|

November 2022 MSCI USA Momentum Top 50 Select Index Supplement to the Underlier Supplement, the Prospectus Supplement and the Prospectus, each as may be amended from time to time, that form a part of Registration Statement No. 333-253421 |

Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-253421 |

|

|

GS Finance Corp.

Medium-Term Notes, Series F | Warrants, Series G

guaranteed by

The Goldman Sachs Group, Inc. |

MSCI USA Momentum Top 50 Select Index

Overview

|

|

This section constitutes only a brief overview of the MSCI USA Momentum Top 50 Select Index. The index is described in more detail under “The Underliers — MSCI USA Momentum Top 50 Select Index” in the underlier supplement referred to in “About This Index Supplement” below. |

The MSCI USA Momentum Top 50 Select Index (current Bloomberg symbol: “MXUSM50 Index”), which we also refer to in this index supplement as the “index,” is designed to measure the performance of an equity momentum strategy applied to the MSCI USA Index. The MSCI USA Index is free-float adjusted market capitalization weighted index of large- and mid-cap U.S. companies.

The index was launched on August 4, 2020 at an initial value of USD 6,078.6053, as adjusted, and is calculated, maintained and published by MSCI Inc.

We have derived all information contained in this index supplement regarding the index from publicly available information. Additional information about the index (including the top ten constituent stocks and weights and sector weights) is available on the following websites: msci.com/index-methodology and msci.com. We are not incorporating by reference the websites or any material they include in this index supplement.

|

|

|

|

Quick Facts |

Historical Performance |

|

|

Sponsor |

MSCI Inc. |

|

The graph below shows the daily historical closing levels of the index from January 3, 2017 through November 14, 2022 (using hypothetical performance data and historical closing levels). As a result, the below graph does not reflect the global financial crisis which began in 2008, which had a materially negative impact on the price of most equity securities and, as a result, the level of most equity indices. Since the MSCI USA Momentum Top 50 Select Index was launched on August 4, 2020 and has a limited operating history, the graph includes hypothetical performance data for the MSCI USA Momentum Top 50 Select Index prior to its launch of August 4, 2020. The hypothetical performance data prior to August 4, 2020 was obtained from the index sponsor’s website, without independent verification. The daily historical closing levels from August 4, 2020 to November 14, 2022 were obtained from Bloomberg Financial Services, without independent verification. (In the graph, historical closing levels can be found to the right of the vertical solid line marker.) You should not take the hypothetical performance data or historical levels of the index as an indication of its future performance. |

|

Calculation Agent |

MSCI Inc. |

|

Index Currency |

USD |

|

|

Reuters Ticker |

.MXUSM50 |

|

Bloomberg Ticker |

MXUSM50 |

|

Rebalancing |

Semi-annual |

|

Index Members |

Variable |

|

|

Annualized Return and Annualized Volatility |

|

Geographical Coverage |

US |

|

The following table provides the annualized return and annualized volatility of the index for each applicable period ended November 14, 2022 (using hypothetical performance data and historical closing levels, as described above). Annualized return represents the average rate of return per annum, calculated as the geometric average of the percentage change of the index during the applicable time period. Annualized volatility is a measure of the historical variability of returns, and is calculated as the square root of 252 multiplied by the sample standard deviation of the daily logarithmic returns of the index during the applicable time period. You should not take any hypothetical or historical annualized return or annualized volatility information regarding the index as an indication of its future performance. |

|

Type |

Price Return |

|

Launch Date |

August 4, 2020 |

|

|

|

Annualized Return |

Annualized Volatility |

|

|

1 Year |

-20.05% |

29.81% |

|

History Available Since |

August 4, 2020 |

|

3 Years* |

16.19% |

32.33% |

|

|

5 Years* |

11.48% |

27.80% |

|

|

Since January 3, 2017* |

13.17% |

26.28% |

|

|

|

|

|

* Historical information begins August 4, 2020 (the index launch date). Hypothetical performance data, which was used for all data prior to August 4, 2020, was obtained from the index sponsor’s website, without independent verification. |

|

|

|

Your investment in securities linked to the index involves certain risks. See “Selected Risk Factors” on page S-3 to read about investment risks relating to such securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this index supplement, the applicable pricing supplement, the applicable product supplement, if any, the applicable general terms supplement, if any, the accompanying underlier supplement, the accompanying prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The securities are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman Sachs & Co. LLC

November 2022 MSCI USA Momentum Top 50 Select Index Supplement dated November 22, 2022.

