As filed with the Securities and Exchange Commission

on September 1, 2022

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FREYR Battery

(Exact name of registrant as specified in its charter)

| Grand Duchy of Luxembourg |

|

Not Applicable |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

22-24, Boulevard Royal, L-2449

Luxembourg

Grand Duchy of Luxembourg

+352 46 61 11 3721

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Tom Einar Jensen

FREYR Battery

22-24, Boulevard Royal, L-2449 Luxembourg

Grand Duchy of Luxembourg

+352 46 61 11 3721

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Oscar K. Brown

FREYR Battery US Holding, Inc.

c/o The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

(302)-658-7581

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to

Danny Tricot, Esq.

Denis Klimentchenko, Esq.

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

Canary Wharf

London, E14 5DS

+44 20 7519 7000

Approximate date

of commencement of proposed sale to the public: From time to time after this Registration

Statement becomes effective.

If the only securities being

registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to

register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☒ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby

amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file

a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section

8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to such Section 8(a), may determine.

STATEMENT

PURSUANT TO RULE 429

The registrant is filing

a single prospectus in this registration statement pursuant to Rule 429 under the Securities Act of 1933 (the “Securities Act”).

The prospectus is a combined prospectus relating to: (1) the offering, issuance and sale by FREYR

Battery, a corporation in the form of a public limited liability company (société anonyme) incorporated under the

laws of Luxembourg (“FREYR Battery”) of up to $500,000,000 in the aggregate of the securities identified on the cover

of this prospectus from time to time in one or more offerings; and (2) (i) 24,625,000 Ordinary Shares issuable upon exercise of warrants

of FREYR Battery, (ii) the resale of an additional 118,968,753 Ordinary

Shares of FREYR Battery (including 12,839,394 Ordinary Shares issuable upon exercise of warrants of FREYR Battery) and (iii) the resale

of warrants exercisable for up to 10,250,000 Ordinary Shares, which were previously registered by the Registration Statement on Form S-1

(File No. 333-258607) originally filed with the SEC on August 9, 2021 and subsequently declared effective, as amended and/or supplemented

(the “Prior Registration Statement”). Pursuant to Rule 429 under the Securities Act, this registration statement on Form S-3

upon effectiveness will serve as a post-effective amendment to the Prior Registration Statement. Such post-effective amendment shall hereafter

become effective concurrently with the effectiveness of this registration statement and in accordance with Section 8(c) of, and Rule 429

under, the Securities Act.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED September 1, 2022

PRELIMINARY PROSPECTUS

FREYR Battery

$500,000,000

Ordinary Shares, Preferred

Shares, Debt Securities, Warrants, Rights, Purchase Units

Offered by FREYR Battery

24,625,000 Ordinary Shares

Offered by FREYR Battery

118,968,753 Ordinary Shares

10,250,000 Warrants to

Purchase Ordinary Shares

Offered by Selling Securityholders

We may from time to time offer

and sell ordinary shares, preferred shares, debt securities, warrants, subscription rights and purchase units. This prospectus also relates

to (i) the offer and sale of 24,625,000 Ordinary Shares issuable upon exercise of warrants, (ii) the resale from time to time by the selling

securityholders identified in this prospectus of an additional 118,968,753 of our Ordinary Shares (including 12,839,394 Ordinary Shares

issuable upon exercise of our warrants) and (iii) the resale from time to time by the selling securityholders of warrants exercisable

for up to 10,250,000 of our Ordinary Shares.

This prospectus also covers any

additional securities that may become issuable by reason of stock splits, stock dividends or recapitalizations. We will not receive any

of the proceeds from the sale by the selling securityholders of the shares of the securities offered by them hereby. We will receive proceeds

from FREYR Warrants covered by this Registration Statement in the event that such FREYR Warrants are exercised for cash.

The selling securityholders

will pay all underwriting discounts and selling commissions, if any, in connection with their sale of our Ordinary Shares and warrants.

We have agreed to pay certain expenses in connection with this registration statement and to indemnify the selling securityholders and

certain related persons against certain liabilities. As of the date of this prospectus, no underwriter or other person has been engaged

to facilitate the sale of our Ordinary Shares or warrants held by the selling securityholders.

This prospectus provides you with a general description of the securities

and the general manner in which we and the selling securityholders may offer or sell the applicable securities. We will provide the specific

prices and terms of these securities in one or more prospectus supplements to this prospectus at the time of offering. For general information

about the distribution of securities offered by us and the selling securityholders, see “Plan of Distribution for Securities Offered

by Us” and “Plan of Distribution for Securities Offered by Selling Securityholders”. You should read this prospectus

and any accompanying prospectus supplement before you invest.

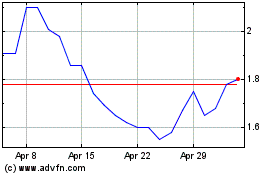

Our Ordinary Shares and FREYR

Public Warrants, FREYR Private Warrants and FREYR Working Capital Warrants are listed on the NYSE under the symbols FREY and FREY WS,

respectively. On August 31, 2022, the closing price of our Ordinary Shares was $14.24 and the closing price of our publicly traded warrants

was $5.05.

We are an “emerging

growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and will

be subject to reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that

is an emerging growth company.

Investing in our securities

involves a high degree of risk. See “Risk Factors” on page 3 of this prospectus and any similar section included in any

accompanying prospectus supplement and in the documents incorporated by reference in this prospectus. You should carefully consider these

factors before making your investment decision.

Neither the SEC nor any

other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any

representation to the contrary is a criminal offense.

The

date of this prospectus is , 2022.

TABLE OF CONTENTS

You should rely only on

the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained

in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information

contained in this prospectus is accurate as of any date other than that date or as of any earlier date as of which information is given.

For investors outside

the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any

jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and

to observe any restrictions relating to this offering and the distribution of this prospectus.

ABOUT

THIS PROSPECTUS

This prospectus is part of

a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf”

registration process. Under this shelf registration process, we may from time to time sell any combination of the securities described

in this prospectus in one or more offerings for an aggregate offering price of up to $500,000,000.

This prospectus also relates

to the offer and sale of:

(i) 14,375,000 Ordinary Shares

issuable upon the exercise of warrants issued in connection with the Business Combination (as defined below) in exchange for public warrants

issued as part of the units in Alussa’s (as defined below) initial public offering (the “FREYR Public Warrants”),

(ii) 8,750,000 Ordinary Shares

issuable upon the exercise of warrants issued in connection with the Business Combination in exchange for private placement warrants to

purchase Class A ordinary shares of Alussa (the “FREYR Private Warrants”), and

(iii) 1,500,000 Ordinary

Shares issuable upon the exercise of warrants issued in connection with the Business Combination in exchange for warrants issued upon

the conversion of a working capital loan (the “FREYR Working Capital Warrants”),

which Ordinary Shares were

originally registered in the Registration Statement on Form S-4 (File No. 333-254743) (the “S-4 Registration Statement”) and

subsequently registered in the Registration Statement on Form S-1 (File No. 333-258607) originally filed with the SEC on August 9, 2021

and subsequently declared effective, as amended and/or supplemented (the “Prior Registration Statement”).

