0001048911Q1false--05-312025http://fasb.org/us-gaap/2024#AccountsPayableCurrent0001048911srt:MaximumMember2024-06-300001048911srt:MinimumMember2024-06-012024-06-3000010489112023-05-310001048911fdx:CreditAgreementsMember2024-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMember2024-08-310001048911us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-310001048911fdx:SupplyChainFinanceMember2024-06-012024-08-310001048911us-gaap:AdditionalPaidInCapitalMember2024-05-310001048911us-gaap:RetainedEarningsMember2024-05-310001048911fdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:FreightRevenueMember2024-06-012024-08-310001048911us-gaap:CommonStockMember2024-05-310001048911us-gaap:AccumulatedTranslationAdjustmentMember2023-06-012023-08-310001048911fdx:InternationalDomesticMemberfdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMember2023-06-012023-08-310001048911us-gaap:AdditionalPaidInCapitalMember2023-08-310001048911us-gaap:AccumulatedTranslationAdjustmentMember2023-08-310001048911fdx:PackageRevenueMemberus-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMember2023-06-012023-08-310001048911us-gaap:TreasuryStockCommonMember2024-08-310001048911fdx:ZeroPointFourFiveZeroPercentageNotesDueTwoThousandTwentyFiveMember2024-06-012024-08-310001048911fdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMember2024-05-310001048911fdx:Boeing777FreighterMember2024-06-012024-08-310001048911fdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:FreightRevenueMemberfdx:UnitedStatesRevenueMember2024-06-012024-08-310001048911us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-012024-08-310001048911us-gaap:AccumulatedTranslationAdjustmentMember2024-08-310001048911us-gaap:CommonStockMember2023-08-3100010489112024-02-012024-02-290001048911fdx:TwoThousandAndTwentyFourRepurchaseProgramMember2024-06-012024-08-310001048911us-gaap:TreasuryStockCommonMember2023-06-012023-08-310001048911fdx:VoluntaryContributionMembercountry:US2024-06-012024-08-310001048911fdx:CorporateReconcilingItemsAndEliminationsMember2024-05-310001048911srt:MaximumMember2024-06-012024-08-310001048911fdx:ZeroPointNineFiveZeroPercentageNotesDueTwoThousandThirtyThreeMember2024-06-012024-08-310001048911us-gaap:IntersegmentEliminationMember2024-06-012024-08-310001048911fdx:CorporateReconcilingItemsAndEliminationsMember2023-06-012023-08-310001048911fdx:O2025Q12DividendsMember2024-06-102024-06-100001048911us-gaap:CommonStockMember2023-05-310001048911us-gaap:OperatingSegmentsMemberfdx:FedexFreightSegmentMember2024-05-310001048911fdx:O2025Q11DividendsMember2024-08-160001048911us-gaap:DefinedBenefitPostretirementHealthCoverageMember2024-06-012024-08-310001048911fdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:FreightRevenueMemberfdx:InternationalEconomyMember2024-06-012024-08-310001048911fdx:FacilitiesAndOtherMember2024-08-310001048911fdx:ThreeYearCreditAgreementMember2024-06-012024-08-310001048911fdx:InternationalDomesticMemberfdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMember2024-06-012024-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FedexFreightSegmentMember2024-08-310001048911us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-06-012023-08-3100010489112024-06-012024-08-310001048911fdx:CorporateReconcilingItemsAndEliminationsMember2024-06-012024-08-310001048911fdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:UnitedStatesRevenueMember2024-06-012024-08-310001048911us-gaap:AccumulatedTranslationAdjustmentMember2024-05-310001048911us-gaap:RetainedEarningsMember2024-06-012024-08-310001048911fdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:FreightRevenueMemberfdx:InternationalPriorityMember2024-06-012024-08-310001048911fdx:OnePointSixTwoFivePercentageNotesDueTwoThousandTwentySevenMember2024-06-012024-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:OtherMember2024-06-012024-08-310001048911us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-08-310001048911us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-012023-08-310001048911fdx:O2025Q12DividendsMember2024-06-100001048911us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-08-310001048911us-gaap:TreasuryStockCommonMember2023-05-310001048911us-gaap:AdditionalPaidInCapitalMember2023-05-310001048911srt:MinimumMember2024-06-012024-08-310001048911us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-06-012023-08-310001048911us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-08-3100010489112024-08-310001048911fdx:AircraftAndRelatedEquipmentCommitmentsMember2024-08-310001048911us-gaap:TreasuryStockCommonMember2024-05-310001048911us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-310001048911fdx:OnePointThreeZeroZeroPercentageNotesDueTwoThousandThirtyOneMember2024-06-012024-08-310001048911us-gaap:AdditionalPaidInCapitalMember2024-08-310001048911us-gaap:RetainedEarningsMember2023-06-012023-08-310001048911fdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:FreightRevenueMemberfdx:UnitedStatesRevenueMember2023-06-012023-08-310001048911fdx:PackageRevenueMemberus-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:InternationalEconomyMember2024-06-012024-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMember2024-06-012024-08-310001048911us-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMembercountry:US2025-05-310001048911fdx:TwoThousandAndTwentyFourRepurchaseProgramMember2023-06-012023-08-310001048911fdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:UnitedStatesGroundMember2023-06-012023-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:FreightRevenueMemberfdx:InternationalEconomyMember2023-06-012023-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMember2023-06-012023-08-310001048911fdx:SupplyChainFinanceMember2024-05-310001048911fdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:InternationalExportPackageRevenueMember2023-06-012023-08-310001048911us-gaap:AdditionalPaidInCapitalMember2023-06-012023-08-3100010489112024-09-170001048911fdx:PackageRevenueMemberus-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:UnitedStatesPriorityMember2023-06-012023-08-310001048911fdx:CorporateReconcilingItemsAndEliminationsMember2024-08-310001048911us-gaap:RetainedEarningsMember2023-05-310001048911fdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:UnitedStatesRevenueMember2023-06-012023-08-310001048911fdx:O2025Q11DividendsMember2024-08-162024-08-160001048911fdx:Boeing767FreighterMember2024-06-012024-08-3100010489112024-06-012024-06-300001048911us-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:OtherMember2023-06-012023-08-310001048911us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2023-06-012023-08-310001048911fdx:OtherCommitmentsMember2024-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:FreightRevenueMember2023-06-012023-08-310001048911fdx:AcceleratedShareRepurchaseAgreementMember2024-08-310001048911fdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:InternationalPriorityMember2023-06-012023-08-310001048911fdx:AcceleratedShareRepurchaseAgreementMember2023-06-012023-08-310001048911us-gaap:TreasuryStockCommonMember2023-08-310001048911fdx:ThreeYearCreditAgreementMember2024-08-310001048911us-gaap:IntersegmentEliminationMember2023-06-012023-08-310001048911fdx:TwoThousandTwentyTwoRepurchaseProgramMember2021-12-160001048911fdx:PackageRevenueMemberus-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:UnitedStatesGroundMember2024-06-012024-08-310001048911fdx:CessnaCE408AircraftMember2024-06-012024-08-310001048911fdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:UnitedStatesPriorityMember2024-06-012024-08-310001048911fdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMemberfdx:InternationalEconomyMember2023-06-012023-08-310001048911fdx:PackageRevenueMemberfdx:FederalExpressSegmentMemberus-gaap:OperatingSegmentsMember2024-06-012024-08-310001048911fdx:AcceleratedShareRepurchaseAgreementMember2024-03-310001048911us-gaap:OperatingSegmentsMemberfdx:FedexFreightSegmentMember2023-06-012023-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:FreightRevenueMemberfdx:InternationalPriorityMember2023-06-012023-08-3100010489112024-05-310001048911fdx:OnePointEightSevenFiveZeroPercentDueInFebruaryTwoThousandThirtyFourMember2024-06-012024-08-310001048911srt:MinimumMember2024-06-300001048911us-gaap:RetainedEarningsMember2023-08-310001048911us-gaap:TreasuryStockCommonMember2024-06-012024-08-310001048911fdx:CommonStockParValueZeroPointOneZeroPerShareMember2024-06-012024-08-310001048911fdx:FiveYearCreditAgreementMember2024-06-012024-08-310001048911us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2024-06-012024-08-310001048911fdx:OnePointEightSevenFiveZeroPercentDueInFebruaryTwoThousandThirtyFourMember2024-08-310001048911fdx:ATR72600FreighterMember2024-06-012024-08-310001048911us-gaap:DefinedBenefitPostretirementHealthCoverageMember2023-06-012023-08-310001048911fdx:PackageRevenueMemberus-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:InternationalExportPackageRevenueMember2024-06-012024-08-310001048911us-gaap:CommonStockMember2024-08-310001048911fdx:AcceleratedShareRepurchaseAgreementMember2024-05-310001048911us-gaap:AccumulatedTranslationAdjustmentMember2023-05-310001048911fdx:FiveYearCreditAgreementMember2024-08-310001048911us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-310001048911us-gaap:RetainedEarningsMember2024-08-310001048911us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-05-310001048911fdx:SupplyChainFinanceMember2024-08-3100010489112023-08-3100010489112023-06-012023-08-310001048911us-gaap:AdditionalPaidInCapitalMember2024-06-012024-08-310001048911fdx:PackageRevenueMemberus-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:InternationalPriorityMember2024-06-012024-08-3100010489112022-10-252022-10-250001048911srt:MaximumMember2024-06-012024-06-300001048911fdx:AcceleratedShareRepurchaseAgreementMember2024-06-012024-08-310001048911fdx:PackageRevenueMemberus-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:UnitedStatesDeferredMember2024-06-012024-08-310001048911fdx:ZeroPointFourFiveZeroPercentageNotesDueTwoThousandTwentyNineMember2024-06-012024-08-310001048911us-gaap:OperatingSegmentsMemberfdx:FedexFreightSegmentMember2024-06-012024-08-310001048911us-gaap:PensionPlansDefinedBenefitMembercountry:US2024-06-012024-08-310001048911us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-05-310001048911fdx:AircraftAndRelatedEquipmentMember2024-08-310001048911us-gaap:AccumulatedTranslationAdjustmentMember2024-06-012024-08-310001048911fdx:PackageRevenueMemberus-gaap:OperatingSegmentsMemberfdx:FederalExpressSegmentMemberfdx:UnitedStatesDeferredMember2023-06-012023-08-310001048911us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-06-012024-08-31iso4217:EURxbrli:purexbrli:sharesfdx:AirCraftfdx:Employeeiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

