” in Part I of the

Company’s Annual Report on Form 10-K.

GRAHAM HOLDINGS COMPANY

CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months

Ended September 30 % (in thousands, except per share

amounts)

2018 2017

Change Operating revenues

$ 674,766

$ 657,225 3 Operating expenses

580,001 603,038 (4 )

Depreciation of property, plant and equipment

13,648 16,002

(15 ) Amortization of intangible assets

12,269 10,923 12

Impairment of long-lived assets

8,109

312 —

Operating income 60,739 26,950 — Equity

in earnings (losses) of affiliates, net

9,537 (532 ) —

Interest income

611 861 (29 ) Interest expense

(6,135

) (8,619 ) (29 ) Non-operating pension and postretirement

benefit income, net

22,214 17,621 26 Gain on marketable

equity securities, net

44,962 — — Other income, net

3,142 1,963 60

Income before

income taxes 135,070 38,244 —

Provision for income

taxes 10,000 13,400 (25 )

Net income 125,070 24,844 —

Net income

attributable to noncontrolling interests (6 )

(60 ) (90 )

Net Income Attributable to Graham

Holdings Company Common Stockholders $ 125,064

$ 24,784 —

Per Share Information

Attributable to Graham Holdings Company Common Stockholders

Basic net income per common share

$ 23.43 $ 4.45 —

Basic average number of common shares outstanding

5,302

5,518 Diluted net income per common share

$ 23.28 $

4.42 — Diluted average number of common shares outstanding

5,337 5,554 GRAHAM HOLDINGS COMPANY

CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Nine Months

Ended September 30 % (in thousands, except per share

amounts)

2018 2017

Change Operating revenues

$ 2,006,879

$ 1,916,029 5 Operating expenses

1,752,230 1,744,734

0 Depreciation of property, plant and equipment

41,909

46,525 (10 ) Amortization of intangible assets

34,052 28,290

20 Impairment of goodwill and other long-lived assets

8,109

9,536 (15 )

Operating income

170,579 86,944 96 Equity in earnings of affiliates, net

13,047 1,448 — Interest income

3,884 3,397 14

Interest expense

(31,371 ) (25,783 ) 22 Debt

extinguishment costs

(11,378 ) — — Non-operating

pension and postretirement benefit income, net

66,641 55,042

21 Gain on marketable equity securities, net

28,306 — —

Other income, net

14,662 6,881 —

Income before income taxes 254,370 127,929 99

Provision for income taxes 39,700

40,000 (1 )

Net income 214,670 87,929 —

Net income attributable to noncontrolling interests

(149 ) (63 ) —

Net Income

Attributable to Graham Holdings Company Common Stockholders

$ 214,521 $ 87,866 —

Per Share Information Attributable to Graham Holdings Company

Common Stockholders Basic net income per common share

$

39.81 $ 15.74 — Basic average number of common shares

outstanding

5,354 5,530 Diluted net income per common share

$ 39.54 $ 15.64 — Diluted average number of common

shares outstanding

5,390 5,567 GRAHAM HOLDINGS

COMPANY

BUSINESS DIVISION

INFORMATION

(Unaudited)

Three Months Ended

Nine Months Ended

September 30 %

September 30 % (in thousands)

2018 2017 Change

2018 2017 Change

Operating Revenues Education

$ 358,601 $ 376,805 (5 )

$ 1,104,105 $

1,136,201 (3 ) Television broadcasting

130,014 101,295 28

352,902 298,893 18 Manufacturing

126,028 115,594 9

369,896 298,164 24 Healthcare

35,486 40,473 (12 )

111,315 115,592 (4 ) SocialCode

13,781 14,497 (5 )

41,850 41,926 0 Other businesses

10,856 8,561 27

26,856 25,253 6 Corporate office

— — —

— — —

Intersegment elimination

— — —

(45 ) — —

$

674,766 $ 657,225 3

$

2,006,879 $ 1,916,029 5

Operating Expenses Education

$ 336,339 $

363,008 (7 )

$ 1,021,589 $ 1,079,636 (5 ) Television

broadcasting

74,561 67,833 10

215,789 199,171 8

Manufacturing

120,882 108,881 11

347,457 291,961 19

Healthcare

44,188 39,553 12

120,644 115,214 5

SocialCode

8,657 20,745 (58 )