In addition, the securities

offered for resale from time to time by the selling securityholders named in this prospectus hereunder include:

(i) an aggregate of 60,000,000

Ordinary Shares (the “PIPE Shares”) issued in a private placement immediately prior to the closing of the Business Combination,

(ii) securities issued to

former securityholders of FREYR AS, a private limited liability company organized under the laws of Norway (“FREYR Legacy”)

in connection with the Business Combination pursuant to an exemption from the registration requirements of the Securities Act of 1933,

as amended (the “Securities Act”), consisting of 37,452,359 Ordinary Shares issued in exchange for ordinary shares of FREYR

Legacy, 2,589,394 Ordinary Shares issuable upon the exercise of warrants issued in exchange for warrants to purchase ordinary shares of

FREYR Legacy, and 1,489,500 Ordinary Shares issued in exchange for preferred shares of FREYR Legacy, and

(iii) securities that were

registered in the S-4 Registration Statement and the Prior Registration Statement, consisting of 7,187,500 Ordinary Shares issued in

connection with the Business Combination in exchange for Class B ordinary shares of Alussa initially purchased by the Alussa Energy Sponsor

LLC (“Sponsor”) in a private placement prior to the initial public offering of Alussa Energy Acquisition Corp., a Cayman

Islands exempted company (“Alussa”), 8,750,000 Ordinary Shares issuable upon the exercise of the FREYR Private Warrants,

1,500,000 Ordinary Shares issuable upon the exercise of the FREYR Working Capital Warrants, 8,750,000 FREYR Private Warrants, and 1,500,000

FREYR Working Capital Warrants.

We will not receive any proceeds

from the sale by such Selling Securityholders (as defined below) of the securities offered by them described in this prospectus. We will

receive proceeds from FREYR Warrants covered by this Registration Statement in the event that such FREYR Warrants are exercised for cash.

Neither we nor the Selling

Securityholders have authorized anyone to provide you with any information or to make any representations other than those contained in

this prospectus or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. Neither we nor

the Selling Securityholders take responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. Neither we nor the Selling Securityholders will make an offer to sell these securities in any jurisdiction where

the offer or sale is not permitted.

We may also provide a prospectus

supplement or, if appropriate, a post-effective amendment, to the registration statement to add information to, or update or change information

contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment

to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled

“Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

FREQUENTLY

USED TERMS

Unless otherwise stated or

unless the context otherwise requires, the term “FREYR Legacy” refers to FREYR AS, a company organized under the laws of Norway,

and their consolidated subsidiaries, and the term “Alussa” refers to Alussa Energy Acquisition Corp., a Cayman Islands exempted

company, and “FREYR”, the “Company”, “Registrant”, “we”, “us” and “our”

refers to FREYR Battery, a Luxembourg company and where appropriate, our wholly owned subsidiaries. In this document:

“24M” means 24M

Technologies, Inc., a Delaware corporation.

“Alussa” means

Alussa Energy Acquisition Corp., a Cayman Islands exempted company.

“Alussa Articles”

means the Amended and Restated Memorandum and Articles of Association of Alussa adopted on November 25, 2019.

“Alussa Public Warrant”

means each whole warrant (other than the Private Placement Warrants), entitling the holder thereof to purchase one Alussa Class A ordinary

share at a price of $11.50 per share as issued by Alussa as part of its initial public offering on November 25, 2019.

“Alussa Units”

means the Alussa units issued in the IPO, each consisting of one Class A ordinary share and one-half of one Alussa Public Warrant.

“Alussa Warrants”

means Private Placement Warrants and Alussa Public Warrants, collectively.

“Base Consideration”

means $410,550,000.

“Business Combination”

or “Transactions” means the Mergers and the other transactions contemplated by the Business Combination Agreement.

“Business Combination

Agreement” means the Business Combination Agreement, dated as of January 29, 2021, as it may be amended from time to time, by and

among Alussa, the Purchaser Representative, FREYR Legacy, the Shareholder Representative, FREYR, the Merger Subs and the Major Shareholders.

“Cayman Companies Act”

means the Companies Act (2021 Revision), as amended, of the Cayman Islands.

“Cayman Merger”

means the merger pursuant to the terms of the Business Combination Agreement and the Plan of Merger whereby Alussa merged with and into

Cayman Merger Sub, with Alussa continuing as the surviving entity.

“Cayman Merger Sub”

means Adama Charlie Sub, a Cayman Islands exempted company.

“Class A ordinary shares”

means the class A ordinary shares of Alussa, par value $0.0001 per share.

“Class B ordinary shares”

means the class B ordinary shares of Alussa, par value $0.0001 per share.

“Closing” means

the closing of the Business Combination.

“Code” means

the Internal Revenue Code of 1986, as amended.

“Company Preferred

Share Transferors” means Encompass Capital Master Fund LP, BEMAP Master Fund Ltd. and Encompass Capital E L Master Fund L.P.

“Cross-Border Merger”

means the merger pursuant to the terms of the Business Combination Agreement whereby Norway Merger Sub 1 merged with and into FREYR, with

FREYR continuing as the surviving entity.

“EDGE Global”

means EDGE Global LLC.

“Encompass” means

Encompass Capital Advisors LLC.

“Equity Consideration”

means the Base Consideration plus or minus the Legal Cost Adjustment (as applicable).

“Exchange Act”

means the Securities Exchange Act of 1934, as amended.

“Exchange Ratio”

means the quotient obtained by dividing (a) the amount of the Equity Consideration divided by the lower of (i) the Redemption Price and

(ii) the PIPE Price, by (b) the number of Aggregate Fully Diluted Company Shares (as defined in the Business Combination Agreement). The

Exchange Ratio was 0.179038.

“First Closing”

means the consummation of the Cayman Merger in accordance with the terms and subject to the conditions of the Business Combination Agreement.

“First Closing Date”

means the date on which the First Closing actually occurred.

“FREYR” means

FREYR Battery, a corporation in the form of a public limited liability company (société anonyme) incorporated under

the laws of Luxembourg, with registered office at 22-24, Boulevard Royal, L-2449 Luxembourg, Grand Duchy of Luxembourg, registered with

the Luxembourg Trade and Companies Register (Registre de Commerce et des Sociétés) under number B 251199.

“FREYR Articles”

means the articles of FREYR as of the date of the Closing (as amended from time to time and for the last time on November 26, 2021) unless

otherwise provided herein.

“FREYR Options”

means options to purchase FREYR Ordinary Shares.

“FREYR Private Warrant”

means each one whole warrant issued in connection with the Business Combination in exchange for private placement warrants, entitling

the holder thereof to purchase one (1) FREYR Ordinary Share at a purchase price of $11.50 per share on the same terms and conditions as

the Private Placement Warrants.

