0000798354false00007983542024-10-222024-10-220000798354us-gaap:CommonStockMember2024-10-222024-10-220000798354fisv:SeniorNotesDue2027Member2024-10-222024-10-220000798354fisv:SeniorNotesDue2030Member2024-10-222024-10-220000798354fisv:SeniorNotesDue2025Member2024-10-222024-10-220000798354fisv:ThreePointZeroPercentSeniorNotesDue2031Member2024-10-222024-10-220000798354fisv:FourPointFivePercentSeniorNotesDue2031Member2024-10-222024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 22, 2024

Fiserv, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | |

| Wisconsin | | 1-38962 | | 39-1506125 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

600 N. Vel R. Phillips Avenue, Milwaukee, Wisconsin 53203

(Address of Principal Executive Offices, Including Zip Code)

(262) 879-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

| Common Stock, par value $0.01 per share | | FI | | The New York Stock Exchange |

| | | | |

| 1.125% Senior Notes due 2027 | | FI27 | | The New York Stock Exchange |

| 1.625% Senior Notes due 2030 | | FI30 | | The New York Stock Exchange |

| 2.250% Senior Notes due 2025 | | FI25 | | The New York Stock Exchange |

| 3.000% Senior Notes due 2031 | | FI31 | | The New York Stock Exchange |

| 4.500% Senior Notes due 2031 | | FI31A | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On October 22, 2024, Fiserv, Inc. issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d)Exhibits.

EXHIBIT INDEX

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | FISERV, INC. |

| | | |

| Date: | October 22, 2024 | By: | | /s/ Robert W. Hau |

| | | | Robert W. Hau |

| | | | Chief Financial Officer |

| | | | | |

| For more information contact: | |

| |

Media Relations: Sophia Marshall Head of Communications Fiserv, Inc. 470-351-9908 sophia.marshall@fiserv.com | Investor Relations: Julie Chariell Head of Investor Relations Fiserv, Inc. 212-515-0278 julie.chariell@fiserv.com |

Fiserv Reports Third Quarter 2024 Results

GAAP revenue growth of 7% both in the quarter and year to date;

GAAP EPS decreased 37% in the quarter and increased 6% year to date;

Operating cash flow increased 24% to $4.41 billion year to date;

Organic revenue growth of 15% in the quarter and 17% year to date;

Adjusted EPS increased 17% in the quarter and 18% year to date;

Free cash flow increased 23% to $3.34 billion year to date;

Company raises 2024 organic revenue growth outlook to 16% to 17%

and adjusted EPS outlook to $8.73 to $8.80

MILWAUKEE, Wis., October 22, 2024 – Fiserv, Inc. (NYSE: FI), a leading global provider of payments and financial services technology solutions, today reported financial results for the third quarter of 2024.

Third Quarter 2024 GAAP Results

GAAP revenue for the company increased 7% to $5.22 billion in the third quarter of 2024 compared to the prior year period, with 9% growth in the Merchant Solutions segment and 5% growth in the Financial Solutions segment. GAAP revenue for the company increased 7% to $15.21 billion in the first nine months of 2024 compared to the prior year period, with 10% growth in the Merchant Solutions segment and 5% growth in the Financial Solutions segment.

GAAP earnings per share decreased 37% to $0.98 in the third quarter of 2024 and increased 6% to $3.74 in the first nine months of 2024 compared to the prior year periods. The third quarter and first nine months of 2024 included a $570 million non-cash impairment charge related to one of the company’s equity method investments. The third quarter and first nine months of 2023 included a $177 million pre-tax gain related to the sale of the company’s financial reconciliation business.

GAAP operating margin was 30.7% and 27.7% in the third quarter and first nine months of 2024 compared to 30.8% and 25.2% in the third quarter and first nine months of 2023. GAAP operating margin in the Merchant Solutions segment was 37.7% and 36.2% in the third quarter and first nine months of 2024 compared to 34.8% and 32.9% in the third quarter and first nine months of 2023.

GAAP operating margin in the Financial Solutions segment was 47.4% and 45.8% in the third quarter and first nine months of 2024 compared to 46.9% and 45.1% in the third quarter and first nine months of 2023. Net cash provided by operating activities increased 24% to $4.41 billion in the first nine months of 2024 compared to $3.57 billion in the prior year period.

“We are pleased with our third quarter performance, which showcases strength across both our Merchant and Financial Solutions segments and several significant new wins,” said Frank Bisignano, Chairman, President and Chief Executive Officer of Fiserv. “This performance is anchored in the privileged position we hold at the crossroads of two ecosystems – merchants and financial institutions – which are increasingly interconnected.”

Third Quarter 2024 Non-GAAP Results and Additional Information

•Adjusted revenue increased 7% to $4.88 billion in the third quarter and 7% to $14.22 billion in the first nine months of 2024 compared to the prior year periods.

•Organic revenue growth was 15% in the third quarter of 2024, led by 24% growth in the Merchant Solutions segment and 6% growth in the Financial Solutions segment.

•Organic revenue growth was 17% in the first nine months of 2024, led by 29% growth in the Merchant Solutions segment and 6% growth in the Financial Solutions segment.

•Adjusted earnings per share increased 17% to $2.30 in the third quarter and 18% to $6.29 in the first nine months of 2024 compared to the prior year periods.

•Adjusted operating margin increased 170 basis points to 40.2% in the third quarter and 170 basis points to 38.2% in the first nine months of 2024 compared to the prior year periods.