S-1

|

|

November 2022 MSCI USA Momentum Top 50 Select Index Supplement

Dated November 22, 2022 |

Comparative Performance Data

Index Performance Compared to its Parent Index and a Select Broad-Based Stock Index

For comparative purposes, the graph below shows the performance, from January 3, 2017 through November 14, 2022, of the MSCI USA Momentum Top 50 Select Index (in black), the MSCI USA Index (in gray) and a broad-based equity index, the S&P 500® Index (in blue). The S&P 500® Index seeks to track a representative sample of 500 companies in leading industries of the U.S. economy.

For comparative purposes, each of the MSCI USA Momentum Top 50 Select Index, the MSCI USA Index and the S&P 500® Index have been adjusted to have a closing level of 100.00 on January 3, 2017 by dividing the applicable closing level on each day by that index’s closing level on January 3, 2017 and multiplying the quotient by 100.00.

Since the MSCI USA Momentum Top 50 Select Index was launched on August 4, 2020 and has a limited operating history, the graph includes hypothetical performance data for the MSCI USA Momentum Top 50 Select Index prior to its launch of August 4, 2020. The hypothetical performance data for the MSCI USA Momentum Top 50 Select Index prior to August 4, 2020 used to create this graph was obtained from the index sponsor’s website, without independent verification. The daily historical closing levels of the MSCI USA Momentum Top 50 Select Index from August 4, 2020 to November 14, 2022 used to create this graph were obtained from Bloomberg Financial Services, without independent verification. (In the graph, historical closing levels can be found to the right of the vertical solid line marker.) The daily historical closing levels of the MSCI USA Index and the S&P 500® Index from January 3, 2017 through November 14, 2022 used to create this graph were obtained from Bloomberg Financial Services, without independent verification. You should not take this graph, the hypothetical performance data or historical closing levels of the indices used to create this graph as an indication of the future performance of any index, including the MSCI USA Momentum Top 50 Select Index, or the correlation (if any) between the level of the MSCI USA Momentum Top 50 Select Index and the levels of the MSCI USA Index or the S&P 500® Index.

Comparative Performance of the MSCI USA Momentum Top 50 Select Index (MXUSM50), the MSCI USA Index (MXUS) and a Broad-Based Stock Index (SPX)

Index Annualized Return Compared to its Parent Index and a Select Broad-Based Stock Index

The following table provides a comparison of the annualized returns of the MSCI USA Momentum Top 50 Select Index, the MSCI USA Index and the S&P 500® Index for the applicable period ended November 14, 2022 (using hypothetical performance data and historical closing levels, as described above). Annualized return represents the average rate of return per annum, calculated as the geometric average of the percentage change of the applicable index during the applicable time period. You should not take the hypothetical or historical annualized returns of the indices as an indication of the future performance of any index, including the MSCI USA Momentum Top 50 Select Index.

Comparison of Annualized Returns of the MSCI USA Momentum Top 50 Select Index, the MSCI USA Index and a Broad-Based Stock Index

|

|

1

Year |

3

Years |

5

Years |

Since January 3, 2017 |

|

S&P 500® Index |

-15.49% |

8.52% |

8.94% |

10.05% |

|

MSCI USA Index |

-17.34% |

8.45% |

8.90% |

10.03% |

|

MSCI USA Momentum Top 50 Select Index |

-20.05% |

16.19%* |

11.48%* |

13.17%* |

* Historical information begins August 4, 2020 (the index launch date). Hypothetical performance data, which was used for all data prior to August 4, 2020, was obtained from the index sponsor’s website, without independent verification.