“FREYR Public Warrant”

means each one whole warrant (other than the FREYR Private Warrants and FREYR Working Capital Warrants) entitling the holder thereof to

purchase one (1) FREYR Ordinary Share at a purchase price of $11.50 per share.

“FREYR Warrants”

means FREYR Public Warrants, FREYR Private Warrants, FREYR Working Capital Warrants and any warrants issued to the holders of FREYR warrants

pursuant to the Business Combination Agreement, collectively.

“FREYR Working Capital

Warrant” means one whole warrant issued in connection with the Business Combination in exchange for warrants issued upon the conversion

of a working capital loan, entitling the holder thereof to purchase one (1) FREYR Ordinary Share at a purchase price of $11.50 per share

on the same terms and conditions as the Private Placement Warrants.

“FREYR Legacy”

means FREYR AS, a private limited liability company organized under the laws of Norway.

“FREYR Legacy Ordinary

Shares” means 209,196,827 ordinary shares of FREYR Legacy, each with a par value of, after giving effect of the Norway Demerger,

NOK 0.00993 per share.

“IPO” means the

initial public offering of Alussa Units consummated on November 29, 2019.

“Legal Cost Adjustment”

means (i) to the extent the legal costs incurred in connection with the Transactions by FREYR Legacy up to the Second Closing Date (“FREYR

Legal Costs”) exceed $5,500,000, an amount equal to the FREYR Legal Costs minus $5,500,000 (which amount shall be deducted from

the consideration above) and (ii) to the extent the FREYR Legal Costs are less than $2,500,000, an amount equal to $2,500,000 minus the

FREYR Legal Costs.

“Major Shareholders”

means those certain shareholders of FREYR Legacy as set forth in the Business Combination Agreement, which include (i) ATS AS (in its

capacity as a Major Shareholder), (ii) EDGE Global and (iii) entities affiliated with Teknovekst NUF.

“Mergers” means

the Cayman Merger, the Norway Merger and the Cross-Border Merger.

“Merger Subs”

means the Norway Merger Subs and Cayman Merger Sub.

“Norway Demerger”

means the transfer of the FREYR Wind Business to SVPH prior to the First Closing, resulting in such business becoming held by FREYR Legacy’s

shareholders through SVPH.

“Norway Merger”

means the merger pursuant to the terms of the Business Combination Agreement whereby FREYR Legacy merged with and into Norway Merger Sub

2, with Norway Merger Sub 2 continuing as the surviving entity.

“Norway Merger Sub

1” means Norway Sub 1 AS, a private limited liability company organized under the laws of Norway.

“Norway Merger Sub

2” means Norway Sub 2 AS, a private limited liability company organized under the laws of Norway.

“Norway Merger Subs”

means Norway Merger Sub 1 and Norway Merger Sub 2.

“NYSE” means

The New York Stock Exchange.

“Ordinary Shares”

means the ordinary shares of FREYR, without nominal value.

“PIPE Investment”

means the sale and issuance to the PIPE Investors $600 million of FREYR Legacy Ordinary Shares, at the PIPE Price, immediately prior to

the Second Closing, pursuant to the relevant subscription agreements.

“PIPE Investor”

means those certain investors who entered into subscription agreements with Alussa and FREYR.

“PIPE Price”

means $10.00 per FREYR Ordinary Share.

“Plan of Merger”

means the plan of merger filed with the Registrar of Companies of the Cayman Islands in respect of the Cayman Merger and any amendment

or variation thereto made in accordance with the provisions of the Cayman Companies Act.

“Private Placement

Warrants” means the 8,750,000 Alussa Warrants purchased by the Sponsor in a private placement at the time of the IPO for a purchase

price of $1.00 per warrant, each of which was exercisable for one Class A ordinary share.

“Public Shares”

means Class A ordinary shares of Alussa issued as part of the Alussa Units sold in the IPO.

“Purchaser Representative”

means the Sponsor in its capacity as the purchaser representative in accordance with the terms and conditions of the Business Combination

Agreement.

“Redemption Price”

means an amount equal to a pro rata portion of the aggregate amount on deposit in the Trust Account two days prior to the completion of

the Business Combination calculated in accordance with the Alussa Articles (as equitably adjusted for shares splits, shares dividends,

combinations, recapitalizations and the like after the Closing).

“Registration Rights

Agreement” means the registration rights agreement for the Major Shareholders and the Purchaser Representative in substantially

the form attached hereto as Exhibit 4.5 and as an exhibit to the Business Combination Agreement.

“RESA” means

Recueil Électronique des Sociétés et Associations of the Grand Duchy of Luxembourg.

“SEC” means the

U.S. Securities and Exchange Commission.

“Second Closing”

means the consummation of the transactions contemplated under the Business Combination Agreement (other than the Cayman Merger, which

occurred on the First Closing Date).

“Second Closing Date”

means the date on which the Second Closing actually occurred.

“Securities Act”

means the U.S. Securities Act of 1933, as amended.

“Shareholder Representative”

means ATS AS, in the capacity as the representative for the Major Shareholders in accordance with the terms and conditions of the Business

Combination Agreement.

“Sponsor” means

Alussa Energy Sponsor LLC, a Delaware limited liability company.

“SVPH” means

Sjonfjellet Vindpark Holding AS, a private limited liability company incorporated as a result of the Norway Demerger.

“Trust Account”

means the trust account that holds a portion of the proceeds of the IPO and the concurrent sale of warrants to the Sponsor in a private

placement.

“$” means the

currency in dollars of the United States of America.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein may contain forward-looking

statements. All statements other than statements of historical or current facts contained or incorporated by reference in this prospectus

and any accompanying prospectus supplement may be forward-looking statements. Statements regarding our future results of operations and

financial position, business strategy and plans and objectives of management for future operations, including, among others, statements

regarding the offering, liquidity, growth and profitability strategies and factors and trends affecting our business are forward-looking

statements. Forward-looking statements can be identified in some cases by the use of words such as “believe,” “can,”

“could,” “potential,” “plan,” “predict,” “goals,” “seek,” “should,”

“may,” “may have,” “would,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” the negative of these words, other similar expressions or by discussions of strategy, plans

or intentions.

The forward-looking statements contained or incorporated by reference

in this prospectus and any accompanying prospectus supplement are only predictions. We base these forward-looking statements largely on

our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition

and results of operations. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that

may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements. We believe that these factors include, but are not limited to,

the factors set forth under the heading “Risk Factors” in our most recent Annual Report on Form 10-K. These factors

include risks related to: (1) changes adversely affecting the battery industry and the development of existing or new technologies; (2)

the failure of 24M Technologies, Inc. technology or our batteries to perform as expected; (3) our ability to manufacture battery cells

and to develop and increase our production capacity in a cost-effective manner; (4) technological developments in existing technologies

or new developments in competitive technologies that could adversely affect the demand for our battery cells; (5) increases in the cost

of electricity or raw materials and components.

Because forward-looking statements

are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking

statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved

or occur and actual results could differ materially from those projected in the forward-looking statements.

