UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

|

|

|

|

|

|

|

|

o

|

Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

|

|

Or

|

|

þ

|

Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

|

For Fiscal year ended: January 3, 2021 Commission File number: 01-14830

GILDAN ACTIVEWEAR INC.

(Exact name of registrant as specified in its charter)

Canada

(Province or other jurisdiction of incorporation or organization)

2200, 2250, 2300

(Primary standard industrial classification code number, if applicable)

Not Applicable

(I.R.S. employer identification number, if applicable)

600 de Maisonneuve Boulevard West, Montreal, Quebec, Canada H3A 3J2, (514) 735-2023

(Address and telephone number of registrant’s principal executive office)

Gildan USA Inc., 1980 Clements Ferry Road, Charleston, SC 29492, (843) 606-3600

(Name, address and telephone number of agent for service in the United States)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Shares

|

GIL

|

New York Stock Exchange

|

|

Rights to Purchase Common Shares

|

GIL

|

New York Stock Exchange

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

þ Annual Information Form þ Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Common Shares:

198,410,119

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Emerging Growth Company o

|

|

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised accounting standards† provided pursuant to Section 13(a) of the Exchange Act o

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicated by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

PRINCIPAL DOCUMENTS

The following documents have been filed as part of the Annual Report on From 40-F:

A.Management's Discussion and Analysis of Gildan Activewear Inc. (the “Registrant”, “Company” or “us”) for the year ended January 3, 2021.

B. Audited comparative consolidated financial statements of the Registrant as at and for the year ended January 3, 2021.

C. Annual Information Form of the Registrant for the year ended January 3, 2021.

DISCLOSURE CONTROLS AND PROCEDURES

A.Evaluation of disclosure controls and procedures

Our disclosure controls and procedures (as such term is defined in the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, Rules 13a-15(e) and 15d-15(e)) are designed to ensure that information required to be disclosed in our reports filed with the SEC is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms and is accumulated and communicated to our management, including our principal executive officer and our principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

An evaluation was carried out under the supervision of, and with the participation of, our management, including our principal executive officer and our principal financial officer, of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this Annual Report on Form 40-F.

Based on that evaluation, our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were effective as of the end of such period.

B. Management’s annual report on internal control over financial reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act.

Our internal control over financial reporting includes those policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

Under the supervision and with the participation of our principal executive officer and our principal financial officer, management conducted an evaluation of the effectiveness of our internal control over financial reporting, as of January 3, 2021, based on the framework set forth in Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Based on that evaluation, our principal executive officer and our principal financial officer concluded that our internal control over financial reporting was effective as of that date.

C. Attestation of the registered public accounting firm.

KPMG LLP (“KPMG”), an independent registered public accounting firm, that audited and reported on our financial statements attached as Exhibit 99.2 to this Annual Report on Form 40-F, has issued an attestation report on the effectiveness of our internal control over financial reporting as of January 3, 2021. The report is included on page 5 of the financial statements attached as Exhibit 99.2 to this Annual Report on Form 40-F.

D. Changes in internal controls over financial reporting.

There have been no changes that occurred during the period beginning on December 30, 2019 and ended on January 3, 2021 in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

The design of any system of controls and procedures is based in part upon certain assumptions about the likelihood of certain events. There can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote.

AUDIT COMMITTEE FINANCIAL EXPERT

The Registrant’s board of directors has determined that it has at least one (1) audit committee financial expert serving on its Audit and Finance Committee. Mr. Russell Goodman has been determined to be such audit committee financial expert and is independent, as that term is defined by the New York Stock Exchange’s listing standards applicable to the Registrant. The SEC has indicated that the designation of Mr. Goodman as an audit committee financial expert does not make Mr. Goodman an “expert” for any purpose, impose any duties, obligations or liability on Mr. Goodman that are greater than those imposed on members of the Audit and Finance Committee and Board of Directors who do not carry this designation, or affect the duties, obligations or liability of any other member of the Audit and Finance Committee.

