Amended Statement of Beneficial Ownership (sc 13d/a)

June 24 2021 - 11:58AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

GeoPark Limited

(Name

of Issuer)

Common Stock, $0.001 Par Value Per Share

(Title of Class of Securities)

G38327105

(CUSIP Number)

Gerald E. O’Shaughnessy

8301 E. 21st Street North, Suite 420

Wichita, Kansas 67206, USA

316-630-0247

With a copy to:

Werner F. Ahlers

Janet Geldzahler

Sullivan & Cromwell LLP

125 Broad Street

New York, New

York 10004

212-558-4000

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

June 24, 2021

(Date

of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-l(f) or 240.13d-l(g), check the following box. ☐

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of

securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

CUSIP No. G38327105

|

|

13D

|

|

Page

2

of 7 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

Names of Reporting Persons

Gerald E. O’Shaughnessy

|

|

2

|

|

Check the Appropriate Box

if a Member of a Group

(a) ☒ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Source of Funds

PF

|

|

5

|

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

|

6

|

|

Citizenship or Place of

Organization

U.S.

citizen

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

Sole Voting Power

184,042

|

|

|

8

|

|

Shared Voting Power

6,354,178 (1)

|

|

|

9

|

|

Sole Dispositive Power

184,042

|

|

|

10

|

|

Shared Dispositive Power

6,354,178

(1)

|

|

|

|

|

|

|

|

|

|

11

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

6,538,220 (1)

|

|

12

|

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares

☐

|

|

13

|

|

Percent of Class

Represented by Amount in Row (11)

10.7%

|

|

14

|

|

Type of Reporting Person

(See Instructions)

IN

|

|

(1)

|

Of these shares of Common Stock, 211,015 shares are held by The Timothy P. O’Shaughnessy Foundation, on

the board of which Mr. O’Shaughnessy serves as a non-controlling director and as to which shares he disclaims beneficial ownership.

|

|

|

|

|

|

|

|

CUSIP No. G38327105

|

|

13D

|

|

Page

3

of 7 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

Names of Reporting Persons

GP Investments LLP

|

|

2

|

|

Check the Appropriate Box

if a Member of a Group

(a) ☒ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Source of Funds

OO

|

|

5

|

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

|

6

|

|

Citizenship or Place of

Organization

KANSAS,

USA

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

Sole Voting Power

None

|

|

|

8

|

|

Shared Voting Power

1,123,083 (2)

|

|

|

9

|

|

Sole Dispositive Power

None

|

|

|

10

|

|

Shared Dispositive Power

1,123,083

(2)

|

|

|

|

|

|

|

|

|

|

11

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,123,083 (2)

|

|

12

|

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares

☐

|

|

13

|

|

Percent of Class

Represented by Amount in Row (11)

1.8% (2)

|

|

14

|

|

Type of Reporting Person

(See Instructions)

PN

|

|

(2)

|

Due to a clerical error, the Schedule 13D filed by the Reporting Persons on June 18, 2021 did not correctly

state the number of shares of Common Stock and the resulting percentage of the outstanding shares of Common Stock beneficially owned by such Reporting Persons that resulted from the transfer of 800,000 shares of Common Stock from GPK Holdings, LLC

to GP Investments LLP that was effected on May 18, 2021. This Amendment No. 1 includes the corrected numbers.

|

|

|

|

|

|

|

|

CUSIP No. G38327105

|

|

13D

|

|

Page 4 of 7 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

Names of Reporting Persons

GPK Holdings, LLC

|

|

2

|

|

Check the Appropriate Box

if a Member of a Group

(a) ☒ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Source of Funds

OO

|

|

5

|

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

|

6

|

|

Citizenship or Place of

Organization

KANSAS,

USA

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

Sole Voting Power

None

|

|

|

8

|

|

Shared Voting Power

5,000,000 (2)

|

|

|

9

|

|

Sole Dispositive Power

None

|

|

|

10

|

|

Shared Dispositive Power

5,000,000

(2)

|

|

|

|

|

|

|

|

|

|

11

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

5,000,000 (2)

|

|

12

|

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐

|

|

13

|

|

Percent of Class

Represented by Amount in Row (11)

8.2% (2)

|

|

14

|

|

Type of Reporting Person

(See Instructions)

OO

|

|

(2)

|

Due to a clerical error, the Schedule 13D filed by the Reporting Persons on June 18, 2021 did not correctly

state the number of shares of Common Stock and the resulting percentage of the outstanding shares of Common Stock beneficially owned by such Reporting Persons that resulted from the transfer of 800,000 shares of Common Stock from GPK Holdings, LLC

to GP Investments LLP that was effected on May 18, 2021. This Amendment No. 1 includes the corrected numbers.

