Ben Barber Rejoins Franklin Templeton to Head Municipal Bond Team

February 26 2020 - 9:00AM

Business Wire

Sheila Amoroso to Retire after 34 Years with

the Firm

Franklin Templeton today announces that Ben Barber, who has most

recently served as co-head of municipal bonds at Goldman Sachs

Asset Management, will rejoin the firm to succeed Sheila Amoroso as

senior vice president, director of Municipal Bonds on April 27,

2020, overseeing $68 billion in municipal bond investments.

Sheila Amoroso, who is currently senior vice president, director

of Franklin Templeton Fixed Income’s municipal bond department, has

announced her plans to retire after 34 years of service. She will

work closely with Barber through a period of transition until her

retirement date of July 1, 2020.

Barber has over 28 years of industry experience, having started

his career in municipal bond investing with Franklin Templeton in

1991, working with several current investment team members,

including Amoroso, through 1999, when he joined Goldman Sachs. He

will be based in San Mateo, CA and will report to Sonal Desai, CIO,

Franklin Templeton Fixed Income.

“We are very thankful for Sheila’s more than three decades of

excellent service and wish her all the best in her retirement. She

has been a key partner to me in my role of CIO, and I am grateful

for the time we worked together,” said Desai, CIO, Franklin

Templeton Fixed Income. “As Sheila transitions we are very lucky to

have Ben back at Franklin Templeton, where he started his career.

He brings strong leadership experience to the municipal bond team

and our fixed income platform, and I couldn’t be more delighted to

have him on board.”

Under Amoroso’s steadfast leadership, Franklin Templeton’s

municipal bond group has become a premier municipal bond manager,

with a very stable and experienced team consisting of long-tenured

investment professionals that have maintained a consistent approach

and philosophy for managing municipal bond portfolios.

“I am excited to be returning to Franklin Templeton to join a

team of such talented investment professionals and helping to build

on the world class platform,” said Barber. “Our industry continues

to evolve right before us. I can see the commitment and enthusiasm

that is core to Franklin Templeton’s culture, and I look forward to

the opportunities that lie ahead.”

Franklin Templeton’s 31-member municipal bond team manages a

wide variety of single state and national municipal bond strategies

for investors in the US and beyond, via a comprehensive fund lineup

and separately managed accounts and institutional accounts.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization operating as Franklin Templeton. Franklin

Templeton’s goal is to deliver better outcomes by providing global

and domestic investment management to retail, institutional and

sovereign wealth clients in over 170 countries. Through specialized

teams, the Company has expertise across all asset classes,

including equity, fixed income, alternatives and custom multi-asset

solutions. The Company’s more than 600 investment professionals are

supported by its integrated, worldwide team of risk management

professionals and global trading desk network. With employees in

over 30 countries, the California-based company has more than 70

years of investment experience and approximately $688 billion in

assets under management as of January 31, 2020.

Copyright © 2020. Franklin Templeton. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200226005267/en/

Franklin Templeton Corporate Communications: Stacey Coleman,

(650) 525-7458, stacey.coleman@franklintempleton.com Becky

Radosevich, (212) 632-3207,

rebecca.radosevich@franklintempleton.com

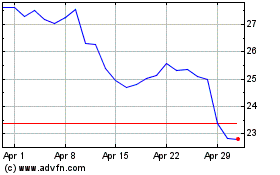

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

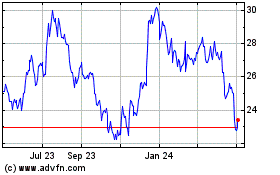

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Apr 2023 to Apr 2024