Franklin Resources, Inc. (the “Company”) [NYSE: BEN] today

announced net income1 of $79.1 million or $0.16 per diluted share

for the quarter ended March 31, 2020, as compared to $350.5 million

or $0.70 per diluted share for the previous quarter, and $367.5

million or $0.72 per diluted share for the quarter ended March 31,

2019. The mark-to-market of the Company’s investment portfolio

resulted in significant nonoperating losses that drove the decline

in net income for the quarter ended March 31, 2020. Operating

income was $356.1 million for the quarter ended March 31, 2020, as

compared to $392.7 million for the previous quarter and $379.5

million in the prior year.

As supplemental information, the Company is providing certain

adjusted performance measures which are based on methodologies

other than generally accepted accounting principles2. Adjusted net

income2 was $332.8 million and adjusted diluted earnings per share

was $0.66 for the quarter ended March 31, 2020, as compared to

$338.3 million and $0.67 for the previous quarter, and $330.6

million and $0.65 for the quarter ended March 31, 2019. Adjusted

operating income2 was $385.9 million for the quarter ended March

31, 2020, as compared to $405.5 million for the previous quarter

and $406.6 million in the prior year.

“While the global impact of the COVID-19 pandemic is just

beginning to be understood, the virus has already profoundly

altered our world and its implications are far reaching,” said

Jenny Johnson, President and CEO of Franklin Resources, Inc. “Above

all else, this pandemic is a humanitarian issue – no matter where

you live around the globe, the virus has touched your life in some

way. We offer our heartfelt gratitude to the frontline healthcare

workers and other professionals who are keeping essential

operations functioning.

“Franklin Templeton remains focused on the health and safety of

our employees and their families, and our ability to maintain

high-quality service and stability for our clients is paramount. We

have fully activated our global business continuity plan to protect

our employees and have seamlessly moved to over 97% of our staff

working remotely. We are extremely proud of and grateful for how

our employees have adapted with great agility to operate under

these extraordinary conditions and keep our business running

efficiently.

“Being an active manager during this unprecedented time has

allowed us to find compelling investment opportunities amidst sharp

dislocations across sectors. With this backdrop, security selection

is critical. During the recent market volatility, we’re pleased to

see that our sound investment disciplines are producing strong

results, notably in the areas of U.S. equity, municipal bonds,

global macro, and global equity.

“Our acquisition of Legg Mason remains on track to close in the

third quarter of the calendar year, and integration plans are well

underway. We continue to see the long-term value of these combined

franchises and that our strategy to diversify and create new

opportunities is the right one. There’s excitement at both firms as

we continue to move forward with planning for a combined company

and working to satisfy the conditions to close. Our combined

company will offer a broader range of leading investment

strategies, a more encompassing geographical presence, a

diversified client base, and a resilient and adaptable platform

that can aptly navigate market cycles. It’s also premised on the

stability and continuity of our client-facing teams, while

providing opportunities to invest in our sales and client service

model. We are very focused on integration planning to meet these

goals. Following the close of the transaction, our financial

resources and flexibility will remain robust, an important

foundation of our company.”

Quarter Ended

% Change

Quarter Ended

% Change

31-Mar-20

31-Dec-19

Qtr. vs. Qtr.

31-Mar-19

Year vs. Year

Financial Results

(in millions, except per share data)

Operating revenues

$

1,338.3

$

1,412.7

(5

%)

$

1,433.8

(7

%)

Operating income

356.1

392.7

(9

%)

379.5

(6

%)

Operating margin

26.6

%

27.8

%

26.5

%

Net income¹

$

79.1

$

350.5

(77

%)

$

367.5

(78

%)

Diluted earnings per share

0.16

0.70

(77

%)

0.72

(78

%)

As adjusted

(non-GAAP):2

Adjusted operating income

$

385.9

$

405.5

(5

)%

$

406.6

(5

)%

Adjusted operating margin

43.2

%

42.6

%

41.9

%

Adjusted net income

$

332.8

$

338.3

(2

)%

$

330.6

1

%

Adjusted diluted earnings per share

0.66

0.67

(1

)%

0.65

2

%

Assets Under Management

(in billions)

Ending

$

580.3

$

698.3

(17

%)

$

712.3

(19

%)

Average3

655.8

693.8

(5

%)

688.6

(5

%)

Net flows

(25.4

)

(12.3

)

(6.3

)

Total assets under management (“AUM”) were $580.3 billion at

March 31, 2020, down $118.0 billion or 17% during the quarter due

to $98.2 billion of net market change, distributions and other and

$25.4 billion of net outflows, slightly offset by $5.6 billion from

an acquisition.

