Current Report Filing (8-k)

March 04 2021 - 5:06PM

Edgar (US Regulatory)

false 0001136893 0001136893 2021-03-02 2021-03-02 0001136893 fis:CommonStockParValue001PerShareMember 2021-03-02 2021-03-02 0001136893 fis:FloatingRateSeniorNotesDueTwoThousandTwentyOneMember 2021-03-02 2021-03-02 0001136893 fis:M0.125SeniorNotesDue2021Member13Member 2021-03-02 2021-03-02 0001136893 fis:M1.700SeniorNotesDue20222Member 2021-03-02 2021-03-02 0001136893 fis:M0.125SeniorNotesDue20221Member 2021-03-02 2021-03-02 0001136893 fis:M0.750SeniorNotesDue2023Member12Member 2021-03-02 2021-03-02 0001136893 fis:M1.100SeniorNotesDue20243Member 2021-03-02 2021-03-02 0001136893 fis:M2.602SeniorNotesDue20254Member 2021-03-02 2021-03-02 0001136893 fis:M0.625SeniorNotesDue20255Member 2021-03-02 2021-03-02 0001136893 fis:M1.500SeniorNotesDue20276Member 2021-03-02 2021-03-02 0001136893 fis:M1.000SeniorNotesDue20287Member 2021-03-02 2021-03-02 0001136893 fis:M2.250SeniorNotesDue20298Member 2021-03-02 2021-03-02 0001136893 fis:M2.000SeniorNotesDue20309Member 2021-03-02 2021-03-02 0001136893 fis:M3.360SeniorNotesDue203110Member 2021-03-02 2021-03-02 0001136893 fis:M2.950SeniorNotesDue203911Member 2021-03-02 2021-03-02

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 2, 2021

Fidelity National Information Services, Inc.

(Exact name of Registrant as Specified in its Charter)

1-16427

(Commission

File Number)

|

|

|

|

|

Georgia

|

|

37-1490331

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

|

(IRS Employer

Identification Number)

|

601 Riverside Avenue

Jacksonville, Florida 32204

(Address of Principal Executive Offices)

(904) 438-6000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

FIS

|

|

New York Stock Exchange

|

|

Floating Rate Senior Notes due 2021

|

|

FIS21B

|

|

New York Stock Exchange

|

|

0.125% Senior Notes due 2021

|

|

FIS21C

|

|

New York Stock Exchange

|

|

1.700% Senior Notes due 2022

|

|

FIS22B

|

|

New York Stock Exchange

|

|

0.125% Senior Notes due 2022

|

|

FIS22C

|

|

New York Stock Exchange

|

|

0.750% Senior Notes due 2023

|

|

FIS23A

|

|

New York Stock Exchange

|

|

1.100% Senior Notes due 2024

|

|

FIS24A

|

|

New York Stock Exchange

|

|

2.602% Senior Notes due 2025

|

|

FIS25A

|

|

New York Stock Exchange

|

|

0.625% Senior Notes due 2025

|

|

FIS25B

|

|

New York Stock Exchange

|

|

1.500% Senior Notes due 2027

|

|

FIS27

|

|

New York Stock Exchange

|

|

1.000% Senior Notes due 2028

|

|

FIS28

|

|

New York Stock Exchange

|

|

2.250% Senior Notes due 2029

|

|

FIS29

|

|

New York Stock Exchange

|

|

2.000% Senior Notes due 2030

|

|

FIS30

|

|

New York Stock Exchange

|

|

3.360% Senior Notes due 2031

|

|

FIS31

|

|

New York Stock Exchange

|

|

2.950% Senior Notes due 2039

|

|

FIS39

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Amended Credit Agreement

On March 2, 2021, Fidelity National Information Services, Inc. (“FIS”), JPMorgan Chase Bank, N.A., as administrative agent, and the lenders party thereto entered into a Fourth Amendment Agreement, dated as of March 2, 2021 (the “Amendment”), which further amends FIS’s existing Seventh Amended and Restated Credit Agreement dated as of September 21, 2018 (as amended by (i) that certain Amendment Agreement dated as of March 29, 2019, (ii) that certain Second Amendment Agreement dated as of April 5, 2019, (iii) that certain Third Amendment and Joinder Agreement as of May 29, 2019 and (iv) the Amendment, the “Amended Credit Agreement”). The Amendment extends the term of the Amended Credit Agreement to March 2, 2026. Under the Amended Credit Agreement, (i) the maximum leverage ratio will step down to 4.00:1.00 on March 31, 2021, 3.75:1.00 on September 30, 2021 and 3.50:1.00 on December 31, 2021 and (ii) the cap on cash-netting for the purposes of calculating the maximum leverage ratio is the sum of (x) up to $600,000,000 of unrestricted cash maintained in the U.S. (or that could be repatriated to the U.S., less applicable repatriation taxes) (“Qualified Cash”) plus (y) up to $800,000,000 of Qualified Cash held outside of the U.S. for regulatory purposes.

