UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

Annual Report Pursuant to Section 15(d) of the

Securities Exchange Act of 1934

(Mark One) | | | | | |

| X | Annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934 |

(No Fee Required)

For the fiscal year ended December 31, 2021

OR

| | | | | |

| Transition report pursuant to Section 15(d) of the Securities Exchange Act of 1934 |

(No Fee Required)

For the transition period from _______ to _______

Commission file number 1-2376

FMC CORPORATION SAVINGS AND INVESTMENT PLAN

Full title of the plan and the address of the plan, if different

from that of the issuer named below

FMC CORPORATION

2929 WALNUT STREET

PHILADELPHIA, PA 19104

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Table of Contents | | | | | |

| Page |

| |

| Financial Statements: | |

| |

| |

| |

| Supplemental Schedule: | |

| |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Plan Administrator

FMC Corporation Savings and Investment Plan:

Opinion on the Financial Statements

We have audited the accompanying statement of net assets available for benefits of the FMC Corporation Savings and Investment Plan (the Plan) as of December 31, 2021 and 2020, the related statement of changes in net assets available for benefits for the year ended December 31, 2021 and 2020, the related notes and schedules (collectively referred to as the financial statements.) In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, the changes in net assets available for benefits for the year ended December 31, 2021 and 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting, but not for purposes of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Accompanying Supplemental Information

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/MITCHELL & TITUS LLP

We have served as the Plan’s auditor since 2020.

Philadelphia, Pennsylvania

June 22, 2022

| | | | | | | | | | | |

| FMC CORPORATION |

| SAVINGS AND INVESTMENT PLAN |

| Statements of Net Assets Available for Benefits |

| December 31, 2021 and 2020 |

| (in thousands) |

| 2021 | | 2020 |

| Assets: | | | |

| Investments at fair value | $ | 695,430 | | | $ | 702,074 | |

| Receivables: | | | |

| Contributions receivable | 7,475 | | | 8,287 | |

| Notes receivable from participants | 2,814 | | | 2,625 | |

| Net assets available for benefits | $ | 705,719 | | | $ | 712,986 | |

See accompanying Notes to Financial Statements.

| | | | | | | | | | | |

| FMC CORPORATION |

| SAVINGS AND INVESTMENT PLAN |

| Statements of Changes in Net Assets Available for Benefits |

| Years Ended December 31, 2021 and 2020 |

| (in thousands) |

| | | |

| 2021 | | 2020 |

| Additions: | | | |

| Interest and dividend income | $ | 23,315 | | | $ | 15,109 | |

| Net appreciation in fair value of investments | 56,402 | | | 100,890 | |

| Contributions: | | | |

| Participants | 18,373 | | | 18,160 | |

| Rollovers | 3,859 | | | 4,033 | |

| Employer | 14,146 | | | 14,631 | |

| Total additions | $ | 116,095 | | | $ | 152,823 | |

| | | |

| Deductions: | | | |

| | | |

| Benefits paid to participants | 122,875 | | | 72,761 | |

| Administrative expenses | 487 | | | 492 | |

| Total deductions | $ | 123,362 | | | $ | 73,253 | |

| | | |

| Net increase (decrease) | $ | (7,267) | | | $ | 79,570 | |

| Net assets available for benefits, beginning of year | 712,986 | | | 633,416 | |

| Net assets available for benefits, end of year | $ | 705,719 | | | $ | 712,986 | |

See accompanying Notes to Financial Statements.

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements

December 31, 2021 and 2020

Note 1 - Description of the Plan

The following description of the FMC Corporation Savings and Investment Plan (the Plan) provides only general information. A more complete description of the Plan's provisions may be found in the Plan Document.

a. General

The Plan is a qualified defined contribution plan under Section 401(k) of the Internal Revenue Code, which covers substantially all employees of FMC Corporation (FMC, the Company or the Plan Sponsor), other than employees who generally reside or work outside of the United States. Such employees are eligible to participate in the Plan immediately upon commencement of their employment with the Company. The Plan is subject to the provisions of the Employee Retirement Income Security Act (ERISA). The Plan is administered by the Employee Welfare Benefits Plan Committee of FMC Corporation.