42,249 50,078 (16 )

Other businesses

16,513 16,047 3

49,032 49,265 0

Corporate office

12,887 14,208 (9 )

39,585 43,760 (10

) Intersegment elimination

— — —

(45 ) — —

$

614,027 $ 630,275 (3 )

$

1,836,300 $ 1,829,085 0

Operating Income (Loss) Education

$ 22,262 $

13,797 61

$ 82,516 $ 56,565 46 Television

broadcasting

55,453 33,462 66

137,113 99,722 37

Manufacturing

5,146 6,713 (23 )

22,439 6,203 —

Healthcare

(8,702 ) 920 —

(9,329 ) 378

— SocialCode

5,124 (6,248 ) —

(399 ) (8,152 )

95 Other businesses

(5,657 ) (7,486 ) 24

(22,176 ) (24,012 ) 8 Corporate office

(12,887

) (14,208 ) 9

(39,585 )

(43,760 ) 10

$ 60,739 $

26,950 —

$ 170,579 $

86,944 96

Depreciation Education

$

6,685 $ 8,085 (17 )

$ 21,130 $ 24,994 (15 )

Television broadcasting

3,198 3,118 3

9,243 8,703 6

Manufacturing

2,333 2,717 (14 )

7,115 6,629 7

Healthcare

648 1,166 (44 )

1,948 3,429 (43 )

SocialCode

187 256 (27 )

620 753 (18 ) Other

businesses

345 381 (9 )

1,095 1,157 (5 ) Corporate

office

252 279 (10 )

758

860 (12 )

$ 13,648

$ 16,002 (15 )

$ 41,909

$ 46,525 (10 )

Amortization of Intangible

Assets and Impairment of Goodwill and Other Long-Lived Assets

Education

$ 2,682 $ 1,355 98

$ 5,494 $

3,798 45 Television broadcasting

1,408 1,071 31

4,224

2,943 44 Manufacturing

6,345 6,306 1

18,216 25,117

(27 ) Healthcare

9,839 2,420 —

13,456 5,718 —

SocialCode

104 83 25

771 250 — Other businesses

— — —

— — — Corporate office

—

— —

— — —

$

20,378 $ 11,235 81

$

42,161 $ 37,826 11

Pension

Expense Education

$ 2,107 $ 2,430 (13 )

$

6,649 $ 7,289 (9 ) Television broadcasting

544 485 12

1,638 1,457 12 Manufacturing

18 15 20

54 62

(13 ) Healthcare

143 166 (14 )

430 498 (14 )

SocialCode

181 149 21

542 445 22 Other businesses

147 113 30

417 336 24 Corporate office

1,333

1,233 8

4,000

4,009 —

$ 4,473 $

4,591 (3 )

$ 13,730 $

14,096 (3 ) GRAHAM HOLDINGS COMPANY

EDUCATION DIVISION

INFORMATION

(Unaudited)

Three Months Ended Nine Months Ended

September 30 %

September 30 % (in thousands)

2018 2017 Change

2018 2017 Change

Operating Revenues Kaplan

international

$ 167,668 $ 171,259 (2 )

$

535,553 $ 507,568 6 Higher education

89,269 105,210

(15 )

275,080 328,161 (16 ) Test preparation

67,749

72,680 (7 )

195,504 212,978 (8 ) Professional (U.S.)

34,302 28,249 21

98,715 88,812 11

Kaplan corporate and other

143 49 —

870 120 — Intersegment elimination

(530 ) (642 ) —

(1,617 )

(1,438 ) —

$ 358,601

$ 376,805 (5 )

$ 1,104,105

$ 1,136,201 (3 )

Operating Expenses

Kaplan international

$ 159,293 $ 165,911 (4 )

$ 482,587 $ 478,559 1 Higher education

83,227

103,717 (20 )

256,464 311,082 (18 ) Test preparation

57,177 65,350 (13 )

178,291 202,771 (12 )

Professional (U.S.)

