Current Report Filing (8-k)

June 23 2020 - 4:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): June 23, 2020

FS KKR Capital Corp.

(Exact

name of Registrant as specified in its charter)

|

Maryland

|

|

814-00757

|

|

26-1630040

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

|

|

|

|

|

201

Rouse Boulevard

Philadelphia,

Pennsylvania

|

|

19112

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (215) 495-1150

None

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

stock

|

|

FSK

|

|

New

York Stock Exchange

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

☐

|

Emerging

growth company

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

FS KKR Capital Corp. (the “Company”)

held its Annual Meeting of Stockholders (the “Annual Meeting”) on June 23, 2020. As of April 20, 2020, the record date

(the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting,

495,032,065 shares of common stock were eligible to be voted in person or by proxy.

As previously announced, on June 15, 2020, the Company effected a 4 to 1 reverse split of the Company’s shares of common

stock (the “Reverse Stock Split”). As a result of the Reverse Stock Split, every four shares of the Company’s

common stock issued and outstanding were automatically combined into one share of the Company’s common stock. As adjusted

to give effect to the Reverse Stock Split, at the close of business on the Record Date, there would have been 123,758,016 shares

of the Company’s common stock (instead of 495,032,065), constituting all of

the outstanding voting securities of the Company. The Reverse Stock Split did not modify the rights or preferences of the Company’s

common stock. Of the eligible shares of common stock to be voted, 61,694,461 were voted in person or by proxy at the Annual Meeting.

Stockholders were asked to consider and

act upon the following proposals, each of which was described in the Company’s definitive proxy statement filed with the

Securities and Exchange Commission (the “SEC”) on April 21, 2020:

|

|

●

|

Proposal No. 1 – to elect the following individuals

as Class A Directors, each of whom has been nominated for election for a three year term expiring at the 2023 annual meeting

of the stockholders: (a) Elizabeth J. Sandler, (b) Michael J. Hagan, (c) Jeffrey K. Harrow and (d) James H.

Kropp (the “Director Proposal”);

|

|

|

●

|

Proposal No. 2 – to approve a proposal to allow the

Company in future offerings to sell its shares below net asset value per share in order to provide flexibility for future sales

(the “Share Issuance Proposal”).

|

All director nominees listed in the

Director Proposal were elected by the Company’s stockholders at the Annual Meeting. The votes for, votes withheld

and broker non-votes for each director nominee are set forth below:

|

Director Nominee

|

Votes For

|

Votes Withheld

|

Broker Non-Votes

|

|

Elizabeth J. Sandler

|

58,820,911

|

2,873,550

|

0

|

|

Michael J. Hagan

|

54,610,389

|

7,084,072

|

0

|

|

Jeffrey K. Harrow

|

54,182,708

|

7,511,753

|

0

|

|

James H. Kropp

|

57,771,443

|

3,923,018

|

0

|

On June 23, 2020, the Company adjourned the

Annual Meeting with respect to the Share Issuance Proposal to permit additional time to solicit stockholder votes for such proposal.

The reconvened meeting (the “Reconvened Meeting”) will be held on July 15, 2020 at 10:00 a.m., Eastern Time, at 201

Rouse Boulevard, Philadelphia, Pennsylvania 19112. Valid proxies submitted prior to the Annual Meeting will continue to be valid for the Reconvened

Meeting, unless properly changed or revoked prior to votes being taken at the Reconvened Meeting. The record date of April 29,

2020 will remain the same for the Reconvened Meeting.

The Company previously disclosed that certain

directors and officers of the Company and affiliates and employees of owners of the Company’s investment advisor, FS/KKR

Advisor, LLC, committed approximately $18 million to an investment fund with aggregate commitments of up to approximately $124

million established to invest from time to time in shares of the Company. The governing documents of such investment fund have

been amended to permit such investment fund to also invest from time to time in shares of the Company’s affiliate, FS KKR

Capital Corp. II. There can be no assurance that this investment fund will purchase any Company shares.

Forward-Looking Statements

Statements included herein may constitute “forward-looking”

statements as that term is defined in Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act

of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements with regard to future events

or the future performance or operations of the Company. Words such as “anticipates,” “will,” “believes,”

“expects,” “projects,” and “future” or similar expressions are intended to identify forward-looking

statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions.

Certain factors could cause actual results to differ materially from those projected in these forward-looking statements. Factors

that could cause actual results to differ materially include changes in the economy, risks associated with possible disruption

to the Company’s operations or the economy generally due to terrorism, natural disasters or pandemics such as COVID-19, future

changes in laws or regulations and conditions in the Company’s operating area, unexpected costs, and the investment fund

may not purchase Company shares as anticipated or at all. Some of these factors are enumerated in the filings the Company made

with the U.S. Securities and Exchange Commission. The inclusion of forward-looking statements should not be regarded as a representation

that any plans, estimates or expectations will be achieved. Any forward-looking statements speak only as of the date of this communication.

Except as required by federal securities laws, the Company undertakes no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on any of

these forward-looking statements.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

FS KKR Capital Corp.

|

|

|

|

|

|

Date: June 23, 2020

|

By:

|

/s/ Stephen Sypherd

|

|

|

|

|

Stephen Sypherd

|

|

|

|

General Counsel

|

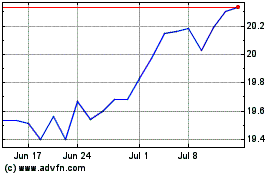

FS KKR Capital (NYSE:FSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

FS KKR Capital (NYSE:FSK)

Historical Stock Chart

From Apr 2023 to Apr 2024