First Trust/Aberdeen Global Opportunity Income Fund Announces Commencement of Tender Offer

January 14 2021 - 9:44AM

Business Wire

First Trust/Aberdeen Global Opportunity Income Fund (NYSE: FAM)

(the “Fund”) today commenced a tender offer.

As previously announced, the Fund will purchase up to 20% of its

outstanding common shares for cash at a price per share equal to

98% of the net asset value per share as determined as of the close

of the regular trading session of the NYSE on February 16, 2021, or

if the offer is extended, as determined by the close of the regular

trading session of the NYSE on the next trading day after the day

to which the offer is extended (in each case, the “Valuation

Date”). The tender offer will expire on February 12, 2021 at 5:00

p.m. Eastern time, or on such later date to which the offer is

extended.

Additional terms and conditions of the tender offer are set

forth in the Fund’s tender offer materials, which will be

distributed to shareholders. If the amount of the Fund’s

outstanding common shares that is tendered exceeds the maximum

amount of its offer, the Fund will purchase shares from tendering

shareholders on a pro rata basis. Accordingly, there is no

assurance that the Fund will purchase all of a shareholder’s

tendered shares.

Completion of the tender offer is subject to the satisfaction of

certain customary conditions, as described in the tender offer

materials, and there can be no assurance such conditions will be

satisfied. In addition, under certain circumstances, the Fund may

terminate or abandon the tender offer, as described in the tender

offer materials, and there can be no assurance such circumstances

will not arise.

The Fund is a diversified, closed-end management investment

company that seeks to provide a high level of current income. As a

secondary objective, the Fund seeks capital appreciation. The Fund

pursues these investment objectives by investing in the world bond

markets through a diversified portfolio of investment grade and

below-investment grade government and corporate debt

securities.

First Trust Advisors L.P., the Fund’s investment advisor, along

with its affiliate, First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $171.6

billion as of December 31, 2020 through unit investment trusts,

exchange-traded funds, closed-end funds, mutual funds and separate

managed accounts.

Aberdeen Standard Investments Inc. (“ASII”) (formerly, Aberdeen

Asset Management Inc.) serves as the Fund’s investment sub-advisor.

ASII is an indirect wholly-owned subsidiary of Standard Life

Aberdeen plc. Aberdeen Standard Investments is the brand name for

the asset management group of Standard Life Aberdeen plc, managing

approximately $562.9 billion in assets as of June 30, 2020, for a

range of pension funds, financial institutions, investment trusts,

unit trusts, offshore funds, charities and private clients.

TENDER OFFER STATEMENT

This press release does not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction. The

tender offer will be made only by an offer to purchase, a related

letter of transmittal and other documents, which have been filed

with the Securities and Exchange Commission as exhibits to a tender

offer statement on Schedule TO. Common shareholders of the Fund

should read the offer to purchase and tender offer statement on

Schedule TO and related exhibits as they contain important

information about the tender offer. The offer to purchase and

related letter of transmittal are available free of charge at

http://www.sec.gov and from the Fund by calling Georgeson LLC, the

Fund’s information agent for the tender offer, at: (888)

680-1528.

FORWARD-LOOKING STATEMENTS

Certain statements made in this press release are

forward-looking statements. Actual results or occurrences may

differ significantly from those anticipated in any forward-looking

statements due to numerous factors. Completion of the tender offer

is subject to satisfaction of conditions, and there can be no

assurance such conditions will be satisfied. Also, there are

circumstances under which the tender offer may be

terminated/abandoned, and there can be no assurance such

circumstances do not arise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210114005653/en/

Jim Dykas – (630) 517-7665

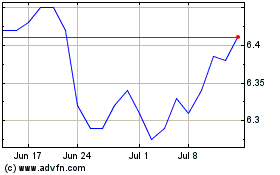

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

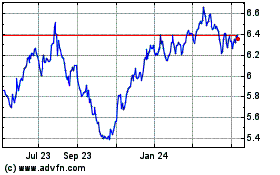

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

From Apr 2023 to Apr 2024