|

|

☒ |

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED August 31, 2024

OR

|

|

|

☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO__________

Commission File Number: 1-15829

FedEx Corporation

(Exact name of registrant as specified in its charter)

|

|

Delaware |

62-1721435 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

942 South Shady Grove Road, Memphis, Tennessee |

38120 |

(Address of principal executive offices) |

(ZIP Code) |

Registrant’s telephone number, including area code: (901) 818-7500

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, par value $0.10 per share |

|

FDX |

|

New York Stock Exchange |

0.450% Notes due 2025 |

|

FDX 25A |

|

New York Stock Exchange |

1.625% Notes due 2027 |

|

FDX 27 |

|

New York Stock Exchange |

0.450% Notes due 2029 |

|

FDX 29A |

|

New York Stock Exchange |

1.300% Notes due 2031 |

|

FDX 31 |

|

New York Stock Exchange |

0.950% Notes due 2033 |

|

FDX 33 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer ☑ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

Emerging growth company ☐ |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

|

|

Common Stock |

|

Outstanding Shares at September 17, 2024 |

Common Stock, par value $0.10 per share |

|

244,323,464 |

FEDEX CORPORATION

INDEX

|

|

|

|

|

PAGE |

|

|

|

PART I. FINANCIAL INFORMATION |

|

|

|

|

|

ITEM 1. Financial Statements |

|

|

Condensed Consolidated Balance Sheets

August 31, 2024 and May 31, 2024 |

|

3 |

Condensed Consolidated Statements of Income

Three Months Ended August 31, 2024 and August 31, 2023 |

|

5 |

Condensed Consolidated Statements of Comprehensive Income

Three Months Ended August 31, 2024 and August 31, 2023 |

|

6 |

Condensed Consolidated Statements of Cash Flows

Three Months Ended August 31, 2024 and August 31, 2023 |

|

7 |

Condensed Consolidated Statements of Changes In Common Stockholders’ Investment

Three Months Ended August 31, 2024 and August 31, 2023 |

|

8 |

Notes to Condensed Consolidated Financial Statements |

|

9 |

Report of Independent Registered Public Accounting Firm |

|

19 |

ITEM 2. Management’s Discussion and Analysis of Results of Operations and Financial Condition |

|

20 |

ITEM 3. Quantitative and Qualitative Disclosures About Market Risk |

|

38 |

ITEM 4. Controls and Procedures |

|

38 |

|

|

|

PART II. OTHER INFORMATION |

|

|

|

|

|

ITEM 1. Legal Proceedings |

|

39 |

ITEM 1A. Risk Factors |

|

39 |

ITEM 2. Unregistered Sales of Equity Securities and Use of Proceeds |

|

39 |

ITEM 5. Other Information |

|

40 |

ITEM 6. Exhibits |

|

41 |

Signature |

|

42 |

|

|

|

FEDEX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN MILLIONS)

|

|

|

|

|

|

|

|

|

|

|

August 31, 2024

(Unaudited) |

|

|

May 31,

2024 |

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,943 |

|

|

$ |

6,501 |

|

Receivables, less allowances of $702 and $775 |

|

|

10,312 |

|

|

|

10,087 |

|

Spare parts, supplies, and fuel, less allowances of $290 and $288 |

|

|

611 |

|

|

|

614 |

|

Prepaid expenses and other |

|

|

1,228 |

|

|

|

1,005 |

|

Total current assets |

|

|

18,094 |

|

|

|

18,207 |

|

PROPERTY AND EQUIPMENT, AT COST |

|

|

85,158 |

|

|

|

84,391 |

|

Less accumulated depreciation and amortization |

|

|

43,903 |

|

|

|

42,900 |

|

Net property and equipment |

|

|

41,255 |

|

|

|

41,491 |

|

OTHER LONG-TERM ASSETS |

|

|

|

|

|

|

Operating lease right-of-use assets, net |

|

|

17,094 |

|

|

|

17,115 |

|

Goodwill |

|

|

6,512 |

|

|

|

6,423 |

|

Other assets |

|

|

3,756 |

|

|

|

3,771 |

|

Total other long-term assets |

|

|

27,362 |

|

|

|

27,309 |

|

|

|

$ |

86,711 |

|

|

$ |

87,007 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN MILLIONS, EXCEPT SHARE DATA)

