Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

May 09 2019 - 5:20PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☒

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Under Rule 14a-12

|

|

GANNETT CO., INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

MNG ENTERPRISES, INC.

MNG INVESTMENT HOLDINGS LLC

STRATEGIC INVESTMENT OPPORTUNITIES LLC

ALDEN GLOBAL CAPITAL LLC

HEATH FREEMAN

DANA NEEDLEMAN

STEVEN ROSSI

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

MNG Enterprises, Inc.,

together with the other participants in the solicitation (collectively, “MNG”), has filed a definitive proxy statement

and an accompanying BLUE proxy card with the Securities and Exchange Commission to be used to solicit proxies for the election

of its slate of director nominees at the 2019 annual meeting of stockholders of Gannett Co., Inc., a Delaware corporation (the

“Company”).

On May 9, 2019, MNG delivered

the following letter to shareholders of the Company:

MNG ENTERPRISES, INC. May 8 , 2019 Dear Fellow Gannett Shareholders : MNG ENTERPRISES URGES GANNETT SHAREHOLDERS: VOTE FOR CHANGE NOW! The annual meeting of shareholders of Gannett Co . , Inc . (“Gannett” or the “Company”) to be held on May 16 , 2019 offers you a clear choice : either endorse the Company’s current board of directors (the “Board”) and Gannett’s status quo, with its prolonged underperformance since its 2015 spin - off and its risky, unproven and unprofitable “digital transformation”, 1 OR vote on the BLUE Proxy card for ALL THREE of MNG’s highly qualified director nominees who will serve as an immediate catalyst for change to maximize value for all Gannett shareholders, including by supporting a full review of strategic alternatives . The choice is clear : 2 MNG NOMINEES: “VALUE CATALYST” GANNETT INCUMBENTS: “STATUS QUO” Core business in decline Continuing underperformance in Q1 with no end in sight – additional declines projected for 2019 Failure to adequately explore premium cash acquisition offer Risky, unproven and unprofitable “digital transformation” strategy Leadership void: no CEO and departure of the head of ReachLocal in early 2019 Increased leverage since 2015 spin - off 2 Support immediately commencing a full review of strategic alternatives to maximize value for all shareholders MNG’s premium $12/share cash offer to acquire Gannett All other offers duly considered New perspective on running core business profitably and sustainably Moratorium on overpriced and value - destructive digital acquisitions

MNG ENTERPRISES, INC. THE VERDICT IS IN: THE INCUMBENT BOARD’S DIGITAL TRANSFORMATION STRATEGY HAS FAILED TO GENERATE PROFITABLE GROWTH AND CONTINUES TO DESTROY VALUE FOR GANNETT SHAREHOLDERS Gannett’s most recent earnings announcement confirms what MNG has been saying all along – that Gannett is an underperformer and its multi - year “digital transformation” is not working and extremely unlikely to produce a $ 12 per share valuation . Gannett’s key performance metrics have continued to worsen and the Company’s performance since its 2015 spin - off looks even worse given Gannett’s first quarter 2019 results . This includes : 3 We believe Gannett is acting like a 1990 s dot . com internet company, touting clicks, eyeballs and selling cheap digital subscriptions instead of focusing on what truly drives value – profitability . We believe there is little reason to believe that Gannett’s digital transformation strategy will turn things around at Gannett, or that Gannett has the leadership team in place to execute that strategy . Starting May 7 th , Gannett is without a CEO and is run by a newly appointed interim COO with a predominantly legal (rather than operational) background . NET INCOME 98% DILUTED EPS 98% OPERATING INCOME 90% FREE CASH FLOW 66% SINCE SPIN - OFF 3 Gannett’s supposed panacea – its “digital transformation” – is highly risky and, in the words of Institutional Shareholder Services, Inc. (“ISS”), “yet to bear fruit.” As ISS stated in its report: 4 “Moreover, it is worth noting that GCI's digital transformation has yet to bear fruit, as evidenced by the fact that ReachLocal has had operating expenses in excess of revenue every year since FY 2016 , while the publishing segment's operating income and operating margin have declined since 2016 (despite digital sources accounting for a larger proportion of the segment's revenue mix) – these factors, along with the earnings and revenue miss in February, suggest that there is execution risk inherent in the standalone plan . ” (emphasis added) 4