In

addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These

statements are based upon information available to us as of the date of this prospectus or any accompanying prospectus supplement, and

while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our

statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available

relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You

should read this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein with

the understanding that our actual future results, levels of activity, performance and achievements may be materially different from

what we expect. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety

by these cautionary statements.

These

forward-looking statements speak only as of the date of this prospectus or, in the case of any accompanying prospectus supplement or

documents incorporated by reference, the date of any such document. Except as required by applicable law, we do not plan to publicly

update or revise any forward-looking statement, whether as a result of any new information, future events or otherwise.

SUMMARY

OF THE PROSPECTUS

This summary highlights

selected information appearing elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that may

be important to you. To understand this offering fully, you should read this entire prospectus carefully, including the information set

forth under the heading “Risk Factors” and our financial statements and related notes included in this prospectus or incorporated

by reference into this prospectus, any applicable prospectus supplement and the documents to which we have referred to in the “Incorporation

of Certain Documents by Reference” section below.

Company Overview

Our mission and vision is to

accelerate the decarbonization of the transportation sector and energy systems by delivering some of the world’s cleanest and most

cost-effective batteries. The global response to climate change is driving two notable trends: first, a shift from an energy system based

on fossil fuels to an energy system based on renewable, intermittent sources of energy such as solar and wind power, and second, an increased

electrification of existing transportation, energy and infrastructure systems. We believe that these two trends will drive substantially

increased demand for electricity storage in general and the need for lithium-ion batteries in particular. Our initial focus is on production

of the battery cell, which represents approximately 32% of battery value chain revenues and is one of the more energy intensive parts

of the value chain. Our manufacturing platform will have the capabilities to host many types of battery specifications, as determined

by customer demand, and will pursue (1) licensing-based partnerships to develop and enhance next-generation technology and (2) partnerships

with conventional battery cell technology providers.

We are a development stage

company with no revenue to date. FREYR incurred a net loss of approximately $93.4 million for the year ended December 31, 2021.

We believe that we will continue to incur operating and net losses each quarter until at least the time we begin significant production

of our battery cells, which is not expected to occur until 2024, and may occur later.

FREYR was incorporated on January 20,

2021 for the purpose of effectuating the Business Combination.

FREYR was incorporated under

the laws of Luxembourg as a public limited liability company (société anonyme).

The Business Combination

FREYR AS, a private limited

liability company organized under the laws of Norway (“FREYR Legacy”), previously consummated a merger pursuant to that certain

Business Combination Agreement, dated January 29, 2021 (the “Business Combination Agreement”), by and among Alussa Energy

Acquisition Corp., a Cayman Islands exempted company (“Alussa”), Alussa Energy Sponsor LLC (“Sponsor”), FREYR,

FREYR Legacy, ATS AS (“Shareholder Representative”), Norway Sub 1 AS, a private limited liability company organized under

the laws of Norway (“Norway Merger Sub 1”), Norway Sub 2 AS, a private limited liability company organized under the laws

of Norway (“Norway Merger Sub 2”), Adama Charlie Sub, a Cayman Islands exempted company (“Cayman Merger Sub”)

and the shareholders of FREYR Legacy named therein (the “Major Shareholders”). In connection with the Business Combination,

among other things, (i) prior to the First Closing, the FREYR Legacy’s wind farm business was transferred to Sjonfjellet Vindpark

Holding AS (“SVPH”), a private limited liability company to be incorporated by way of the Norway Demerger resulting in such

business being held by FREYR Legacy’s shareholders through SVPH, (ii) Alussa merged with and into Cayman Merger Sub, with Alussa

continuing as the surviving entity and a wholly owned subsidiary of FREYR (the “Cayman Merger”), (iii) Alussa distributed

all of its interests in Norway Merger Sub 1 to FREYR, (iv) FREYR Legacy merged with and into Norway Merger Sub 2, with Norway Merger

Sub 2 continuing as the surviving entity, (v) FREYR acquired all preferred shares of Norway Merger Sub 1 (issued in exchange for

the FREYR Legacy convertible preferred shares as a part of the Norway Merger) from the Company Preferred Share Transferors in exchange

for a number of newly issued shares of FREYR, and (vi) Norway Merger Sub 1 merged with and into FREYR, with FREYR continuing as the

surviving entity (the transactions contemplated by the Business Combination Agreement collectively, the “Business Combination”).

The Private Placement

On January 29, 2021, Alussa

and FREYR entered into the relevant subscription agreements with certain investors for the PIPE Investment, pursuant to which FREYR issued

and sold to the PIPE Investors $600 million of FREYR Ordinary Shares, at a price of $10.00 per share for which PIPE Investors received

60,000,000 FREYR Ordinary Shares.

Stock Exchange Listing

FREYR Ordinary Shares and FREYR

Public Warrants, FREYR Private Warrants and FREYR Working Capital Warrants are currently listed on the NYSE under the symbols FREY and

FREY WS, respectively.

Emerging Growth Company

We are an emerging growth company

as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will remain an emerging growth

company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.07 billion in annual revenues;

the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates;

the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day

of the fiscal year ending after the fifth anniversary of our initial public offering.

Section 107 of the JOBS

Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of

the Securities Act, for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption

of certain accounting standards until those standards would otherwise apply to private companies. We have elected not to opt out of such

extended transition period, which means that when a standard is issued or revised and it has different application dates for public or

private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new

or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible

because of the potential differences in accounting standards used.

Corporate Information

The mailing address of FREYR’s registered

and principal executive office is 22-24, Boulevard Royal, L-2449 Luxembourg, Grand Duchy of Luxembourg.

Our investor relations website

is located at ir.freyrbattery.com/overview/, and its news site located at ir.freyrbattery.com/ir-news, our Twitter account

is located at https://twitter.com/freyrbattery?lang=en, our LinkedIn account is located at www.linkedin.com/company/freyrbattery,

and our Youtube page is located at https://www.youtube.com/channel/UCo0NLMtaYsf2HfnDe6XtFLw. We use our investor relations website,

our Twitter account, our LinkedIn account and our Youtube page to post important information for investors, including news releases, analyst

presentations, and supplemental financial information, and as a means of disclosing material non-public information and for complying

with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our investor relations website, our

Twitter account, our LinkedIn account and our Youtube page, in addition to following press releases, SEC filings and public conference

calls and webcasts. Our website, Twitter account, our LinkedIn account and our Youtube page and the information contained on each, or

that can be accessed through each, is not deemed to be incorporated by reference in, and is not considered part of, this prospectus or

any accompanying prospectus supplement, and you should not consider it a part of this prospectus or any accompanying prospectus supplement.

We also make available, free of charge, on our investor relations website under “Financials — SEC Filings,”

our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports

as soon as reasonably practicable after electronically filing or furnishing those reports to the SEC.