|

|

|

|

|

|

|

|

|

|

|

August 31, 2024

(Unaudited) |

|

|

May 31,

2024 |

|

LIABILITIES AND COMMON STOCKHOLDERS’ INVESTMENT |

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

622 |

|

|

$ |

68 |

|

Accrued salaries and employee benefits |

|

|

2,336 |

|

|

|

2,673 |

|

Accounts payable |

|

|

3,738 |

|

|

|

3,189 |

|

Operating lease liabilities |

|

|

2,510 |

|

|

|

2,463 |

|

Accrued expenses |

|

|

4,905 |

|

|

|

4,962 |

|

Total current liabilities |

|

|

14,111 |

|

|

|

13,355 |

|

LONG-TERM DEBT, LESS CURRENT PORTION |

|

|

19,664 |

|

|

|

20,135 |

|

OTHER LONG-TERM LIABILITIES |

|

|

|

|

|

|

Deferred income taxes |

|

|

4,485 |

|

|

|

4,482 |

|

Pension, postretirement healthcare, and other benefit obligations |

|

|

1,780 |

|

|

|

2,010 |

|

Self-insurance accruals |

|

|

3,833 |

|

|

|

3,701 |

|

Operating lease liabilities |

|

|

14,969 |

|

|

|

15,053 |

|

Other liabilities |

|

|

693 |

|

|

|

689 |

|

Total other long-term liabilities |

|

|

25,760 |

|

|

|

25,935 |

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

COMMON STOCKHOLDERS’ INVESTMENT |

|

|

|

|

|

|

Common stock, $0.10 par value; 800 million shares authorized; 318 million shares

issued as of August 31, 2024 and May 31, 2024 |

|

|

32 |

|

|

|

32 |

|

Additional paid-in capital |

|

|

4,134 |

|

|

|

3,988 |

|

Retained earnings |

|

|

38,767 |

|

|

|

38,649 |

|

Accumulated other comprehensive loss |

|

|

(1,332 |

) |

|

|

(1,359 |

) |

Treasury stock, at cost |

|

|

(14,425 |

) |

|

|

(13,728 |

) |

Total common stockholders’ investment |

|

|

27,176 |

|

|

|

27,582 |

|

|

|

$ |

86,711 |

|

|

$ |

87,007 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

August 31, 2024 |

|

|

August 31, 2023 |

|

REVENUE |

|

$ |

21,579 |

|

|

$ |

21,681 |

|

OPERATING EXPENSES: |

|

|

|

|

|

|

Salaries and employee benefits |

|

|

7,785 |

|

|

|

7,785 |

|

Purchased transportation |

|

|

5,275 |

|

|

|

5,036 |

|

Rentals and landing fees |

|

|

1,161 |

|

|

|

1,151 |

|

Depreciation and amortization |

|

|

1,078 |

|

|

|

1,071 |

|

Fuel |

|

|

1,075 |

|

|

|

1,101 |

|

Maintenance and repairs |

|

|

829 |

|

|

|

824 |

|

Business optimization costs |

|

|

128 |

|

|

|

105 |

|

Other |

|

|

3,168 |

|

|

|

3,123 |

|

|

|

|

20,499 |

|

|

|

20,196 |

|

OPERATING INCOME |

|

|

1,080 |

|

|

|

1,485 |

|

OTHER (EXPENSE) INCOME: |

|

|

|

|

|

|

Interest, net |

|

|

(84 |

) |

|

|

(91 |

) |

Other retirement plans, net |

|

|

49 |

|

|

|

39 |

|

Other, net |

|

|

11 |

|

|

|

(10 |

) |

|

|

|

(24 |

) |

|

|

(62 |

) |

INCOME BEFORE INCOME TAXES |

|

|

1,056 |

|

|

|

1,423 |

|

PROVISION FOR INCOME TAXES |

|

|

262 |

|

|

|

345 |

|

NET INCOME |

|

$ |

794 |

|

|

$ |

1,078 |

|

EARNINGS PER COMMON SHARE: |

|

|

|

|

|

|

Basic |

|

$ |

3.24 |

|

|

$ |

4.28 |

|

Diluted |

|

$ |

3.21 |

|

|

$ |

4.23 |

|

DIVIDENDS DECLARED PER COMMON SHARE |

|

$ |

2.76 |

|

|

$ |

1.26 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

(IN MILLIONS)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

August 31, 2024 |

|

|

August 31, 2023 |

|

NET INCOME |

|

$ |

794 |

|

|

$ |

1,078 |

|

OTHER COMPREHENSIVE INCOME (LOSS): |

|

|

|

|

|

|

Foreign currency translation adjustments, net of tax (expense)/benefit of ($4) in 2024 and $4 in 2023 |

|

|

29 |

|

|

|

(28 |

) |

Amortization of prior service credit, net of tax benefit of $1 in 2024 and $0 in 2023 |

|

|

(2 |

) |

|

|

(1 |

) |

|

|

|

27 |

|

|

|

(29 |

) |

COMPREHENSIVE INCOME |

|

$ |

821 |

|

|

$ |

1,049 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(IN MILLIONS)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

August 31, 2024 |

|

|

August 31, 2023 |

|

Operating Activities: |

|

|

|

|

|

|

Net income |

|

$ |

794 |

|

|

$ |

1,078 |

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,078 |

|

|

|

1,071 |

|

Provision for uncollectible accounts |

|

|

129 |

|

|

|

103 |

|

Other noncash items including leases and deferred income taxes |

|

|

817 |

|

|

|

728 |

|

Stock-based compensation |

|

|

48 |

|

|

|

56 |

|

Business optimization costs, net of payments |

|

|

(69 |

) |

|

|

(73 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

Receivables |

|

|

(305 |

) |

|

|

(126 |

) |

Other assets |

|

|

(223 |

) |

|

|

(131 |

) |

Accounts payable and other liabilities |

|

|

(1,105 |

) |

|

|

(470 |

) |

Other, net |

|

|

23 |

|

|

|

(6 |

) |

Cash provided by operating activities |

|

|

1,187 |

|

|

|

2,230 |

|

Investing Activities: |

|

|

|

|

|

|

Capital expenditures |

|

|

(767 |

) |

|

|

(1,290 |

) |

Purchase of investments |

|

|

(61 |

) |

|

|

(2 |

) |

Proceeds from sale of investments |

|

|

13 |

|

|

|

— |

|

Proceeds from asset dispositions and other |

|

|

13 |

|

|

|

12 |

|

Cash used in investing activities |

|

|

(802 |

) |

|

|

(1,280 |

) |

Financing Activities: |

|

|

|

|

|

|

Principal payments on debt |

|

|

(34 |

) |

|

|

(66 |

) |

Proceeds from stock issuances |

|

|

404 |

|

|

|

157 |

|

Dividends paid |

|

|

(339 |

) |

|

|

(318 |

) |

Purchase of treasury stock |

|

|

(1,000 |

) |

|

|

(500 |

) |

Cash used in financing activities |

|

|

(969 |

) |

|

|

(727 |

) |

Effect of exchange rate changes on cash |

|

|

26 |

|

|

|

(24 |

) |

Net (decrease) increase in cash and cash equivalents |

|

|

(558 |

) |

|

|

199 |

|

Cash and cash equivalents at beginning of period |

|

|

6,501 |

|

|

|

6,856 |

|

Cash and cash equivalents at end of period |

|

$ |

5,943 |

|

|

$ |

7,055 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN COMMON STOCKHOLDERS’ INVESTMENT