CODE OF ETHICS

The Registrant adopted a Code of Ethics (the “Code of Ethics”) that applies to all employees and officers, including its principal executive officer, principal financial officer and principal accounting officer. The Code of Ethics is available at the Registrant’s website, http://www.gildancorp.com, and is available, without charge, in print to any shareholder who requests it.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

In addition to retaining KPMG to report upon the annual consolidated financial statements of the Registrant, the Registrant retained KPMG to provide various audit-related and non-audit services in fiscal 2020. The aggregate fees billed for professional services by KPMG for each of the last two (2) fiscal years, were as follows:

Audit Fees - The aggregate audit fees billed by KPMG were Cdn $2,578,750 for the fiscal year ended January 3, 2021 and Cdn $2,459,500 for the fiscal year ended December 29, 2019. These services consisted of professional services rendered for the annual audit of the Company’s consolidated financial statements and the quarterly reviews of the Company’s interim financial statements, and services provided in connection with statutory and regulatory filings or engagements. The fees for the annual audit of the Company’s consolidated financial statements include fees relating to KPMG’s audit of the effectiveness of the Company’s internal control over financial reporting.

Audit-Related Fees - The aggregate audit-related fees billed by KPMG were Cdn $172,940 for fiscal 2020 and Cdn $180,500 for fiscal 2019. These services consisted of consultation concerning financial reporting and accounting standards, and translation services in both years.

Tax Fees - The aggregate tax fees billed by KPMG were Cdn $695,750 for fiscal 2020 and Cdn $956,500 for fiscal 2019. These services consisted of tax compliance, including assistance with the preparation and review of tax returns, assistance regarding income, capital and sales tax audits, and the preparation of annual transfer pricing studies.

All fees billed to the Registrant by KPMG in fiscal 2020 were pre-approved by the Registrant’s Audit and Finance Committee pursuant to the procedures and policies set forth in the Audit and Finance Committee mandate and pursuant to applicable legislation. The mandate of the Audit and Finance Committee is available on the Registrant’s website at http://www1.gildan.com/corporate/IR/corporateGovernance.cfm.

In accordance with the Code of Ethics of the Ordre des comptables professionnels agréés du Québec (CPA) independence standards for auditors, the Sarbanes-Oxley Act of 2002 and rules of the U.S. Securities and Exchange Commission, the Company is restricted from engaging its external auditor to provide certain non-audit services to the Company and its subsidiaries, including bookkeeping or other services related to the accounting records or financial statements, information technology services, valuation services, actuarial services, internal audit services, corporate finance services, management functions, human resources functions, legal services and expert services unrelated to the audit. The Company does engage its external auditor from time to time to provide certain non-audit services other than the restricted services. All non-audit services must be specifically pre-approved by the Audit and Finance Committee.

In fiscal 2020 and fiscal 2019, the Company’s Audit and Finance Committee did not approve any audit-related, tax or other services pursuant to paragraph (c) (7) (i) (C) of Rule 2-01 of Regulation S-X.

OFF BALANCE SHEET ARRANGEMENTS

Leases and Commitments

The Registrant has no commitments that are not reflected in its balance sheets except for purchase obligations, as well as minimum royalty payments, which are included in the table of contractual obligations on page 35 of its Management’s Discussion and Analysis (see Exhibit 99.1) under the caption “Off-balance sheet arrangements and maturity analysis of contractual obligations”, which is incorporated by reference herein. As disclosed in Note 23(b) to the Registrant’s consolidated financial statements (see Exhibit 99.2), the Registrant has issued financial guarantees, irrevocable standby letters of credit and surety bonds amounting to $54.6 million at January 3, 2021.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATION

See page 35 of Exhibit 99.1 under the caption “Off-balance sheet arrangements and maturity analysis of contractual obligations”, which is incorporated by reference herein.