Cash and cash equivalents and investments were $7.6 billion at

March 31, 2020, as compared to $7.4 billion at September 30, 2019.

Including the Company’s direct investments in consolidated

investment products, cash and cash equivalents and investments were

$8.2 billion at March 31, 2020, as compared to $8.5 billion at

September 30, 2019. Total stockholders’ equity was $10.8 billion at

March 31, 2020, as compared to $10.6 billion at September 30, 2019.

The Company had 495.3 million shares of common stock outstanding at

March 31, 2020, as compared to 499.3 million shares outstanding at

September 30, 2019. The Company repurchased 2.9 million shares of

its common stock for a total cost of $64.6 million during the

quarter ended March 31, 2020.

Conference Call Information

A commentary on the results by President and CEO Jenny Johnson,

Executive Chairman Greg Johnson and Executive Vice President and

CFO Matthew Nicholls will be available today at approximately 8:30

a.m. Eastern Time. Access to the commentary will be available via

investors.franklinresources.com.

Ms. Johnson, Mr. Johnson and Mr. Nicholls will also lead a live

teleconference today at 11:00 a.m. Eastern Time to answer questions

of a material nature. Access to the teleconference will be

available via investors.franklinresources.com or by dialing (877)

407-8293 in the U.S. and Canada or (201) 689-8349 internationally.

A replay of the teleconference can also be accessed by calling

(877) 660-6853 in the U.S. and Canada or (201) 612-7415

internationally using access code 13701317, after 2:00 p.m. Eastern

Time on April 30, 2020 through May 30, 2020.

Analysts and investors are encouraged to review the Company’s

recent filings with the U.S. Securities and Exchange Commission and

to contact Investor Relations at (650) 312-4091 before the live

teleconference for any clarifications or questions related to the

earnings release or commentary.

FRANKLIN RESOURCES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

Unaudited

(in millions, except per share data and

AUM)

Three Months Ended March

31,

%

Change

Six Months Ended March

31,

% Change

2020

2019

2020

2019

Operating Revenues

Investment management fees

$

908.2

$

992.4

(8

%)

$

1,887.9

$

1,964.2

(4

%)

Sales and distribution fees

341.7

358.5

(5

%)

693.2

713.3

(3

%)

Shareholder servicing fees

54.8

57.1

(4

%)

104.8

112.2

(7

%)

Other

33.6

25.8

30

%

65.1

55.6

17

%

Total operating revenues

1,338.3

1,433.8

(7

%)

2,751.0

2,845.3

(3

%)

Operating Expenses

Sales, distribution and marketing

423.9

449.4

(6

%)

867.8

893.9

(3

%)

Compensation and benefits

365.7

409.6

(11

%)

755.1

764.6

(1

%)

Information systems and technology

61.8

62.1

0

%

124.3

123.0

1

%

Occupancy

34.4

31.4

10

%

68.9

62.6

10

%

General, administrative and other

96.4

101.8

(5

%)

186.1

210.2

(11

%)

Total operating expenses

982.2

1,054.3

(7

%)

2,002.2

2,054.3

(3

%)

Operating Income

356.1

379.5

(6

%)

748.8

791.0

(5

%)

Other Income (Expenses)

Investment and other income (losses),

net

(249.0

)

118.7

NM

(189.4

)

59.6

NM

Interest expense

(4.2

)

(5.7

)

(26

%)

(10.9

)

(12.1

)

(10

%)

Other income (expenses), net

(253.2

)

113.0

NM

(200.3

)

47.5

NM

Income before taxes

102.9

492.5

(79

%)

548.5

838.5

(35

%)

Taxes on income

44.1

110.9

(60

%)

141.6

196.9

(28

%)

Net income

58.8

381.6

(85

%)

406.9

641.6

(37

%)

Less: net income (loss) attributable

to

Redeemable noncontrolling interests

(28.5

)

21.5

NM

(19.5

)

6.1

NM

Nonredeemable noncontrolling interests

8.2

(7.4

)

NM

(3.2

)

(7.9

)

(59

%)

Net Income Attributable to Franklin

Resources, Inc.