•Adjusted operating margin increased 290 basis points to 37.7% in the Merchant Solutions segment and increased 40 basis points to 47.4% in the Financial Solutions segment in the third quarter of 2024, compared to the prior year period.

•Adjusted operating margin increased 330 basis points to 36.2% in the Merchant Solutions segment and 60 basis points to 45.8% in the Financial Solutions segment in the first nine months of 2024, compared to the prior year period.

•Free cash flow increased 23% to $3.34 billion in the first nine months of 2024 compared to $2.72 billion in the prior year period.

•The company repurchased 7.6 million shares of common stock for $1.3 billion in the third quarter and 27.8 million shares of common stock for $4.3 billion in the first nine months of 2024.

•Fiserv was named as the #1 global financial technology provider on the 2024 International Data Corporation (IDC) FinTech Top 100 Rankings for the second consecutive year.

Outlook for 2024

Fiserv raises organic revenue growth outlook to 16% to 17% and adjusted earnings per share outlook to $8.73 to $8.80, representing growth of 16% to 17%, for 2024.

“Fiserv continues to demonstrate consistency and sustainability in our top-line growth and margin improvement, leading us to raise the outlook on our 2024 financial commitments,” said Bisignano. “Our unparalleled track record remains intact as we move closer to achieving our 39th consecutive year of double-digit adjusted earnings per share growth.”

Segment Realignment

The company realigned its reportable segments during the first quarter of 2024 to correspond with changes in its business designed to further enhance operational performance in the delivery of its integrated portfolio of products and solutions to its financial institution clients (“Segment Realignment”). The company’s new reportable segments are Merchant Solutions and Financial Solutions. Segment results for the three and nine months ended September 30, 2023 have been recast to reflect the Segment Realignment.

Earnings Conference Call

The company will discuss its third quarter 2024 results in a live webcast at 7 a.m. CT on Tuesday, October 22, 2024. The webcast, along with supplemental financial information, can be accessed on the investor relations section of the Fiserv website at investors.fiserv.com. A replay will be available approximately one hour after the conclusion of the live webcast.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500™ company, aspires to move money and information in a way that moves the world. As a global leader in payments and financial technology, the company helps clients achieve best-in-class results through a commitment to innovation and excellence in areas including account processing and digital banking solutions; card issuer processing and network services; payments; e-commerce; merchant acquiring and processing; and the Clover® cloud-based point-of-sale and business management platform. Fiserv is a member of the S&P 500® Index and has been recognized as one of Fortune® World’s Most Admired Companies™ for 9 of the last 10 years. Visit fiserv.com and follow on social media for more information and the latest company news.

Use of Non-GAAP Financial Measures

In this news release, the company supplements its reporting of information determined in accordance with generally accepted accounting principles (“GAAP”), such as revenue, operating income, operating margin, net income attributable to Fiserv, diluted earnings per share and net cash provided by operating activities, with “adjusted revenue,” “adjusted revenue growth,” “organic revenue,” “organic revenue growth,” “adjusted operating income,” “adjusted operating margin,” “adjusted net income,” “adjusted earnings per share,” “adjusted earnings per share growth,” and “free cash flow.” Management believes that adjustments for certain non-cash or other items and the exclusion of certain pass-through revenue and expenses should enhance shareholders' ability to evaluate the company’s performance, as such measures provide additional insights into the factors and trends affecting its business. Therefore, the company excludes these items from its GAAP financial measures to calculate these unaudited non-GAAP measures. The corresponding reconciliations of these unaudited non-GAAP financial measures to the most comparable GAAP measures are included in this news release, except for forward-looking measures where a reconciliation to the corresponding GAAP measures is not available due to the variability,

complexity and limited visibility of the non-cash and other items described below that are excluded from the non-GAAP outlook measures. See pages 15-17 for additional information regarding the company’s forward-looking non-GAAP financial measures.

Examples of non-cash or other items may include, but are not limited to, non-cash intangible asset amortization expense associated with acquisitions; non-cash impairment charges; severance costs; merger and integration costs; gains or losses from the sale of businesses, certain assets or investments; and certain discrete tax benefits and expenses. The company excludes these items to more clearly focus on the factors management believes are pertinent to the company’s operations, and management uses this information to make operating decisions, including the allocation of resources to the company’s various businesses.

The company adjusts its non-GAAP results to exclude amortization of acquisition-related intangible assets as such amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Management believes that the adjustment of acquisition-related intangible asset amortization supplements GAAP information with a measure that can be used to assess the comparability of operating performance. Although the company excludes amortization from acquisition-related intangible assets from its non-GAAP expenses, management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation.

Management believes organic revenue growth is useful because it presents adjusted revenue growth excluding the impact of foreign currency fluctuations, acquisitions and dispositions. Management believes free cash flow is useful to measure the funds generated in a given period that are available for debt service requirements and strategic capital decisions. Management believes this supplemental information enhances shareholders’ ability to evaluate and understand the company’s core business performance.

These unaudited non-GAAP measures may not be comparable to similarly titled measures reported by other companies and should be considered in addition to, and not as a substitute for, revenue, operating income, operating margin, net income attributable to Fiserv, diluted earnings per share and net cash provided by operating activities or any other amount determined in accordance with GAAP.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding anticipated organic revenue growth, adjusted earnings per share, adjusted earnings per share growth and other statements regarding our future financial performance. Statements can generally be identified as forward-looking because they include words such as “believes,” “anticipates,” “expects,” “could,” “should,” “confident,” “likely,” “plan,” or words of similar meaning. Statements that describe the company’s future plans, outlook, objectives or goals are also forward-looking statements.