27,534 20,933 32

77,852 66,767 17

Kaplan corporate and other

6,913 6,325 9

22,486

18,061 25 Amortization of intangible assets

2,682 1,355 98

5,494 3,798 45 Intersegment elimination

(487 )

(583 ) —

(1,585 ) (1,402

) —

$ 336,339 $ 363,008

(7 )

$ 1,021,589 $ 1,079,636

(5 )

Operating Income (Loss) Kaplan international

$ 8,375 $ 5,348 57

$ 52,966 $ 29,009 83

Higher education

6,042 1,493 —

18,616 17,079 9 Test

preparation

10,572 7,330 44

17,213 10,207 69

Professional (U.S.)

6,768 7,316 (7 )

20,863 22,045 (5

) Kaplan corporate and other

(6,770 ) (6,276 ) (8 )

(21,616 ) (17,941 ) (20 ) Amortization of intangible

assets

(2,682 ) (1,355 ) (98 )

(5,494 )

(3,798 ) (45 ) Intersegment elimination

(43 )

(59 ) —

(32 ) (36 ) —

$

22,262 $ 13,797 61

$

82,516 $ 56,565 46

Depreciation Kaplan international

$ 3,759 $

3,780 (1 )

$ 11,497 $ 11,071 4 Higher education

915 2,010 (54 )

4,047 7,142 (43 ) Test preparation

1,033 1,407 (27 )

2,984 4,080 (27 ) Professional

(U.S.)

859 758 13

2,171 2,306 (6 ) Kaplan corporate

and other

119 130 (8 )

431 395 9

$ 6,685

$ 8,085 (17 )

$ 21,130

$ 24,994 (15 )

Pension Expense

Kaplan international

$ 66 $ 24 —

$ 233

$ 198 18 Higher education

1,050 467 —

3,260 3,951 (17

) Test preparation

577 244 —

2,035 2,066 (2 )

Professional (U.S.)

291 81 —

871 685 27 Kaplan

corporate and other

123 1,614

(92 )

250 389 (36 )

$

2,107 $ 2,430 (13 )

$

6,649 $ 7,289 (9 )

NON-GAAP FINANCIAL INFORMATIONGRAHAM HOLDINGS

COMPANY(Unaudited)

In addition to the results reported in accordance with

accounting principles generally accepted in the United States

(GAAP) included in this press release, the Company has provided

information regarding net income, excluding certain items described

below, reconciled to the most directly comparable GAAP measures.

Management believes that these non-GAAP measures, when read in

conjunction with the Company’s GAAP financials, provide useful

information to investors by offering:

- the ability to make meaningful

period-to-period comparisons of the Company’s ongoing results;

- the ability to identify trends in the

Company’s underlying business; and

- a better understanding of how

management plans and measures the Company’s underlying

business.

Net income, excluding certain items, should not be considered

substitutes or alternatives to computations calculated in

accordance with and required by GAAP. These non-GAAP financial

measures should be read only in conjunction with financial

information presented on a GAAP basis.

The following table reconciles the non-GAAP financial measures

to the most directly comparable GAAP measures:

Three Months Ended September 30

2018 2017 (in thousands, except per

share amounts)

Incomebeforeincometaxes

IncomeTaxes

NetIncome

Incomebeforeincometaxes

IncomeTaxes

NetIncome

Amounts attributable to Graham Holdings Company Common

Stockholders

As reported

$ 135,070 $

10,000 $ 125,070 $ 38,244 $ 13,400 $ 24,844

Attributable to noncontrolling interests

(6 ) (60 )

Attributable to Graham Holdings Company Stockholders

125,064

24,784 Adjustments: Intangible asset impairment charge

7,909

2,099 5,810 — — — Reduction to operating expenses in

connection with the broadcast spectrum repacking

(999

) (229 ) (770 ) — — — Net gains

on marketable equity securities

(44,962 )

(11,357 ) (33,605 ) — — — Non-operating

gain, net, from cost and equity method investments and related to

sales of businesses

(10,091 ) (2,138 )

(7,953 ) — — — Foreign currency loss (gain)

116 28 88 (1,414 ) (523 ) (891 ) Nonrecurring

deferred state tax benefit related to release of valuation

allowances

— 17,783 (17,783 ) — — —

Net Income, adjusted (non-GAAP)