$

79.1

$

367.5

(78

%)

$

429.6

$

643.4

(33

%)

Earnings per Share

Basic

$

0.16

$

0.72

(78

%)

$

0.86

$

1.26

(32

%)

Diluted

0.16

0.72

(78

%)

0.86

1.25

(31

%)

Dividends Declared per Share

$

0.27

$

0.26

4

%

$

0.54

$

0.52

4

%

Average Shares Outstanding

Basic

491.5

504.7

(3

%)

493.1

507.6

(3

%)

Diluted

491.8

505.1

(3

%)

493.6

508.0

(3

%)

Operating Margin

26.6

%

26.5

%

27.2

%

27.8

%

AUM (in billions)

Ending

$

580.3

$

712.3

(19

%)

$

580.3

$

712.3

(19

%)

Average

655.8

688.6

(5

%)

671.4

691.1

(3

%)

Net flows

(25.4

)

(6.3

)

(37.7

)

(13.6

)

FRANKLIN RESOURCES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

Unaudited

(in millions, except per share data)

Three Months Ended

%

Change

Three Months Ended

31-Mar-20

31-Dec-19

30-Sep-19

30-Jun-19

31-Mar-19

Operating Revenues

Investment management fees

$

908.2

$

979.7

(7

%)

$

1,001.6

$

1,019.4

$

992.4

Sales and distribution fees

341.7

351.5

(3

%)

363.8

367.5

358.5

Shareholder servicing fees

54.8

50.0

10

%

51.4

52.7

57.1

Other

33.6

31.5

7

%

35.7

37.1

25.8

Total operating revenues

1,338.3

1,412.7

(5

%)

1,452.5

1,476.7

1,433.8

Operating Expenses

Sales, distribution and marketing

423.9

443.9

(5

%)

463.3

462.4

449.4

Compensation and benefits

365.7

389.4

(6

%)

382.4

437.7

409.6

Information systems and technology

61.8

62.5

(1

%)

69.8

65.7

62.1

Occupancy

34.4

34.5

0

%

38.8

32.2

31.4

General, administrative and other

96.4

89.7

7

%

106.7

103.8

101.8

Total operating expenses

982.2

1,020.0

(4

%)

1,061.0

1,101.8

1,054.3

Operating Income

356.1

392.7

(9

%)

391.5

374.9

379.5

Other Income (Expenses)

Investment and other income (losses),

net

(249.0

)

59.6

NM

11.3

44.2

118.7

Interest expense

(4.2

)

(6.7

)

(37

%)

(7.0

)

(5.6

)

(5.7

)

Other income (expenses), net

(253.2

)

52.9

NM

4.3

38.6

113.0

Income before taxes

102.9

445.6

(77

%)

395.8

413.5

492.5

Taxes on income4

44.1

97.5

(55

%)

86.5

158.9

110.9

Net income

58.8

348.1

(83

%)

309.3

254.6

381.6

Less: net income (loss) attributable

to

Redeemable noncontrolling interests

(28.5

)

9.0

NM

—

0.1

21.5

Nonredeemable noncontrolling interests

8.2

(11.4

)

NM

2.9

8.6

(7.4

)

Net Income Attributable to Franklin

Resources, Inc.

$

79.1

$

350.5

(77

%)

$

306.4

$

245.9

$

367.5

Earnings per Share

Basic

$

0.16

$

0.70

(77

%)

$

0.61

$

0.48

$

0.72

Diluted

0.16

0.70

(77

%)

0.61

0.48

0.72

Dividends Declared per Share

$

0.27

$

0.27

0

%

$

0.26

$

0.26

$

0.26

Average Shares Outstanding

Basic

491.5

494.7

(1

%)

497.9

501.6

504.7

Diluted

491.8

495.3

(1

%)

498.8

502.3

505.1

Operating Margin

26.6

%

27.8

%

27.0

%

25.4

%

26.5

%

AUM AND FLOWS

(in billions)

Three Months Ended March

31,

%

Change

Six Months Ended March

31,

% Change

2020

2019

2020

2019

Beginning AUM

$

698.3

$

649.9

7

%

$

692.6

$

717.1

(3

%)

Long-term sales

27.7

27.0

3

%

50.4

48.7

3

%

Long-term redemptions

(54.3

)

(36.2

)

50

%

(100.0

)

(78.6

)

27

%

Long-term net exchanges

(1.5

)

—

NM

(1.6

)

(0.5

)

220

%

Long-term reinvested distributions

2.7

2.9

(7

%)

13.5

16.8

(20

%)

Net flows

(25.4

)

(6.3

)

303

%

(37.7

)

(13.6

)

177

%

Acquisitions

5.6

26.4

(79

%)

5.6

26.4

(79

%)

Net market change, distributions and

other5

(98.2

)

42.3

NM

(80.2

)

(17.6

)

356

%

Ending AUM

$

580.3

$

712.3

(19

%)

$

580.3

$

712.3

(19

%)

AUM BY INVESTMENT OBJECTIVE

(in billions)

31-Mar-20

31-Dec-19

% Change

30-Sep-19

30-Jun-19

31-Mar-19

Equity

Global/international

$

114.7

$

163.5

(30

%)

