General Mills Anticipates Higher Demand Beyond Pandemic -- Update

December 17 2020 - 12:12PM

Dow Jones News

By Annie Gasparro

General Mills Inc. on Thursday said the initial surge in sales

at the start of the pandemic is moderating but expects to benefit

from consumers choosing to eat more at home for years as they

continue to grapple with financial strain or work remotely.

"What we have learned from past recessions is that one of the

first ways consumers look to save money is by eating at home more

than at restaurants," Chief Executive Jeff Harmening said in an

interview.

Sales at General Mills' North America retail division, which

includes U.S. groceries, rose 9% in the latest quarter from a year

ago, after jumping 14% in the quarter that ended in August.

Campbell Soup Co. last week reported a similar trend, with sales

growth receding.

Still, General Mills and Campbell are among the companies

continuing to bet on expectations that people will keep eating at

home more than they used to long term.

Mr. Harmening said many consumers are enjoying the benefits of

working from home and having more time with their families. "I am

highly confident people won't be going into the office as much as

they used to; they won't be going on as many business trips," Mr.

Harmening said. "That means eating more at home."

The coronavirus pandemic has provided big food makers with an

opportunity to attract millions of new consumers who filled their

pantries and refrigerators in the early months of the pandemic as

dining rooms closed and they hunkered down at home. The companies

said they want to capitalize on the momentum by investing in

marketing and production capacity.

"This is really about ensuring that we have a shot at holding on

to some of the gains that we're seeing in this environment," Mr.

Harmening said.

In the latest quarter, General Mills' sales rose 7% to $4.72

billion, topping analysts' expectation of $4.65 billion. Its

adjusted earnings per share of $1.06 also beat Wall Street's

estimate of 97 cents. General Mills shares rose slightly Thursday,

in line with the broader stock market.

General Mills, which makes Cheerios, Yoplait yogurt, Progresso

soup and more, said many of its brands have gained market share

this year.

Mr. Harmening said improvements the company made to its

ingredients and recipes before the pandemic have attracted

consumers. For instance, General Mills had made changes to reduce

sugar in its yogurt and add protein in its cereals.

General Mills said it has largely rebuilt inventories of its

food that were depleted in the early months of the pandemic, but it

still has significant capacity issues with soup, dessert mixes and

Old El Paso taco shells.

Distributions of coronavirus vaccines in the U.S. began this

week, injecting optimism that the end of the pandemic is in sight.

However, case counts, hospitalizations and deaths from the virus

continue to rise -- a reminder of the virus' toll on the U.S.

"We're still very much in the midst of a pandemic," Mr.

Harmening said. "The widespread impact of vaccination will likely

take time."

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

December 17, 2020 11:57 ET (16:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

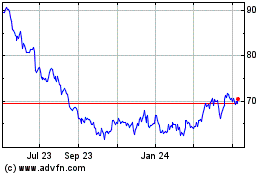

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

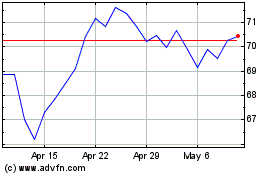

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024