Forward-looking statements are subject to assumptions, risks and uncertainties that may cause actual results to differ materially from those contemplated by such forward-looking statements. The factors that could cause the company’s actual results to differ materially include, among

others, the following: the company’s ability to compete effectively against new and existing competitors and to continue to introduce competitive new products and services on a timely, cost-effective basis; changes in customer demand for the company’s products and services; the ability of the company’s technology to keep pace with a rapidly evolving marketplace; the success of the company’s merchant alliances, some of which are not controlled by the company; the impact of a security breach or operational failure in the company’s business, including disruptions caused by other participants in the global financial system; losses due to chargebacks, refunds or returns as a result of fraud or the failure of the company’s vendors and merchants to satisfy their obligations; changes in local, regional, national and international economic or political conditions, including those resulting from heightened inflation, rising interest rates, a recession, bank failures, or intensified international hostilities, and the impact they may have on the company and its employees, clients, vendors, supply chain, operations and sales; the effect of proposed and enacted legislative and regulatory actions affecting the company or the financial services industry as a whole; the company’s ability to comply with government regulations and applicable card association and network rules; the protection and validity of intellectual property rights; the outcome of pending and future litigation and governmental proceedings; the company’s ability to successfully identify, complete and integrate acquisitions, and to realize the anticipated benefits associated with the same; the impact of the company’s strategic initiatives; the company’s ability to attract and retain key personnel; volatility and disruptions in financial markets that may impact the company’s ability to access preferred sources of financing and the terms on which the company is able to obtain financing or increase its costs of borrowing; adverse impacts from currency exchange rates or currency controls; changes in corporate tax and interest rates; and other factors included in “Risk Factors” in the company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in other documents that the company files with the Securities and Exchange Commission, which are available at http://www.sec.gov. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements. The company assumes no obligation to update any forward-looking statements, which speak only as of the date of this news release.

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiserv, Inc. |

| Condensed Consolidated Statements of Income |

| (In millions, except per share amounts, unaudited) |

| | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | | | | | | |

| Processing and services | $ | 4,237 | | | $ | 4,008 | | | $ | 12,377 | | | $ | 11,605 | |

| Product | 978 | | | 865 | | | 2,828 | | | 2,571 | |

| Total revenue | 5,215 | | | 4,873 | | | 15,205 | | | 14,176 | |

| | | | | | | |

| Expenses | | | | | | | |

| Cost of processing and services | 1,346 | | | 1,311 | | | 4,043 | | | 4,067 | |

| Cost of product | 661 | | | 583 | | | 1,951 | | | 1,761 | |

| Selling, general and administrative | 1,606 | | | 1,652 | | | 5,000 | | | 4,952 | |

| Net gain on sale of businesses and other assets | — | | | (176) | | | — | | | (172) | |

| Total expenses | 3,613 | | | 3,370 | | | 10,994 | | | 10,608 | |

| | | | | | | |

| Operating income | 1,602 | | | 1,503 | | | 4,211 | | | 3,568 | |

| Interest expense, net | (326) | | | (258) | | | (872) | | | (692) | |

| | | | | | | |

| Other expense, net | (5) | | | (35) | | | (17) | | | (81) | |

| | | | | | | |

| Income before income taxes and loss from investments in unconsolidated affiliates | 1,271 | | | 1,210 | | | 3,322 | | | 2,795 | |

| Income tax provision | (74) | | | (239) | | | (448) | | | (544) | |

| Loss from investments in unconsolidated affiliates | (626) | | | (2) | | | (642) | | | (11) | |

| | | | | | | |

| Net income | 571 | | | 969 | | | 2,232 | | | 2,240 | |

| Less: net income attributable to noncontrolling interests | 7 | | | 17 | | | 39 | | | 42 | |

| | | | | | | |

| Net income attributable to Fiserv | $ | 564 | | | $ | 952 | | | $ | 2,193 | | | $ | 2,198 | |

| | | | | | | |

| GAAP earnings per share attributable to Fiserv — diluted | $ | 0.98 | | | $ | 1.56 | | | $ | 3.74 | | | $ | 3.54 | |

| | | | | | | |

| Diluted shares used in computing earnings per share attributable to Fiserv | 576.9 | | | 610.3 | | | 585.7 | | | 620.3 | |

| | | | | | | |

Earnings per share is calculated using actual, unrounded amounts.

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiserv, Inc. |

| Reconciliation of GAAP to |

| Adjusted Net Income and Adjusted Earnings Per Share |

| (In millions, except per share amounts, unaudited) |

| | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| GAAP net income attributable to Fiserv | $ | 564 | | $ | 952 | | | $ | 2,193 | | $ | 2,198 | |

| Adjustments: | | | | | | | |

Merger and integration costs 1 | — | | 30 | | | 59 | | 120 | |

| Severance costs | 14 | | 15 | | | 77 | | 52 | |

Amortization of acquisition-related intangible assets 2 | 346 | | 388 | | | 1,085 | | 1,245 | |

| | | | | | | |

| | | | | | | |

Non wholly-owned entity activities 3 | 24 | | 31 | | | 78 | | 102 | |

Impairment of equity method investments 4 | 610 | | — | | | 610 | | — | |

Net gain on sale of businesses and other assets 5 | — | | (176) | | | — | | (172) | |