$

158.4

$

169.8

$

174.4

United States

92.7

117.0

(21

%)

112.1

112.4

109.5

Total equity

207.4

280.5

(26

%)

270.5

282.2

283.9

Multi-Asset/Balanced

118.2

136.5

(13

%)

134.3

136.0

134.7

Fixed Income

Tax-free

64.9

66.7

(3

%)

66.3

65.0

63.4

Taxable

Global/international

113.3

136.7

(17

%)

144.6

154.9

152.5

United States

65.8

67.5

(3

%)

67.4

67.9

68.9

Total fixed income

244.0

270.9

(10

%)

278.3

287.8

284.8

Cash Management

10.7

10.4

3

%

9.5

9.2

8.9

Total AUM

$

580.3

$

698.3

(17

%)

$

692.6

$

715.2

$

712.3

Average AUM for the Three-Month

Period

$

655.8

$

693.8

(5

%)

$

702.0

$

710.8

$

688.6

AUM AND FLOWS - UNITED STATES AND

INTERNATIONAL6

As of and for the Three Months

Ended

(in billions)

31-Mar-20

% of Total

31-Dec-19

% of Total

31-Mar-19

% of Total

Long-Term Sales

United States

$

15.9

57

%

$

12.9

57

%

$

14.2

53

%

International

11.8

43

%

9.8

43

%

12.8

47

%

Total long-term sales

$

27.7

100

%

$

22.7

100

%

$

27.0

100

%

Long-Term Redemptions

United States

$

(31.9

)

59

%

$

(28.0

)

61

%

$

(20.6

)

57

%

International

(22.4

)

41

%

(17.7

)

39

%

(15.6

)

43

%

Total long-term redemptions

$

(54.3

)

100

%

$

(45.7

)

100

%

$

(36.2

)

100

%

AUM

United States

$

408.3

70

%

$

481.0

69

%

$

486.6

68

%

International

172.0

30

%

217.3

31

%

225.7

32

%

Total AUM

$

580.3

100

%

$

698.3

100

%

$

712.3

100

%

AUM AND FLOWS BY INVESTMENT

OBJECTIVE

(in billions)

Equity

Multi- Asset/ Balanced

Fixed Income

Cash Management

Total

for the three months ended March 31,

2020

Global/ International

United States

Tax-Free

Taxable Global/

International

Taxable

United

States

AUM at January 1, 2020

$

163.5

$

117.0

$

136.5

$

66.7

$

136.7

$

67.5

$

10.4

$

698.3

Long-term sales

4.6

6.4

5.1

2.5

6.7

2.4

—

27.7

Long-term redemptions

(12.6

)

(7.7

)

(8.3

)

(3.2

)

(18.9

)

(3.6

)

—

(54.3

)

Long-term net exchanges

(0.3

)

(0.1

)

(0.5

)

(0.3

)

(0.7

)

0.4

—

(1.5

)

Long-term reinvested distributions

0.1

0.1

1.1

0.4

0.8

0.2

—

2.7

Net flows

(8.2

)

(1.3

)

(2.6

)

(0.6

)

(12.1

)

(0.6

)

—

(25.4

)

Acquisition

—

—

5.6

—

—

—

—

5.6

Net market change, distributions and

other5

(40.6

)

(23.0

)

(21.3

)

(1.2

)

(11.3

)

(1.1

)

0.3

(98.2

)

AUM at March 31, 2020

$

114.7

$

92.7

$

118.2

$

64.9

$

113.3

$

65.8

$

10.7

$

580.3

(in billions)

Equity

Multi- Asset/

Balanced

Fixed Income

Cash

Management

Total

for the three months ended December 31,

2019

Global/

International

United

States

Tax-Free

Taxable

Global/

International

Taxable

United

States

AUM at October 1, 2019

$

158.4

$

112.1

$

134.3

$

66.3

$

144.6

$

67.4

$

9.5

$

692.6

Long-term sales

3.8

4.4

3.5

2.0

6.6

2.4

—

22.7

Long-term redemptions

(10.7

)

(7.6

)

(6.2

)

(1.9

)

(16.2

)

(3.1

)

—

(45.7

)

Long-term net exchanges

(0.2

)

0.1

0.1

0.1

(0.7

)

0.5

—

(0.1

)

Long-term reinvested distributions

2.4

4.8

1.9

0.4

1.0

0.3

—

10.8

Net flows

(4.7

)

1.7

(0.7

)

0.6

(9.3

)

0.1

—

(12.3

)

Net market change, distributions and

other5

9.8

3.2

2.9

(0.2

)