CORPORATE GOVERNANCE PRACTICES

The Registrant has adopted Corporate Governance Guidelines as well as mandates for its board of directors and each of its three committees which are available at the Registrant’s Internet website, http://www1.gildan.com/corporate/IR/corporateGovernance.cfm, and are available in print to any shareholder who requests them. All references in this Annual Report on Form 40-F to websites are inactive textual references, and information contained in or otherwise accessible through the websites mentioned in this Annual Report on Form 40-F does not form part of this Annual Report on From 40-F.

The Registrant is committed to adopting and adhering to corporate governance practices that either meet or exceed applicable Canadian and U.S. corporate governance standards. As a Canadian reporting issuer with securities listed on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”), the Registrant complies with all applicable rules adopted by the Canadian Securities Administrators as well as the rules of the U.S. Securities and Exchange Commission giving effect to the provisions of the U.S. Sarbanes-Oxley Act of 2002.

Although many of the NYSE Corporate Governance Standards (the “NYSE Standards”) do not apply to the Registrant, it nevertheless voluntarily complies with most of the NYSE Standards. In fact, the Registrant’s corporate governance practices differ significantly in only one respect from those required of U.S. domestic issuers under the NYSE Standards, which is with respect to the approval of equity compensation plans. The NYSE Standards require shareholder approval of all equity compensation plans and material revisions to such plans, regardless of whether the securities to be delivered under such plans are newly issued or purchased on the open market, subject to a few limited exceptions. The rules of the TSX (the “TSX Rules”), however, do not require shareholder approval in all those circumstances. The Registrant complies with the TSX Rules in this respect, hence, only the creation or material amendments to equity compensation plans that provide for new issuances of securities are subject to shareholder approval. The Registrant has in place plans which did not require the approval of its shareholders under the TSX Rules but which could have required the approval of its shareholders under the NYSE Standards as applicable to U.S. domestic issuers.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Registrant has a separately-designated standing audit committee, known as the Audit and Finance Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the Registrant's Audit and Finance Committee are Ms. Maryse Bertand, Mr. Marc Caira, Ms. Shirley Cunningham, Mr. Russell Goodman, Mr. Luc Jobin and Mr. Craig A. Leavitt. Please refer to the section of our Annual Information Form entitled "Audit and Finance Committee Disclosure", incorporated by reference herein, for additional information.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the staff of the SEC, and to furnish promptly, when requested to do so by the SEC staff, information

relating to the securities in relation to which the obligation to file an annual report on Form 40-F arises or transactions in such securities.

B. Consent to Service of Process

The Registrant has previously filed with the SEC a written irrevocable consent and power of attorney on Form F-X in connection with the Class A Subordinate Voting Shares (now Common Shares).

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

DATED: February 26, 2021

GILDAN ACTIVEWEAR INC.

/s/ Lindsay Matthews

Name: Lindsay Matthews

Title: Vice-President, General Counsel and Corporate Secretary

-

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

99.1

|

Management’s Discussion and Analysis of the Registrant for the year ended January 3, 2021

|

|

|

99.2

|

Audited comparative consolidated financial statements of the Registrant as at and for the year ended January 3, 2021

|

|

|

99.3

|

Annual Information Form of the Registrant for the year ended January 3, 2021

|

|

|

99.4

|

Consent of KPMG LLP

|

|

|

99.5

|

Officers’ Certifications Required by Rule 13a-14(a) or Rule 15d-14(a)

|

|

|

99.6

|

Officers’ Certifications Required by Rule 13a-14(b) or Rule 15d-14(b) and Section 1350 of Chapter 63 of Title 18 of the United States Code

|

|

|

101

|

XBRL Instance Document

|

|

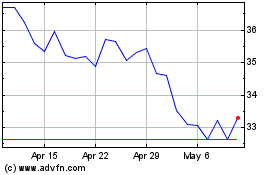

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

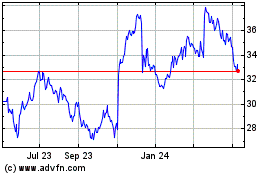

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Apr 2023 to Apr 2024