Given the COVID-19 pandemic there has been instability in the global economy and financial markets. The extent to which COVID-19 will continue to impact the Plan's financial position will depend on future developments, many of which remain uncertain and cannot be predicted with confidence, including the duration of the pandemic, further actions to be taken to contain the pandemic or mitigate its impact, and the extent of the direct and indirect economic effects of the pandemic and containment measures, among others.

On March 27, 2020 Congress enacted the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act") which contains several relief provisions that apply to retirement plans. As part of the CARES Act, a qualifying participant was allowed to delay outstanding retirement loan repayments for up to one year for loans due between March 27, 2020 to December 31, 2020. The loan amortization schedule was adjusted to reflect the delay and any interest accrued in that time period. A qualified participant could elect to take a penalty free distribution up to $100,000, not to exceed the participants vested balance. The distributions were made during the period of January 1, 2020 to December 31, 2020. Income attributable to the distributions are subject to tax over three years, and the participant may recontribute the funds to an eligible retirement plan within three years without regard to that year’s contribution cap. The Plan has implemented the above mentioned changes. The ability to utilize the provisions of the CARES Act ceased as of December 31, 2020.

b. Contributions

Participants may elect to defer no more than 50% of their eligible compensation, and contribute it to the Plan's trust on a pretax (i.e. traditional 401(k)) or after-tax (i.e. Roth 401(k)) basis up to the Internal Revenue Code Section 402(g) limit for 2021 of $19,500. Participants who are aged 50 or older by the end of the plan year may elect to contribute pretax or after-tax catch up contributions, up to a maximum of $6,500. Participants may also elect to make traditional after-tax contributions (all contributions not to exceed 50% of the total compensation in aggregate).

Employees hired before April 1, 2017 who did not enroll in the Plan within 60 days from their date of hire were automatically enrolled at a contribution rate of 3% of pre-tax eligible pay. At each of the following two anniversaries of the employees’ enrollment, the contribution rate increases 1% until a 5% contribution rate is reached. Employees hired after April 1, 2017 who do not enroll in the Plan within 60 days from their date of hire will be automatically enrolled at a contribution rate of 5% of pre-tax eligible pay. Employees who do not want to be automatically enrolled may opt out by electing a 0% contribution rate.

For eligible employees participating in the Plan, the Company makes matching contributions of 80% of the portion of those contributions up to 5% of the employee's compensation (Basic Contribution). The Company matching contributions are paid in the form of cash and are allocated to participant accounts based upon the participant's investment elections. For the 2021 plan year, total annual contributions from all sources, other than catch-up contributions, were limited to the Internal Revenue Code Section 415(c) limit of the lesser of 100% of compensation or $58,000.

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements—(Continued)

December 31, 2021 and 2020

In addition to the Basic Contribution, all newly hired and rehired salaried and nonunion hourly employees of the Company beginning July 1, 2007 receive an annual employer core contribution of 5% of the employee's eligible compensation. This amount is contributed to the employee's account after the end of each plan year. This change was instituted for these employees effective July 1, 2007, since these employees are not eligible for the Company's defined benefit plan. Also, effective February 1, 2013, existing and newly hired Middleport union employees, except for certain employees who were grandfathered in the defined benefit plan, are eligible for the annual employer core contribution. The 5% core contribution funds are not eligible for participant withdrawals and loans, but are subject to the same vesting requirements as discussed in Note 1(f). Additionally, the 5% core contribution funds are included in the 415(c) limit described above but not in the $19,500 402(g) limit on pretax contributions also described above. The amount of these 5% core contributions included in the statements of changes in net assets available for benefits were approximately $7,449,989 and $7,941,703 for the years ended December 31, 2021 and 2020, respectively.

With the approval of the Plan Administrator, participants are allowed to make rollover contributions of amounts received from other tax-qualified employer-sponsored retirement plans to the Plan.

c. Participant Account Activity

Each participant's account is credited with the participant's contributions, employer matching contributions, and allocations of plan earnings and losses, as determined by the Plan Document. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account.

d. Trust

The Company established a trust (the Trust) at Fidelity Management Trust Company (the Trustee) for investment purposes as part of the Plan. The recordkeeper of the Plan, Fidelity Investments Institutional Operations Company, is an affiliate of the Trustee.