RISK

FACTORS

Investing in our securities

involves risks. You should carefully review the risk factors contained under the heading “Risk Factors” in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2021 and any risk factors that we may describe in our Quarterly Reports on

Form 10-Q or Current Reports on Form 8-K filed subsequently to the Annual Report on Form 10-K, which risk factors are incorporated by

reference in this prospectus, the information contained under the heading “Cautionary Note Regarding Forward-Looking Statements”

in this prospectus or under any similar heading in any applicable prospectus supplement or in any document incorporated herein or therein

by reference, any specific risk factors discussed under the caption “Risk Factors” in any applicable prospectus supplement

or in any document incorporated herein or therein by reference and the other information contained in, or incorporated by reference in,

this prospectus or any applicable prospectus supplement before making an investment decision. The risks and uncertainties described in

our SEC filings are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see

as immaterial, may also harm our business. If any such risks and uncertainties actually occur, our business, financial condition, results

of operations, cash flows and prospects could be materially and adversely affected, the market price of our securities could decline and

you could lose all or part of your investment. See “Incorporation of Certain Documents by Reference” and “Cautionary

Note Regarding Forward-Looking Statements.”

USE

OF PROCEEDS

We expect to use the net

proceeds from the sale of any securities offered under this prospectus for general corporate purposes unless otherwise indicated in the

applicable prospectus supplement. General corporate purposes may include the financing of our operations or investments. We have not

determined the amount of net proceeds to be used specifically for such purposes. As a result, management will retain broad discretion

over the allocation of net proceeds.

All of the securities offered

by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts.

We cannot currently determine the price or prices at which such securities may be sold by the Selling Securityholders. We will not receive

any of the proceeds from these sales. We will, however, receive up to an aggregate of approximately $283,187,500 from the exercise of

the FREYR Public Warrants, FREYR Private Warrants and FREYR Working Capital Warrants, assuming the exercise in full of all of such FREYR

Warrants for cash. We expect to use the net proceeds from the exercise of these FREYR Warrants for general corporate purposes. No assurances

can be given that any FREYR Warrants will be exercised or that we will receive any cash proceeds upon such exercise if cashless exercise

is available.

The Selling Securityholders

will pay any underwriting fees, discounts, selling commissions, stock transfer taxes and certain legal expenses incurred by such Selling

Securityholders in disposing of their securities, and we will bear all other costs, fees and expenses incurred in effecting the registration

of such securities covered by this prospectus, including, without limitation, all registration and filing fees, any NYSE fees and fees

and expenses of our counsel and our independent registered public accountants.

SECURITIES

WE MAY OFFER

This prospectus contains summary

descriptions of the securities we may offer from time to time. These summary descriptions are not meant to be complete descriptions of

each security. The particular terms of any security will be described in the applicable prospectus supplement and/or any related free

writing prospectus.

DESCRIPTION

OF CAPITAL STOCK

The following description

of our Ordinary Shares and Preferred Shares, together with the additional information we include in any applicable prospectus supplement

and/or any related free writing prospectus, summarizes the material terms and provisions of the Ordinary Shares and Preferred Shares

that may be offered under this prospectus. The following summary of the material terms of our Ordinary Shares and Preferred Shares is

not intended to be a complete summary of the rights and preferences of such Ordinary Shares and Preferred Shares. It is qualified by

reference to our Consolidated Articles of Association as of November 26, 2021 (the “FREYR Articles”) as may be amended from

time to time and the Registration Rights Agreement, which are exhibits to the registration statement of which this prospectus is a part,

and the Luxembourg law of 10th August 1915 on commercial companies, as amended (the “Luxembourg Company Law”).

Authorized Share Capital

In accordance with the FREYR

Articles, the authorized share capital of FREYR (including the issued share capital other than the Initial Shares (as defined hereinafter))

is set at $245,000,000, represented by 245,000,000 Ordinary Shares without nominal value, valid for a period ending on June 9, 2026, the

date which falls five years after the publication in the RESA, on June 8, 2021, of the resolutions of the former sole shareholder of the

Company held on May 20, 2021. As further detailed below in the Section "Issuance of Preferred Shares", FREYR intends to

take the requisite corporate actions in order to allow for the issuance of preferred shares by the board of directors of FREYR.

Share Capital

As of June 21, 2021, FREYR’s

issued share capital amounted to $40,000, represented by a total of 40,000 redeemable shares with no nominal value (the “Initial

Shares”). All Initial Shares were fully paid and subscribed for. A shareholder in a Luxembourg société anonyme

holding fully paid up shares is not liable, solely because of his or her or its shareholder status, for additional payments to FREYR or

its creditors.

Upon effectiveness of the First

Closing, FREYR redeemed and subsequently cancelled all the Initial Shares so that the share capital of FREYR is solely represented by

the Ordinary Shares. The FREYR Articles further provide for an authorized share capital in the amount of $245,000,000 (including the issued

share capital but excluding the Initial Shares) divided into 245,000,000 ordinary shares with no nominal value.

On November 26, 2021,

following the exercise of warrants by certain warrant holders, the FREYR Articles were amended to reflect under Article 5.1 an increase

of the issued share capital from $116,440,191.00 (represented by 116,440,191 Ordinary Shares) to $116,853,504.00 (represented by

116,853,504 Ordinary Shares).

As of August 31, 2022, FREYR

held 150,000 treasury shares.

FREYR Articles

FREYR is registered with the

Luxembourg Trade and Companies’ Register under number B251199.

Its corporate purpose, as stated

in Article 4 of the FREYR Articles, is the holding of participations, in any form whatsoever, in Luxembourg and foreign companies,

or other entities or enterprises, the acquisition by purchase, subscription, or in any other manner as well as the transfer by sale, exchange

or otherwise of stock, bonds, debentures, notes and other securities or rights of any kind including interests in partnerships, and the

holding, acquisition, disposal, investment in any manner (in), development, licensing or sub licensing of, any patents or other intellectual

property rights of any nature or origin as well as the ownership, administration, development and management of its portfolio. FREYR may

carry out its business through branches in Luxembourg or abroad. FREYR may borrow in any form and proceed to the issue by private or public

of bonds, convertible bonds and debentures or any other securities or instruments it deems fit. In a general fashion FREYR may grant assistance

(by way of loans, advances, guarantees or securities or otherwise) to companies or other enterprises in which FREYR has an interest or

which form part of the group of companies to which the Company belongs or any entity as FREYR may deem fit (including upstream or cross

stream), take any controlling, management, administrative and/or supervisory measures and carry out any operation which it may deem useful

in the accomplishment and development of its purposes. FREYR can perform all commercial, technical and financial or other operations,

connected directly or indirectly in all areas in order to facilitate the accomplishment of its purpose. Finally, FREYR may conduct, or

be involved in any way in, directly or indirectly, the development, financing, construction and operation of batteries and/or battery

cells, as well as the production of any materials required for battery cell manufacturing, and sales of batteries and/or battery cells

into markets including but without limitation, electric mobility, energy storage systems as well as marine and aviation applications and

any related or connected activity.

