Ford Expects 40% of Global Vehicle Volume to Be Fully Electric By 2030 -- Update

May 26 2021 - 10:15AM

Dow Jones News

By Mike Colias

Ford Motor Co. plans to boost spending on electric-vehicle

development by billions of dollars beyond previous plans and

expects 40% of its global sales to be fully electric by 2030, as

Chief Executive Jim Farley bets bigger on plug-in cars.

Ford will spend $30 billion by 2025 to expand its electric

lineup, up from the $22 billion it forecast earlier in the year, it

said Wednesday. That figure is a cumulative total that includes

spending over the past few years, and includes capital earmarked

for two future U.S. battery-cell factories with Korea's SK

Innovation Co. The companies said last week they plan to form a

joint venture.

Mr. Farley, who took over last fall, is scheduled to present

more details during a virtual investor presentation later Wednesday

to outline his plan to reverse years of declining profits.

The company also said it expects in 2023 to achieve an 8%

operating margin, up from around 4% in recent years. It had

previously pegged the 8% mark as a goal but hadn't specified a

timeline.

The nation's No. 2 auto maker by sales said it has created an

internal business called Ford Pro to serve commercial customers,

such as the contractors, utility companies and government agencies

that maintain fleets of vehicles.

Ford said it expects to increase revenue in that space to $45

billion by 2025, from $27 billion in 2019. It plans to achieve that

goal in part by adding services to help those customers do work,

such as providing electric-vehicle chargers and digital tools to

help them track their vehicle fleets.

The CEO's focus on the commercial business was evident with last

week's unveiling of the electric F-150 Lightning pickup truck. The

first fully electric version of Ford's top-selling and

most-profitable product is aimed at protecting Ford's lead among

commercial customers.

Ford said Wednesday it has received 70,000 reservations for the

new electric truck since the Lightning's May 19 introduction. The

company's shares have rallied in the wake of the debut, which was

punctuated by a factory visit from President Biden.

The Lightning drew praise from Wall Street analysts, who said

the lower-than-expected starting price of around $40,000 should

help Ford fend off several electric-truck startups expected to

enter the market.

"It's imperative for Ford to gain that beachhead in electric

pickups now to maintain their dominance in pickups over time," RBC

Capital analyst Joseph Spak said in an investor note this week.

Ford has accelerated its electric-vehicle ambitions under Mr.

Farley, who began his career at Toyota and spent many years as

Ford's marketing chief.

Under previous CEO Jim Hackett, who retired last year,

executives said they didn't see a need to bring battery-cell

production in house for electric vehicles. Mr. Farley reversed

course with the planned SK deal, saying he wants better control of

Ford's battery supply.

Still, Ford's electric-vehicle strategy has been seen by some

analysts as lagging General Motors Co. and Volkswagen AG, which is

providing its electric-vehicle technology to Ford for future

plug-in offerings in Europe. GM and VW both have outlined

more-aggressive timetables for transitioning their vehicle lineups

to electric and moved more quickly into battery-cell

production.

GM earlier this year said it plans to mostly phase out gasoline-

and diesel-powered vehicles from its showrooms globally by

2035.

Mr. Farley has said Ford's strategy is more-selective than those

of its competitors, with plans to offer electric versions of its

most popular nameplates, including the F-150 and the Mustang Mach-E

SUV. As electric vehicles spread through Ford's lineup, it will

help the company expand in-vehicle digital services especially to

commercial customers and generate subscription-based revenue, he

has said.

After missing profit forecasts several times under Mr. Hackett,

Ford has strung together several strong quarters, including its

highest profit in years during the first quarter. But the

continuing computer-chip shortage has hit the company harder than

rivals and is expected to weigh on results for much of the

year.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

May 26, 2021 10:03 ET (14:03 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

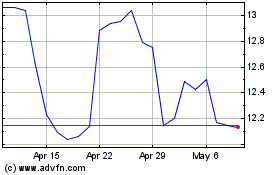

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

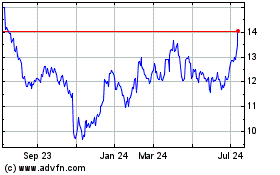

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024