Elliott Calls for Board Changes at GlaxoSmithKline Ahead of Consumer-Healthcare Spinoff -- Update

July 01 2021 - 5:50AM

Dow Jones News

--Activist investor Elliott has called on GlaxoSmithKline to

appoint new directors

--Elliott also urged the drugmaker to consider selling its

consumer-healthcare business

--In its first public comments since building a stake in the

company, Elliott criticized GlaxoSmithKline's underperformance

By Adria Calatayud

Activist investor Elliott Management Corp. has called on

GlaxoSmithKline PLC to assess its board and management ahead of a

long-planned separation of its consumer-healthcare business, and to

consider a sale of the unit.

The investor turned up the pressure on GlaxoSmithKline a week

after the U.K. pharmaceutical company outlined its future plans in

an attempt to convince investors that Chief Executive Officer Emma

Walmsley's turnaround efforts will pay off.

In a letter published Thursday, Elliot criticized

GlaxoSmithKline's "poor record of execution and value creation." In

Elliott's first public intervention over GlaxoSmithKline since it

built a stake in the FTSE 100 company, the investor said the

group's combined businesses should be worth around 45% more than

GlaxoSmithKline's current valuation.

Elliott urged the company's board to appoint nonexecutive

directors with biopharma and consumer-healthcare expertise prior to

the separation and to run robust processes for selecting the best

executive leadership for the two businesses, considering both

internal and external candidates.

Ms. Walmsley, who became CEO in 2017, has driven more investment

into research as well as the separation of the consumer-healthcare

business.

"Elliott is not advocating a specific outcome but is arguing for

a robust process, because it is critical that the board assure

current and future shareholders that the new leadership of both

companies was selected through a credible process that conforms to

corporate governance best practices," the investor said. Existing

management should remain in place until a decision is made on new

leadership, Elliott said.

A GlaxoSmithKline spokesperson said the issues identified by

Elliott in its letter aren't new, and that the company's

transformation program has been designed to address those legacy

issues and more.

"We believe our shareholders are supportive of this strategy,

and that they are focused on GSK executing on it without

distraction or delay," the spokesperson said.

Elliott didn't disclose the size of its shareholding in

GlaxoSmithKline, but said it has built a "significant position" in

the company.

The investor said GlaxoSmithKline should incentivize stronger

performance and greater ambition, improve profitability while

investing more in research-and-development, display openness to

value-maximizing pathways and preserve the nimbleness of its

vaccines and pharma operations. It also said GlaxoSmithKline's

vaccines and pharma operations shouldn't be fully integrated, as

they are largely separate in their manufacturing processes and

commercialization.

As part of these considerations, Elliott said GlaxoSmithKline

should remain open to diverting from its base-case plan and

evaluate a sale of its consumer-healthcare business, which

generates nearly one third of the company's revenue. This would

allow the company to accelerate R&D investment, pay down debt

and return remaining proceeds to shareholders, the company

said.

"Any strategic opportunity for the sale of [consumer healthcare]

should be diligently pursued and accompanied by a clear plan for

how GSK will use the proceeds," the investor said.

Last week, the company said the separation of the

consumer-healthcare business would take place in mid-2022 through a

demerger of at least 80% of its 68% holding in the business to

shareholders. GlaxoSmithKline said it would retain up to a fifth of

its holding in the new consumer-healthcare company--which is

expected to be listed London Stock Exchange--and receive a special

dividend of up to 8 billion pounds ($11.06 billion).

The British drugmaker also pledged last week to accelerate

growth in sales and adjusted operating profit over the next five

years, supported by new vaccines and specialty medicines.

Shares in GlaxoSmithKline at 0923 GMT were up 0.5% at 1,427

pence.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

July 01, 2021 05:41 ET (09:41 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

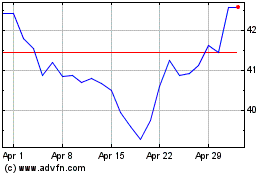

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024