Issuance of Ordinary Shares

Pursuant to Luxembourg law,

the issuance of Ordinary Shares requires approval by the general meeting of shareholders of FREYR at the quorum and majority required

for amending the FREYR Articles. The former sole shareholder of FREYR approved an authorized capital and authorized the board of directors

to issue Ordinary Shares up to the maximum amount of such authorized capital for a maximum period of five years after the publication

of the resolution of the sole shareholder approving such authorization in the Luxembourg RESA. The general meeting may amend, renew, or

extend such authorized capital and such authorization to the board of directors to issue Ordinary Shares.

FREYR recognizes only one (1) holder

per share. In case a share is owned by several persons, they shall appoint a single proxy who shall represent them in respect of FREYR. FREYR

has the right to suspend the exercise of all rights attached to that share until such representative has been appointed.

Upon the consummation of the

Business Combination, the board of directors of FREYR resolved on the issuance of Ordinary Shares out of the authorized capital. The board

of directors also resolved on the applicable procedures and timelines to which such issuance will be subjected. If the proposal of the

board of directors to issue new Ordinary Shares exceeds the limits of FREYR’s authorized share capital, the board of directors must

convene the shareholders to an extraordinary general meeting for the purpose of increasing the issued and/or the authorized share capital.

Such meeting will be subject to the quorum and majority requirements required for amending the FREYR Articles.

Preemptive Rights

Under Luxembourg law, existing

shareholders benefit from a preemptive subscription right on the issuance of the Ordinary Shares for cash consideration. However, FREYR’s

shareholders have, in accordance with Luxembourg law, authorized the board of directors to suppress, waive, or limit any preemptive subscription

rights of shareholders provided by law to the extent that the board of directors deems such suppression, waiver, or limitation advisable

for any issuance or issuances of the Ordinary Shares within the scope of FREYR’s authorized share capital. Such authorization will

be valid for a period ending on June 9, 2026, the date which falls five years after the publication in the RESA, on June 8, 2021, of

the resolutions of the former sole shareholder of the Company held on May 20, 2021. The extraordinary general meeting of shareholders

may, by two-thirds majority vote, limit, waive, or cancel such preemptive rights or renew, amend, or extend them, in each case for a

period not to exceed five years. Such shares may be issued above, at, or below market value. Under Luxembourg Company Law subject

to certain formal requirements, which have not to date been undertaken and which include the approval of the extraordinary general meeting,

such shares may also be issued below the accounting par value per share. The Ordinary Shares may also be issued by way of incorporation

of available reserves, including share premium. In addition, the board of directors has been authorized by the general meeting to allocate,

within the limits of the authorized share capital, existing shares or new shares, including free of charge, to directors, officers and

staff members of the Company or of companies or other entities in which the Company holds directly or indirectly at least 10 per cent

of the capital or voting rights. Such authorization shall by operation of law, operate as a waiver by existing shareholders of their

preemptive subscription right for the benefit of the recipients of such shares allotted free of charge. The board of directors may determine

the terms and conditions of such allocation, which may comprise a period after which the allocation is final and a minimum holding period

during which the recipients must retain the shares.

Repurchase of Ordinary Shares

FREYR cannot subscribe to its

own shares. FREYR may, however, itself or through its subsidiaries repurchase issued Ordinary Shares or have another person repurchase

issued Ordinary Shares for its account, subject to the following conditions:

| ● | prior authorization by a simple majority vote at an ordinary

general meeting of shareholders, which authorization sets forth: |

| ● | the terms and conditions of the proposed repurchase and in

particular the maximum number of Ordinary Shares that may be repurchased; |

| ● | the duration of the period for which the authorization is

given, which may not exceed five years; and |

| ● | in the case of repurchase for consideration, the minimum

and maximum consideration per share, provided that the prior authorization shall not apply in the case of Ordinary Shares acquired by

either FREYR, or by a person acting in his or her own name on its behalf, for the distribution thereof to its staff or to the staff of

a company with which it is in a control relationship; |

| ● | only fully paid-up Ordinary Shares may be repurchased; |

| ● | the voting and dividend rights attached to the repurchased

Ordinary Shares will be suspended as long as the repurchased Ordinary Shares are held by FREYR or its direct subsidiaries. The voting

rights attached to Ordinary Shares held by indirect subsidiaries will also be suspended. |

The repurchase offer must be

made on the same terms and conditions to all the shareholders who are in the same position. In addition, as a listed company FREYR may

repurchase Ordinary Shares on the stock market without having to make or an offer to all of its shareholders.

The authorization will be valid

for a period ending on the earlier of five years from the date of such shareholder authorization and the date of its renewal by a

subsequent general meeting of shareholders.

In addition, pursuant to

Luxembourg Company Law, FREYR may directly or indirectly repurchase Ordinary Shares by resolution of its board of directors without the

prior approval of the general meeting of shareholders if such repurchase is deemed by the board of directors to be necessary to prevent

serious and imminent harm to FREYR, or if the acquisition of Ordinary Shares has been made with the intent of distribution to its employees

and/or the employees of any entity having a controlling relationship with FREYR.

Form and Transfer of Ordinary Shares

The Ordinary Shares are issued

in registered form only and are freely transferable under Luxembourg law and the FREYR Articles. Luxembourg law does not impose any limitations

on the rights of Luxembourg or non-Luxembourg residents to hold or vote the Ordinary Shares.

Under Luxembourg law, the ownership

of registered shares is prima facie established by the inscription of the name of the shareholder and the number of shares held by him

or her in the shareholders’ register. Without prejudice to the conditions for transfer by book-entry where the Ordinary Shares are

recorded in the shareholders’ register on behalf of one or more persons in the name of a depository, each transfer of the Ordinary

Shares shall be effected by written declaration of transfer to be recorded in the shareholders’ register, with such declaration

to be dated and signed by the transferor and the transferee or by their duly appointed agents. FREYR may accept and enter into the shareholders’

register any transfer effected pursuant to an agreement or agreements between the transferor and the transferee, true and complete copies

of which have been delivered to FREYR.

The FREYR Articles provide

that FREYR may appoint registrars in different jurisdictions, each of whom may maintain a separate register for the Ordinary Shares entered

in such register, and that the holders of shares shall be entered into one of the registers. Shareholders may elect to be entered into

one of these registers and to transfer their shares to another register so maintained. FREYR’s board of directors may however impose

transfer restrictions for shares that are registered, listed, quoted, dealt in, or have been placed in certain jurisdictions in compliance

with the requirements applicable therein.

In the case of Ordinary Shares

held through the operator of a securities settlement system or depository, Ordinary Shares will be made available to the shareholders

in book-entry form and, without prejudice to the provisions of the FREYR Articles, give to the shareholders in book-entry-form beneficial

ownership of the rights attaching to the Ordinary Shares.

Liquidation Rights and Dissolution

In the event of FREYR’s

dissolution and liquidation, any surplus of the assets remaining after allowing for the payment of all of FREYR’s liabilities will

be paid out to the shareholders pro rata according to their respective shareholdings. The decision to dissolve and liquidate FREYR requires

approval by an extraordinary general meeting of FREYR’s shareholders.