e. Investment Options

Upon enrollment in the Plan, a participant may direct his or her contributions in 1% increments to each investment option selected. Participants may also elect to have professionals at the Trustee help manage the investments under a program called Fidelity® Portfolio Advisory Services at Work. Certain investment options of the Plan qualify for Class K based on volume held by the Plan in these funds. Class K offers the Plan a lower expense ratio compared to similar retail classes. Investment options for both participant and trustee-directed investments are further described in Note 3.

f. Vesting

On April 1, 2017, the Plan was amended to remove the five-year vesting schedule for both the Company matching contributions and core contribution for active employees. At that date, all non-vested matching and core contributions for active employees became fully vested. As a result, all future matching contributions, core contributions, and any related earnings will immediately vest for active employees.

g. Payment of Benefits

Upon termination of service, death or disability, any participant or, if applicable, his or her beneficiary may elect to immediately receive a lump-sum distribution equal to the vested balance of his or her account. Upon attainment of age 59 1/2, participants who are employed by the Company can elect in-service distribution of all vested accounts. Participants or beneficiaries whose accounts were valued at not less than $1,000 upon termination are able to elect to defer their lump-sum distribution, take distribution in the form of periodic payments or receive installments (annually, quarterly, or monthly) over a certain period that may not exceed the joint life expectancy of the participant and beneficiary.

h. Participant Withdrawals and Loans

The Plan allows participants to make hardship cash withdrawals (subject to income taxation and Internal Revenue Service penalties) from some or all of his or her vested account balances. Withdrawals from participants' after-tax

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements—(Continued)

December 31, 2021 and 2020

and rollover accounts may be made at any time. Eligible participants may also receive money from the Plan in the form of loans. Loans are secured by participant accounts and repaid through payroll deductions. The minimum that may be borrowed is $1,000. The maximum that may be borrowed is the lesser of $50,000, less the balance of any outstanding loans, or 50% of the participant's vested account balance. The Plan limits participant loans to one outstanding loan at any time. Additionally, a 30-day waiting period is required before a participant can initiate a new loan from an employee plan account after the outstanding loan is paid in full. Loans must be repaid over a period not greater than 60 months with the exception of loans used for the purchase of a primary residence, which may be repaid over a maximum of 240 months with interest charged at the prime rate at loan inception. As of December 31, 2021, the interest rates on the participant loans ranged from 3.25% to 8.25%.

i. Forfeited Accounts

Forfeitures by participants of non-vested matching contributions ("Forfeitures") are used to offset future employer matching contributions for other participants and to pay future plan expenses. In 2021 and 2020 employer matching contributions were reduced from Forfeitures by zero and $511,005, respectively. Also, in 2021 and 2020, plan expenses of $157,779 and $184,873, respectively, were paid from Forfeitures. At December 31, 2021 there were $325,135 Forfeitures available to reduce future employer matching contributions and pay future plan expenses. At December 31, 2020 there were no Forfeitures available to reduce future employer matching contributions and pay future plan expenses.

j. Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA.

Note 2 - Summary of Significant Accounting Policies

The following are the significant accounting policies followed by the Plan:

a. Basis of Accounting

The Plan's financial statements have been prepared using the accrual basis of accounting.

b. Investment Valuation and Income Recognition

The Plan's investments are reported at fair value. Fair value is the price that would be received to sell an asset or would be paid to transfer a liability in an orderly transaction between participants at the measurement date. See Note 4 for a discussion of fair value measurements.

Purchases and sales of securities are recorded on a trade-date basis. Dividends are recorded on the ex-dividend date. Interest income is recorded on the accrual basis. Net appreciation (depreciation) includes gains and losses on investments bought and sold as well as held during the year.

c. Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Delinquent notes receivable from a participant are reclassified as distributions based upon the terms of the Plan document.

d. Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from these estimates.

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements—(Continued)

December 31, 2021 and 2020

e. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities, in general, are exposed to various risks such as interest rate, credit risks and overall market volatility risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the statements of net assets available for benefits.

f. Payment of Benefits

Benefit payments are recorded when paid.

g. Plan Expenses

The compensation and expenses of the Trustee are paid by participants and the Company. All other expenses of the Plan may be paid by the Trustee out of the assets of the Plan and constitute a charge upon the respective investment funds or upon the individual participants' accounts as provided for in the Plan.

Note 3 - Description of Investment

The objectives of the primary investments in which participants were invested in during 2021 are described below.

Common Stocks:

FMC Stock - Funds are invested in the common stock of the Company.