Canadian tax law change 6 | — | | — | | | — | | 27 | |

Tax impact of adjustments 7 | (233) | | (44) | | | (416) | | (261) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted net income | $ | 1,325 | | $ | 1,196 | | | $ | 3,686 | | $ | 3,311 | |

| | | | | | | |

| GAAP earnings per share attributable to Fiserv - diluted | $ | 0.98 | | $ | 1.56 | | | $ | 3.74 | | $ | 3.54 | |

| | | | | | | |

| Adjustments - net of income taxes: | | | | | | | |

Merger and integration costs 1 | — | | 0.04 | | | 0.08 | | 0.15 | |

| Severance costs | 0.02 | | 0.02 | | | 0.10 | | 0.07 | |

Amortization of acquisition-related intangible assets 2 | 0.48 | | 0.51 | | | 1.48 | | 1.60 | |

| | | | | | | |

| | | | | | | |

Non wholly-owned entity activities 3 | 0.03 | | 0.04 | | | 0.11 | | 0.13 | |

Impairment of equity method investments 4 | 0.79 | | — | | | 0.78 | | — | |

Net gain on sale of businesses and other assets 5 | — | | (0.21) | | | — | | (0.20) | |

Canadian tax law change 6 | — | | — | | | — | | 0.03 | |

| | | | | | | |

| Adjusted earnings per share | $ | 2.30 | | $ | 1.96 | | | $ | 6.29 | | $ | 5.34 | |

| | | | | | | |

| GAAP earnings per share attributable to Fiserv growth | (37) | % | | | | 6 | % | | |

| Adjusted earnings per share growth | 17 | % | | | | 18 | % | | |

| | | | | | | |

See pages 3-4 for disclosures related to the use of non-GAAP financial measures.

Earnings per share is calculated using actual, unrounded amounts.

1Represents acquisition and related integration costs incurred in connection with acquisitions. Merger and integration costs associated with integration activities in the first nine months of 2024 primarily include $13 million of third-party professional service fees and $22 million of share-based compensation and associated taxes. Merger and integration costs associated with integration activities in the third quarter and first nine months of 2023 primarily include $19 million and $52 million of third-party professional service fees, respectively, as well as $39 million of share-based compensation in the first nine months of 2023.

2Represents amortization of intangible assets acquired through acquisition, including customer relationships, software/technology and trade names. This adjustment does not exclude the amortization of other intangible assets such as contract costs (sales commissions and deferred conversion costs), capitalized and purchased software, financing costs and debt discounts. See additional information on page 14 for an analysis of the company's amortization expense. 3Represents the company’s share of amortization of acquisition-related intangible assets at its unconsolidated affiliates, as well as the minority interest share of amortization of acquisition-related intangible assets at its subsidiaries in which the company holds a controlling financial interest.

4Represents a non-cash impairment of certain equity method investments during the third quarter of 2024, primarily related to the company’s Wells Fargo Merchant Services joint venture, recorded within loss from investments in unconsolidated affiliates in the consolidated statement of income.

5Represents a net gain primarily associated with the sale of the company’s financial reconciliation business during the third quarter of 2023.

6Represents the impact of a multi-year retroactive Canadian tax law change, enacted in June 2023, related to the Goods and Services Tax / Harmonized Sales Tax (GST/HST) treatment of payment card services.

7The tax impact of adjustments is calculated using a tax rate of 20% in both the first nine months of 2024 and 2023, which approximates the company’s anticipated annual effective tax rate, exclusive of actual tax impacts of a $156 million benefit associated with the impairment of certain equity method investments during the first nine months of 2024 and a $49 million provision associated with the net gain on sale of businesses during the first nine months of 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| Fiserv, Inc. |

| Financial Results by Segment |

| (In millions, unaudited) |

| | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Total Company | | | | | | | |

| Revenue | $ | 5,215 | | | $ | 4,873 | | | $ | 15,205 | | | $ | 14,176 | |

| Adjustments: | | | | | | | |

| Postage reimbursements | (331) | | | (307) | | | (984) | | | (927) | |

| Deferred revenue purchase accounting adjustments | — | | | 5 | | | — | | | 16 |

| | | | | | | |

| Adjusted revenue | $ | 4,884 | | | $ | 4,571 | | | $ | 14,221 | | | $ | 13,265 | |

| | | | | | | |

| Operating income | $ | 1,602 | | | $ | 1,503 | | | $ | 4,211 | | | $ | 3,568 | |

| Adjustments: | | | | | | | |

Merger and integration costs 1 | — | | | 30 | | | 59 | | | 120 | |

| Severance costs | 14 | | | 15 | | | 77 | | | 52 | |

| Amortization of acquisition-related intangible assets | 346 | | | 388 | | | 1,085 | | | 1,245 | |

| | | | | | | |

| Net gain on sale of businesses and other assets | — | | | (176) | | | — | | | (172) | |

| Canadian tax law change | — | | | — | | | — | | | 27 | |

| Adjusted operating income | $ | 1,962 | | | $ | 1,760 | | | $ | 5,432 | | | $ | 4,840 | |

| | | | | | | |

| Operating margin | 30.7 | % | | 30.8 | % | | 27.7 | % | | 25.2 | % |

| Adjusted operating margin | 40.2 | % | | 38.5 | % | | 38.2 | % | | 36.5 | % |

| | | | | | | |

Merchant Solutions (“Merchant”) 2 | | | | | | | |

| Revenue | $ | 2,469 | | | $ | 2,259 | | | $ | 7,132 | | | $ | 6,461 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income | $ | 931 | | | $ | 786 | | | $ | 2,582 | | | $ | 2,123 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating margin | 37.7 | % | | 34.8 | % | | 36.2 | % | | 32.9 | % |