1.4

—

0.9

18.0

AUM at December 31, 2019

$

163.5

$

117.0

$

136.5

$

66.7

$

136.7

$

67.5

$

10.4

$

698.3

(in billions)

Equity

Multi-Asset/

Balanced

Fixed Income

Cash

Management

Total

for the three months ended March 31,

2019

Global/

International

United

States

Tax-Free

Taxable

Global/

International

Taxable

United

States

AUM at January 1, 2019

$

166.0

$

97.1

$

124.8

$

62.0

$

147.7

$

42.2

$

10.1

$

649.9

Long-term sales

5.1

4.1

3.1

1.8

11.1

1.8

—

27.0

Long-term redemptions

(12.0

)

(5.8

)

(4.4

)

(2.2

)

(8.6

)

(3.2

)

—

(36.2

)

Long-term net exchanges

(0.2

)

(0.1

)

0.1

0.2

—

—

—

—

Long-term reinvested distributions

0.1

—

1.1

0.4

1.1

0.2

—

2.9

Net flows

(7.0

)

(1.8

)

(0.1

)

0.2

3.6

(1.2

)

—

(6.3

)

Acquisition

—

—

—

—

—

26.4

—

26.4

Net market change, distributions and

other5

15.4

14.2

10.0

1.2

1.2

1.5

(1.2

)

42.3

AUM at March 31, 2019

$

174.4

$

109.5

$

134.7

$

63.4

$

152.5

$

68.9

$

8.9

$

712.3

Supplemental Non-GAAP Financial Measures

As supplemental information, we are providing performance

measures for “adjusted operating income,” “adjusted operating

margin,” “adjusted net income” and “adjusted diluted earnings per

share”, each of which are based on methodologies other than

generally accepted accounting principles (“non-GAAP measures”).

Management believes these non-GAAP measures are useful indicators

of our financial performance and may be helpful to investors in

evaluating our relative performance against industry peers as these

measures exclude the impact of consolidated investment products and

mitigate the margin variability related to sales and distribution

revenues and expenses across multiple distribution channels

globally. These non-GAAP measures also exclude acquisition-related

expenses, certain items which management considers to be

nonrecurring, unrealized investment gains and losses included in

investment and other income (losses), net, and the related income

tax effect of these adjustments, as applicable.

“Adjusted operating income,” “adjusted operating margin,”

“adjusted net income” and “adjusted diluted earnings per share” are

defined below, along with reconciliations of operating income,

operating margin, net income attributable to Franklin Resources,

Inc. and diluted earnings per share on a U.S. GAAP basis to these

non-GAAP measures. Non-GAAP measures should not be considered in

isolation from, or as substitutes for, any financial information

prepared in accordance with GAAP, and may not be comparable to

other similarly titled measures of other companies. Additional

reconciling items may be added in the future to these non-GAAP

measures if deemed appropriate.

Adjusted Operating Income

We define adjusted operating income as operating income adjusted

to exclude the following:

- Revenues and expenses of consolidated investment products, but

include revenues eliminated upon consolidation of investment

products.

- Acquisition-related retention compensation.

- Other acquisition-related expenses including professional fees

and fair value adjustments related to contingent consideration

liabilities and retention awards.

- Amortization and impairment of intangible assets.

- Special termination benefits related to voluntary separation

and workforce reduction initiatives of 4.5% of our global workforce

in the fiscal year ended September 30, 2019 (“fiscal year

2019”).

Adjusted Operating Margin

We calculate adjusted operating margin as adjusted operating

income divided by adjusted operating revenues. We define adjusted

operating revenues as operating revenues adjusted to exclude the

following:

- Sales and distribution fees and a portion of investment

management fees allocated to cover sales, distribution and

marketing expenses paid to the financial advisers and other

intermediaries who sell our funds on our behalf.

- Revenues of consolidated investment products, but include

revenues eliminated upon consolidation of investment products.

Adjusted Net Income

We define adjusted net income as net income attributable to

Franklin Resources, Inc. adjusted to exclude the following:

- Activities of consolidated investment products, including

revenues, expenses, investment and other income (losses), net, and

income (loss) attributable to noncontrolling interests, net of

amounts eliminated upon consolidation of investment products.

- Acquisition-related retention compensation.

- Other acquisition-related expenses including professional fees

and fair value adjustments related to contingent consideration

liabilities and retention awards.

- Amortization and impairment of intangible assets.

- Special termination benefits related to voluntary separation

and workforce reduction initiatives of 4.5% of our global workforce

in fiscal year 2019.

- Unrealized investment gains and losses included in investment

and other income (losses), net.

- Net income tax benefit of the above adjustments based on the

respective blended rates applicable to the adjustments.

