SEC Investigating BMW Over Sales Practices--Update

December 23 2019 - 7:05PM

Dow Jones News

By William Boston in Berlin and Mike Colias in Detroit

BERLIN -- The Securities and Exchange Commission has opened an

investigation into German luxury car maker BMW AG, a company

spokesman said on Monday.

The SEC is looking into whether the Munich-based auto maker

engaged in the practice known as sales punching in the U.S.,

according to people familiar with the matter.

Sale punching occurs when a company boosts sales figures by

having dealers register cars as sold when the vehicles actually are

still standing on car lots.

"We have been contacted by the SEC and will cooperate fully with

their investigation," the spokesman told The Wall Street Journal,

declining to elaborate further on the investigation.

The SEC couldn't immediately be reached for comment.

The probe comes as the U.S. officials continue to pursue

companies suspected of falsifying data and misleading

investors.

Fiat Chrysler Automobiles N.V. in September agreed to pay $40

million to settle claims by the SEC that the company had for years

paid dealers to report exaggerated sales numbers. The company said

at the time it had reviewed and refined its sales reporting

procedures and was committed to maintaining strong controls.

The company also revised monthly sales results going back

several years, nullifying a 75-month streak of sales increases.

Under those revised methods, the streak ended in September 2013,

three years earlier than previously stated.

This year, Fiat Chrysler joined General Motors Co. and Ford

Motor Co. in ending the practice of reporting monthly U.S. sales

numbers. The Detroit companies now report their U.S. sales

quarterly, while most other major car companies still disclose

results each month.

The SEC investigation also follows 2015 indictments against

Volkswagen AG on charges of defrauding U.S. consumers and the U.S.

government and violating the Clean Air Act by rigging

diesel-powered vehicles to cheat emissions test. That case was

brought by the Justice Department.

Volkswagen pleaded guilty to the charges in 2016 and has faced

more than $30 billion in fines, penalties, and compensation

fees.

In addition, BMW faces litigation by European authorities on

allegations of colluding with rivals to manipulate prices on

technology to control emissions. BMW, which has vowed to fight the

case, in April took a $1.1 billion charge against earnings as a

provision for potential fines from the case.

BMW sold 322,862 vehicles in the U.S. in the first nine months

of the year, an increase of 1.7% from a year ago, including its

namesake BMW brands and its Mini brand.

BMW also has been under pressure in the U.S. because of the

Trump administration's trade war with China, which has hit BMW's

SUV exports from its Spartanburg, S.C., factory. BMW has responded

by shifting some production from the U.S. to China.

Nora Naughton in Detroit contributed to this article.

Write to William Boston at william.boston@wsj.com and Mike

Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

December 23, 2019 18:50 ET (23:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

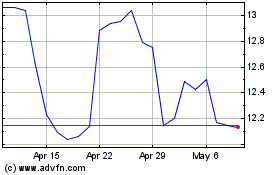

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

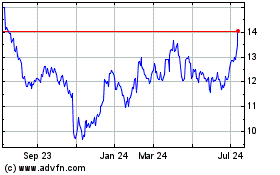

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024