Mutual Funds:

Large Cap Funds:

Fidelity® Blue Chip Growth K6 Fund - Funds are invested primarily in the common stock of well-known and established companies.

T. Rowe Price Large-Cap Value Fund I Class - The fund will normally invest at least 80% of its net assets (including any borrowings for investment purposes) in securities of large-cap companies that the portfolio manager regards as undervalued.

Vanguard Institutional Index Fund Institutional "Plus" Shares - The fund employs an indexing investment approach designed to track the performance of the Standard & Poor (S&P) 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies.

Mid Cap Funds:

Fidelity® Low-Priced Stock K6 Fund - Funds are heavily invested in stocks considered to be undervalued by the fund manager, which can lead to investment in small and medium-sized companies.

Vanguard Extended Market Index Fund Institutional Shares - The fund employs an indexing investment approach designed to track the performance of S&P Completion Index, a broadly diversified index of stocks of small and mid-size U.S. companies.

Small Cap Funds:

Harbor Small Cap Growth Fund Retirement Class - The fund invests primarily in equity securities, principally common and preferred stocks of small cap companies. Under normal market conditions, the fund invests at least 80% of its net assets, plus borrowings for investment purposes, in securities of small cap companies.

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements—(Continued)

December 31, 2021 and 2020

Cardinal Small Cap Value Fund Institutional Class - Under normal circumstances, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in securities of small capitalization companies. The securities in which the fund invests are primarily common stock and REITs.

Blended Funds:

Vanguard Target Retirement Funds - A series of asset allocation funds: Vanguard Institutional Target Retirement Income Fund Institutional Shares, Vanguard Institutional Target Retirement 2015 Fund, Vanguard Institutional Target Retirement 2020 Fund, Vanguard Institutional Target Retirement 2025 Fund, Vanguard Institutional Target Retirement 2030 Fund, Vanguard Institutional Target Retirement 2035 Fund, Vanguard Institutional Target Retirement 2040 Fund, Vanguard Institutional Target Retirement 2045 Fund, Vanguard Institutional Target Retirement 2050 Fund, Vanguard Institutional Target Retirement 2055 Fund, Vanguard Institutional Target Retirement 2060 Fund, and Vanguard Institutional Target Retirement 2065 Fund. The income fund invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors currently in retirement. The 11 target date funds are designed for investors who want a simple approach to investing for retirement by investing in a collection of other Vanguard mutual funds by targeting their retirement dates.

International Funds:

Fidelity® Diversified International K6 Fund - Funds are invested primarily in common stock of companies located outside the United States.

Vanguard Total International Stock Index Fund Institutional Shares - The fund employs an indexing investment approach designed to track the performance of the FTSE Global All Cap ex US Index, a float-adjusted market capitalization - weighted index designed to measure equity market performance of companies located in developed and emerging markets, excluding the United States.

Income Funds:

PIMCO Total Return Fund Institutional Class - Fund invests at least 65% in a diversified portfolio of fixed income instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. It may also invest in securities denominated in foreign currencies.

Vanguard Total Bond Market Index Fund Institutional Shares - The fund seeks the performance of Bloomberg Barclays U.S. Aggregate Float Adjusted Index, which represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States - including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

Money Market Fund:

Government Money Market Portfolio - Funds are invested in short-term obligations of the U.S. government or its agencies.

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements—(Continued)

December 31, 2021 and 2020

Collective Investment Trust:

Stable Value Fund:

Managed Income Portfolio II Class 2 - Fund invests in investment contracts offered by insurance companies and other approved financial institutions as well as fixed income securities, including U.S. Treasury and agency bonds, corporate bonds, mortgage-backed securities, commercial mortgage-backed securities, and asset-backed securities, bond funds and money market funds. The selection of these contracts and administration of this fund is directed by the fund's investment manager.

Mid Cap Fund:

Wells Fargo Discovery CIT Class E2 - The fund invests in equity securities of small-and mid-capitalization companies where the investment advisor believes that growth is robust, sustainable, and not fully recognized by the market. The fund may also invest in equity securities of foreign issuers through ADRs and similar investments.

Note 4 - Fair Value Measurements

The Plan has categorized its assets that are recorded at fair value, based on the priority of the inputs to the valuation technique, into a three-level fair value hierarchy. The fair value hierarchy gives the highest level to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest level to unobservable inputs (Level 3). The three levels of the fair value hierarchy are as follows:

Level 1 - Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level 2 - Inputs other than Level 1 that are observable, such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the asset or liability.

