Delivery Wars Hurt FedEx's Profit -- WSJ

December 18 2019 - 3:02AM

Dow Jones News

By Paul Ziobro

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 18, 2019).

FedEx Corp. cut its earnings targets for the fourth time in

2019, as the delivery giant struggles to adapt to a world where

fewer packages are being flown around the globe and more are being

delivered to people's homes from warehouses.

Profit has been sapped by a global slump in air shipments --

FedEx's core business -- and a surge in e-commerce deliveries to

residences -- a service the company is expanding at considerable

cost. The challenge has become acute as Amazon.com Inc. flips from

FedEx customer to formidable competitor.

On Tuesday, FedEx executives said the company had experienced

higher-than-expected expenses in the quarter that ended on Nov. 30

and cautioned costs would be elevated during the peak shipping

season now testing its limits. The company plans to take new steps

to rein in spending, including grounding aircraft, eliminating some

international flights and restricting hiring.

"We continue to be in a period of challenges and changes," FedEx

founder and Chief Executive Fred Smith said on a conference call.

He cited "a significant bow wave of expenses to handle volumes that

will largely fall" in the next quarter and a drag on the industrial

economy from trade disputes and tepid business-to-business

shipping.

FedEx shares, which were trading above $250 last year, fell more

than 6% in late trading Tuesday to around $153.

For its just-ended fiscal second quarter, FedEx posted a 40%

drop in profit and a 3% decline in revenue. It continues to deal

with the loss of Amazon's shipping contracts, which totaled $900

million in annual revenue, and a slump in global trade that has

damped demand for air shipments. FedEx said the pricing environment

is more competitive as well.

Rival United Parcel Service Inc. has capitalized on FedEx's

cutting ties with Amazon. UPS has spent heavily in recent years to

expand and automate its network to handle more online orders. In

recent quarters, it has significantly expanded its air shipments to

carry more packages, including from Amazon. In October, UPS posted

higher quarterly profit and revenue, and backed its earnings

targets for the year.

Both FedEx and UPS are absorbing higher costs in the U.S. as

they modernize sorting centers and shift to seven-day residential

delivery, not just during the holidays but year round. FedEx is

also beginning to keep in its network more of the packages it had

sent to the U.S. Postal Service for last-mile delivery.

The goal is to shift FedEx's delivery network, designed

primarily for shipments between businesses, to one that can deliver

more individual packages to residences to capitalize on the

relentless growth of online shopping.

The latest quarter shows that the changes FedEx is making to its

Ground network "are costing them more than they had realized," said

Satish Jindel, president of the parcel research firm SJ Consulting

Group Inc.

FedEx executives admitted that they underestimated how much it

would cost to expand to seven-day delivery, which started in early

November. "Clearly, we didn't do the greatest job of forecasting

our cost," Mr. Smith said.

Finance chief Alan Graf added that FedEx has had to pay

higher-than-expected wages in some areas given the tight labor

market.

Both FedEx and UPS have acknowledged some problems making all

their deliveries during the holiday season. They said winter storms

slowed operations in some areas during Cyber Week, the busy

shipping period after Thanksgiving. They are also facing a

truncated calendar this year with six fewer days between

Thanksgiving and Christmas.

For FedEx, this calendar shift pushed Cyber Week into the

company's fiscal third quarter. That added costs to the second

quarter without the revenue bump.

Amazon hasn't just stopped using FedEx's service. It is also

ramping up its own delivery capabilities, including leasing cargo

planes and buying thousands of vehicles. Analysts estimate Amazon

will handle nearly half of its own package deliveries this holiday

season.

This week, Amazon prohibited its third-party sellers from using

FedEx's Ground network for Prime shipments citing poor delivery

performance. The online retailer said it won't allow merchants to

resume using FedEx for such orders until service improves.

For its second quarter, FedEx reported a profit of $560 million,

compared with net income of $935 million a year earlier. Excluding

integration expenses and aircraft impairment charges, per share

earnings were $2.51 -- below Wall Street's expectations.

Revenue fell 3% to $17.3 billion, including a 5% decline in its

Express segment and a 3% increase in its Ground business. Analysts

polled by FactSet expected $17.6 billion in quarterly revenue.

For the current fiscal year, FedEx is now forecasting per share

earnings of between $10.25 and $11.50 before pension accounting

adjustments, compared with its forecast of $11 to $13 issued in

September.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

December 18, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

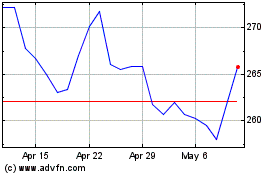

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

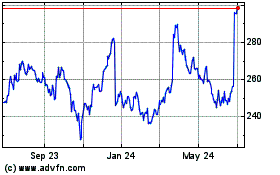

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024