Post-effective Amendment to an Automatic Shelf Registration of Form S-3asr or Form F-3asr (posasr)

December 03 2020 - 9:30AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on December 3, 2020

Securities Act File No. 333-231221

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-2

|

|

|

|

|

|

|

|

|

Registration Statement

|

|

☒

|

|

|

|

under

|

|

|

|

|

|

the Securities Act of 1933

|

|

|

|

|

|

Pre-Effective Amendment No.

|

|

☐

|

|

|

|

Post-Effective Amendment No. 1

|

|

☒

|

FS KKR Capital Corp.

(Exact name of registrant as specified in charter)

201 Rouse

Boulevard

Philadelphia, PA 19112

(215) 495-1150

(Address and telephone number, including area code, of principal executive offices)

Michael C. Forman

FS

KKR Capital Corp.

201 Rouse Boulevard

Philadelphia, PA 19112

(Name and address of agent for service)

COPIES TO:

James A. Lebovitz

David J. Harris

Dechert

LLP

Cira Centre

2929 Arch Street

Philadelphia, PA 19104

Tel: (215) 994-4000

Fax: (215) 994-2222

Approximate Date of Commencement of Proposed Public Offering: From time to time after the effective date of this Registration

Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,

check the following box ☐

If any securities being registered on this Form will be offered on a delayed or continuous

basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan, check the following box. ☒

If this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto, check the following

box ☐

If this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto

that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box ☐

It is proposed that this filing will become effective (check appropriate box):

|

|

☐

|

When declared effective pursuant to section 8(c) of the Securities Act

|

Check each box that appropriately characterizes the Registrant:

|

|

☐

|

Registered Closed-End Fund

(closed-end company that is registered under the Investment Company Act of 1940 (the “Investment Company Act”)).

|

|

|

☒

|

Business Development Company (closed-end company that intends or has

elected to be regulated as a business development company under the Investment Company Act.

|

|

|

☐

|

Interval Fund (Registered Closed-End Fund or a Business Development

Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

|

|

|

☒

|

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

|

|

|

☒

|

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

|

|

|

☐

|

Emerging Growth Company (as defined by Rule 12b-2 under the Securities

and Exchange Act of 1934).

|

|

|

☐

|

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

|

|

|

☐

|

New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months

preceding this filing).

|

CALCULATION

OF REGISTRATION FEE UNDER THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

Title of Securities

Being Registered

|

|

Proposed

Maximum

Aggregate

Offering Price (1) (2)

|

|

Amount of

Registration Fee (1) (2)

|

|

Common Stock, $0.001 par value per share (3)

|

|

|

|

|

|

Preferred Stock, $0.001 par value per share (3)

|

|

|

|

|

|

Warrants

(3)

|

|

|

|

|

|

Subscription Rights (4)

|

|

|

|

|

|

Debt Securities

(5)

|

|

|

|

|

|

Total

|

|

$2,045,000,000 (5)

|

|

$241,259.50

|

|

|

|

|

|

(1)

|

Estimated pursuant to Rule 457(o) under the Securities Act, solely for the purpose of determining the

registration fee. The proposed maximum offering price per security will be determined, from time to time, by the Registrant in connection with the sale by the Registrant of the securities registered under this registration statement.

|

|

(2)

|

The Registrant previously registered an aggregate offering price of $1,500,000,000 under the Registrant’s

Registration Statement on Form N-2 (File No. 333-231221), initially filed with the Commission on May 3, 2019 (the “Original Registration

Statement”), for which a filing fee of $181,800.00 was previously paid. In accordance with Rule 462(e) under the Securities Act, an additional proposed maximum offering price of $545,000,000 is hereby registered and an additional filing fee

of $59,459.50 is being paid in connection with such registration.

|

|

(3)

|

Subject to Note 6 in the Original Registration Statement, an indeterminate number of shares of common stock,

preferred stock or warrants as may be sold, from time to time, are being registered hereunder. Warrants may represent rights to purchase common stock, preferred stock or debt securities.