(UNAUDITED)

(IN MILLIONS, EXCEPT SHARE DATA)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

August 31, 2024 |

|

|

August 31, 2023 |

|

Common Stock |

|

|

|

|

|

|

Beginning Balance |

|

$ |

32 |

|

|

$ |

32 |

|

Ending Balance |

|

|

32 |

|

|

|

32 |

|

Additional Paid-in Capital |

|

|

|

|

|

|

Beginning Balance |

|

|

3,988 |

|

|

|

3,769 |

|

Purchase of treasury stock |

|

|

(9 |

) |

|

|

(36 |

) |

Employee incentive plans and other |

|

|

155 |

|

|

|

67 |

|

Ending Balance |

|

|

4,134 |

|

|

|

3,800 |

|

Retained Earnings |

|

|

|

|

|

|

Beginning Balance |

|

|

38,649 |

|

|

|

35,259 |

|

Net Income |

|

|

794 |

|

|

|

1,078 |

|

Cash dividends declared ($2.76 and $1.26 per share) |

|

|

(676 |

) |

|

|

(316 |

) |

Ending Balance |

|

|

38,767 |

|

|

|

36,021 |

|

Accumulated Other Comprehensive Loss |

|

|

|

|

|

|

Beginning Balance |

|

|

(1,359 |

) |

|

|

(1,327 |

) |

Other comprehensive income/(loss), net of tax (expense)/benefit of ($3) and $4 |

|

|

27 |

|

|

|

(29 |

) |

Ending Balance |

|

|

(1,332 |

) |

|

|

(1,356 |

) |

Treasury Stock |

|

|

|

|

|

|

Beginning Balance |

|

|

(13,728 |

) |

|

|

(11,645 |

) |

Purchase of treasury stock (3.4 and 2.0 million shares) |

|

|

(994 |

) |

|

|

(464 |

) |

Employee incentive plans and other (2.2 and 1.1 million shares) |

|

|

297 |

|

|

|

146 |

|

Ending Balance |

|

|

(14,425 |

) |

|

|

(11,963 |

) |

Total Common Stockholders’ Investment Balance |

|

$ |

27,176 |

|

|

$ |

26,534 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

FEDEX CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1: Description of Business Segments and Summary of Significant Accounting Policies

DESCRIPTION OF BUSINESS SEGMENTS. FedEx Corporation (“FedEx”) provides a broad portfolio of transportation, e-commerce, and business services, offering integrated business solutions utilizing our flexible, efficient, and intelligent global network. Our primary operating companies are Federal Express Corporation (“Federal Express”), the world’s largest express transportation company and a leading North American provider of small-package ground delivery services, and FedEx Freight, Inc. (“FedEx Freight”), a leading North American provider of less-than-truckload (“LTL”) freight transportation services.

In connection with our one FedEx consolidation plan, on June 1, 2024, FedEx Ground Package System, Inc. (“FedEx Ground”) and FedEx Corporate Services, Inc. (“FedEx Services”) were merged into Federal Express, becoming a single company operating a unified, fully integrated air-ground express network under the respected FedEx brand. FedEx Freight continues to provide LTL freight transportation services as a separate subsidiary. Beginning in the first quarter of 2025, Federal Express and FedEx Freight represent our major service lines and constitute our reportable segments. Additionally, the results of FedEx Custom Critical, Inc. (“FedEx Custom Critical”) are included in the FedEx Freight segment instead of the Federal Express segment in 2025. Prior-year amounts were revised to reflect this presentation.

We evaluated our reporting units with significant recorded goodwill during the fourth quarter of 2024, and the estimated fair value of each reporting unit exceeded its carrying value as of the end of 2024 immediately before our one FedEx consolidation. We reevaluated the conclusion of our 2024 goodwill impairment tests as of June 1, 2024 immediately after our one FedEx consolidation and concluded that the estimated fair values of our reporting units with significant goodwill continued to exceed their respective carrying values.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES. These interim financial statements of FedEx have been prepared in accordance with accounting principles generally accepted in the United States and Securities and Exchange Commission (“SEC”) instructions for interim financial information, and should be read in conjunction with our Annual Report on Form 10-K for the fiscal year ended May 31, 2024 (“Annual Report”). Significant accounting policies and other disclosures normally provided have been omitted since such items are disclosed in our Annual Report.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments (including normal recurring adjustments) necessary to present fairly our financial position as of August 31, 2024, and the results of our operations for the three-month periods ended August 31, 2024 and 2023, cash flows for the three-month periods ended August 31, 2024 and 2023, and changes in common stockholders’ investment for the three-month periods ended August 31, 2024 and 2023. Operating results for the three-month period ended August 31, 2024 are not necessarily indicative of the results that may be expected for the year ending May 31, 2025.

Except as otherwise specified, references to years indicate our fiscal year ending May 31, 2025 or ended May 31 of the year referenced and comparisons are to the corresponding period of the prior year.

Contract Assets and Liabilities. Contract assets include billed and unbilled amounts resulting from in-transit shipments, as we have an unconditional right to payment only once all performance obligations have been completed (e.g., packages have been delivered). Contract assets are generally classified as current, and the full balance is converted each quarter based on the short-term nature of the transactions. Our contract liabilities consist of advance payments and billings in excess of revenue. The full balance of deferred revenue is converted each quarter based on the short-term nature of the transactions.

Gross contract assets related to in-transit shipments totaled $614 million and $672 million at August 31, 2024 and May 31, 2024, respectively. Contract assets net of deferred unearned revenue were $459 million and $463 million at August 31, 2024 and May 31, 2024, respectively. Contract assets are included within current assets in the accompanying unaudited condensed consolidated balance sheets. Contract liabilities related to advance payments from customers were $20 million and $23 million at August 31, 2024 and May 31, 2024, respectively. Contract liabilities are included within current liabilities in the accompanying unaudited condensed consolidated balance sheets.

Disaggregation of Revenue. The following table provides revenue by service type (in millions) for the three-month periods ended August 31. This presentation is consistent with how we organize our segments internally for making operating decisions and measuring performance.