Merger and De-Merger

A merger by absorption whereby

one Luxembourg company, after its dissolution without liquidation, transfers all of its assets and liabilities to another company in exchange

for the issuance of ordinary shares in the acquiring company to the shareholders of the company being acquired, or a merger effected by

transfer of assets and liabilities to a newly incorporated company, must, in principle, be approved at an extraordinary general meeting

of shareholders of the Luxembourg company, enacted in front of a Luxembourg notary. Similarly, a de-merger of a Luxembourg company is

generally subject to the approval by an extraordinary general meeting of shareholders, enacted in front of a Luxembourg notary.

No Appraisal Rights

Neither Luxembourg law nor

the FREYR Articles provide for appraisal rights of dissenting shareholders.

General Meeting of Shareholders

Any regularly constituted general

meeting of shareholders represents the entire body of FREYR shareholders.

Any holder of an Ordinary Share

is entitled to attend its general meeting of shareholders, either in person or by proxy, to address the general meeting of shareholders

and to exercise voting rights, subject to the provisions of the FREYR Articles and compliance with the conditions governing attendance

or representation at the meeting. Each Ordinary Share entitles the holder to one vote at a general meeting of shareholders. The FREYR

Articles provide that general meetings of shareholders are convened in accordance with the provisions of law. The Luxembourg Company Law

provides that convening notices for every general meeting shall contain the agenda and take the form of announcements filed with the register

of commerce and companies and will be published in the RESA and in a newspaper published in the Grand Duchy of Luxembourg at least fifteen days

before the meeting. The convening notices shall also be communicated by post (or, in respect of any shareholder having individually agreed

to receive convening notices by any other means of communications, by such means of communication) to registered shareholders at least

eight days before the meeting.

A shareholder may participate

in general meetings of shareholders by appointing another person as his or her proxy, the appointment of which shall be in writing. The

FREYR Articles also provide that, in the case of Ordinary Shares held through the operator of a securities settlement system or depository,

a holder of such Ordinary Shares wishing to attend a general meeting of shareholders should receive from such operator or depository a

certificate certifying the number of Ordinary Shares recorded in the relevant account on the relevant record date. FREYR’s board

of director may determine the formal requirements with which such certificates must comply.

The board of directors may

determine a date preceding the general meeting as the record date for admission to, and voting any Ordinary Shares at, the general meeting

(the “GM Record Date”). If a GM Record Date is determined for the admission to and voting at a general meeting only those

persons holding Ordinary Shares on the GM Record Date may attend and vote at the general meeting (and only with respect to those Ordinary

Shares held by them on the GM Record Date).

The annual general shareholder

meeting must be held within six months from the end of the respective financial year at FREYR’s registered office or in any

other place in Luxembourg as may be specified in the convening notice of the meeting. Other general meetings of shareholders may be held

at such place and time as may be specified in the respective convening notices of the meeting.

Luxembourg law provides that

the board of directors is obliged to convene a general meeting of shareholders if shareholders representing, in the aggregate, 10% of

the issued share capital so request in writing with an indication of the meeting agenda. In such case, the general meeting of shareholders

must be held within one month of the request. If the requested general meeting of shareholders is not held within one month, shareholders

representing, in the aggregate, 10% of the issued share capital may petition the competent president of the district court in Luxembourg

to have a court appointee convene the meeting. Luxembourg law provides that shareholders representing, in the aggregate, 10% of the issued

share capital may request that additional items be added to the agenda of a general meeting of shareholders. That request must be made

by registered mail sent to FREYR’s registered office at least five days before the general meeting of shareholders.

The board of directors of FREYR

has the right to adjourn a general meeting for four weeks (up to six weeks, in case of a combined ordinary and extraordinary

general meeting). It must do so if requested by one or more shareholders representing at least 10% of the share capital of FREYR. In

the event of an adjournment, any resolution already adopted by the general meeting shall be cancelled and final resolutions will be adopted

at the adjourned general meeting. Furthermore, one or more shareholders representing at least 10% of the share capital or at least10%

of the voting rights attached to the shares issued by FREYR may ask the board of directors of FREYR questions on one or more transactions

of FREYR or any companies controlled by it.Each Ordinary Share entitles the holder thereof to one vote.

Neither Luxembourg law nor

the FREYR Articles contain any restrictions as to the voting of Ordinary Shares by non-Luxembourg residents and there is no minimum shareholding

(beyond owning a single Ordinary Share or representing the owner of a single Ordinary Share) to attend or vote at a general meeting of

shareholders.

As described further below,

Luxembourg law distinguishes between ordinary general meetings of shareholders and extraordinary general meetings of shareholders.

Ordinary General Meetings. At

an ordinary general meeting, there is no quorum requirement and resolutions are adopted by a simple majority of validly cast votes. Abstentions

are not considered “votes.”

Extraordinary General Meeting. Extraordinary

general meetings are required to be convened for among others any of the following matters: (i) the increase or decrease of the authorized

or issued capital, (ii) the limitation or exclusion of preemptive rights or the authorization of the board of directors to limit

or exclude such rights, (iii) the approval of a statutory merger or de-merger (scission), (iv) FREYR’s dissolution and

liquidation, and (v) any amendments to the FREYR Articles. Pursuant to the FREYR Articles, for any resolutions to be considered at

an extraordinary general meeting of shareholders, except for those on certain specific topics described below, the quorum shall be at

least one half (50%) of FREYR’s outstanding Ordinary Shares. If such quorum is not present, a second meeting may be convened, which

does not need a quorum. Any extraordinary resolution shall be adopted, except otherwise provided by law and the FREYR Articles, by at

least a two-thirds majority of the votes validly cast. Where there is more than one class of shares (e.g., ordinary shares and preferred

shares) and the resolutions of the general meeting is such as to change the respective rights thereof, the resolutions must, in order

to be valid, fulfil the conditions to attendance and majority with respect to each class. Abstentions are not considered “votes”.

The FREYR Articles provide for an increased majority of at least 75% of votes validly cast for the amendments to Articles 9.4, 9.5 and

17.3 to the FREYR Articles. Article 9.4 set outs the requirements for candidates for election to the board of directors, and Article 9.5

sets out the process for shareholders to propose candidates for the election to the board of directors to the general meeting of shareholders.

Article 17.3 is the article setting the increased majority for Articles 9.4 and 9.5.

Minority Action Right. Luxembourg

Company Law provides that one or more shareholders holding, in the aggregate, at least 10% of the securities having a right to vote at

the general meeting that has granted discharge to the members of the board of directors for the execution of their mandate, may act on

FREYR’s behalf to file a liability claim for damages against one or more directors for mismanagement and/or a violation of Luxembourg

Company Law, or of the FREYR Articles.

Dividends

Except for shares held in treasury,

each Ordinary Share is entitled to participate equally in dividends if and when declared out of funds legally available for such purposes.