S-2

|

|

November 2022 MSCI USA Momentum Top 50 Select Index Supplement

Dated November 22, 2022 |

Selected Risk Factors

An investment in securities linked to the index is subject to the risks described below as well as the risks and considerations described in the accompanying underlier supplement no. 29, the applicable pricing supplement, the applicable product supplement, if any, the applicable general terms supplement, if any, the accompanying prospectus supplement and the accompanying prospectus. The following risk factors are discussed in greater detail in the accompanying underlier supplement no. 29.

|

|

• |

The Estimated Value of Your Securities At the Time the Terms of Your Securities Are Set On the Trade Date (as Determined By Reference to Pricing Models Used By GS&Co.) Is Less Than the Original Issue Price Of Your Securities |

|

|

• |

Your Securities Are Subject to the Credit Risk of GS Finance Corp., as Issuer, and the Credit Risk of The Goldman Sachs Group, Inc., as Guarantor |

|

|

• |

The Market Value of Your Securities May Be Influenced by Many Unpredictable Factors |

|

|

• |

If the Value of an Underlier Changes, the Market Value of Your Securities May Not Change in the Same Manner |

|

|

• |

The Return on Your Securities Will Not Reflect Any Dividends Paid on an Underlier, or Any Underlier Stock, as Applicable |

|

|

• |

You Have No Shareholder Rights or Rights to Receive Any Shares of an Underlier or Any Underlier Stock, as Applicable |

|

|

• |

Past Performance is No Guide to Future Performance |

|

|

• |

The Policies of an Underlier Sponsor, and Changes that Affect an Underlier to Which Your Securities are Linked, or the Underlier Stocks Comprising Such Underlier, Could Affect the Amount Payable on Your Securities and Their Market Value |

|

|

• |

Except to the Extent That We or Our Affiliates May Currently or in the Future Own Securities of, or Engage in Business With, the Applicable Underlier Sponsor or the Underlier Stock Issuers, There Is No Affiliation Between the Underlier Stock Issuers or Any Underlier Sponsor and Us |

|

|

• |

Your Investment in the Securities Is Subject to Concentration Risks |

|

|

• |

Momentum Securities Risk. Stocks that have previously exhibited high momentum characteristics within a given measurement period may not experience positive momentum in the future or may experience more volatility than the market as a whole. |

|

|

• |

The MSCI USA Momentum Top 50 Select Index Has a Limited Operating History |

S-3

|

|

November 2022 MSCI USA Momentum Top 50 Select Index Supplement

Dated November 22, 2022 |

About This Index Supplement

GS Finance Corp. may use this index supplement in the initial sale of the securities. In addition, Goldman Sachs & Co. LLC (GS&Co.), or any other affiliate of GS Finance Corp., may use this index supplement in a market-making transaction in a security after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this index supplement is being used in a market-making transaction.

S-4

We have not authorized anyone to provide any information or to make any representations other than those contained in or incorporated by reference in this index supplement, the accompanying underlier supplement no. 29, the accompanying prospectus supplement or the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide. This index supplement addendum is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this index supplement addendum, the accompanying index supplement no. 29, the accompanying prospectus supplement and the accompanying prospectus is current only as of the respective dates of such documents.

TABLE OF CONTENTS

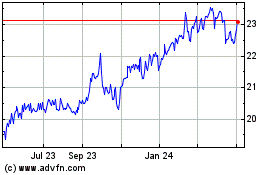

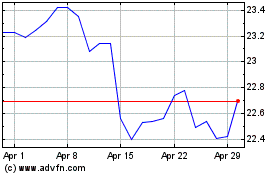

Goldman Sachs (NYSE:GS-A)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goldman Sachs (NYSE:GS-A)

Historical Stock Chart

From Apr 2023 to Apr 2024