UPS, FedEx Fees on Heavy Packages to Hit Consumers and Merchants

December 30 2019 - 9:04AM

Dow Jones News

By Paul Ziobro

FedEx Corp. and United Parcel Service Inc. are escalating their

war on bulky items by levying $24 fees on packages weighing more

than 50 pounds.

Previously, packages weighing more than 70 pounds triggered

additional handling surcharges. But the carriers are lowering their

thresholds as part of an annual round of rate increases that could

cause millions of packages to be hit by the fee -- or force

customers to change their shipping practices to avoid it.

The number of packages affected by the change could be

significant. Neither company responded to questions about the

estimated revenue the new fees would generate, but Shipware LLC, a

shipping consulting firm, estimates that 14.5% of packages sent by

its 100 largest shipper clients would be hit by the $24 fee under

the new rules, up from 8.4%.

"The impact is alarming," said Trevor Outman, Shipware's founder

and co-chief executive. "For some, the cost increase will be in the

millions [of dollars]. For others, it will be hundreds of

thousands."

Boxed Wholesale, an online startup that sells batteries, laundry

detergent and water in bulk, aims to ship orders in as few boxes as

possible and currently avoids shipments anywhere near 70 pounds.

The new weight limits could mean that Boxed will split up orders

more often.

"Customers who get their order in one box may now get it in

two," said Joe Bobko, Boxed's vice president of transportation.

Multiple boxes means higher costs for shipping, labor and

packaging, according to Mr. Bobko, and increases the odds that the

customer may not get their whole order at the same time.

The pricing changes may also mean carriers must make additional

stops at individual homes, which is why Mr. Bobko has been meeting

with UPS, its carrier, to try to minimize the impact. He said the

two sides "have reached an agreement that is favorable to both

parties."

While shipments with multiple items could get split up to avoid

the fee, others could be stuck. John Haber, CEO of Spend Management

Experts Inc., another shipping consulting firm, said some examples

of products weighing between 50 and 70 pounds include dog food,

lounge chairs, exercise equipment, home theater systems, mini dirt

bikes and medical devices.

"It's massive for certain shippers," Mr. Haber said.

FedEx and UPS say the changes to the threshold are being made so

that they are properly compensated for the increasing number of

large and heavy packages that are moving through their networks as

things like televisions, furniture and auto parts are increasingly

ordered online. Often, those bigger packages don't easily move

through automated facilities increasingly designed for e-commerce

packages, which are typically lighter and smaller, and can require

additional handling.

"These changes will ensure that we continue to provide the level

of service that our customers expect while responsibly managing

capacity through our network," a FedEx spokeswoman said.

The changes went into effect at UPS on Dec. 29. FedEx's new

rates start Jan. 6.

The changes were announced in recent weeks as part of the annual

rate increases carriers impose on shippers. As in years past, FedEx

and UPS said prices, spread across various weights and distances,

will rise 4.9% on average.

Mr. Outman estimated that a 50-pound parcel shipped over 1,000

miles using UPS Ground service could cost more than $75 to ship

under the new rates, compared with about $48 under previous rates.

That example applies to the carrier's list prices, so the impact

could be lower based on negotiated prices.

Boxed's Mr. Bobko said he understands carriers wanting packages

that are easier to handle but that he doesn't think assigning an

arbitrary weight limit works in all cases.

"A poorly packed 40-pound package may be more difficult for the

carrier to handle than a well-packed 69-pound package," he

said.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

December 30, 2019 08:49 ET (13:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

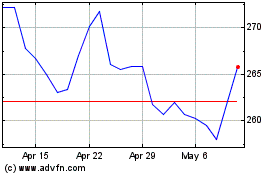

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

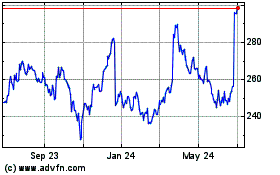

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024