Current Report Filing (8-k)

June 15 2020 - 5:29PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): June 15, 2020

FS

KKR Capital Corp.

(Exact

name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

814-00757

|

|

26-1630040

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

|

|

|

|

|

201

Rouse Boulevard

Philadelphia,

Pennsylvania

|

|

19112

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (215) 495-1150

None

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange

on

which registered

|

|

Common

stock

|

|

FSK

|

|

New

York Stock Exchange

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

☐

|

Emerging

growth company

|

|

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws;

Change in Fiscal Year.

|

FS

KKR Capital Corp. (the "Company") filed Articles of Amendment to its Articles of Incorporation (the “Reverse Stock

Split Amendment”) with the State Department of Assessments and Taxation of the State of Maryland to effect a 4 to 1 reverse

split of the Company’s shares of common stock (the “Reverse Stock Split”). The Reverse Stock Split became effective

in accordance with the terms of the Reverse Stock Split Amendment on June 15, 2020. The Company also filed a separate Articles

of Amendment to Articles of Incorporation (the “Par Value Amendment”) with the State Department of Assessments and

Taxation of the State of Maryland to provide that there will be no change in the par value of $0.001 per share as a result of

the Reverse Stock Split.

As

a result of the Reverse Stock Split, every four shares of the Company’s common stock issued and outstanding will be automatically

combined into one share of the Company’s common stock, and the number of outstanding shares of the Company’s common

stock will be reduced from approximately 495 million to approximately 123.75million.

The

foregoing descriptions of the Reverse Stock Split Amendment and the Par Value Amendment do not purport to be complete and are

subject to, and are qualified in their entirety by reference to, the full text of the Reverse Stock Split Amendment and the Par

Value Amendment, copies of which are attached hereto as Exhibits 3.1 and 3.2, respectively, and are incorporated herein by reference.

On

June 15, 2020, the Company issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein

by reference.

Forward-Looking

Statements

This

Current Report on Form 8-K may contain certain forward-looking statements, including statements with regard to future events or

the future performance or operation of the Company. Words such as “believes,” “expects,” “projects”

and “future” or similar expressions are intended to identify forward-looking statements. These forward-looking statements

are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results

to differ materially from those projected in these forward-looking statements. Factors that could cause actual results to differ

materially include changes in the economy, risks associated with possible disruption in the Company’s operations or the

economy generally due to terrorism, natural disasters or pandemics such as COVID-19, future changes in laws or regulations and

conditions in the Company’s operating area, and the price at which shares of common stock may trade on the New York Stock

Exchange. Some of these factors are enumerated in the filings the Company makes with the Securities and Exchange Commission. The

Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise.

|

Item 9.01.

|

Financial

Statements and Exhibits.

|

(d) Exhibits.

|

|

DESCRIPTION

|

|

|

|

|

3.1

|

Reverse

Stock Split Amendment.

|

|

3.2

99.1

|

Par

Value Amendment.

Press

Release, dated June 15, 2020.

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

FS

KKR Capital Corp.

|

|

|

|

|

|

|

Date:

June 15, 2020

|

|

|

|

By:

|

|

/s/

Stephen Sypherd

|

|

|

|

|

|

|

|

Stephen

Sypherd

|

|

|

|

|

|

|

|

General

Counsel

|

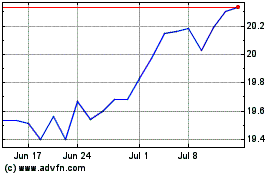

FS KKR Capital (NYSE:FSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

FS KKR Capital (NYSE:FSK)

Historical Stock Chart

From Apr 2023 to Apr 2024