| | | | | | | |

| | | | | | | |

Financial Solutions (“Financial”) | | | | | | | |

| Revenue | $ | 2,412 | | | $ | 2,302 | | | $ | 7,076 | | | $ | 6,770 | |

| Adjustments: | | | | | | | |

| Deferred revenue purchase accounting adjustments | — | | | 5 | | | — | | | 16 | |

| Adjusted revenue | $ | 2,412 | | | $ | 2,307 | | | $ | 7,076 | | | $ | 6,786 | |

| | | | | | | |

| Operating income | $ | 1,143 | | | $ | 1,079 | | | $ | 3,244 | | | $ | 3,050 | |

| Adjustments: | | | | | | | |

| Deferred revenue purchase accounting adjustments | — | | | 5 | | | — | | | 16 | |

| Adjusted operating income | $ | 1,143 | | | $ | 1,084 | | | $ | 3,244 | | | $ | 3,066 | |

| | | | | | | |

| Operating margin | 47.4 | % | | 46.9 | % | | 45.8 | % | | 45.1 | % |

| Adjusted operating margin | 47.4 | % | | 47.0 | % | | 45.8 | % | | 45.2 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Fiserv, Inc. |

| Financial Results by Segment (cont.) |

| (In millions, unaudited) |

| | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Corporate and Other | | | | | | | |

| Revenue | $ | 334 | | | $ | 312 | | | $ | 997 | | | $ | 945 | |

| Adjustments: | | | | | | | |

| Postage reimbursements | (331) | | | (307) | | | (984) | | | (927) | |

| Adjusted revenue | $ | 3 | | | $ | 5 | | | $ | 13 | | | $ | 18 | |

| | | | | | | |

| Operating loss | $ | (472) | | | $ | (362) | | | $ | (1,615) | | | $ | (1,605) | |

| Adjustments: | | | | | | | |

| Merger and integration costs | — | | | 25 | | | 59 | | | 104 | |

| Severance costs | 14 | | | 15 | | | 77 | | | 52 | |

| Amortization of acquisition-related intangible assets | 346 | | | 388 | | | 1,085 | | | 1,245 | |

| Net gain on sale of businesses and other assets | — | | | (176) | | | — | | | (172) | |

| Canadian tax law change | — | | | — | | | — | | | 27 | |

| Adjusted operating loss | $ | (112) | | | $ | (110) | | | $ | (394) | | | $ | (349) | |

| | | | | | | |

See pages 3-4 for disclosures related to the use of non-GAAP financial measures.

Operating margin percentages are calculated using actual, unrounded amounts.

1Includes deferred revenue purchase accounting adjustments within the Financial segment related to the 2019 acquisition of First Data Corporation. Adjustments for this residual activity concluded as of December 31, 2023.

2For all periods presented in the Merchant segment, there were no adjustments to GAAP measures presented and thus the adjusted measures are equal to the GAAP measures presented.

| | | | | | | | | | | |

| Fiserv, Inc. |

| Condensed Consolidated Statements of Cash Flows |

| (In millions, unaudited) |

| Nine Months Ended

September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net income | $ | 2,232 | | | $ | 2,240 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and other amortization | 1,248 | | | 1,093 | |

| Amortization of acquisition-related intangible assets | 1,089 | | | 1,261 | |

| Amortization of financing costs and debt discounts | 33 | | | 30 | |

| | | |

| Share-based compensation | 273 | | | 275 | |

| | | |

| Deferred income taxes | (539) | | | (344) | |

| Net gain on sale of businesses and other assets | — | | | (172) | |

| Loss from investments in unconsolidated affiliates | 642 | | | 11 | |

| Distributions from unconsolidated affiliates | 29 | | | 42 | |

| | | |

| | | |

| Non-cash impairment charges | 14 | | | — | |

| Other operating activities | 79 | | | (2) | |

| Changes in assets and liabilities, net of effects from acquisitions and dispositions: | | | |

| Trade accounts receivable | (136) | | | 119 | |

| Prepaid expenses and other assets | (503) | | | (506) | |

| Contract costs | (189) | | | (180) | |

| Accounts payable and other liabilities | 134 | | | (303) | |

| Contract liabilities | 4 | | | 3 | |

| Net cash provided by operating activities | 4,410 | | | 3,567 | |

| | | |

| Cash flows from investing activities | | | |

| Capital expenditures, including capitalized software and other intangibles | (1,170) | | | (1,034) | |

| Net proceeds from sale of businesses and other assets | — | | | 232 | |

| | | |

Merchant cash advances, net | (645) | | | — | |

| Distributions from unconsolidated affiliates | 59 | | | 110 | |

| Purchases of investments | (37) | | | (15) | |

| Proceeds from sale of investments | 53 | | | — | |

| | | |

| Other investing activities | — | | | (3) | |

| Net cash used in investing activities | (1,740) | | | (710) | |

| | | |

| Cash flows from financing activities | | | |

| Debt proceeds | 6,141 | | | 5,188 | |

| Debt repayments | (4,665) | | | (1,652) | |

| Net borrowings from (repayments of) commercial paper and short-term borrowings | 345 | | | (2,032) | |

| Payments of debt financing costs | (28) | | | (38) | |

| Proceeds from issuance of treasury stock | 79 | | | 68 | |

| Purchases of treasury stock, including employee shares withheld for tax obligations | (4,491) | | | (3,790) | |

| | | |

| Settlement activity, net | 487 | | | (630) | |

Distributions paid to noncontrolling interests and redeemable noncontrolling interest | (48) | | | (22) | |