MNG ENTERPRISES, INC. THE BEST WAY TO ENSURE MUCH - NEEDED CHANGE AT GANNETT IS TO VOTE FOR ALL THREE MNG NOMINEES We appreciate that leading shareholder advisory firm ISS has recognized the need for change at Gannett . But to truly bring about change, it is imperative that shareholders vote the BLUE card for ALL THREE of MNG’s nominees – Heath Freeman, Dana Needleman and Steven Rossi . The election of ALL THREE of MNG’s nominees is needed to send a clear message to the incumbent directors that the status quo is not acceptable, and the Board needs to explore all possible ways to enhance value for all Gannett shareholders . Without the election of ALL THREE of MNG’s nominees, the incumbent directors may continue to resist any change to the Company’s current strategy, despite severe declines in profitability and value destruction since Gannett’s 2015 spin - off . VOTE THE BLUE CARD FOR FREEMAN, NEEDLEMAN & ROSSI MNG’s nominees will be strong advocates for change and have the right mix of newspaper turnaround, real estate, and capital allocation expertise to improve the Gannett Board ; would provide the objective perspective, experience and oversight required to put Gannett on the path to a profitable and sustainable future ; and are committed to maximizing value for all Gannett shareholders now before further value is destroyed . MNG’s nominees are committed to listening to all Gannett shareholders and exploring all possible ways to enhance value at Gannett . As seen by MNG’s switch to a minority slate that was based on feedback from other Gannett shareholders who wanted meaningful Board change but also wanted to preserve continuity at the Board, MNG and its nominees embrace and respect the views of all Gannett shareholders . Our sole focus is to maximize value for all shareholders, and if elected, our three nominees will aim to serve as a true shareholder voice on the Gannett Board . A VOTE FOR MNG’S NOMINEES IS A VOTE FOR CHANGE Sincerely, /s/ R. Joseph Fuchs On behalf of the Board of Directors, MNG Enterprises, Inc. Chairman, R. Joseph Fuchs Gannett’s struggles were chronicled just days ago in The Wall Street Journal , 5 which wrote: “Local papers have suffered sharper declines in circulation than national outlets and greater incursions into their online advertising businesses from tech giants such as Alphabet Inc . ’s Google and Facebook Inc . The data also shows that they are having a much more difficult time converting readers into paying digital customers … Gannett, which has a big audience across its local papers, is especially inefficient, converting just 0 . 4 % of its digital audience into paying subscribers , according to the Journal’s analysis of digital audience and subscription data . ” (emphasis added) 5

MNG ENTERPRISES, INC. Okapi Partners LLC is assisting us with the solicitation of proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares of Common Stock, please contact: Okapi Partners LLC 1212 Avenue of the Americas, 24 th Floor New York, New York 10036 (212) 297 - 0720 (Main) Stockholders Call Toll - Free: (888) 785 - 6668 Email: info@okapipartners.com www.SaveGannett.com 1 Since spin - off, Gannett has spent $350mm on digital acquisitions while diluted EPS has declined 98% (represents decline in trailing 12 months diluted EPS from June 28, 2015 to March 31, 2019). 2 Gannett moved from a net cash position of $62mm as of June 28, 2015 to a net debt position of $211mm as of March 31, 2019. 3 Changes in Gannett financial results since its 2015 spin - off from its former parent company reflect changes in trailing 12 - month financials from June 28, 2015 to March 31, 2019. 4 Gannett Co., Inc. – ISS report published on May 2, 2019; permission to quote from report was neither sought nor obtained. 5 In News Industry, a Stark Divide Between Haves and Have - Nots , Local newspapers are failing to make the digital transition larger players did — and are in danger of vanishing , Keach Hagey, Lukas I. Alpert and Yaryna Serkez, Wall Street Journal, 4 May 2019.

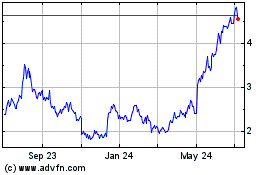

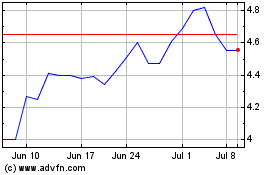

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024