FedEx, Bed Bath & Beyond, Netflix: Stocks That Defined the Week

December 20 2019 - 7:04PM

Dow Jones News

By Francesca Fontana

FedEx Corp.

No one is delivering holiday cheer to FedEx. The delivery giant

Tuesday cut its earnings targets for the fourth time in 2019.

Shares fell 10% the next day, highlighting investor concerns about

the company's ability to adapt as more of its business shifts to

delivering less-profitable e-commerce packages to homes. Meanwhile,

Amazon.com Inc. announced this week that it has blocked third-party

sellers from using FedEx's ground delivery network for Prime

shipments.

Bed Bath & Beyond Inc.

The executive suite at Bed Bath & Beyond will be a lot

emptier during this holiday season. A half-dozen top executives are

leaving in an unusual shakeup for the struggling home goods

retailer. Chief Executive Mark Tritton said Tuesday that five

executives would leave their roles, including the heads of

merchandising, marketing, digital and legal. In addition, the chief

brand officer resigned last week, he said. Earlier this year, Bed

Bath & Beyond replaced several directors, including the chain's

co-founders, amid pressure from activist investors, and has been

conducting a strategic review of its portfolio of roughly 1,500

stores. Shares rose 11% Tuesday.

Netflix Inc.

Netflix is trying to sell Wall Street on what it hopes will be

its next blockbuster: overseas sales. The company's subscription

growth in the U.S. has begun to slow, and it is set to face greater

competition as new streaming rivals come online. The region of

Europe, the Middle East and Africa has more than doubled in

subscribers since the start of 2017, and is the largest non-U.S.

region, Netflix data shows. Netflix released new subscriber growth

metrics late Monday in an effort to persuade Wall Street to focus

more on its growth outside of the U.S. Latin America has also

posted sharp growth, while Asia is promising but still a small

portion of the overall business. Netflix shares gained 3.7%

Tuesday.

Uber Technologies Inc.

Uber might drop off its food-delivery business in India to a

local rival. The Wall Street Journal reported Monday that the sale

would be a potential boost for the American company as Chief

Executive Dara Khosrowshahi seeks a path to profitability. A deal

would see the San Francisco-based company unload the costly Indian

operations of its global food-delivery arm, Uber Eats, to

competitor Zomato Media Pvt. Ltd., the people said. Mr.

Khosrowshahi is trying to improve the unprofitable company's

finances. Uber's shares have fallen about a third from the

initial-public-offering price of $45. Shares gained 5.5%

Monday.

General Mills

Pets are adorable. Even more so for shareholders of General

Mills, where sales of the Blue Buffalo pet food that General Mills

acquired last year rose 16% in the company's latest quarter. Pet

food is helping the Minneapolis-based food maker make up for weaker

snack bar and yogurt sales. The owner of Cheerios and Betty Crocker

has been weighed down by brands that are outdated or facing tougher

competition from generic products. Diversifying into businesses

such as pet food is helping General Mills offset laggards like

baking mixes and Yoplait yogurt. General Mills shares gained 1.9%

Wednesday.

Facebook Inc.

Facebook is choosing a giant stage for its next message to

consumers: the Super Bowl. The embattled social media giant has

bought time for a 60-second ad featuring Chris Rock and Sylvester

Stallone to promote its Groups feature, the company said late

Wednesday. Facebook has been seeking to improve the appeal of its

platform, partly through a campaign themed "More Together" that

positions Groups as a way for people to connect with like-minded

users. It's part of a larger increase in global ad spending by

Facebook in a bid to rebuild trust and positive consumer sentiment

after a series of controversies over privacy practices and

misinformation on its platform. Facebook shares gained 1.8%

Thursday.

IAC/Interactive Corp.

The media and internet holding company wants to get into the

family-care business. IAC/InterActive Group agreed Friday to buy

Care.com for about $500 million in cash. Care.com is the nation's

largest online marketplace for babysitters and other caregivers,

with about 35 million members in over 20 countries. A March

investigation by The Wall Street Journal showed that it largely

left it up to families to determine whether a caregiving listed on

Care.com was trustworthy. IAC/InterActive expects to close the

transaction in the first quarter of 2020 and name one of its own

executives as CEO. Its shares gained 3.1% Friday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

December 20, 2019 18:49 ET (23:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

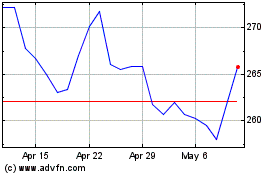

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

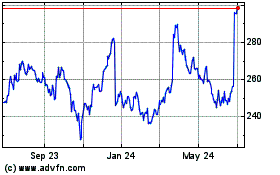

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024