First Trust/Aberdeen Global Opportunity Income Fund Announces Final Results of Tender Offer

February 16 2021 - 5:55PM

Business Wire

First Trust/Aberdeen Global Opportunity Income Fund (NYSE: FAM)

(the “Fund”) today announced the final results of the tender offer

it conducted.

As previously announced, the Fund conducted a tender offer for

up to 20% of its outstanding common shares for cash at a price per

share equal to 98% of the net asset value per share as determined

as of the close of the regular trading session of the NYSE on

February 16, 2021 (the “Valuation Date”). The Fund’s tender offer,

which expired at 5:00 p.m. New York City time on Friday, February

12, 2021, was oversubscribed.

Since the Fund’s tender offer was oversubscribed, the Fund will

purchase 20% of its outstanding common shares on a pro-rata basis

based on the number of shares properly tendered (Pro-Ration

Factor). The final results of the tender offer are provided in the

table below.

Number of Shares Tendered

Number of Tendered Shares to be

Purchased

Pro- Ration Factor

Purchase Price (98% of NAV on

Valuation Date)

Number of Outstanding Shares

after Tender Offer

5,450,859

2,534,207

46.50%

$10.7604

10,136,829

The Fund will purchase the common shares that it has accepted

for payment as promptly as practicable. Shareholders who have

questions regarding the tender offer should contact their financial

advisors or should call Georgeson LLC, the Fund’s information agent

for the tender offer, at: (888) 680-1528.

The Fund is a diversified, closed-end management investment

company that seeks to provide a high level of current income. As a

secondary objective, the Fund seeks capital appreciation. The Fund

pursues these investment objectives by investing in the world bond

markets through a diversified portfolio of investment grade and

below-investment grade government and corporate debt

securities.

First Trust Advisors L.P., the Fund’s investment advisor, along

with its affiliate, First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $174

billion as of January 31, 2021 through unit investment trusts,

exchange-traded funds, closed-end funds, mutual funds and separate

managed accounts.

Aberdeen Standard Investments Inc. (“ASII”) serves as the Fund’s

investment sub-advisor. ASII is an indirect wholly-owned subsidiary

of Standard Life Aberdeen plc. Aberdeen Standard Investments is the

brand name for the asset management group of Standard Life Aberdeen

plc, managing a range of pension funds, financial institutions,

investment trusts, unit trusts, offshore funds, charities and

private clients.

FORWARD-LOOKING STATEMENTS

Certain statements made in this press release are

forward-looking statements. Actual results or occurrences may

differ significantly from those anticipated in any forward-looking

statements due to numerous factors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210216006213/en/

Jim Dykas – (630) 517-7665

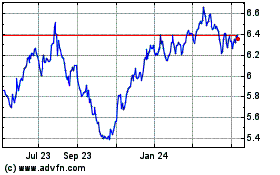

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

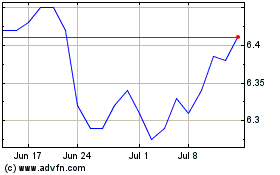

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

From Apr 2023 to Apr 2024