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

REVENUE BY SERVICE TYPE |

|

|

|

|

|

|

Federal Express segment: |

|

|

|

|

|

|

Package: |

|

|

|

|

|

|

U.S. priority |

|

$ |

2,591 |

|

|

$ |

2,673 |

|

U.S. deferred |

|

|

1,151 |

|

|

|

1,187 |

|

U.S. ground |

|

|

8,056 |

|

|

|

8,133 |

|

Total U.S. domestic package revenue |

|

|

11,798 |

|

|

|

11,993 |

|

International priority |

|

|

2,206 |

|

|

|

2,327 |

|

International economy |

|

|

1,360 |

|

|

|

1,117 |

|

Total international export package revenue |

|

|

3,566 |

|

|

|

3,444 |

|

International domestic(1) |

|

|

1,112 |

|

|

|

1,140 |

|

Total package revenue |

|

|

16,476 |

|

|

|

16,577 |

|

Freight: |

|

|

|

|

|

|

U.S. |

|

|

569 |

|

|

|

577 |

|

International priority |

|

|

526 |

|

|

|

553 |

|

International economy |

|

|

463 |

|

|

|

472 |

|

Total freight revenue |

|

|

1,558 |

|

|

|

1,602 |

|

Other |

|

|

271 |

|

|

|

247 |

|

Total Federal Express segment |

|

|

18,305 |

|

|

|

18,426 |

|

FedEx Freight segment |

|

|

2,329 |

|

|

|

2,385 |

|

Other and eliminations(2) |

|

|

945 |

|

|

|

870 |

|

|

|

$ |

21,579 |

|

|

$ |

21,681 |

|

(1)International domestic revenue relates to our international intra-country operations.

(2)Includes the FedEx Dataworks, Inc. (“FedEx Dataworks”), FedEx Office and Print Services, Inc. (“FedEx Office”), and FedEx Logistics, Inc. (“FedEx Logistics”) operating segments.

EMPLOYEES UNDER COLLECTIVE BARGAINING ARRANGEMENTS. The pilots of Federal Express, who are a small number of its total employees, are represented by the Air Line Pilots Association, International (“ALPA”) and are employed under a collective bargaining agreement that took effect on November 2, 2015. The agreement became amendable in November 2021. Bargaining for a successor agreement began in May 2021, and in November 2022 the National Mediation Board (“NMB”), which is the U.S. governmental agency that oversees labor agreements for entities covered by the Railway Labor Act of 1926, as amended, began actively mediating the negotiations. In July 2023, Federal Express’s pilots failed to ratify the tentative successor agreement that was approved by ALPA’s FedEx Master Executive Council the prior month. Bargaining for a successor agreement continues. In April 2024, the NMB rejected ALPA’s request for a proffer of arbitration. The conduct of mediated negotiations has no effect on our operations. A small number of our other employees are members of unions.

STOCK-BASED COMPENSATION. We have three types of equity-based compensation: stock options, restricted stock, and, for outside directors, restricted stock units. The key terms of our equity-based compensation plans and financial disclosures about these programs are set forth in our Annual Report. Our stock-based compensation expense was $48 million for the three-month period ended August 31, 2024 and $56 million for the three-month period ended August 31, 2023. Due to its immateriality, additional disclosures related to stock-based compensation have been excluded from this quarterly report.

BUSINESS OPTIMIZATION COSTS. In the second quarter of 2023, we announced DRIVE, a comprehensive program to improve long-term profitability. This program includes a business optimization plan to drive efficiency within and among our transportation segments, lower our overhead and support costs, and transform our digital capabilities. We have commenced our plan to consolidate our sortation facilities and equipment, reduce pickup-and-delivery routes, and optimize our enterprise linehaul network by moving beyond discrete collaboration to an end-to-end optimized network through Network 2.0, the multi-year effort to improve the efficiency with which we pick up, transport, and deliver packages in the U.S. and Canada.

We have implemented Network 2.0 optimization in more than 150 locations in the U.S. and Canada. Contracted service providers will handle the pickup and delivery of packages in some locations while employee couriers will handle others.

We incurred costs associated with our business optimization activities of $128 million ($98 million, net of tax, or $0.39 per diluted share) in the three-month period ended August 31, 2024 and $105 million ($81 million, net of tax, or $0.32 per diluted share) in the

three-month period ended August 31, 2023. These costs were primarily related to professional services and severance and are included in Corporate, other, and eliminations and Federal Express.

In June 2024, Federal Express announced a workforce reduction plan in Europe as part of its ongoing measures to reduce structural costs. The plan will impact between 1,700 and 2,000 employees in Europe across back-office and commercial functions. The execution of the plan is subject to a consultation process that is expected to occur over an 18-month period in accordance with local country processes and regulations. We expect the pre-tax cost of the severance benefits and legal and professional fees to be provided under and related to the plan to range from $250 million to $375 million in cash expenditures. These charges are expected to be incurred through fiscal 2026 and will be classified as business optimization expenses.

DERIVATIVE FINANCIAL INSTRUMENTS. We enter into derivative financial instruments to reduce the effects of volatility in foreign currency exchange exposure on operating results and cash flows. Our derivative financial instruments are used to manage differences in the amount, timing, and duration of cash receipts and cash payments principally related to our investments. We use debt denominated in foreign currency and fixed-to-fixed cross-currency swaps to hedge our exposure to changes in foreign exchange rates on certain of our foreign investments.

As of August 31, 2024, we had €176 million of debt designated as a net investment hedge to reduce the volatility of the U.S. dollar value of a portion of our net investment in a euro-denominated consolidated subsidiary.

As of August 31, 2024, we had four cross-currency swaps outstanding, and the fair value of the swaps classified as assets and liabilities was $7 million and $23 million, respectively. As of May 31, 2024, the fair value of the swaps classified as assets and liabilities was $8 million and $14 million, respectively. We record all derivatives on the balance sheet at fair value within either “Prepaid expenses and other” or “Other liabilities” in the accompanying unaudited condensed consolidated balance sheets. The estimated fair values were determined using pricing models that rely on market-based inputs such as foreign currency exchange rates and yield curves, and are classified as Level 2 within the fair value hierarchy. This classification is defined as a fair value determined using market-based inputs other than quoted prices that are observable for the derivative financial instruments, either directly or indirectly.

As of August 31, 2024, our net investment hedges remain effective.

SUPPLIER FINANCE PROGRAM. We offer voluntary Supply Chain Finance (“SCF”) programs through financial institutions to certain of our suppliers. We agree to commercial terms with our suppliers, including prices, quantities, and payment terms, and they issue invoices to us based on the agreed-upon contractual terms. If our suppliers choose to participate in the SCF programs, they determine which invoices, if any, to sell to the financial institutions to receive an early discounted payment, while we settle the net payment amount with the financial institutions on the payment due dates. We guarantee these payments with the financial institutions.

