By Nora Naughton

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 26, 2019).

After 40 days of picketing, the United Auto Workers union is

ending its nationwide strike at General Motors Co.

The UAW said Friday it has secured a new labor deal with GM,

resolving one of the nation's longest private-sector walkouts in

years and allowing the Detroit car company to restart its U.S.

factories.

GM workers voted 57% in favor of approving the new four-year

agreement, which includes better wages, hefty signing bonuses and a

commitment from GM to invest $7.7 billion in its U.S. manufacturing

operations, securing 9,000 jobs.

The new labor accord, covering more than 46,000 blue-collar

workers, will allow GM to move forward with closing three U.S.

factories, including a massive assembly plant in Lordstown, Ohio.

Workers will return to work immediately, and GM plans to resume

production as soon as possible at more than 30 U.S. factories that

have sat idle for six weeks, a company spokesman said.

The car company will schedule overtime to make up for lost

production, giving workers who have been without a paycheck for six

weeks a way to recoup their finances.

Among the auto maker's first priorities is to fill back-ordered

parts at dealerships, which have had to delay repairs. GM plans to

have its plants running full-tilt again early next week, the

spokesman said.

The new contract represents a victory for UAW President Gary

Jones, who will next turn the union's attention to contract talks

at Ford Motor Co. UAW negotiators will use the GM agreement as a

template for reaching similar deals with the other two U.S. car

companies, a tactic typical in pattern bargaining.

The strike, the company's longest nationwide walkout in nearly a

half century, crippled GM's U.S. manufacturing operations and

rippled through the broader economy, resulting in temporary layoffs

for thousands of non-UAW workers. The financial toll on GM and the

Midwest economy will continue to linger well after the strike

ends.

Analysts estimate the disruption to GM's U.S. factories, as well

as those in Mexico and Canada that were idled because of parts

shortages, has cost GM roughly 300,000 units of lost vehicle

production that it will now have to make up.

The damage to GM's bottom line is likely to exceed $3 billion

with most of the hit to be reported in the fourth quarter,

according to Bank of America. On top of that, the new union

agreement is expected to tack on $100 million or more a year in

higher labor costs, industry analysts estimate.

The strike's impact also cut deep for GM's auto-parts suppliers.

Many were forced to idle their own plants and temporarily lay off

workers. For some, such as Magna International Inc. and Lear Corp.,

the work stoppage could shave more than 3% from their 2019

earnings, according to analysts at Citigroup Inc.

GM workers won some considerable gains in this latest round of

bargaining, including better pay for new hires, a path to full-time

status for temps and no changes to the employee health-care

contribution, currently at 3% and far lower than the average for

other private-sector workers. They also will receive a one-time

$11,000 bonuses for ratifying the contract.

Still, some UAW members had reservations, expecting more after

spending six weeks on strike without a company paycheck.

Aaron Fowlkes, a production worker at GM's Orion Township,

Mich., assembly plant, said he isn't totally sold on the new

contract, mostly because he doesn't feel it goes far enough on job

security, but voted yes anyway. "If we send it back, what's our end

game?" he said. "I don't know if there's anything else we can ask

for that is feasible."

Some of the gains achieved by the UAW at GM will be a harder

sell at Ford and Fiat Chrysler, which aren't as strong financially

and have different workforce needs, labor experts say.

With 56,000 UAW-represented employees, Ford's hourly workforce

is much larger than GM's, and it is confronting a fast-rising

health-care tab that is expected to exceed $1 billion annually next

year.

Fiat Chrysler is likely to have more trouble absorbing costs

associated with the changes on temporary workers and new-hire pay,

mostly because it has a relatively newer workforce, with many

members still not earning the top wage. The company has about

47,200 UAW-represented workers, and about half of those working in

manufacturing earn less than full pay of nearly $30 an hour.

"This pattern is pretty costly because one of the big things GM

won is closing plants that will save billions," said Kristin

Dziczek, an economist and labor expert at the Center for Automotive

Research in Ann Arbor, Mich. "The other two don't want to close

plants. If you don't want to close plants, what is the win for the

company?"

(END) Dow Jones Newswires

October 26, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

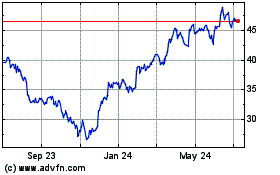

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

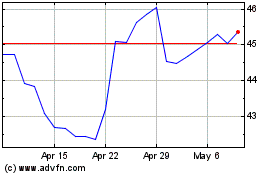

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024