$ 70,851

$ 23,893

Per share information attributable

to Graham Holdings Company Common Stockholders Diluted income

per common share, as reported

$ 23.28 $ 4.42

Adjustments: Intangible asset impairment charge

1.08

— Reduction to operating expenses in connection with the broadcast

spectrum repacking

(0.14 ) — Net losses on marketable

equity securities

(6.26 ) — Non-operating gain, net,

from cost and equity method investments and related to sales of

businesses

(1.48 ) — Foreign currency loss (gain)

0.02 (0.16 ) Nonrecurring deferred state tax benefit related

to release of valuation allowances

(3.31 ) —

Diluted income per common share, adjusted (non-GAAP)

$

13.19 $ 4.26

The adjusted diluted per share amounts may not compute due to

rounding.

Nine Months Ended September 30

2018 2017 (in thousands, except per share

amounts)

Incomebeforeincometaxes

IncomeTaxes

NetIncome

Incomebeforeincometaxes

IncomeTaxes

NetIncome

Amounts attributable to Graham Holdings Company Common

Stockholders

As reported

$ 254,370 $

39,700 $ 214,670 $ 127,929 $ 40,000 $ 87,929

Attributable to noncontrolling interests

(149 ) (63 )

Attributable to Graham Holdings Company Stockholders

$

214,521 $ 87,866 Adjustments: Goodwill and other long-lived

asset impairment charge

7,909 2,099 5,810

9,224 3,413 5,811 Reduction to operating expenses in connection

with the broadcast spectrum repacking

(2,067 )

(475 ) (1,592 ) — — — Interest expense

related to the settlement of a mandatorily redeemable

noncontrolling interest

6,169 — 6,169 — — —

Debt extinguishment costs

11,378 2,731 8,647 —

— — Net gains on marketable equity securities

(28,305

) (7,359 ) (20,946 ) — — —

Non-operating gain, net, from cost and equity method investments

and related to sales of land and businesses

(17,038 )

(3,664 ) (13,374 ) — — — Gain on Kaplan

University Transaction

(4,315 ) (2,472

) (1,843 ) — — — Foreign currency loss (gain)

2,205 529 1,676 (6,608 ) (2,445 ) (4,163 )

Nonrecurring deferred state tax benefit related to the release of

valuation allowances

— 17,783 (17,783 )

— — — Tax benefit related to stock compensation

—

1,810 (1,810 ) — 5,933 (5,933 ) Net Income,

adjusted (non-GAAP)

$ 179,475 $ 83,581

Per share information attributable to Graham Holdings

Company Common Stockholders Diluted income per common share, as

reported

$ 39.54 $ 15.64 Adjustments:

Goodwill and other long-lived asset impairment charge

1.08

1.03 Reduction to operating expenses in connection with the

broadcast spectrum repacking

(0.29 ) — Interest

expense related to the settlement of a mandatorily redeemable

noncontrolling interest

1.14 — Debt extinguishment costs

1.60 — Net gains on marketable equity securities

(3.86 ) — Non-operating gain, net, from cost and

equity method investments and related to sales of land and

businesses

(2.46 ) — Gain on Kaplan University

Transaction

(0.33 ) — Foreign currency loss (gain)

0.31 (0.74 ) Nonrecurring deferred state tax benefit related

to the release of valuation allowances

(3.31 ) — Tax

benefit related to stock compensation

(0.33 ) (1.06 )

Diluted income per common share, adjusted (non-GAAP)

$

33.09 $ 14.87

The adjusted diluted per share amounts may not compute due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181031005115/en/

Graham Holdings CompanyWallace R. Cooney, 703-345-6470

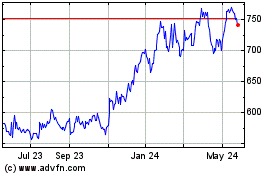

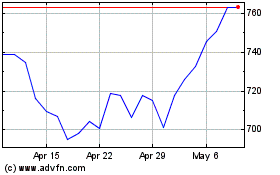

Graham (NYSE:GHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Graham (NYSE:GHC)

Historical Stock Chart

From Apr 2023 to Apr 2024