Level 3 - Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurement. These unobservable inputs reflect the Plan's own assumptions about the assumptions a market participant would use in pricing the asset or liability. There were no Level 3 assets held as of December 31, 2021 and 2020.

If the inputs used to measure a financial asset or liability fall within different levels of the fair value hierarchy, the categorization is based on the lowest level input that is significant to the fair value measurement.

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2021 and 2020.

Common Stock:

Valued at the closing price reported on the active exchange or market in which the individual asset is traded, and therefore, presented as Level 1.

Mutual Funds:

Fair value of the mutual funds, excluding the money market fund below, are based on net asset value ("NAV"), which are the funds' readily determinable fair value. The NAV of these mutual funds are quoted daily on an active market, and therefore, presented as Level 1.

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements—(Continued)

December 31, 2021 and 2020

Money Market:

The Plan holds an investment in the Fidelity Government Money Market Fund. Fair value of the money market fund is based on NAV, which is the fund's readily determinable fair value. This investment is categorized as a Level 2 in the fair value hierarchy below. This portfolio represents a commingled fund with an investment objective to seek a high level of current income with the preservation of principal and liquidity. The fund normally invests assets in U.S. government securities and repurchase agreements for those securities.

Collective Investment Trust:

Wells Fargo Discovery CIT Class E2

The plan holds an investment in the Wells Fargo Discovery CIT Class E2 Fund. The investment option is a collective investment trust. The fund invests in equity securities of small-and mid-capitalization companies. The Wells Fargo Discovery Fund is classified within Level 2 of the valuation hierarchy below.

Fidelity Managed Income Portfolio II Class 2 Fund

The plan holds an investment in the Fidelity Managed Income Portfolio II Class 2 Fund ("MIP II Fund"), a collective investment trust. The MIP II Fund is managed by the Fidelity Management Trust Company. The MIP II Fund primarily invests in fixed income securities, including U.S. Treasury and agency bonds, corporate bonds, mortgage-backed securities, commercial mortgage-backed securities, and asset-backed securities, bond funds and money market funds. The MIP II Fund may invest in derivative instruments, including futures contracts and swap agreements. Additionally, the MIP II Fund enters into wrap contracts with third-party issuers, such as financial institutions or insurance companies, normally rated in the top three long-term rating categories (A- or the equivalent and above). The wrap contracts are designed to allow the portfolio to maintain a constant net asset value and to protect the portfolio in extreme circumstances.

The MIP II Fund’s investment objective is to seek preservation of capital while providing a competitive level of income over time and to maintain a stable net asset value of $1 per unit. The beneficial interest of each participant is represented by units. Distribution to the trust’s unit holders is declared daily from the net investment income and automatically reinvested in the trust on a monthly basis, when paid. The contract value, or NAV, of the MIP II Fund represents the readily determinable fair value. Certain events may limit the ability to transact at contract value with the issuer such as plan termination or bankruptcy but the occurrence of these events is not considered probable. The MIP II fund is classified within Level 2 of the valuation hierarchy below.

The following tables present the Plan's fair value hierarchy for those financial assets measured at fair value on a recurring basis in the Plan's statements of net assets available for benefits as of December 31, 2021 and 2020. The Plan currently does not have any nonfinancial assets, nonfinancial liabilities, financial assets, or financial liabilities measured at fair value on a nonrecurring basis.

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements—(Continued)

December 31, 2021 and 2020

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | December 31, 2021 | | Quoted prices in active markets for identical assets (Level 1) | | Significant other observable inputs (Level 2) | | Significant unobservable inputs (Level 3) |

| Common Stock | $ | 81,054 | | | $ | 81,054 | | | $ | — | | | $ | — | |

| | | | | | | |

| | | | | | | |

| Mutual Funds: | | | | | | | |

| Large Cap | 214,526 | | | 214,526 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Mid Cap | 42,221 | | | 42,221 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Small Cap | 2,249 | | | 2,249 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| Blended | 198,243 | | | 198,243 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| International | 35,081 | | | 35,081 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| Income | 39,222 | | | 39,222 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Money Market Funds | 325 | | | — | | | 325 | | | — | |