Amounts due to our suppliers that participate in the SCF programs are included in “Accounts payable” in the accompanying unaudited condensed consolidated balance sheets. We have been informed by the participating financial institutions that as of August 31, 2024 and May 31, 2024, suppliers have been approved to sell to them $75 million and $94 million, respectively, of our outstanding payment obligations. A rollforward of obligations confirmed and paid during the three-month period ended August 31, 2024 is presented below (in millions):

|

|

|

|

|

|

|

2024 |

|

Confirmed obligations outstanding at beginning of period |

|

$ |

94 |

|

Invoices confirmed during the quarter |

|

|

164 |

|

Confirmed invoices paid during the quarter |

|

|

(185 |

) |

Currency translation adjustments |

|

|

2 |

|

Confirmed obligations outstanding at end of period |

|

$ |

75 |

|

RECENT ACCOUNTING GUIDANCE. New accounting rules and disclosure requirements can significantly affect our reported results and the comparability of our financial statements. We believe the following new accounting guidance is relevant to the readers of our financial statements.

Accounting Standards Not Yet Adopted

In March 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-04, Reference Rate Reform (Topic 848), and in December 2022 subsequently issued ASU 2022-06, to temporarily ease the potential burden in accounting for reference rate reform. The standards provide optional expedients and exceptions for applying accounting principles generally accepted in the United States to existing contracts, hedging relationships, and other transactions affected by reference rate reform. The standards apply only to contracts and hedging relationships that reference the London Interbank Offered

Rate (“LIBOR”) or another reference rate to be discontinued because of reference rate reform. The standards were effective upon issuance and can generally be applied through December 31, 2024. While there has been no material effect to our financial condition,

results of operations, or cash flows from reference rate reform as of August 31, 2024, we continue to monitor our contracts and transactions for potential application of these ASUs.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which expands disclosures about a public entity’s reportable segments and requires more enhanced information about a reportable segment’s expenses, interim segment profit or loss, and how a public entity’s chief operating decision maker uses reported segment profit or loss information in assessing segment performance and allocating resources. The update will be effective for annual periods beginning after December 15, 2023 (fiscal 2025), and interim periods within annual periods beginning after December 15, 2024 (fiscal 2026). We are assessing the effect of this update on our consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which expands disclosures in an entity’s income tax rate reconciliation table and regarding cash taxes paid both in the U.S. and foreign jurisdictions. The update will be effective for annual periods beginning after December 15, 2024 (fiscal 2026). We are assessing the effect of this update on our consolidated financial statements and related disclosures.

In March 2024, the SEC adopted final rules requiring public entities to provide certain climate-related information in their registration statements and annual reports. As part of the disclosures, entities will be required to quantify certain effects of severe weather events and other natural conditions in a note to their audited financial statements. The rules were originally scheduled to be effective for annual periods beginning in calendar 2025 (fiscal 2026). In April 2024, the SEC voluntarily stayed implementation of the final rules pending certain legal challenges. We are assessing the effect of the new rules on our consolidated financial statements and related disclosures.

INVESTMENTS IN EQUITY AND DEBT SECURITIES. Investments in equity securities with a readily determinable fair value are carried at fair value and are classified as Level 1 investments in the fair value hierarchy. For equity securities without readily determinable fair values that qualify for the net asset value (“NAV”) practical expedient, we have elected to apply the NAV practical expedient to estimate fair value. Changes in fair value are recognized in “Other (expense) income” in the accompanying unaudited condensed consolidated statements of income.

We apply the measurement alternative to all other investments in equity securities without a readily determinable fair value. Under the measurement alternative these equity securities are accounted for at cost, with adjustments for observable changes in prices and impairments recognized in “Other (expense) income” on our accompanying unaudited condensed consolidated statements of income. We perform a qualitative assessment each reporting period to evaluate whether these equity securities are impaired. Our assessment includes a review of recent operating results and trends and other publicly available data. If an investment is impaired, we write it down to its estimated fair value.

Equity securities totaled $414 million and $360 million at August 31, 2024 and May 31, 2024, respectively. Equity securities are recorded within “Other assets” in the accompanying unaudited condensed consolidated balance sheets.

Debt securities, which are considered short-term investments, are classified as “available-for-sale” and are carried at fair value. Debt securities are Level 2 within the fair value hierarchy. Realized gains and losses on available-for-sale debt securities are included in net income, while unrealized gains and losses, net of tax, are included in “Accumulated other comprehensive loss” (“AOCL”) in the accompanying unaudited condensed consolidated balance sheets.

Debt securities totaled $76 million and $77 million at August 31, 2024 and May 31, 2024, respectively. Debt securities are recorded within “Prepaid expenses and other” in the accompanying unaudited condensed consolidated balance sheets.

TREASURY SHARES. In December 2021, our Board of Directors authorized a stock repurchase program of up to $5 billion of FedEx common stock. In March 2024, our Board of Directors authorized a new stock repurchase program for additional repurchases of up to $5 billion of FedEx common stock. As of May 31, 2024, $64 million remained available to be used for repurchases under the 2021 program.

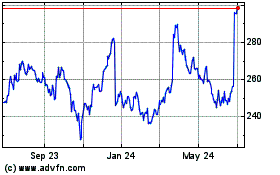

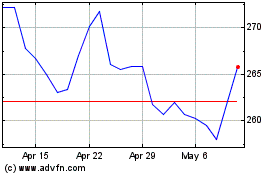

During the three-month period ended August 31, 2024, 3.4 million shares were repurchased under accelerated share repurchase (“ASR”) agreements as part of the 2021 and 2024 repurchase programs with two banks at an average price of $295.99 per share for a total of $1 billion. The final number of shares delivered upon settlement of the ASR agreements was determined based on a discount to the volume-weighted average price of our stock during the term of the transaction. The repurchased shares were accounted for as a reduction to common stockholders’ investment in the accompanying unaudited condensed consolidated balance sheet and resulted in a reduction of the outstanding shares used to calculate the weighted-average common shares outstanding for basic and diluted earnings per share.

During the three-month period ended August 31, 2023, 2.0 million shares were repurchased at an average price of $256.41 per share for a total of $500 million.

As of August 31, 2024, $4.1 billion remained available to use for repurchases under the 2024 stock repurchase program. Shares under the 2024 repurchase program may be repurchased from time to time in the open market or in privately negotiated transactions. The timing and volume of repurchases are at the discretion of management, based on the capital needs of the business, the market price of FedEx common stock, and general market conditions. No time limits were set for the completion of the program; however, we may decide to suspend or discontinue the program.

DIVIDENDS DECLARED PER COMMON SHARE. On August 16, 2024, our Board of Directors declared a quarterly cash dividend of $1.38 per share of common stock. The dividend will be paid on October 1, 2024 to stockholders of record as of the close of business on September 9, 2024. On June 10, 2024, our Board of Directors declared a quarterly cash dividend of $1.38 per share of common stock. The dividend was paid on July 9, 2024 to stockholders of record as of the close of business on June 24, 2024. Each quarterly dividend payment is subject to review and approval by our Board of Directors, and we evaluate our dividend payment amount on an annual basis. There are no material restrictions on our ability to declare dividends, nor are there any material restrictions on the ability of our subsidiaries to transfer funds to us in the form of cash dividends, loans, or advances.

NOTE 2: Credit Losses

We are exposed to credit losses primarily through our trade receivables. We assess ability to pay for certain customers by conducting a credit review, which considers the customer’s established credit rating and our assessment of creditworthiness. We determine the allowance for credit losses on accounts receivable using a combination of specific reserves for accounts that are deemed to exhibit credit loss indicators and general reserves that are determined using loss rates based on historical write-offs by geography and recent forecast information, including underlying economic expectations. We update our estimate of credit loss reserves quarterly.

