GlaxoSmithKline 2Q Net Profit Boosted by Horlicks Sale Proceeds

July 29 2020 - 7:51AM

Dow Jones News

By Ian Walker

GlaxoSmithKline PLC on Wednesday reported a market-beating net

profit for the second quarter of the year after booking a profit on

the sale of its Horlicks business and other consumer healthcare

brands, and backed its full-year forecast.

The British pharmaceutical giant made a net profit for the

quarter ended June 30 of 2.26 billion pounds ($2.92 billion)

compared with GBP964 million for the same period last year, and a

consensus of GBP1.12 billion taken from FactSet and based on three

analysts' forecasts.

Adjusted earnings per share--a metric closely watched by

analysts that strips out one-off items--fell 38% when accounting

for currency effects, to 19.20 pence from 30.5 pence, missing

analysts' expectations of 19.63 pence, taken from FactSet and based

on nine forecasts.

Sales fell to GBP7.62 billion from GBP7.81 billion, missing a

consensus forecast of GBP7.69 billion provided by FactSet.

Looking ahead, the FTSE 100-listed company reiterated that it

expects adjusted EPS to decline by between 1% and 4% at constant

rates in 2020.

Glaxo has declared a dividend of 19 pence for the quarter and

said it expects the payout to remain unchanged at 80 pence a share

for the year.

Earlier Wednesday Glaxo and French peer Sanofi S.A. said that

they had reached an agreement with the U.K. government to supply up

to 60 million doses of a Covid-19 vaccine, subject to final

contract.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

July 29, 2020 07:36 ET (11:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

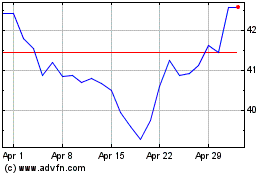

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024