| Collective Investment Trust: | | | | | | | |

| Stable Value | 64,518 | | | — | | | 64,518 | | | — | |

| Mid Cap | 17,991 | | | — | | | 17,991 | | | — | |

| Investment assets at fair value | $ | 695,430 | | | $ | 612,596 | | | $ | 82,834 | | | $ | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | December 31, 2020 | | Quoted prices in active markets for identical assets (Level 1) | | Significant other observable inputs (Level 2) | | Significant unobservable inputs (Level 3) |

| Common Stock | $ | 148,860 | | | $ | 148,860 | | | $ | — | | | $ | — | |

| | | | | | | |

| | | | | | | |

| Mutual Funds: | | | | | | | |

| Large Cap | 183,226 | | | 183,226 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Mid Cap | 54,105 | | | 54,105 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Small Cap | 8,389 | | | 8,389 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| Blended | 153,384 | | | 153,384 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| International | 33,018 | | | 33,018 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| Income | 51,524 | | | 51,524 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Collective Investment Trust | 69,568 | | | — | | | 69,568 | | | — | |

| | | | | | | |

| Investment assets at fair value | $ | 702,074 | | | $ | 632,506 | | | $ | 69,568 | | | $ | — | |

Note 5 - Tax Status

The Internal Revenue Service ("IRS") has determined and informed the Company by letter dated December 23, 2015 that the Plan and related trust are designed in accordance with applicable sections of the Internal Revenue Code ("IRC"). Although the Plan has been amended since receiving the determination letter, the Plan administrator and the Plan's tax and ERISA counsel believe that the Plan is designed and is currently being operated in compliance with the applicable provisions of the IRC, and therefore, believe that the Plan is qualified and the related trust is tax-exempt.

In accordance with U.S. GAAP, plan management analyzed the tax positions taken by the Plan and concluded that as of December 31, 2021, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Notes to Financial Statements—(Continued)

December 31, 2021 and 2020

taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan administrator believes the Plan is no longer subject to income tax examinations for years prior to 2018.

Note 6 - Related-Party Transactions

Certain plan investments are managed by Fidelity Management Trust Company. Fidelity Management Trust Company is the Trustee as defined by the Plan, and therefore, these transactions qualify as party-in-interest transactions. Fees paid by the Plan for investment management and certain administrative services amounted to approximately $487,000 and $492,000 for the years ended December 31, 2021 and 2020, respectively.

Note 7 - Subsequent Events

Management evaluated subsequent events for the Plan through June 22, 2022, the date the financial statements were available to be issued. Such evaluation resulted in no adjustments to the accompanying financial statements.

As previously disclosed in FMC Corporation's Form 8-K filing on January 31, 2022, there was a blackout period in which Affected Participants, as defined below, and their beneficiaries temporarily were unable to obtain a loan or distribution or direct or diversify their Plan investments in the FMC Stock Fund under the Plan. In order to promote diversification and reduce risk for former employees whose holdings in the FMC Stock Fund exceeded 20% of their account balance as of March 4, 2022 ("Affected Participants"), the Plan administrator liquidated a portion of the Affected Participant’s FMC Stock Fund holdings to reduce such holdings to not more than 20% of the Affected Participant’s total Plan account balance. The proceeds of the sale were invested in the investment option designated by the Plan Administrator as the qualified default investment alternative. Affected Participants had the opportunity to reduce their FMC Stock Fund holdings in their Plan accounts to below the 20% cap before the deadline through voluntary self-directed transactions under the Plan. The blackout period began at 4:00 p.m. Eastern time on March 7, 2022 and ended during the week of March 13, 2022 (the "Blackout Period").

FMC CORPORATION

SAVINGS AND INVESTMENT PLAN

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2021

(In thousands, except shares) | | | | | | | | |

| Identity of issuer, borrower, lessor, or similar party | Description of investment, including maturity date, rate of interest, collateral, par, or maturity value | Current Value |

| FMC Stock* | FMC Corporation Common Stock, 737,552 shares (the cost basis of the FMC Stock at December 31, 2021 totaled $19,643) | $ | 81,054 | |

| | |

| Fidelity Blue Chip Growth K6 Fund* | Domestic Equity Mutual Fund | 80,930 | |

| Vanguard Total Bond Market Index Fund Institutional Shares | Bond Mutual Fund | 16,143 | |