Credit losses were $129 million for the three-month period ended August 31, 2024 and $103 million for the three-month period ended August 31, 2023. Our allowance for credit losses was $408 million at August 31, 2024 and $436 million at May 31, 2024.

NOTE 3: Accumulated Other Comprehensive Loss

The following table provides changes in AOCL, net of tax, reported in our unaudited condensed consolidated financial statements for the three-month periods ended August 31 (in millions; amounts in parentheses indicate debits to AOCL):

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Foreign currency translation loss: |

|

|

|

|

|

|

Balance at beginning of period |

|

$ |

(1,422 |

) |

|

$ |

(1,362 |

) |

Translation adjustments |

|

|

29 |

|

|

|

(28 |

) |

Balance at end of period |

|

|

(1,393 |

) |

|

|

(1,390 |

) |

Retirement plans adjustments: |

|

|

|

|

|

|

Balance at beginning of period |

|

|

63 |

|

|

|

35 |

|

Reclassifications from AOCL |

|

|

(2 |

) |

|

|

(1 |

) |

Balance at end of period |

|

|

61 |

|

|

|

34 |

|

AOCL at end of period |

|

$ |

(1,332 |

) |

|

$ |

(1,356 |

) |

NOTE 4: Financing Arrangements

We have a shelf registration statement filed with the SEC that allows us to sell, in one or more future offerings, any combination of our unsecured debt securities and common stock and allows pass-through trusts formed by Federal Express to sell, in one or more future offerings, pass-through certificates.

Federal Express has issued $970 million of Pass-Through Certificates, Series 2020-1AA (the “Certificates”) with a fixed interest rate of 1.875% due in February 2034 utilizing pass-through trusts. The Certificates are secured by 19 Boeing aircraft with a net book value of $1.6 billion at August 31, 2024. The payment obligations of Federal Express in respect of the Certificates are fully and unconditionally guaranteed by FedEx.

We have a $1.75 billion three-year credit agreement (the “Three-Year Credit Agreement”) and a $1.75 billion five-year credit agreement (the “Five-Year Credit Agreement” and together with the Three-Year Credit Agreement, the “Credit Agreements”). The Three-Year Credit Agreement and the Five-Year Credit Agreement expire in March 2027 and March 2029, respectively, and each has a $125 million letter of credit sublimit. The Credit Agreements are available to finance our operations and other cash flow needs. As of August 31, 2024, no amounts were outstanding under the Credit Agreements, no commercial paper was outstanding, and we had

$250 million of the letter of credit sublimit unused under the Credit Agreements. Outstanding commercial paper reduces the amount available to borrow under the Credit Agreements.

The Credit Agreements contain a financial covenant requiring us to maintain a ratio of debt to consolidated earnings (excluding noncash retirement plans mark-to-market adjustments, noncash pension service costs, noncash asset impairment charges, business optimization and restructuring expenses, and pro forma cost savings and synergies associated with an acquisition) before interest, taxes, depreciation, and amortization (“adjusted EBITDA”) of not more than 3.5 to 1.0, calculated as of the last day of each fiscal quarter on a rolling four-quarters basis. The ratio of our debt to adjusted EBITDA was 1.8 at August 31, 2024. Additional information on the financial covenant can be found in our Annual Report.

The financial covenant discussed above is the only significant restrictive covenant in the Credit Agreements. The Credit Agreements contain other customary covenants that do not, individually or in the aggregate, materially restrict the conduct of our business. We are in compliance with the financial covenant and all other covenants in the Credit Agreements and do not expect the covenants to affect our operations, including our liquidity or expected funding needs. If we failed to comply with the financial covenant or any other covenants in the Credit Agreements, our access to financing could become limited. Our commercial paper program is backed by unused commitments under the Credit Agreements, and borrowings under the program reduce the amount available under the Credit Agreements.

Long-term debt, including current maturities and exclusive of finance leases, had carrying values of $19.9 billion at August 31, 2024 and $19.8 billion at May 31, 2024, compared with estimated fair values of $18.2 billion at August 31, 2024 and $17.5 billion at May 31, 2024. The annualized weighted-average interest rate on long-term debt was 3.5% at August 31, 2024. The estimated fair values were determined based on quoted market prices and the current rates offered for debt with similar terms and maturities. The fair value of our long-term debt is classified as Level 2 within the fair value hierarchy. This classification is defined as a fair value determined using market-based inputs other than quoted prices that are observable for the derivative financial instruments, either directly or indirectly.

NOTE 5: Computation of Earnings Per Share

The calculation of basic and diluted earnings per common share for the three-month periods ended August 31 was as follows (in millions, except per share amounts):

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Basic earnings per common share: |

|

|

|

|

|

|

Net earnings allocable to common shares(1) |

|

$ |

793 |

|

|

$ |

1,077 |

|

Weighted-average common shares |

|

|

244 |

|

|

|

251 |

|

Basic earnings per common share |

|

$ |

3.24 |

|

|

$ |

4.28 |

|

Diluted earnings per common share: |

|

|

|

|

|

|

Net earnings allocable to common shares(1) |

|

$ |

793 |

|

|

$ |

1,077 |

|

Weighted-average common shares |

|

|

244 |

|

|

|

251 |

|

Dilutive effect of share-based awards |

|

|

3 |

|

|

|

3 |

|

Weighted-average diluted shares |

|

|

247 |

|

|

|

254 |

|

Diluted earnings per common share |

|

$ |

3.21 |

|

|

$ |

4.23 |

|

Anti-dilutive options excluded from diluted earnings per

common share |

|

|

4.3 |

|

|

|

6.2 |

|

(1)Net earnings available to participating securities were immaterial in all periods presented.

NOTE 6: Retirement Plans

We sponsor programs that provide retirement benefits to most of our employees. These programs include defined benefit pension plans, defined contribution plans, and postretirement healthcare plans. Key terms of our retirement plans are provided in our Annual Report.

Our retirement plans costs for the three-month periods ended August 31 were as follows (in millions):

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Defined benefit pension plans |

|

$ |

70 |

|

|

$ |

91 |

|

Defined contribution plans |

|

|

287 |

|

|

|

240 |

|

Postretirement healthcare plans |

|

|

22 |

|

|

|

23 |

|

|

|

$ |

379 |

|

|

$ |

354 |

|

Net periodic benefit cost of the pension and postretirement healthcare plans for the three-month periods ended August 31 included the following components (in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Pension Plans |

|

|

International Pension Plans |

|

|

Postretirement Healthcare Plans |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Service cost |

|

$ |

125 |

|

|

$ |

136 |

|

|

$ |

9 |

|

|

$ |

10 |

|

|

$ |

7 |

|

|

$ |

7 |

|

Interest cost |

|

|

361 |

|

|

|

341 |

|

|

|

12 |

|

|

|

10 |

|

|

|

16 |

|

|

|

16 |

|

Expected return on plan assets |

|

|

(430 |

) |

|

|

(400 |

) |

|

|

(5 |

) |

|

|

(4 |

) |

|

|

— |

|

|

|

— |

|

Amortization of prior service credit and other |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

Net periodic benefit cost |

|

$ |

54 |

|

|

$ |

75 |

|

|

$ |

16 |

|

|

$ |

16 |

|

|

$ |

22 |

|

|

$ |

23 |

|

For 2025, no pension contributions are required for our tax-qualified U.S. domestic pension plan (“U.S. Pension Plan”) as it is fully funded under the Employee Retirement Income Security Act. We made voluntary contributions of $300 million to our U.S. Pension Plan during the three-month period ended August 31, 2024.

