Ferrari NV: H1 2019 RESULTS CONFIRM 2019 GUIDANCE WITH IMPROVED CASH FLOW.

August 02 2019 - 5:46AM

H1 2019 RESULTS CONFIRM 2019 GUIDANCE WITH

IMPROVED CASH FLOW.UNVEILING OF FIRST HYBRID

SERIES-PRODUCTION SUPERCAR, SF90 STRADALE

- Total shipments of 2,671 units, up +8.4%

- Net revenues of Euro 984 million, up +8.6% or +6.8% at

constant currency([1])

- Adj. EBITDA([2]) of Euro 314 million, up +8.7% with an

EBITDA margin of 32.0%

- Adj. diluted EPS(2) of Euro 0.96

(+13.9%)

- Industrial free cash flow(2) generation

of Euro 139 million, reflecting also the positive cash impact from

advances on the Ferrari Monza SP1 and SP2 as well as Patent Box

benefit

|

For the three months ended |

(In Euro million, unless otherwise stated) |

For the six months ended |

|

June 30, |

June 30, |

|

2019 |

2018 |

Change |

|

2019 |

2018 |

Change |

|

2,671 |

2,463 |

208 |

8% |

Shipments (in units) |

5,281 |

4,591 |

690 |

15% |

|

984 |

906 |

78 |

9% |

Net revenues |

1,924 |

1,737 |

187 |

11% |

|

314 |

291 |

23 |

8% |

EBITDA(2) |

625 |

563 |

62 |

11% |

|

314 |

290 |

24 |

9% |

Adjusted EBITDA(2) |

625 |

562 |

63 |

11% |

|

32.0% |

31.9% |

+10 bps |

Adjusted EBITDA margin(2) |

32.5% |

32.3% |

+20 bps |

|

239 |

218 |

21 |

9% |

EBIT |

471 |

428 |

43 |

10% |

|

239 |

217 |

22 |

10% |

Adjusted EBIT(2) |

471 |

427 |

44 |

10% |

|

24.3% |

23.9% |

+40 bps |

Adjusted EBIT margin(2) |

24.5% |

24.6% |

(10 bps) |

|

184 |

160 |

24 |

14% |

Net profit |

364 |

309 |

55 |

18% |

|

184 |

159 |

25 |

15% |

Adjusted net profit(2) |

364 |

308 |

56 |

18% |

|

0.97 |

0.85 |

0.12 |

14% |

Basic earnings per share (in Euro) |

1.92 |

1.63 |

0.29 |

18% |

|

0.96 |

0.85 |

0.11 |

13% |

Diluted earnings per share (in Euro) |

1.91 |

1.62 |

0.29 |

18% |

|

0.97 |

0.84 |

0.13 |

15% |

Adjusted basic earnings per share (in Euro)(2) |

1.92 |

1.63 |

0.29 |

18% |

|

0.96 |

0.84 |

0.12 |

14% |

Adjusted diluted earnings per share (in Euro)(2) |

1.91 |

1.62 |

0.29 |

18% |

| |

|

|

|

|

|

|

|

|

|

Confirming Guidance approaching the high end of

the range on all metrics at currently prevailing exchange rates.

Increasing industrial free cash flow target: |

- Net revenues: > Euro 3.5 billion

- Adj. EBITDA: Euro 1.2-1.25 billion

- Adj. EBIT: Euro 0.85-0.9 billion

- Adj. diluted EPS ([3]): Euro 3.50-3.70 per share

- Industrial free cash flow: > Euro 0.55 billion (from ~ Euro

0.45 billion)

|

1 The constant currency presentation eliminates the effects of

changes in foreign currency (transaction and translation) and of

foreign currency hedges

2 Refer to specific note on non-GAAP financial measures

3 Calculated using the weighted average diluted number of shares

for 2018

More information in the press release attached.

- 2019_08_02 - Ferrari Risultati Q2 2019 Comunicato Stampa

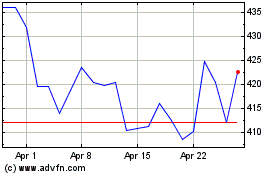

Ferrari NV (NYSE:RACE)

Historical Stock Chart

From Mar 2024 to Apr 2024

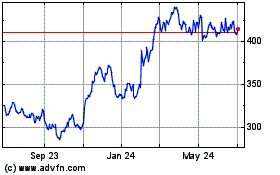

Ferrari NV (NYSE:RACE)

Historical Stock Chart

From Apr 2023 to Apr 2024