By Paul Ziobro

It turns out there is no such thing as free shipping.

Shares of FedEx Corp. tumbled 10% on Wednesday, highlighting

investor concerns about the delivery giant's ability to adapt as

more of its business shifts to delivering less-profitable

e-commerce packages to homes.

The overnight delivery pioneer on Tuesday reported a 40% drop in

fiscal second-quarter profits and cut its earnings targets for the

fourth time in 2019. FedEx has been squeezed by a global drop in

profitable Express air shipments, generally sent between

businesses, and the added costs of building its Ground network,

which is typically associated with package delivery from online

merchants. In the latest quarter, domestic Express parcel volumes

fell 4.1% from a year ago, while Ground shipments rose 3.5%.

Historically, FedEx largely avoided e-commerce shipments,

leaving much of that business to rival United Parcel Service Inc.

and the U.S. Postal Service. Amazon.com Inc., the biggest online

retailer, accounted for just 1.3% of its revenue last year, the

company says.

But FedEx executives decided over the last year to embrace

e-commerce orders, a strategy they said they have been preparing

for years as they watched the growing shift to online shopping and

the deteriorating finances of the Postal Service, its key partner

in handling such packages.

The company has added dozens of facilities to sort packages,

including specialized centers to handle oversize packages, and now

makes regular weekend deliveries.

The transition is shaping up to be one of the most arduous in

FedEx's four-decade history, and some on Wall Street are openly

questioning longtime CEO Fred Smith's strategy.

One reason is that FedEx is chasing growth in a less-profitable

sector. Online parcels are generally small and lightweight, a

combination for lower revenue per package. They are also costly to

deliver since drivers generally drop off one package to individual

homes.

That contrasts with FedEx's larger business delivering shipments

between businesses. In that business, packages are larger and

generate more revenue, while companies often ship multiple packages

to each other. Such shipments tend to be more profitable, but

growth there has stalled.

Operating profit margins in FexEx's e-commerce heavy Ground

business plunged to 6.7% in the fiscal second quarter, down from

12.4% in the first quarter. Executives blamed issues including the

costs of delivering seven days a week, the timing of the Cyber

Monday holiday, a compressed holiday shipping season that required

more staffing and the loss of Amazon as a customer.

"Standing up to [a] 6 and 7 day network was very expensive for

us," Mr. Smith told analysts on a conference call Tuesday evening.

"And we certainly anticipated some of it, but we probably

underestimated the cost of standing it up."

FedEx executives vowed that Ground profit margins would return

to prior levels after the holiday crush. But some analysts were

skeptical, arguing that the timing of Cyber Monday and condensed

holiday calendar were known in advance. UPS, which has invested to

expand and modernize its ground network, has posted strong sales

and profits in recent quarters.

"It is difficult to have clear visibility to improvement on

Ground margin given the magnitude of decline and the number of

moving parts," said UBS analyst Tom Wadewitz. "There remains a

sharp contrast between the favorable trends at UPS and the margin

weakness plaguing FDX."

Mr. Smith defended his strategy to stop delivering packages for

Amazon this year and embrace e-commerce deliveries from companies

like Walmart Inc. and Target Corp. It also has decided to deliver

more of the residential orders that it previously handed off the

Postal Service.

The shift has moved the company into a lower-margin business

where it will compete not just with UPS and Postal Service but also

Amazon, which is ramping up its own delivery network.

"In the last weekend that just finished, we delivered over 14

million packages on Saturday and Sunday," Mr. Smith said on

Tuesday. "We weren't even delivering packages on the weekend a

couple of years ago."

To curb spending, FedEx on Tuesday said it would reduce capacity

in its Express air network, including grounding 10 cargo planes and

cutting flight hours. Previously, Mr. Smith has come under fire for

his reluctance to pare the Express network and the decision to

spend on new jets.

Several analysts asked executives on the conference call whether

the company needs to consider bigger strategic changes, such as

integrating its Express and Ground units. The two currently operate

independently, which can result in employees from each division

visiting the same address on the same day. Mr. Smith has argued the

arrangement is necessary to ensure critical Express deliveries

arrive on time.

"Wall Street is looking for a silver bullet to magically "fix"

FedEx," Rick Paterson, an analyst at Loop Capital Markets, wrote in

a note to clients. "The dual [pickup and delivery] networks may at

some point be a luxury FedEx can no longer afford."

Mr. Paterson said he was surprised "we haven't yet seen any

[investor] activism with regard to FedEx, touting structural

changes such as this one."

Mr. Smith, 75 years old, has run FedEx since he started the

company in 1971. He remains one of the company's largest

shareholders with a nearly 6% stake. But like other investors, he

has suffered investment losses over the last year. FedEx shares,

worth more than $250 last year, were trading Wednesday morning at

$147.19.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

December 18, 2019 12:13 ET (17:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

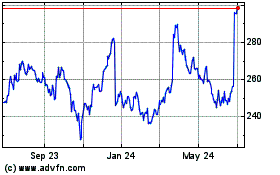

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

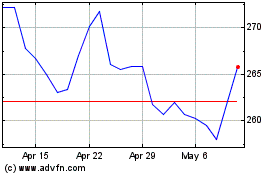

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024