New Junk Bond Sales Add to Growing Tally

April 23 2020 - 3:10PM

Dow Jones News

By Sam Goldfarb

A rush to raise cash in the high-yield bond market picked up

momentum Thursday, with US Foods Holding Corp., Gap Inc. and MGM

Resorts International among the latest companies to announce new

bond sales.

At least seven businesses rated below investment-grade by a

major ratings firm began marketing new bonds Thursday -- looking to

add to a growing tally of businesses that have taken advantage of

investors' improved demand for riskier debt.

Before the new sales were announced, this week's projected

high-yield bond issuance was already expected to exceed $6 billion,

according to LCD, a unit of S&P Global Market Intelligence.

That comes after companies issued $15.8 billion last week -- the

eighth-largest weekly total on record, according to LCD.

The coronavirus pandemic is behind many of the bond sales, as

companies facing a sharp decline in revenue try to avoid running

out of cash.

Gap is expected to issue around $2 billion of new secured bonds

for general corporate purposes and repay existing debt. The apparel

chain -- which like most retailers has closed its North American

stores -- warned Thursday that it had already burned through half

its cash savings, even after drawing down its entire credit line

and skipping April rent payments.

MGM Resorts, which has also closed properties, said Thursday it

would issue $500 million of unsecured bonds to bolster its

liquidity.

Investors' appetite for high-yield bonds is significantly

greater than it was a month ago. The average extra yield, or

spread, investors demand to hold speculative-grade bonds over U.S.

Treasurys was 7.61 percentage points Wednesday, according to

Bloomberg Barclays data. That was down from 11.0 percentage points

on March 23, though still up from around 3.5 percentage points in

mid-February.

In recent trading, the yield on the benchmark 10-year U.S.

Treasury note was 0.600%, according to Tradeweb, compared with

0.618% Wednesday. Yields fall when bond prices rise.

Write to Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

April 23, 2020 14:55 ET (18:55 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

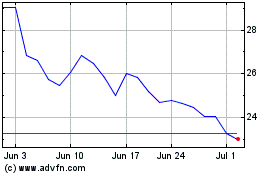

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024