Payment to acquire noncontrolling interest of consolidated subsidiary | — | | | (56) | |

| Payments of acquisition-related contingent consideration | (3) | | | (33) | |

| Other financing activities | (2) | | | (39) | |

| Net cash used in financing activities | (2,185) | | | (3,036) | |

| Effect of exchange rate changes on cash and cash equivalents | 25 | | | (8) | |

| Net change in cash and cash equivalents | 510 | | | (187) | |

| | | |

| Cash and cash equivalents, beginning balance | 2,963 | | | 3,192 | |

| Cash and cash equivalents, ending balance | $ | 3,473 | | | $ | 3,005 | |

| | | |

| | | | | | | | | | | |

| Fiserv, Inc. |

| Condensed Consolidated Balance Sheets |

| (In millions, unaudited) |

| | | |

| September 30, | | December 31, |

| 2024 | | 2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 1,228 | | | $ | 1,204 | |

| Trade accounts receivable – net | 3,714 | | | 3,582 | |

| Prepaid expenses and other current assets | 2,749 | | | 2,344 | |

| Settlement assets | 17,434 | | | 27,681 | |

| | | |

| Total current assets | 25,125 | | | 34,811 | |

| | | |

| Property and equipment – net | 2,377 | | | 2,161 | |

| Customer relationships – net | 6,218 | | | 7,075 | |

| Other intangible assets – net | 4,104 | | | 4,135 | |

| Goodwill | 37,133 | | | 37,205 | |

| Contract costs – net | 985 | | | 968 | |

| Investments in unconsolidated affiliates | 1,585 | | | 2,262 | |

| Other long-term assets | 2,265 | | | 2,273 | |

| Total assets | $ | 79,792 | | | $ | 90,890 | |

| | | |

| Liabilities and Equity | | | |

| Accounts payable and other current liabilities | $ | 4,161 | | | $ | 4,355 | |

| Short-term and current maturities of long-term debt | 1,200 | | | 755 | |

| Contract liabilities | 770 | | | 761 | |

| Settlement obligations | 17,434 | | | 27,681 | |

| | | |

| Total current liabilities | 23,565 | | | 33,552 | |

| | | |

| Long-term debt | 24,085 | | | 22,363 | |

| Deferred income taxes | 2,526 | | | 3,078 | |

| Long-term contract liabilities | 255 | | | 250 | |

| Other long-term liabilities | 958 | | | 978 | |

| Total liabilities | 51,389 | | | 60,221 | |

| | | |

Redeemable noncontrolling interest | — | | | 161 | |

| | | |

| Fiserv shareholders' equity | 27,751 | | | 29,857 | |

| Noncontrolling interests | 652 | | | 651 | |

| Total equity | 28,403 | | | 30,508 | |

| Total liabilities and equity | $ | 79,792 | | | $ | 90,890 | |

| | | |

|

Fiserv, Inc.

Selected Non-GAAP Financial Measures and Additional Information

(In millions, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Organic Revenue Growth 1 | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | Growth | | 2024 | | 2023 | | Growth |

| | | | | | | | | | | | |

Total Company | | | | | | | | | | | | |

Adjusted revenue | | $ | 4,884 | | | $ | 4,571 | | | | | $ | 14,221 | | | $ | 13,265 | | | |

Currency impact 2 | | 371 | | | — | | | | | 1,327 | | | — | | | |

Acquisition adjustments | | (3) | | | — | | | | | (9) | | | — | | | |

Divestiture adjustments | | (3) | | | (7) | | | | | (13) | | | (41) | | | |

Organic revenue | | $ | 5,249 | | | $ | 4,564 | | | 15% | | $ | 15,526 | | | $ | 13,224 | | | 17% |

| | | | | | | | | | | | |

Merchant | | | | | | | | | | | | |

Adjusted revenue | | $ | 2,469 | | | $ | 2,259 | | | | | $ | 7,132 | | | $ | 6,461 | | | |

Currency impact 2 | | 344 | | | — | | | | | 1,225 | | | — | | | |

Acquisition adjustments | | (3) | | | — | | | | | (9) | | | — | | | |

| | | | | | | | | | | | |

Organic revenue | | $ | 2,810 | | | $ | 2,259 | | | 24% | | $ | 8,348 | | | $ | 6,461 | | | 29% |

| | | | | | | | | | | | |

Financial | | | | | | | | | | | | |

Adjusted revenue | | $ | 2,412 | | | $ | 2,307 | | | | | $ | 7,076 | | | $ | 6,786 | | | |

Currency impact 2 | | 27 | | | — | | | | | 102 | | | — | | | |

| | | | | | | | | | | | |

Divestiture adjustments | | — | | | (2) | | | | | — | | | (23) | | | |

Organic revenue | | $ | 2,439 | | | $ | 2,305 | | | 6% | | $ | 7,178 | | | $ | 6,763 | | | 6% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Corporate and Other | | | | | | | | | | | | |

Adjusted revenue | | $ | 3 | | | $ | 5 | | | | | $ | 13 | | | $ | 18 | | | |

| | | | | | | | | | | | |

Divestiture adjustments | | (3) | | | (5) | | | | | (13) | | | (18) | | | |

Organic revenue | | $ | — | | | $ | — | | | | | $ | — | | | $ | — | | | |

See pages 3-4 for disclosures related to the use of non-GAAP financial measures.

