Kaplan Financial Education to Present Webcast on Current Federal Tax Developments

November 20 2019 - 10:27AM

Business Wire

Edward Zollars, CPA and instructor at Kaplan Financial

Education, will lead a webcast on Current Federal Tax Developments

on December 5, 2019 from 1:00-4:30 PM EST.

The webcast, which will deliver 4.0 CPE, will cover the latest

developments in federal taxation, with emphasis on real world

applications. Learn how to avoid penalties, how to use IRS

"Frequently Asked Questions" to answer tough questions relating to

new laws, how to plan with regulations and other guidance issued

since the Tax Cuts and jobs Act, and much more.

This course is designed for tax advisors in public practice and

corporate tax departments who want an up-to-the minute review of

federal tax developments. Participants will learn:

- How to understand and work with tax law changes;

- How to analyze court decisions, IRS notices, revenue rulings,

and revenue procedures for application with clients’ tax planning

and compliance;

- Greater awareness of IRS audit issues;

- How to assess pending legislation;

- How to anticipate and create opportunities for tax

reduction;

- How to avoid penalties IRC Sec. 6662 imposes on careless

taxpayers.

Edward K. Zollars, CPA, licensed as a CPA in Arizona, is in

public practice in Phoenix, Arizona, as a partner with the firm of

Thomas, Zollars & Lynch, Ltd. He has been in practice for over

35 years, specializing in tax issues for closely held businesses

and individuals.

Ed has been professionally involved with both tax and technology

issues, combining the two disciplines in producing the Current

Federal Tax Development Update podcast and website, dealing with

current tax issues. He has been a member of AICPA Tax Division

Committees, dealing with tax and technology issues, and was the Tax

Section’s representative on three occasions to the AICPA’s Top Ten

Technologies project. Ed is also a member of the Phoenix Tax

Workshop’s Advisory Committee, and currently serves on the Tax

Legislation Liaison Committee for the Arizona Society of CPAs. Ed

was selected as a Life Member by the Arizona Society of CPAs in May

of 2010.

For more information, go to Kaplan Financial Education.

About Kaplan Professional

Kaplan Professional®—a division of Kaplan, Inc. is a leading

provider of training and education services operating in more than

30 countries and working with over 10,000 corporations and

businesses globally. Kaplan Professional helps professionals obtain

certifications, licensure, and designations that enable them to

advance and succeed in their careers. Kaplan Professional partners

with organizations to solve their talent management challenges

through customized corporate learning and development solutions.

Through live and online instruction, Kaplan Professional provides

test preparation, licensing, continuing education, and professional

development programs to businesses and individuals in the

accounting, insurance, securities, real estate, financial, wealth

management, engineering, and architecture industries. Kaplan, Inc.

is part of the Graham Holdings Company (NYSE: GHC).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191120005624/en/

Press: John Vita John.vita@jsvcom.com 847/853-8283

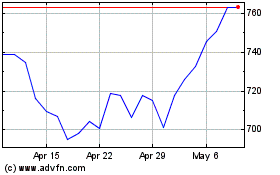

Graham (NYSE:GHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

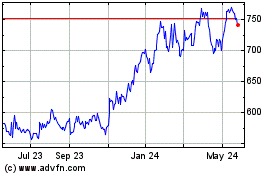

Graham (NYSE:GHC)

Historical Stock Chart

From Apr 2023 to Apr 2024