| Vanguard Institutional Target Retirement 2015 Fund Institutional Shares | Target Date Mutual Fund | 6,982 | |

| Vanguard Institutional Target Retirement 2020 Fund Institutional Shares | Target Date Mutual Fund | 31,797 | |

| Vanguard Institutional Target Retirement 2025 Fund Institutional Shares | Target Date Mutual Fund | 29,599 | |

| Vanguard Institutional Target Retirement 2030 Fund Institutional Shares | Target Date Mutual Fund | 32,127 | |

| Vanguard Institutional Target Retirement 2035 Fund Institutional Shares | Target Date Mutual Fund | 22,284 | |

| Vanguard Institutional Target Retirement 2040 Fund Institutional Shares | Target Date Mutual Fund | 26,430 | |

| Vanguard Institutional Target Retirement 2045 Fund Institutional Shares | Target Date Mutual Fund | 14,545 | |

| Vanguard Institutional Target Retirement 2050 Fund Institutional Shares | Target Date Mutual Fund | 15,042 | |

| Vanguard Institutional Target Retirement 2055 Fund Institutional Shares | Target Date Mutual Fund | 6,987 | |

| Vanguard Institutional Target Retirement 2060 Fund Institutional Shares | Target Date Mutual Fund | 2,847 | |

| Vanguard Institutional Target Retirement 2065 Fund Institutional Shares | Target Date Mutual Fund | 723 | |

| Vanguard Institutional Target Retirement Income Fund Institutional Shares | Target Date Mutual Fund | 8,880 | |

| Fidelity Low-Priced Stock K6 Fund* | Equity Mutual Fund | 21,194 | |

| Vanguard Extended Market Index Fund Institutional Shares | Domestic Equity Mutual Fund | 21,027 | |

T. Rowe Price Funds - US Large Cap Value Fund Institutional Class

| Domestic Equity Mutual Fund | 9,430 | |

| Managed Income Portfolio II Class 2* | Stable Value Collective Investment Fund | 64,518 | |

| Fidelity Government Money Market Fund* | Money Market Mutual Fund | 325 | |

| Vanguard Institutional Index Fund Institutional "Plus" Shares (S&P 500 Index Fund) | Domestic Equity Mutual Fund | 124,166 | |

| Wells Fargo Discovery E | Domestic Equity Collective Investment Fund | 17,991 | |

| Fidelity Diversified International K6 Fund* | International Equity Mutual Fund | 18,661 | |

| Cardinal Small Cap Value Fund Institutional Class | Domestic Equity Mutual Fund | 812 | |

| PIMCO Total Return Fund Institutional Class | Bond Mutual Fund | 23,079 | |

Harbor Small Cap Growth Retirement | Domestic Equity Mutual Fund | 1,437 | |

| Vanguard Total International Stock Index Fund Institutional Shares | International Equity Mutual Fund | 16,420 | |

| Total Investments at Fair Value | | $ | 695,430 | |

Notes receivables from participants* (1) | Varying rates of interest, ranging from 3.25% to 8.25%, maturing 2022 to 2041 | 2,814 | |

| Total assets | | $ | 698,244 | |

| | |

| * Represents a party-in-interest to the Plan. | | |

| (1) Current value represents unpaid principal balance plus any accrued but unpaid interest. |

|

|

Signature

The Plan

Pursuant to the requirements of the Securities Exchange Act of 1934, FMC Corporation, as plan administrator, has duly caused this annual report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| FMC CORPORATION

(Registrant) |

| | | |

| By: | /s/ ANDREW D. SANDIFER |

| | Andrew D. Sandifer

Executive Vice President and Chief Financial Officer |

Date: June 22, 2022

EXHIBIT INDEX | | | | | | | | |

| Exhibit No. | | Exhibit Description |

| | |

| 23.1 | | |

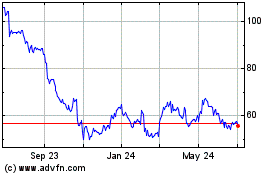

FMC (NYSE:FMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

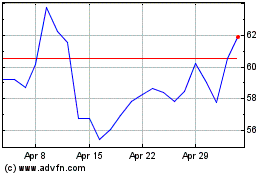

FMC (NYSE:FMC)

Historical Stock Chart

From Apr 2023 to Apr 2024