By Mike Colias and Nora Naughton

General Motors Co. and the United Auto Workers are nearing a

contract deal to end a 30-day strike at the company's factories

with bargainers moving closer on earlier sticking points and

leaders from each side engaging in high-level talks.

GM Chief Executive Mary Barra for the first time since the

strike began met with UAW officials at the bargaining table Tuesday

morning in an effort to solidify an agreement, according to people

familiar with the discussions. UAW President Gary Jones also

attended the bargaining session, as did GM President Mark Reuss,

one of Ms. Barra's top lieutenants, the people said.

After clashing publicly last week, GM and the union made

progress during lengthy bargaining sessions in recent days, working

through thorny issues including wages and the pay scale for new

hires, the people said. In a sign of progress, UAW leadership on

Monday called union-hall officials from GM's plants across the

country to Detroit for a Thursday "contract update."

Ms. Barra met with Mr. Jones last week for a private meeting in

offices at GM's headquarters in Detroit but the CEO hasn't attended

regular bargaining sessions. The UAW and GM are negotiating for a

new four-year labor agreement to replace one that expired

mid-September for more than 46,000 GM hourly workers.

GM shares were up 2% in morning trading Tuesday. They have

declined about 7% since the strike began.

GM has given ground on one of the union's key demands by

proposing to shrink the eight-year period that a new hire must work

to reach top wage, now about $30 an hour, people close to the talks

said.

The sides have spent recent bargaining sessions working out the

details of those changes and how they would affect the broader

structure of any deal, the people said.

The Detroit car maker has also offered to raise pay in each of

the contract's four years through a combination of wage increases

and bonus payouts, though the overall framework of the structure is

still being negotiated, the people said.

Union bargainers had pressed for wage bumps in each year. GM's

proposal is to increase wages by 3% in two of the contract's four

years, with lump-sum bonus payments of 4% in the other two years,

the people said.

Those bonus payouts have been used by GM and the other Detroit

auto makers in the past to keep a lid on long-term labor costs. The

union has pressed for wage increases each year to lock in higher

pay rates beyond the contract's four-year term.

On Monday, the UAW set a national meeting of its GM council, a

group of more than 100 local union leaders from around the country,

for a contract update on Thursday in Detroit. This is typically a

sign the sides are nearing an agreement, as the council must vote

to distribute a tentative agreement to members for

ratification.

Union and company bargainers now are discussing the finer points

of new contract language, having found common ground after earlier

differences including on health care, profit-sharing and a pathway

to full-time status for temporary workers, the people close to the

talks said. This progress moves negotiations closer to the final

stages, though these people cautioned the situation is fluid and

the process already has been marked by numerous setbacks.

Last week, UAW leaders and GM executives publicly sparred over

the pace of talks, accusing each other of impeding negotiations.

Heading into the weekend, Terry Dittes, the UAW's top bargainer

with GM, told members in a Friday letter the union had presented a

contract proposal that could result in a settlement if the company

accepts.

The pay disparity between new hires and veteran workers has been

a point of contention throughout talks and remains a final major

subject of bargaining as negotiators work out the details of a

compressed path to full wages, the people close to the talks

say.

The UAW has long been frustrated that workers with less

seniority must wait years to reach pay parity with longer-tenured

factory employees, and its leaders have been pushing to shorten the

timetable. New workers start at about $17 an hour and receive pay

increases each year until they arrive at the top wage.

The financial damage continues to mount for GM. Credit Suisse

analyst Dan Levy last week estimated the strike's cost to GM at

about $1.5 billion, even if the company manages to recoup some lost

production after the strike ends. The hit comes from lost output of

more than 100,000 vehicles as well as disruption to a major

cost-cutting plan GM outlined late last year that was aimed at

eliminating $4.5 billion in annual expenses.

"We expect GM may need to walk back some of those [cost-saving

estimates]," Mr. Levy wrote in an investor note Friday.

GM's cost-cutting moves, which included plans to close four U.S.

factories, stoked anger among UAW officials and workers and in part

led union leaders in recent days to push for greater job

security.

Last week, Mr. Dittes told members in a letter that any gains in

wages and benefits wouldn't matter without a concrete commitment

from GM to build vehicles in U.S. factories. The UAW has long

criticized GM for importing vehicles built in Mexico and China to

the U.S. market.

"We believe that the vehicles GM sells here should be built

here," Mr. Dittes wrote to members on Oct. 8. "We don't understand

GM's opposition to this proposition."

The union wants to strengthen the language in the current

moratorium on plant closings and sales, one person close to the

talks said. In the 2015 contract, the sides agreed that GM wouldn't

close or idle any factories outside of collective bargaining,

barring extreme market conditions or "an act of God."

GM's description of the factories as "unallocated" in November,

to indicate no future vehicles were earmarked to be built at those

four UAW-represented factories in the near future, deliberately

avoided these terms, the union has said.

An updated offer from GM early last week boosted the amount the

company intends to spend on U.S. factories to around $9 billion,

from $7 billion previously, the people close to the talks said.

That investment figure includes upgrades to a Detroit assembly

plant that is now slated for closure, where GM plans to build a new

electric-pickup truck in coming years.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

October 15, 2019 12:53 ET (16:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

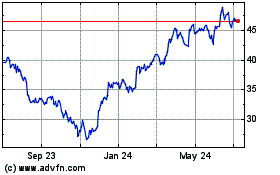

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

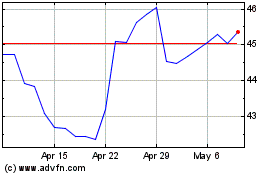

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024