|

|

(4)

|

Subject to Note 6 in the Original Registration Statement, an indeterminate number of subscription rights as may

be sold, from time to time, representing rights to purchase common stock, are being registered hereunder.

|

|

(5)

|

Subject to Note 6 in the Original Registration Statement, an indeterminate principal amount of debt securities

as may be sold, from time to time, are being registered hereunder. If any debt securities are issued at an original issue discount, then the offering price shall be in such greater principal amount as shall result in an aggregate price to investors

not to exceed $2,045,000,000.

|

|

(6)

|

In no event will the aggregate offering price of all securities issued from time to time pursuant to this

registration statement exceed $2,045,000,000.

|

The Registration Statement shall become effective upon filing with the Securities and

Exchange Commission in accordance with Rule 462(e) under the Securities Act of 1933, as amended.

EXPLANATORY NOTE AND INCORPORATION BY REFERENCE

This Post-Effective Amendment No. 1 to Registration Statement on Form N-2 is being filed by FS

KKR Capital Corp. (the “Registrant”) with the U.S. Securities and Exchange Commission (the “Commission”) to register an additional $545,000,000 of proposed maximum offering price of securities. This

Registration Statement incorporates by reference the contents of the Registrant’s Registration Statement on Form N-2 (File No. 333-231221), initially filed

with the Commission on May 3, 2019 (the “Original Registration Statement”), which became immediately effective, including each of the documents filed by the Registrant with the Commission and all the exhibits thereto. The

required opinions of counsel and related consents and accountant’s consent are attached hereto and filed herewith. The contents of the Original Registration Statement, including the exhibits thereto and incorporated by reference therein, are

incorporated by reference into this Registration Statement.

OTHER INFORMATION

Item 25. Financial Statements and Exhibits

2) Exhibits

Signatures

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant has duly caused this Post-Effective Amendment

No. 1 to Registration Statement on Form N-2 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Philadelphia and Commonwealth of Pennsylvania, on the 3rd day of

December, 2020.

|

|

|

|

|

FS KKR CAPITAL CORP.

|

|

|

|

|

By:

|

|

/s/ Michael C. Forman

|

|

Name:

|

|

Michael C. Forman

|

|

Title:

|

|

Chief Executive Officer

|

Pursuant to the requirements of the Securities Act of 1933, this Post-Effective Amendment No. 1 to

Registration Statement on Form N-2 has been signed below by the following persons in the capacities and on the dates indicated:

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Michael C. Forman

Michael C. Forman

|

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

|

December 3, 2020

|

|

|

|

|

|

/s/ Steven Lilly

Steven Lilly

|

|

Chief Financial Officer

(Principal Financial Officer)

|

|

December 3, 2020

|

|

|

|

|

|

/s/ William Goebel

William Goebel

|

|

Chief Accounting Officer

(Principal Accounting Officer)

|

|

December 3, 2020

|

|

|

|

|

|

*

Todd

Builione

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

*

Barbara

Adams

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

*

Brian R.

Ford

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

*

Richard I.

Goldstein

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

*

Michael J.

Hagan

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

*

Jeffrey K.

Harrow

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

*

Jerel A.

Hopkins

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

*

James H.

Kropp

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

/s/ Osagie Imasogie

Osagie Imasogie

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

/s/ Elizabeth Sandler

Elizabeth Sandler

|

|

Director

|

|

December 3, 2020

|

|

|

|

|

|

*By:

|

|

/s/ Michael C. Forman

|

|

|

|

Michael C. Forman,

Attorney-in-Fact

|

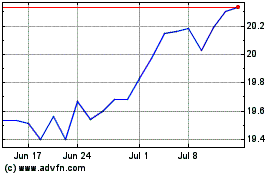

FS KKR Capital (NYSE:FSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

FS KKR Capital (NYSE:FSK)

Historical Stock Chart

From Apr 2023 to Apr 2024