Adjusted Diluted Earnings Per Share

We define adjusted diluted earnings per share as diluted

earnings per share adjusted to exclude the per-share impacts of the

adjustments applied to net income in calculating adjusted net

income.

In calculating adjusted operating income, adjusted operating

margin, adjusted net income and adjusted diluted earnings per

share, we adjust for activities of consolidated investment products

because the impact of consolidated products are not considered

reflective of the underlying results of our operations. We adjust

for acquisition-related retention compensation, other

acquisition-related expenses, and amortization and impairment of

intangible assets to facilitate comparability of our operating

results with the results of other asset management firms. We adjust

for special termination benefits related to certain voluntary

separation and workforce reduction initiatives because these items

are deemed nonrecurring. In calculating adjusted net income and

adjusted diluted earnings per share, we adjust for unrealized

investment gains and losses included in investment and other income

(losses), net because these items primarily relate to seed and

strategic investments which have been and are generally expected to

be held long term.

The calculations of adjusted operating income, adjusted

operating margin, adjusted net income and adjusted diluted earnings

per share are as follows:

(in millions)

Three Months Ended

Fiscal Year Ended

31-Mar-20

31-Dec-19

30-Sep-19

30-Jun-19

31-Mar-19

31-Dec-18

30-Sep-19

Operating income

$

356.1

$

392.7

$

391.5

$

374.9

$

379.5

$

411.5

$

1,557.4

Add (subtract):

Operating income of consolidated

investment products*

(10.0

)

(13.1

)

(19.4

)

(18.8

)

(6.1

)

(15.5

)

(59.8

)

Acquisition-related retention

27.2

21.3

20.7

21.5

16.9

4.6

63.7

Other acquisition-related expenses

5.4

(0.2

)

0.1

(0.1

)

0.6

8.8

9.4

Amortization of intangible assets

4.4

4.8

5.0

5.1

3.9

0.7

14.7

Impairment of intangible assets

2.8

—

4.0

9.3

—

—

13.3

Special termination benefits

—

—

4.9

38.8

11.8

—

55.5

Adjusted operating income

$

385.9

$

405.5

$

406.8

$

430.7

$

406.6

$

410.1

$

1,654.2

Total operating revenues

$

1,338.3

$

1,412.7

$

1,452.5

$

1,476.7

$

1,433.8

$

1,411.5

$

5,774.5

Add (subtract):

Sales and distribution fees

(341.7

)

(351.5

)

(363.8

)

(367.5

)

(358.5

)

(354.8

)

(1,444.6

)

Allocation of investment management fees

for sales, distribution and marketing expenses

(82.2

)

(92.4

)

(99.5

)

(94.9

)

(90.9

)

(89.7

)

(375.0

)

Net revenues of consolidated investment

products*

(20.9

)

(16.8

)

(22.7

)

(21.4

)

(14.8

)

(15.5

)

(74.4

)

Adjusted operating revenues

$

893.5

$

952.0

$

966.5

$

992.9

$

969.6

$

951.5

$

3,880.5

Operating margin

26.6

%

27.8

%

27.0

%

25.4

%

26.5

%

29.2

%

27.0

%

Adjusted operating margin

43.2

%

42.6

%

42.1

%

43.4

%

41.9

%

43.1

%

42.6

%

(in millions, except per share data)

Three Months Ended

Fiscal Year Ended

31-Mar-20

31-Dec-19

30-Sep-19

30-Jun-19

31-Mar-19

31-Dec-18

30-Sep-19

Net income attributable to Franklin

Resources, Inc.

$

79.1

$

350.5

$

306.4

$

245.9

$

367.5

$

275.9

$

1,195.7

Add (subtract):

Net (income) loss of consolidated

investment products*

(16.4

)

4.6

(5.3

)

0.4

4.4

(3.2

)

(3.7

)

Acquisition-related retention

27.2

21.3

20.7

21.5

16.9

4.6

63.7

Other acquisition-related expenses

5.4

(0.2

)

0.1

(0.1

)

0.6

8.8

9.4

Amortization of intangible assets

4.4

4.8

5.0

5.1

3.9

0.7

14.7

Impairment of intangible assets

2.8

—

4.0

9.3

—

—

13.3

Special termination benefits

—

—

4.9

38.8

11.8

—

55.5

Unrealized investment (gains) losses

included in investment and other (income) losses, net

257.6

(36.4

)

29.9

(24.9

)

(66.9

)

81.9

20.0

Net income tax benefit of adjustments

(27.3

)

(6.3

)

(7.3

)

(14.5

)

(7.6

)

(7.9

)