The foregoing descriptions of the Amendment and the Amended Credit Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of such documents, copies of which are filed as Exhibit 10.1 hereto (such Exhibit consisting of the Amendment and, through its Annex A, the Amended Credit Agreement) and are hereby incorporated into this report by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 of this report is incorporated by reference into this Item 2.03.

Settlement of Any and All Tender Offer

On March 3, 2021, FIS completed the settlement of its previously announced tender offer (the “Any and All Tender Offer”) to purchase for cash any and all of its outstanding Floating Rate Senior Notes due 2021 (the “2021 Floating Rate Notes”), its outstanding 0.125% Senior Notes due 2021 (the “2021 Notes” and, together with the 2021 Floating Rate Notes, the “Euro Notes”), its outstanding 3.500% Senior Notes due 2023 (the “2023 Notes”), its outstanding 3.875% Senior Notes due 2024 (the “2024 Notes”), its outstanding 2.602% Senior Notes due 2025 (the “2025 Sterling Notes”), its outstanding 5.000% Senior Notes due 2025 (the “2025 Notes”) and its outstanding 3.000% Senior Notes due 2026 (the “2026 Notes” and, collectively with the 2023 Notes, the 2024 Notes and the 2025 Notes, the “Dollar Notes,” and the Dollar Notes together with the Euro Notes and the 2025 Sterling Notes, the “Any and All Notes”). The table below lists the aggregate principal amount of each series of Any and All Notes that were accepted for purchase and the aggregate principal amount that remains outstanding for each series of Any and All Notes following settlement.

|

|

|

|

|

|

|

Title of Notes

|

|

Principal Amount Accepted for Purchase

|

|

Principal Amount Outstanding After

Any and All Tender Offer

|

|

Floating Rate Senior Notes due 2021

|

|

€54,260,000

|

|

€445,740,000

|

|

0.125% Senior Notes due 2021

|

|

€278,718,000

|

|

€221,282,000

|

|

3.500% Senior Notes due 2023

|

|

$334,101,000

|

|

$365,899,000

|

|

3.875% Senior Notes due 2024

|

|

$126,133,000

|

|

$273,871,000

|

|

2.602% Senior Notes due 2025

|

|

£453,033,000

|

|

£171,967,000

|

|

5.000% Senior Notes due 2025

|

|

$21,971,000

|

|

$589,957,000

|

|

3.000% Senior Notes due 2026

|

|

$592,626,000

|

|

$657,374,000

|

- 2 -

The aggregate purchase price for the Any and All Notes accepted for purchase in the Any and All Tender Offer, including accrued interest, was $1,180,356,453.20 with respect to the Dollar Notes, €333,506,669.78 with respect to the Euro Notes and £499,653,844.09 with respect to the 2025 Sterling Notes.

Redemption of Certain Senior Notes

FIS has called for redemption all of the 2021 Notes, 2025 Sterling Notes and Dollar Notes that were not tendered and not accepted for purchase in the Any and All Tender Offer. The scheduled redemption date with respect to the 2021 Notes and the 2025 Sterling Notes is March 17, 2021. The scheduled redemption date with respect to the Dollar Notes is April 1, 2021.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

- 3 -

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Fidelity National Information Services, Inc.

|

|

|

|

|

|

|

Date: March 4, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Marc M. Mayo

|

|

|

|

|

|

Name:

|

|

Marc M. Mayo

|

|

|

|

|

|

Title:

|

|

Corporate Executive Vice President and Chief Legal Officer

|

- 4 -

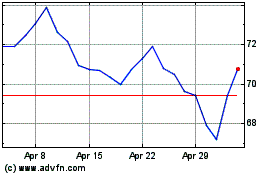

Fidelity National Inform... (NYSE:FIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

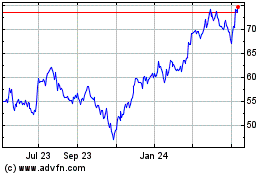

Fidelity National Inform... (NYSE:FIS)

Historical Stock Chart

From Apr 2023 to Apr 2024