NOTE 7: Business Segment Information

We provide a broad portfolio of transportation, e-commerce, and business services, offering integrated business solutions utilizing our flexible, efficient, and intelligent global network. Our primary operating companies are Federal Express, the world’s largest express transportation company and a leading North American provider of small-package ground delivery services, and FedEx Freight, a leading North American provider of LTL freight transportation services. These companies represent our major service lines and constitute our reportable segments. Our reportable segments include the following businesses:

|

|

Federal Express Segment |

Federal Express (express transportation, small-package ground delivery, and freight transportation) |

|

|

FedEx Freight Segment |

FedEx Freight (LTL freight transportation) FedEx Custom Critical (time-critical transportation) |

References to our transportation segments include, collectively, the Federal Express segment and the FedEx Freight segment.

The Federal Express segment operates combined sales, marketing, administrative, and information-technology functions in shared service operations for U.S. customers of our major business units and certain back-office support to FedEx Freight and our other operating segments which allows us to obtain synergies from the combination of these functions. We allocate the net operating costs of these services to reflect the full cost of operating our businesses in the results of those segments. We review and evaluate the performance of FedEx Freight and our other operating segments based on operating income inclusive of these allocations.

Operating expenses for our FedEx Freight segment include allocations of these services from the Federal Express segment. These allocations also include charges and credits for administrative services provided between operating companies. The allocations of net operating costs are based on metrics such as relative revenue or estimated services provided. We believe these allocations approximate the net cost of providing these functions. Our allocation methodologies are refined periodically, as necessary, to reflect changes in our businesses.

Corporate, Other, and Eliminations

Corporate and other includes corporate headquarters costs for executive officers and certain legal and finance functions, certain other costs and credits not attributed to our core business, and certain costs associated with developing integrated business solutions through our FedEx Dataworks operating segment. FedEx Dataworks is focused on creating solutions to transform the digital and physical experiences of our customers and team members.

Also included in Corporate and other is the FedEx Office operating segment, which provides an array of document and business services and retail access to our customers for our package transportation businesses, and the FedEx Logistics operating segment, which provides integrated supply chain management solutions, specialty transportation, customs brokerage, and global ocean and air freight forwarding.

The results of Corporate, other, and eliminations are not allocated to the other business segments.

Certain FedEx operating companies provide transportation and related services for other FedEx companies outside their reportable segment in order to optimize our resources. Billings for such services are based on negotiated rates, and are reflected as revenue of the billing segment. These rates are adjusted from time to time based on market conditions. Such intersegment revenue and expenses are

eliminated in our consolidated results and are not separately identified in the following segment information because the amounts are not material.

The following table provides a reconciliation of reportable segment revenue and operating income (loss) to our unaudited condensed consolidated financial statement totals for the three-month periods ended August 31 (in millions):

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Revenue: |

|

|

|

|

|

|

Federal Express segment |

|

$ |

18,305 |

|

|

$ |

18,426 |

|

FedEx Freight segment |

|

|

2,329 |

|

|

|

2,385 |

|

Other and eliminations |

|

|

945 |

|

|

|

870 |

|

|

|

$ |

21,579 |

|

|

$ |

21,681 |

|

Operating income (loss): |

|

|

|

|

|

|

Federal Express segment |

|

$ |

953 |

|

|

$ |

1,306 |

|

FedEx Freight segment |

|

|

439 |

|

|

|

482 |

|

Corporate, other, and eliminations |

|

|

(312 |

) |

|

|

(303 |

) |

|

|

$ |

1,080 |

|

|

$ |

1,485 |

|

The following table provides a reconciliation of reportable segment assets to our unaudited condensed consolidated financial statement totals as of the periods presented (in millions):

|

|

|

|

|

|

|

|

|

|

|

August 31, 2024

(Unaudited) |

|

|

May 31,

2024 |

|

Total assets: |

|

|

|

|

|

|

Federal Express segment |

|

$ |

73,207 |

|

|

$ |

73,259 |

|

FedEx Freight segment |

|

|

11,815 |

|

|

|

11,615 |

|

Corporate, other, and eliminations |

|

|

1,689 |

|

|

|

2,133 |

|

|

|

$ |

86,711 |

|

|

$ |

87,007 |

|

NOTE 8: Commitments

As of August 31, 2024, our purchase commitments under various contracts for the remainder of 2025 and annually thereafter were as follows (in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aircraft and Aircraft Related |

|

|

Other(1) |

|

|

Total |

|

2025 (remainder) |

|

$ |

1,195 |

|

|

$ |

572 |

|

|

$ |

1,767 |

|

2026 |

|

|

686 |

|

|

|

766 |

|

|

|

1,452 |

|

2027 |

|

|

283 |

|

|

|

540 |

|

|

|

823 |

|

2028 |

|

|

348 |

|

|

|

383 |

|

|

|

731 |

|

2029 |

|

|

316 |

|

|

|

318 |

|

|

|

634 |

|

Thereafter |

|

|

1,332 |

|

|

|

101 |

|

|

|

1,433 |

|

Total |

|

$ |

4,160 |

|

|

$ |

2,680 |

|

|

$ |

6,840 |

|

(1) Primarily software and advertising.

The amounts reflected in the table above for purchase commitments represent noncancelable agreements to purchase goods or services. Open purchase orders that are cancelable are not considered unconditional purchase obligations for financial reporting purposes and are not included in the table above.

As of August 31, 2024, we had $535 million in deposits and progress payments on aircraft purchases and other planned aircraft-related transactions. These deposits are classified in the “Other assets” caption of our accompanying unaudited condensed consolidated balance sheets. Aircraft and related contracts are subject to price escalations. The following table is a summary of the key aircraft we are committed to purchase as of August 31, 2024 with the year of expected delivery:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cessna SkyCourier 408 |

|

|

ATR 72-600F |

|

|

B767F |

|

|

B777F |

|

|

Total |

|

2025 (remainder) |

|

|

17 |

|

|

|

4 |

|

|

|

9 |

|

|

|

2 |

|

|

|

32 |

|

2026 |

|

|

14 |

|

|

|

4 |

|

|

|

3 |

|

|

|

— |

|

|

|

21 |

|

2027 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

2028 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2029 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Thereafter |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total |

|

|

31 |

|

|

|

8 |

|

|

|

12 |

|

|

|

2 |

|

|

|

53 |

|

A summary of future minimum lease payments under noncancelable operating and finance leases with an initial or remaining term in excess of one year as of August 31, 2024 is as follows (in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aircraft

and Related

Equipment |

|

|

Facilities

and Other |