(37.3

)

Adjusted net income

$

332.8

$

338.3

$

358.4

$

281.5

$

330.6

$

360.8

$

1,331.3

Diluted earnings per share

$

0.16

$

0.70

$

0.61

$

0.48

$

0.72

$

0.54

$

2.35

Adjusted diluted earnings per

share

0.66

0.67

0.71

0.55

0.65

0.70

2.62

__________________

*

The impact of consolidated investment

products is summarized as follows:

(in millions)

Three Months Ended

Fiscal Year Ended

31-Mar-20

31-Dec-19

30-Sep-19

30-Jun-19

31-Mar-19

31-Dec-18

30-Sep-19

Revenues of consolidated investment

products

$

27.1

$

23.5

$

29.7

$

28.3

$

21.0

$

26.1

$

105.1

Revenues eliminated upon consolidation of

investment products

(6.2

)

(6.7

)

(7.0

)

(6.9

)

(6.2

)

(10.6

)

(30.7

)

Net revenues of consolidated investment

products

20.9

16.8

22.7

21.4

14.8

15.5

74.4

Expenses of consolidated investment

products

10.9

3.7

3.3

2.6

8.7

—

14.6

Operating income of consolidated

investment products

10.0

13.1

19.4

18.8

6.1

15.5

59.8

Investment and other income (losses), net

of consolidated investment products

(16.9

)

(20.0

)

(12.4

)

(16.6

)

3.0

(24.7

)

(50.7

)

Less: income (loss) attributable to

noncontrolling interests of consolidated investment products

(23.3

)

(2.3

)

1.7

2.6

13.5

(12.4

)

5.4

Net income (loss) of consolidated

investment products

$

16.4

$

(4.6

)

$

5.3

$

(0.4

)

$

(4.4

)

$

3.2

$

3.7

Notes

1.

Net income represents net income

attributable to Franklin Resources, Inc.

2.

“Adjusted operating income,” “adjusted

operating margin,” “adjusted net income” and “adjusted diluted

earnings per share” are based on methodologies other than generally

accepted accounting principles. See “Supplemental Non-GAAP

Financial Measures” for definitions and reconciliations of these

measures.

3.

Average AUM represents simple monthly

average AUM.

4.

Taxes on income for the quarter ended June

30, 2019 includes an $86.4 million reversal of a tax benefit

recognized in the prior fiscal year upon issuance of final

regulations by the U.S. Department of Treasury for the Tax Cuts and

Jobs Act of 2017.

5.

Net market change, distributions and other

includes appreciation (depreciation), distributions to investors

that represent return on investments and return of capital, foreign

exchange revaluation and net cash management.

6.

International includes North America-based

advisors serving non-resident clients.

Franklin Resources, Inc. is a global investment management

organization operating together with its subsidiaries as Franklin

Templeton. Franklin Templeton’s goal is to deliver better outcomes

by providing global and domestic investment management to retail,

institutional and sovereign wealth clients in over 170 countries.

Through specialized teams, the Company has expertise across all

asset classes, including equity, fixed income, alternatives and

custom multi-asset solutions. The Company’s more than 600

investment professionals are supported by its integrated, worldwide

team of risk management professionals and global trading desk

network. With employees in over 30 countries, the California-based

company has more than 70 years of investment experience and $580.3

billion in AUM as of March 31, 2020. The Company posts information

that may be significant for investors in the Investor Relations and

News Center sections of its website, and encourages investors to

consult those sections regularly. For more information, please

visit investors.franklinresources.com.

Forward-Looking Statements

Statements in this press release regarding Franklin Resources,

Inc. and its subsidiaries, which are not historical facts, are

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. When used in this press

release, words or phrases generally written in the future tense

and/or preceded by words such as “will,” “may,” “could,” “expect,”

“believe,” “anticipate,” “intend,” “plan,” “seek,” “estimate” or

other similar words are forward-looking statements.

Forward-looking statements involve a number of known and unknown

risks, uncertainties and other important factors, some of which are

listed below, that could cause actual results and outcomes to

differ materially from any future results or outcomes expressed or

implied by such forward-looking statements. While forward-looking

statements are our best prediction at the time that they are made,

you should not rely on them and are cautioned against doing so.

Forward-looking statements are based on our current expectations

and assumptions regarding our business, the economy and other

future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict. They are

neither statements of historical fact nor guarantees or assurances

of future performance.

These and other risks, uncertainties and other important factors

are described in more detail in our recent filings with the U.S.