|

|

|

|

|

|

|

|

CUSIP No. G38327105

|

|

13D

|

|

Page 5 of 7 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

Names of Reporting Persons

The Globe Resources Group, Inc.

|

|

2

|

|

Check the Appropriate Box

if a Member of a Group

(a) ☒ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Source of Funds

OO

|

|

5

|

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐

|

|

6

|

|

Citizenship or Place of

Organization

KANSAS,

USA

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

Sole Voting Power

None

|

|

|

8

|

|

Shared Voting Power

20,080

|

|

|

9

|

|

Sole Dispositive Power

None

|

|

|

10

|

|

Shared Dispositive Power

20,080

|

|

|

|

|

|

|

|

|

|

11

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

20,080

|

|

12

|

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares

☐

|

|

13

|

|

Percent of Class

Represented by Amount in Row (11)

0.0%

|

|

14

|

|

Type of Reporting Person

(See Instructions)

CO

|

The following constitutes Amendment No. 1 to the Schedule 13D filed by the undersigned (“Amendment

No. 1”). This Amendment No. 1 amends the Schedule 13D as specifically set forth herein.

|

Item 4.

|

Purpose of Transaction

|

Item 4 of the Schedule 13D is hereby amended to add the following:

On June 24, 2021, Mr. O’Shaughnessy issued an open letter to Issuer’s shareholders announcing that the Reporting Persons

were initiating a

“vote no” campaign against one or more directors of the Issuer at the annual meeting of shareholders of the Issuer. A copy of this letter is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Also attached hereto as Exhibit 99.2 and incorporated herein by reference is a proxy statement with respect to the “vote no” campaign. The Reporting Persons strongly advise all stockholders of the Issuer to read these materials. In

addition, the Reporting Persons will provide copies of the proxy statement without charge upon request. Requests for copies should be directed to the Reporting Persons’ proxy solicitor specified in the proxy statement.

|

Item 5.

|

Interest in Securities of the Issuer

|

Item 5 of the Schedule 13D is hereby amended and supplemented as follows:

The following sentence replaces in its entirety the sentence “As of December 31, 2020, 5,800,000 shares over which Mr. O’Shaughnessy

has direct or indirect voting or dispositive power have been pledged pursuant to lending arrangements.”:

As a result of a transfer

of 800,000 shares from GPK Holdings, LLC to GP Investments LLP on May 18, 2021 and the release of a pledge on such shares pursuant to previously disclosed lending arrangements, as of June 24, 2021, the number of shares over which Mr.

O’Shaughnessy has direct or indirect voting or dispositive power that have been pledged pursuant to lending arrangements is 5,000,000.

|

Item 7.

|

Material to be Filed as Exhibits

|

|

|

|

|

Exhibit

Number

|

|

Exhibit Name

|

|

|

|

|

99.1

|

|

Letter from Gerald O’Shaughnessy Urging Shareholders to Vote Against Four Company Director Nominees, dated June 24, 2021.

|

|

|

|

|

99.2

|

|

Solicitation of Against Votes at the Annual General Meeting, dated June 24, 2021.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

By:

|

|

/s/ Gerald E. O’Shaughnessy

|

|

|

|

Name: Gerald E. O’Shaughnessy

|

|

|

|

Date: June 24, 2021

|

|

|

|

GP Investments LLP

|

|

|

|

|

By:

|

|

/s/ Gerald E. O’Shaughnessy

|

|

|

|

Name: Gerald E. O’Shaughnessy

|

|

|

|

Date: June 24, 2021

|

|

|

|

GPK Holdings, LLC

|

|

|

|

|

By:

|

|

/s/ Gerald E. O’Shaughnessy

|

|

|

|

Name: Gerald E. O’Shaughnessy

|

|

|

|

Date: June 24, 2021

|

|

|

|

The Globe Resources Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Gerald E. O’Shaughnessy

|

|

|

|

Name: Gerald E. O’Shaughnessy

|

|

|

|

Date: June 24, 2021

|

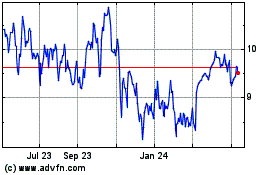

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

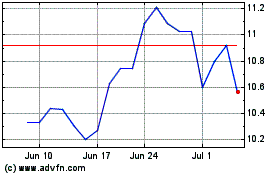

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024