Organic revenue growth is calculated using actual, unrounded amounts.

1Organic revenue growth is measured as the change in adjusted revenue (see pages 9-10) for the current period excluding the impact of foreign currency fluctuations and revenue attributable to acquisitions and dispositions, divided by adjusted revenue from the prior period excluding revenue attributable to dispositions.

2Currency impact is measured as the increase or decrease in adjusted revenue for the current period by applying prior period foreign currency exchange rates to present a constant currency comparison to prior periods.

Fiserv, Inc.

Selected Non-GAAP Financial Measures and Additional Information (cont.)

(In millions, unaudited)

| | | | | | | | | | | | | | | |

| Free Cash Flow | | | Nine Months Ended

September 30, |

| | | | 2024 | | 2023 |

| | | | | | | |

Net cash provided by operating activities | | | | | $ | 4,410 | | | $ | 3,567 | |

Capital expenditures | | | | | (1,170) | | | (1,034) | |

Adjustments: | | | | | | | |

Distributions paid to noncontrolling interests and redeemable noncontrolling interest | | | | | (48) | | | (22) | |

Distributions from unconsolidated affiliates included in cash flows from investing activities | | | | | 59 | | | 110 | |

Severance, merger and integration payments | | | | | 116 | | | 121 | |

| | | | | | | |

| | | | | | | |

Tax payments on adjustments | | | | | (23) | | | (24) | |

| | | | | | | |

Other | | | | | — | | | 5 | |

Free cash flow | | | | | $ | 3,344 | | | $ | 2,723 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Total Amortization 1 | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Acquisition-related intangible assets | $ | 345 | | | $ | 393 | | | $ | 1,089 | | | $ | 1,261 | |

| Capitalized software and other intangibles | 164 | | | 133 | | | 464 | | | 360 | |

| Purchased software | 57 | | | 53 | | | 175 | | | 167 | |

| Financing costs and debt discounts | 11 | | | 10 | | | 33 | | | 30 | |

| Sales commissions | 29 | | | 28 | | | 84 | | | 83 | |

| Deferred conversion costs | 33 | | | 21 | | | 82 | | | 61 | |

| Total amortization | $ | 639 | | | $ | 638 | | | $ | 1,927 | | | $ | 1,962 | |

| | | | | | | |

See pages 3-4 for disclosures related to the use of non-GAAP financial measures.

1The company adjusts its non-GAAP results to exclude amortization of acquisition-related intangible assets as such amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Management believes that the adjustment of acquisition-related intangible asset amortization supplements the GAAP information with a measure that can be used to assess the comparability of operating performance. Although the company excludes amortization from acquisition-related intangible assets from its non-GAAP expenses, management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets.

Fiserv, Inc.

Full Year Forward-Looking Non-GAAP Financial Measures

Reconciliations of unaudited non-GAAP financial measures to the most comparable GAAP measures are included in this news release, except for forward-looking measures where a reconciliation to the corresponding GAAP measures is not available due to the variability, complexity and limited visibility of these items that are excluded from the non-GAAP outlook measures. The company’s forward-looking non-GAAP financial measures for 2024, including organic revenue growth, adjusted earnings per share and adjusted earnings per share growth, are designed to enhance shareholders’ ability to evaluate the company’s performance by excluding certain items to focus on factors and trends affecting its business.

Organic Revenue Growth - The company's organic revenue growth outlook for 2024 excludes the impact of foreign currency fluctuations, acquisitions, dispositions and the impact of the company's postage reimbursements. The currency impact is measured as the increase or decrease in the expected adjusted revenue for the period by applying prior period foreign currency exchange rates to present a constant currency comparison to prior periods.

| | | | | | | | |

| | Growth |

| | |

| 2024 Revenue | | 7.5% - 8.5% |

| Postage reimbursements | | (0.5)% |

| 2024 Adjusted revenue | | 7% - 8% |

| | |

| Currency impact | | 8.5% |

| Acquisition adjustments | | 0.0% |

| Divestiture adjustments | | 0.5% |

| 2024 Organic revenue | | 16% - 17% |

Adjusted Earnings Per Share - The company's adjusted earnings per share outlook for 2024 excludes certain non-cash or other items such as non-cash intangible asset amortization expense associated with acquisitions; non-cash impairment charges; non-cash pension plan termination charges; merger and integration costs; severance costs; gains or losses from the sale of businesses, certain assets and investments; and certain discrete tax benefits and expenses. The company estimates that amortization expense in 2024 with respect to acquired intangible assets will decrease approximately 15% compared to the amount incurred in 2023.

Other adjustments to the company’s financial measures that were incurred in 2023 and for the three and nine months ended September 30, 2024 are presented in this news release; however, they are not necessarily indicative of adjustments that may be incurred throughout the remainder of 2024 or beyond. Estimates of these impacts and adjustments on a forward-looking basis are not available due to the variability, complexity and limited visibility of these items.

Fiserv, Inc.

Full Year Forward-Looking Non-GAAP Financial Measures (cont.)

