First Trust Specialty Finance and Financial Opportunities Fund Declares its Quarterly Distribution of $0.175 Per Share

May 10 2018 - 4:28PM

Business Wire

First Trust Specialty Finance and Financial Opportunities Fund

(the "Fund") (NYSE: FGB) has declared the Fund's regularly

scheduled quarterly distribution of $0.175 per share. The

distribution will be payable on May 31, 2018, to shareholders of

record as of May 23, 2018. The ex-dividend date is expected to be

May 22, 2018. The quarterly distribution information for the Fund

appears below.

First Trust Specialty Finance and

Financial Opportunities Fund (FGB):

Distribution per share: $0.175 Distribution

Rate based on the May 9, 2018 NAV of $6.05: 11.57% Distribution

Rate based on the May 9, 2018 closing market price of $6.09: 11.49%

A portion of the distribution may be treated as paid from

sources other than net investment income, including short-term

capital gain, long-term capital gain and return of capital. The

final determination of the source and tax status of all

distributions paid in 2018 will be made after the end of 2018 and

will be provided on Form 1099-DIV.

The Fund is a non-diversified, closed-end management investment

company that seeks to provide a high level of current income. As a

secondary objective, the Fund seeks to provide attractive total

return. The Fund pursues these investment objectives by investing

at least 80% of its managed assets in a portfolio of securities of

specialty finance and other financial companies that the Fund's

investment sub-advisor believes offer attractive opportunities for

income and capital appreciation.

First Trust Advisors L.P. ("FTA"), a federally registered

investment advisor, and its affiliate First Trust Portfolios L.P.

("FTP"), a FINRA registered broker-dealer, are privately held

companies that provide a variety of investment services. FTA is the

investment advisor to exchange-traded funds, closed-end funds,

mutual funds, separate managed accounts and provides supervisory

services to FTP sponsored unit investment trusts. FTA's assets

under management were approximately $122 billion as of April 30,

2018. This includes the supervisory services FTA provides to FTP

sponsored unit investment trusts, which are unmanaged. FTP is a

sponsor of unit investment trusts and distributor of mutual fund

shares and exchange-traded fund creation units. FTA is based in

Wheaton, Illinois.

Confluence Investment Management LLC ("Confluence"), an SEC

registered investment advisor, serves as the Fund's investment

sub-advisor. The investment professionals at Confluence have over

350 years of combined financial market experience. Confluence

provides portfolio management and advisory services to both

institutional and individual clients. As of March 31, 2018,

Confluence managed or supervised $8.2 billion in assets.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost.

Principal Risk Factors: The Fund invests in business development

companies ("BDCs") which may be subject to a high degree of risks,

including management's ability to meet the BDC's investment

objective, and to manage the BDC's portfolio when the underlying

securities are redeemed or sold, during periods of market turmoil

and as investors' perceptions regarding a BDC or its underlying

investments change.

Investing in real estate investment trusts ("REITs") involves

certain unique risks in addition to investing in the real estate

industry in general. REITs are subject to interest rate risk and

the risk of default by lessees or borrowers.

The Fund may invest in a variety of other mortgage-related

securities. Rising interest rates tend to extend the duration of

mortgage-related securities, making them more sensitive to changes

in interest rates, and may reduce the market value of the

securities. In addition, mortgage-related securities are subject to

the risk that borrowers may pay off their mortgages sooner than

expected, particularly when interest rates decline. This can reduce

the Fund's returns. The Fund's investments in other asset-backed

securities are subject to risks similar to those associated with

mortgage-backed securities, as well as additional risks associated

with the nature of the assets and the servicing of those

assets.

Because the Fund is concentrated in the financials sector, it

will be more susceptible to adverse economic or regulatory

occurrences affecting this sector, such as changes in interest

rates, availability and cost of capital funds, and competition.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the Fund are spelled out in the

prospectus, shareholder report and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA

and the Internal Revenue Code. First Trust has no knowledge of and

has not been provided any information regarding any investor.

Financial advisors must determine whether particular investments

are appropriate for their clients. First Trust believes the

financial advisor is a fiduciary, is capable of evaluating

investment risks independently and is responsible for exercising

independent judgment with respect to its retirement plan

clients.

The Fund’s daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180510006253/en/

First Trust Specialty Finance and Financial Opportunities

FundPress InquiriesJane Doyle, 630-765-8775orAnalyst InquiriesJeff

Margolin, 630-915-6784orBroker InquiriesJeff Margolin,

630-915-6784

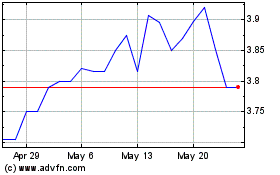

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Apr 2023 to Apr 2024