Securities and Exchange Commission, including, without limitation,

in Risk Factors and Management’s Discussion and Analysis of

Financial Condition and Results of Operations in our Annual Report

on Form 10-K for the fiscal year ended September 30, 2019 and our

subsequent Quarterly Reports on Form 10-Q:

- Our proposed acquisition of Legg Mason, Inc. remains subject to

transaction-related and other risks.

- Our business and operations are subject to adverse effects from

the outbreak and spread of contagious diseases such as COVID-19,

and we expect such adverse effects to continue.

- Volatility and disruption of the capital and credit markets,

and adverse changes in the global economy, may significantly affect

our results of operations and may put pressure on our financial

results.

- The amount and mix of our AUM are subject to significant

fluctuations.

- We are subject to significant risk of asset volatility from

changes in the global financial, equity, debt and commodity

markets.

- Our funds may be subject to liquidity risks or an unanticipated

large number of redemptions.

- A shift in our asset mix toward lower fee products may

negatively impact our revenues.

- We may not effectively manage risks associated with the

replacement of benchmark indices.

- Poor investment performance of our products could reduce the

level of our AUM or affect our sales, and negatively impact our

revenues and income.

- Harm to our reputation may negatively impact our revenues and

income.

- Our business operations are complex and a failure to perform

operational tasks properly or the misrepresentation of our services

and products resulting, without limitation, in the termination of

investment management agreements representing a significant portion

of our AUM, could have an adverse effect on our revenues and

income.

- We face risks, and corresponding potential costs and expenses,

associated with conducting operations and growing our business in

numerous countries.

- Our increasing focus on international markets as a source of

investments and sales of our products subjects us to increased

exchange rate and market-specific political, economic or other

risks that may adversely impact our revenues and income generated

overseas.

- We may review and pursue strategic transactions that could pose

risks to our business.

- Strong competition from numerous and sometimes larger companies

with competing offerings and products could limit or reduce sales

of our products, potentially resulting in a decline in our market

share, revenues and income.

- Increasing competition and other changes in the third-party

distribution and sales channels on which we depend could reduce our

income and hinder our growth.

- Any failure of our third-party providers to fulfill their

obligations, or our failure to maintain good relationships with our

providers, could adversely impact our business.

- We may be adversely affected if any of our third-party

providers is subject to a successful cyber or security attack.

- Our ability to manage and grow our business successfully can be

impeded by systems and other technological limitations.

- Any significant limitation, failure or security breach of our

information and cyber security infrastructure, software

applications, technology or other systems that are critical to our

operations could disrupt our business and harm our operations and

reputation.

- Our inability to recover successfully, should we experience a

disaster or other business continuity problem, could cause material

financial loss, regulatory actions, legal liability, and/or

reputational harm.

- We depend on key personnel and our financial performance could

be negatively affected by the loss of their services.

- Our future results are dependent upon maintaining an

appropriate expense level.

- Our ability to meet cash needs depends upon certain factors,

including the market value of our assets, our operating cash flows

and our perceived creditworthiness.

- We are dependent on the earnings of our subsidiaries.

- We are subject to extensive, complex, overlapping and

frequently changing rules, regulations, policies, and legal

interpretations.

- We may be adversely affected as a result of new or revised

legislation or regulations or by changes in the interpretation of

existing laws and regulations.

- Global regulatory and legislative actions and reforms have made

the regulatory environment in which we operate more costly and

future actions and reforms could adversely impact our financial

condition and results of operations.

- Failure to comply with the laws, rules or regulations in any of

the jurisdictions in which we operate could result in substantial

harm to our reputation and results of operations.

- Changes in tax laws or exposure to additional income tax

liabilities could have a material impact on our financial

condition, results of operations and liquidity.

- Our contractual obligations may subject us to indemnification

costs and liability to third parties.

- Regulatory and governmental examinations and/or investigations,

litigation and the legal risks associated with our business, could

adversely impact our AUM, increase costs and negatively impact our

profitability and/or our future financial results.

Any forward-looking statement made by us in this press release

speaks only as of the date on which it is made. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible for us to predict all of them. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200430005478/en/

Franklin Resources, Inc. Investor Relations: Brian Sevilla (650)

312-4091, brian.sevilla@franklintempleton.com Media Relations: Matt

Walsh (650) 312-2245, matthew.walsh@franklintempleton.com

investors.franklinresources.com

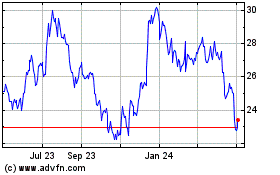

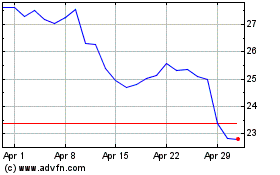

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Apr 2023 to Apr 2024