The company's adjusted earnings per share growth outlook for 2024 is based on 2023 adjusted earnings per share performance.

| | | | | |

| 2023 GAAP net income attributable to Fiserv | $ | 3,068 | |

| Adjustments: | |

Merger and integration costs 1 | 158 | |

| Severance costs | 74 | |

Amortization of acquisition-related intangible assets 2 | 1,623 | |

| |

Non wholly-owned entity activities 3 | 133 | |

Net gain on sale of businesses and other assets 4 | (167) | |

Canadian tax law change 5 | 27 | |

Tax impact of adjustments 6 | (355) | |

| |

| |

| |

| |

| |

Argentine Peso devaluation 7 | 71 | |

| 2023 adjusted net income | $ | 4,632 | |

| |

| Weighted average common shares outstanding - diluted | 615.9 | |

| |

| 2023 GAAP earnings per share attributable to Fiserv - diluted | $ | 4.98 | |

| Adjustments - net of income taxes: | |

Merger and integration costs 1 | 0.21 | |

| Severance costs | 0.10 | |

Amortization of acquisition-related intangible assets 2 | 2.11 | |

| |

Non wholly-owned entity activities 3 | 0.17 | |

| |

| |

| |

| |

| |

| |

Net gain on sale of businesses and other assets 4 | (0.19) | |

Canadian tax law change 5 | 0.04 | |

Argentine Peso devaluation 7 | 0.12 | |

| 2023 adjusted earnings per share | $ | 7.52 | |

| |

| |

| |

| 2024 adjusted earnings per share outlook | $8.73 - $8.80 |

| 2024 adjusted earnings per share growth outlook | 16% - 17% |

| |

In millions, except per share amounts, unaudited. Earnings per share is calculated using actual, unrounded amounts.

See pages 3-4 for disclosures related to the use of non-GAAP financial measures.

Fiserv, Inc.

Full Year Forward-Looking Non-GAAP Financial Measures (cont.)

1Represents acquisition and related integration costs incurred in connection with acquisitions. Merger and integration costs associated with integration activities primarily include $35 million of share-based compensation and $70 million of third-party professional service fees.

2Represents amortization of intangible assets acquired through acquisition, including customer relationships, software/technology and trade names. This adjustment does not exclude the amortization of other intangible assets such as contract costs (sales commissions and deferred conversion costs), capitalized and purchased software, financing costs and debt discounts.

3Represents the company’s share of amortization of acquisition-related intangible assets at its unconsolidated affiliates, as well as the minority interest share of amortization of acquisition-related intangible assets at its subsidiaries in which the company holds a controlling financial interest.

4Represents a net gain primarily associated with the sale of the company’s financial reconciliation business.

5Represents the impact of a multi-year retroactive Canadian tax law change, enacted in June 2023, related to the Goods and Services Tax / Harmonized Sales Tax (GST/HST) treatment of payment card services.

6The tax impact of adjustments is calculated using a tax rate of 20%, which approximates the company's annual effective tax rate, exclusive of actual tax impacts of $48 million associated with the net gain on sale of businesses.

7On December 12, 2023, the Argentina government announced economic reforms, including a significant devaluation of the Argentine Peso. This adjustment represents the corresponding one-day foreign currency exchange loss from the remeasurement of the company’s Argentina subsidiary’s monetary assets and liabilities in Argentina’s highly inflationary economy.

FI-G

# # #

v3.24.3

Cover Page

|

Oct. 22, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 22, 2024

|

| Entity Registrant Name |

Fiserv, Inc.

|

| Entity Incorporation, State or Country Code |

WI

|

| Entity File Number |

1-38962

|

| Entity Tax Identification Number |

39-1506125

|

| Entity Address, Address Line One |

600 N. Vel R. Phillips Avenue

|

| Entity Address, City or Town |

Milwaukee

|

| Entity Address, State or Province |

WI

|

| Entity Address, Postal Zip Code |

53203

|

| City Area Code |

262

|

| Local Phone Number |

879-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000798354

|

| Amendment Flag |

false

|

| Common Stock, par value $0.01 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

FI

|

| Security Exchange Name |

NYSE

|

| 1.125% Senior Notes due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.125% Senior Notes due 2027

|

| Trading Symbol |

FI27

|

| Security Exchange Name |

NYSE

|

| 1.625% Senior Notes due 2030 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Senior Notes due 2030

|

| Trading Symbol |

FI30

|

| Security Exchange Name |

NYSE

|

| 2.250% Senior Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.250% Senior Notes due 2025

|

| Trading Symbol |

FI25

|

| Security Exchange Name |

NYSE

|

| Three Point Zero Percent Senior Notes Due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.000% Senior Notes due 2031

|

| Trading Symbol |

FI31

|

| Security Exchange Name |

NYSE

|

| Four Point Five Percent Senior Notes Due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.500% Senior Notes due 2031

|

| Trading Symbol |

FI31A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fisv_SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fisv_SeniorNotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fisv_SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fisv_ThreePointZeroPercentSeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fisv_FourPointFivePercentSeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

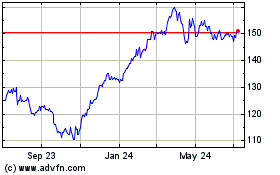

Fiserv (NYSE:FI)

Historical Stock Chart

From Oct 2024 to Nov 2024

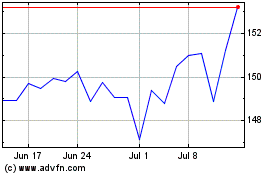

Fiserv (NYSE:FI)

Historical Stock Chart

From Nov 2023 to Nov 2024