The FREYR Articles provide that the annual ordinary general meeting of shareholders may declare a dividend and that the board of directors

may declare interim dividends within the limits set by Luxembourg law.

Declared and unpaid dividends

held by FREYR for the account of its shareholders do not bear interest. Under Luxembourg law, claims for dividends lapse in favor of FREYR

five years after the date on which the dividends have been declared.

Board of Directors

The FREYR Articles stipulate

that FREYR shall be managed by a board of directors composed of no less than eight directors who may but do not need to be shareholders

of FREYR. The FREYR board of directors shall, to the extent required by law and otherwise may, appoint a chairperson amongst its

members/the independent directors. The chairperson shall preside over all meetings of the board of directors and of shareholders. It also

may appoint a secretary, who need not be a director and whose responsibility, powers and duties shall be determined by the board of directors.

The FREYR board of directors will meet upon call by the chairperson or any two directors.

A meeting of the board of directors

shall be quorate if the majority of the directors in office (and entitled to vote) is present or represented. Resolutions are adopted

by the simple majority vote of directors present or represented. No valid decision of the board of directors may be taken if the necessary

quorum has not been reached. In case of an equality of votes, neither the chairperson nor any other director shall have the right to cast

the deciding vote. The board of directors may also take decisions by means of resolutions in writing signed by all directors entitled

to vote. Each director has one vote except in case he/she has a conflict of interest in accordance with Luxembourg Company Law and the

FREYR Articles.

The directors are appointed

by the general meeting of shareholders for a period not exceeding six years and until their successors are elected; provided however

that any one or more of the directors may be removed with or without cause (ad nutum) by the general meeting of shareholders by

a simple majority of the votes cast. The directors shall be eligible for re-election indefinitely. Pursuant to the FREYR Articles, any

proposal by shareholders of candidate(s) for election to the board of directors by the general meeting of shareholders must be (i) made

by one or more shareholders who together hold at least 10% of the subscribed share capital of FREYR and (ii) received by FREYR in

writing pursuant to the provisions set forth in the FREYR Articles.

Unless otherwise determined

by the board of directors, candidates for election to the board of directors must provide to FREYR, (i) a written completed questionnaire

with respect to the background and qualification of such person (which questionnaire shall be provided by FREYR upon written request),

(ii) such information as FREYR may request including, without limitation, as may be required, necessary or appropriate pursuant to

any laws or regulation applicable to the Company (including any rules, policies or regulation of any securities market where shares of

the Company are listed or trading) and (iii) the written representation and undertaking that such person is in compliance, and will

comply with all applicable publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading

and other policies and guidelines of FREYR or under applicable law that are applicable to directors. Any candidate to be considered must

comply as to his/her qualification and affiliations with any laws, regulations, rules or policies applicable to FREYR.

If there is a vacancy on the

board of directors because of death, retirement, resignation, dismissal, removal or otherwise, the remaining directors have the right

to fill such vacancy until the next general meeting of shareholders with the affirmative vote of a majority of the remaining directors

appointed by the general meeting of shareholders. Within the limits provided for by Luxembourg law, the board of directors may delegate

FREYR’s daily management and the authority to represent FREYR to one or more persons.

No director, solely as a result

of being a director, shall be prevented from contracting with FREYR with regard to his tenure in any office or place of profit, or as

vendor, purchaser, or in any other manner whatsoever. No contract or other transaction between FREYR and any other company or firm shall

be affected or invalidated by the fact only that any one or more of the directors or officers of FREYR is financially interested in, or

is a director, associate, officer, agent, adviser or employee of such other company or firm.

In the case of a conflict of

interest of a director, such director shall indicate such conflict of interest to the board of directors and shall not deliberate or vote

on the relevant matter. Any conflict of interest arising at board level shall be reported to the next general meeting of shareholders

before any resolution is put to vote.

The FREYR Articles provide

that directors and officers, past and present, will be entitled to indemnification from FREYR to the fullest extent permitted by Luxembourg

law against liability and all expenses reasonably incurred or paid by him or her in connection with any claim, action, suit, or proceeding

in which he or she would be involved by virtue of his or her being or having been a director or officer and against amounts paid or incurred

by him or her in the settlement thereof. However, no indemnification will be provided against any liability to FREYR’s directors

or officers (i) by reason of willful misfeasance, bad faith, gross negligence, or reckless disregard of the duties of a director

or officer, (ii) with respect to any matter as to which any director or officer shall have been finally adjudicated to have acted

in bad faith and not in FREYR’s interest, or (iii) in the event of a settlement, unless approved by a court of competent jurisdiction

or the board of directors.

There is no mandatory retirement

age for directors under Luxembourg law and no minimum shareholding requirement for directors.

Amendment of Articles of Association

Save in respect of certain

limited matters set out by Luxembourg Company Law and the FREYR Articles which allow the board of directors to implement certain amendments

to the FREYR Articles, Luxembourg Company Law requires an extraordinary general meeting of shareholders to resolve upon an amendment of

the FREYR Articles. The agenda of the extraordinary general meeting of shareholders contained in the convening notice must indicate the

proposed amendments to the FREYR Articles.

Preferred Shares

Issuance of Preferred

Shares

Luxembourg law permits the

issuance of preferred shares by a Luxembourg company provided the board of directors’ authority to issue preferred shares is embedded

in the company’s articles of association. Currently, the FREYR Articles do not grant such authority to the board of directors.

Therefore, prior to the issuance

by the board of directors of FREYR of preferred shares, the board of directors will need to convene, in accordance with applicable laws

and regulations, an extraordinary general meeting of shareholders of FREYR to take place in front of a notary in the Grand Duchy of Luxembourg

in order to inter alia (i) amend article 5.2. of the FREYR Articles (concerning the authorized share capital) in order to indicate

that the board of directors is allowed, within the conditions of the authorized share capital, to issue a certain number of preferred

shares (plus Ordinary Shares, which is currently foreseen in the FREYR Articles) and to waive or limit the preferential subscription right,

if so decided by the board of directors and (ii) determine the rights, preferences, privileges and restrictions applying to preferred

shares (these rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption,

liquidation preferences, sinking fund terms and the number of shares constituting, or the designation of, such series, any or all of which

may be greater than the rights of the Ordinary Shares). The decision to extend the current authorized share capital needs to be adopted

by 2/3 of the votes present or represented with a quorum of half of the share capital and the board of directors needs to present a special

report explaining the reason for putting in place the authorized share capital and waiving or limiting the preferential subscription right.

The extraordinary general meeting of shareholders may amend, renew, or extend such authorized capital and such authorization to the board

of directors, it being understood that the authorized share capital needs to be renewed at least every 5 years.

Upon the completion of the

abovementioned requisite corporate actions, and subject to the extraordinary general meeting of shareholders approving the abovementioned

amendments to the FREYR Articles in accordance with the aforementioned quorum and majority, our board of directors shall have the authority,

during the validity period of the authorized share capital, without further action by our shareholders, to issue up to the authorized